If your business deals with fuel, environmental products, communications services, or similar taxable items, chances are you’re required to file Form 720. This IRS form, also known as the Quarterly Federal Excise Tax Return, is essential for reporting and paying excise taxes.

In this blog, we’ll guide you through everything you need to know about how to file Form 720, including which businesses it applies to, what documents you’ll need, and a step-by-step breakdown of the form. Whether you’re new to excise tax filing or just need a refresher, this guide is built to help.

Table of Contents

What is IRS Form 720 Used For?

Form 720 is used by businesses to report and pay federal excise taxes. These taxes apply to specific products and services such as:

- Fuel (gasoline, diesel, kerosene)

- Airline tickets

- Indoor tanning services

- Environmental taxes

- Communications and air transportation services

Excise taxes are different from income taxes—they are often embedded in the price of goods or services and must be reported quarterly using Form 720.

Who Needs to File Form 720?

You must file Form 720 if your business:

- Sells, manufactures, or uses goods subject to excise tax

- Offers taxable services like tanning or air transportation

- Imports certain taxed items into the U.S.

This includes manufacturers, distributors, retailers, and service providers. Even if your liability is zero for a quarter, you may still need to file the form.

When is Form 720 Due?

Since this is a quarterly return, it’s due four times a year:

| Quarter | Period Covered | Due Date |

| Q1 | Jan 1 – Mar 31 | April 30 |

| Q2 | Apr 1 – Jun 30 | July 31 |

| Q3 | Jul 1 – Sep 30 | October 31 |

| Q4 | Oct 1 – Dec 31 | January 31 |

If the due date falls on a weekend or holiday, it rolls over to the next business day.

Information You’ll Need Before Filing

To correctly fill out Form 720, gather the following:

- Employer Identification Number (EIN)

- Business legal name and mailing address

- Your financial statements show relevant taxable transactions

- Breakdown of each excise tax category applicable to your business

- Payment method details (if taxes are due)

Proper documentation makes it easier to fill in accurate amounts and avoid IRS notices or penalties.

How to Complete IRS Form 720: Step-by-Step Breakdown

Here’s a section-by-section walkthrough to help you fill out Form 720 accurately:

Step 1: Business Identification Information

Start at the top of Form 720:

- Fill in your EIN

- Enter your business name and address

- Choose the quarter you’re filing for by checking the appropriate box

- If this is your final return, check the “Final return” box to notify the IRS.

This section ensures the IRS knows who is filing and for which period.

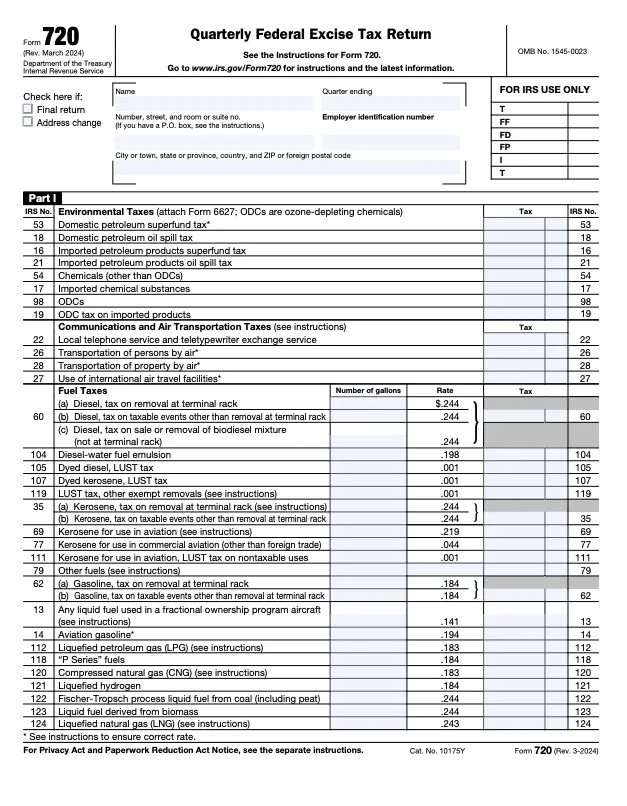

Step 2: Part I – Excise Taxes on Specific Goods and Services

This is where you report taxes for common categories, such as:

- Environmental taxes (e.g., ozone-depleting chemicals)

- Communications and air transportation

- Fuel taxes (e.g., gasoline, diesel)

- Retail tax (e.g., heavy trucks and trailers)

- Ship passenger tax

For each applicable tax:

- Locate the line item

- Enter the number of taxable units

- Multiply by the applicable tax rate

- Input the total tax amount in the column labeled “Ta.”

If you need more space, use Schedule A or Schedule T, depending on your business activity.

Step 3: Part II – Additional Excise Taxes

Part II covers less common or industry-specific taxes, such as:

- Indoor tanning services

- Foreign insurance premiums

- Manufacturer’s taxes on goods like bows, arrows, and fishing equipment

Follow the same process as Part I: find the line, enter units, apply the tax rate, and calculate the tax due.

Step 4: Total the Tax and Complete the Summary

Move to Part III, where you:

- Add the taxes from Parts I and II

- Apply any adjustments or credits (e.g., overpayments or fuel tax credits)

- Calculate the net tax due.

Make sure the total reported here aligns with your financial statements to avoid discrepancies or audit flags.

Step 5: Sign and Date the Form

Sign the form using your:

- Name and title

- Signature

- Date

If a third-party preparer (such as a CPA or accountant) filled out the form, they should also complete the Paid Preparer Use Only section.

Step 6: Submit and Make a Payment (If Required)

There are two main ways to submit Form 720:

- E-file using an IRS-approved provider

- Mail to the IRS (refer to the IRS instructions for the correct address based on your location)

If you’re making a payment, you can use:

- EFTPS (Electronic Federal Tax Payment System)

- IRS Direct Pay

- Check or money order (if mailing)

Avoid These Common Mistakes When Filing Form 720

To file successfully, double-check for these frequent errors:

- Filing the wrong quarter or missing the due date

- Incorrect tax calculations

- Omitting necessary financial data or support

- Using outdated Form 720 versions

- Forgetting to sign or date the return

Working with professional tax services can help you avoid these errors and file with peace of mind.

Final Thoughts: Stay Compliant with Timely Excise Tax Reporting

Form 720 may seem complex, but with the proper documentation, tools, and guidance, you can file accurately and on time. The key is to keep your financial statements organized and understand how each excise tax category applies to your business.

If you’re unsure or overwhelmed, using experienced tax services can make a world of difference. Filing late or incorrectly can lead to penalties, but getting it right helps you stay compliant and focused on running your business.