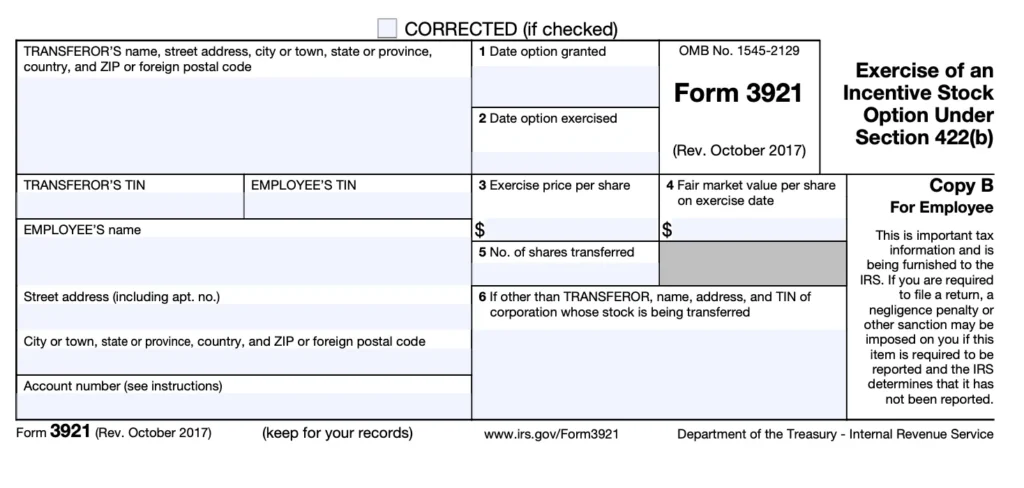

IRS Form 3921 (Exercise of an Incentive Stock Option Under Section 422(b)) is used by corporations to report when employees exercise incentive stock options (ISOs). This form helps track potential alternative minimum tax (AMT) implications for employees.

Table of Contents

Who Must File Form 3921?

You must file if your company:

- Granted incentive stock options to employees

- Had employees exercise ISOs during the tax year

- Needs to report the transfer of stock to option holders

- Must document ISO exercise details for tax purposes

Important: Reporting is mandatory even if no tax is due. Professional tax services can help determine your specific requirements.

Step-by-Step Guide to Completing Form 3921

Step 1: Gather Required Information

Before starting, collect:

- Employee details (name, SSN, address)

- ISO grant documentation

- Exercise dates and prices

- Fair market value (FMV) at exercise

- Number of shares transferred

- Financial statements showing stock transactions

Step 2: Complete Part I – Employer Information

- Box 1a: Employer name

- Box 1b: Employer EIN

- Box 1c: Employer address

- Box 1d: Employer phone number

Step 3: Complete Part II – Employee Information

- Box 2a: Employee name

- Box 2b: Employee SSN

- Box 2c: Employee address

- Box 2d: Number of shares transferred

Step 4: Complete Part III – Option Details

- Box 3a: Date option granted

- Box 3b: Date option exercised

- Box 3c: FMV per share at grant

- Box 3d: Exercise price per share

- Box 3e: FMV per share at an exercise

- Box 3f: Number of shares exercised

Step 5: Complete Part IV – Additional Information

- Box 4: Check if the transfer is pursuant to corporate reorganization

- Box 5: Check if shares acquired are subject to vesting

Step 6: File and Distribute Copies

- File with IRS by February 28 (paper) or March 31 (electronic)

- Provide Copy A to the employee by January 31

- Keep Copy C for your records (4+ years)

- Reconcile with financial statements for accuracy

Common Mistakes to Avoid

- Missing filing deadlines – Strict penalties apply ($310 per form)

- Incorrect FMV calculations – Must use proper valuation methods

- Mismatched employee information – Verify SSNs and names

- Failing to document corporate actions – Reorganizations affect reporting

- Not reconciling with financial statements – Must match equity records

For companies with complex equity plans, professional tax services ensure proper compliance.

Advanced Considerations

Financial Statement Impacts

- Expense recognition under ASC 718

- EPS calculations

- Tax provision considerations

- Equity roll-forward reconciliation

Special Situations

- Corporate reorganizations

- Early exercise with vesting

- Termination scenarios

- Death or disability exercises

Employee Tax Implications

- AMT calculations

- Disqualifying dispositions

- Holding period requirements

- Form 6251 filing requirements

Final Thoughts

Proper completion of IRS Form 3921 is essential for companies granting incentive stock options to maintain compliance and provide employees with accurate tax information. By keeping detailed option records, reconciling with financial statements, and carefully following the latest Form 3921 instructions, companies can meet their reporting obligations while supporting employees’ tax planning. For organizations with complex equity compensation plans, frequent corporate actions, or international employees, partnering with professional tax services provides the expertise needed to navigate these specialized requirements.