Wave and QuickBooks Online are two of the most widely used small company accounting software solutions. The main distinction between QuickBooks Online and Wave is that QuickBooks Online charges for its services. If you’re seeking a free application without restrictions in other software, it’s simple to recognize the usefulness of Wave accounting software. However, QuickBooks Online is better than Wave if you require more sophisticated services like project accounting and inventory management.

However, QuickBooks isn’t the only option for accounting software, and it might not even be your best option. This article contrasts Wave, a free accounting software program that provides many of the same capabilities at a more basic level, with QuickBooks Online, a well-known cloud-based version of the system.

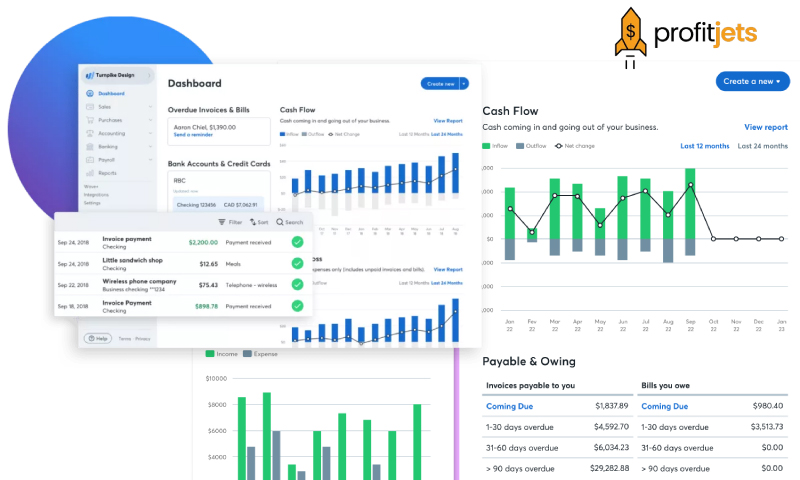

A Quick comparison of Wave with QuickBooks Online

| COMPARISON | WAVE | QUICKBOOKS |

| Best For | Smaller firms that don’t require complete tools, new business owners, and organizations on a restricted budget. | Businesses are transitioning from simpler accounting systems, businesses that intend to grow quickly, and businesses that require capabilities like cash-flow forecasting. |

| Price | Accounting and invoicing software is free; the processing of payroll and payments is charged. | We are starting at only $25 per month for a single user. |

| Plans | There is a single plan for companies of all sizes with the same functionality and upgradeable modules. | There are four standard plans with the option of upgrading modules and additional bookkeeping services. |

| Product Highlights | Even new sole proprietors can easily set up and use a free, basic accounting system. | Numerous third-party solutions, industry standards, and accounting systems can extend as a business expands. |

| Third-Party Integrations Available? | Yes | Yes |

| Is Customer Support Available? | Yes | Yes |

Features of Wave (Free):

- The accounting software from Wave has a lot to offer for being free:

- Modules for billing and accounting are free. The monthly cost of the Payroll module and the cost of the Payments module depend on how much you use them.

- No prior experience is necessary, and the setup is quick.

- There is no restriction on how many banks or credit cards you can connect to the system.

- Accounting reports for tracking profit/loss, sales tax, cash flow, and more can be exported.

- Sales taxes that can be adjusted and automatic exchange rate computations for global transactions.

- Double-entry accounting is used.

Features of QuickBooks Online:

There are four different service levels for QuickBooks Online, each offering extra or improved functionality.

Simple Start for QuickBooks ($25/month)-

The finest accounting software is QuickBooks Simple Start for companies where a single person manages all the books. What Simple Start gives is as follows:

- Keep track of your company’s incoming income and spending, purchases and sales tax, invoices, and business-related miles.

- Send estimates, take payments, and run general reports in addition to sending bills.

- Control 1099 workers.

$50/month for QuickBooks Essentials-

All the capabilities of QuickBooks Simple Start are included in QuickBooks Essentials, plus:

- Three users or more may access it.

- Bill management and payment.

- Tracking time.

Accounting Plus ($80/month)-

All the capabilities of QuickBooks Essentials are also included in QuickBooks Essentials plus:

- Up to five users may have access.

- Monitor the supply.

- Track the success of the project.

Advanced QuickBooks ($180/month)-

For established organizations that require reliable accounting software and assistance, there is QuickBooks Advanced. All the capabilities of QuickBooks Plus are present in Advanced plus:

- Up to 25 people may have tailored access based on their employee roles.

- Business intelligence and analytics, premium, only-available applications like Salesforce and DocuSign, and automated workflow.

- Versioning capability and data backup.

- On-demand online training and committed account staff.

Which accounting software, Wave or QuickBooks Online, is best for me?

The intricacy of your accounting requirements and the stage of business growth you are in will ultimately determine whether you choose Wave or QuickBooks. For instance, Wave’s free accounting software may be adequate if you’re a freelancer or sole entrepreneur.

However, you might want to think about buying QuickBooks Online if you have a few employees, your company is growing quickly, or you need more capability than Wave can provide.

True small businesses won’t make a mistake by choosing either Wave or QuickBooks Online as their option because they are both strong competitors. While small businesses on a tight budget can profit from Wave’s free or inexpensive solutions, larger enterprises would do best with QuickBooks to prevent switching systems down the road.

How are Wave and QuickBooks Online similar?

Both Wave and QuickBooks online are web-based software programs so that you can access your accounting system from any location in the world with just an internet connection and a browser.

Both packages offer extra payroll and payment processing services that may be added to your software at an additional cost and the ability to sync your banks and credit cards to your account.

How do Wave and QuickBooks Online vary from one another?

Wave and QuickBooks Online differ mostly in terms of simplicity and scalability.

Although Wave is simple to set up, it lacks some elements that can be useful for organizations that are expanding quickly. On the other hand, organizations that expect quick expansion may scale with QuickBooks’ extensive features and tools.

Pricing:

For any small-business owner, the cost is a key factor. The fundamental accounting and invoicing system offered by Wave is free, in contrast to the least expensive edition of QuickBooks, which costs $25 a month after any initial discounts or special offers. Free is not always better; if your company expands beyond Wave’s capabilities, you might eventually need to switch platforms.

Integrations:

While Wave and QuickBooks Online have a wealth of functionality built into their accounting programs, you could discover that you need additional task- or industry-specific tools to handle your accounts more effectively.

Through integrations, you can link your accounting software to other applications, such as your customer relationship management system or point-of-sale system. Direct integrations allow your accounting software and other systems to interact more easily.

The fact that QuickBooks Online supports more than 650 integrations makes it the preferable option. Users can connect other business tools to their Wave account using a third-party application like Zapier.

Users in number:

Wave is ideal for many sole proprietors and small organizations because it is for a single user. However, this solution is better suited for bigger businesses because QuickBooks allows access for up to 25 users. Each QuickBooks user will require a separate paid subscription to access the program.

Mobile applications:

For businesses with projects happening simultaneously in various locations or business owners and staff who are frequently on the go, QuickBooks offers a mobile app with all the same capabilities as its cloud-based system.

On the other hand, Wave has an app for invoicing and does not have a complete app for using the system’s other functionalities.

Processing payments and payroll-

Payroll software from Wave provides a lot of value for little money. There is no option for business owners to select between the two programs; rather, the location of your company dictates whether you can use self-service or full service.

A per-person fee for automated tax filings is added to the $35 monthly fee for businesses using Wave’s full-service plan. Businesses in self-service states will also pay $15 less per month and get the same tax records, but they are still in charge of filing the taxes themselves.

Before employee fees, QuickBooks costs between $45 and $125 per month. All plans include automated tax filing, but only Elite plan subscribers are protected from tax penalties; Core and Premium users are responsible for any accounting mistakes or IRS fines, regardless of whether the mistake was a QuickBooks oversight.

Transaction processing-

The cost of payment processing tools varies greatly between Wave and QuickBooks. Whereas the base rates for ACH bank payments and credit card transactions are comparable, Wave charges a little higher base price per transaction while QuickBooks demands a monthly base rate.

As a result, QuickBooks Payments may be more cost-effective for companies with a high volume of monthly transactions. In contrast, Wave’s pay-as-you-go pricing is advantageous for companies that handle credit card payments infrequently.

Conclusion:

Wave is the undisputed winner in terms of cost. However, firms frequently take other factors into account. While extremely small businesses need the bare minimum of accounting and invoicing to function, larger firms may need more sophisticated capabilities like inventory control, check payment of invoices, and location-based income or spending tracking. In this area, QuickBooks Online excels. Overall, the type of accounting software you choose will rely on your needs, company size, and budget.