If you’re a lender, educational institution, or loan servicer, you may need to file Form 1098 to report interest payments received throughout the year. This IRS document helps taxpayers claim deductions on mortgage or student loan interest paid, which can significantly impact their tax returns.

In this blog, we’ll explain how to file Form 1098, what each box means, and what financial records you need. Whether you’re managing property loans or tuition payments, filing this form accurately ensures both compliance and clarity.

Table of Contents

What Is Form 1098, and When Do You Need to File It?

Form 1098, also known as the Mortgage Interest Statement, reports interest payments made on a mortgage, student loan, or even contributions for higher education (depending on the variant: 1098, 1098-E, or 1098-T). This form is sent to both the IRS and the individual who paid the interest, enabling them to potentially deduct it on their tax return.

You’re required to file Form 1098 if:

- You’re a financial institution, government unit, or educational organization that received over $600 in interest during the tax year.

- You’re involved in mortgage lending or servicing student loan debt.

- You’re reporting tuition-related payments for students.

When Should You Submit Form 1098?

Filing deadlines are strict, so it’s essential to keep track:

- To the recipient (homeowner, borrower, or student): January 31

- To the IRS:

- By February 28 (if filing by paper)

- By March 31 (if submitting electronically)

Make sure all data lines up with your financial statements to avoid late penalties or inaccuracies.

Documents Required Before You Begin

To fill out Form 1098, gather the following:

- Your organization’s legal name, address, and TIN

- The borrower’s or student’s full legal name, SSN, and address

- Accurate financial statements showing the amount of interest or tuition paid

- The mortgage details, if applicable (outstanding balance, interest rates, etc.)

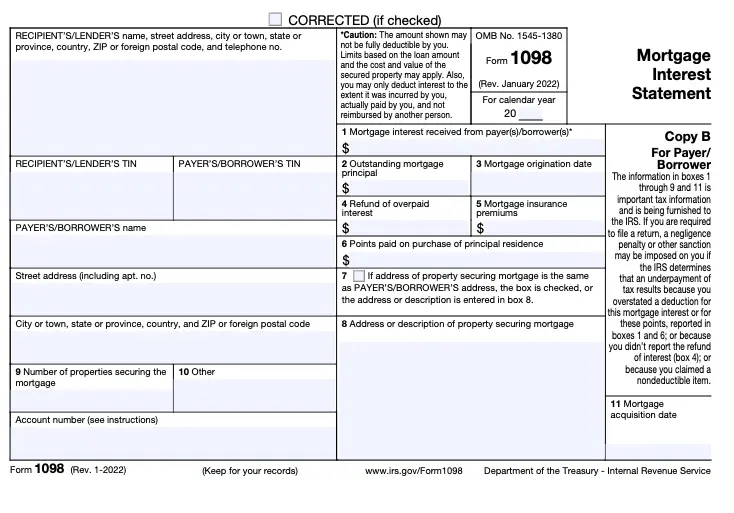

Filing Form 1098: Section-by-Section Instructions

Form 1098 consists of multiple variants. This guide focuses primarily on the mortgage interest version, but we’ll briefly touch on Form 1098-E (student loans) and 1098-T (tuition). Let’s walk through each box step-by-step.

Step 1: Fill In the Payer and Recipient Information

At the top of the form, complete:

- Payer’s Name and TIN – Your business or institution

- Recipient’s Name and SSN – The borrower, homeowner, or student

- Street address, city, state, and ZIP code for both parties

Be sure to double-check spelling and numbers against your financial records.

Step 2: Mortgage Interest Received (Box 1)

Enter the total mortgage interest received from the borrower throughout the tax year.

💡 This amount must be at least $600 to be reportable. Exclude prepaid interest.

Step 3: Points Paid on the Purchase (Box 2)

If you received points (loan origination fees) as part of a real estate purchase, record that amount here. Points are often deductible, so accuracy here is key.

Use your financial statements or closing disclosure to confirm this figure.

Step 4: Outstanding Mortgage Principal (Box 3)

This box reflects the principal balance on the mortgage as of January 1 of the reporting year.

If this is the first year of the mortgage, leave it blank.

Step 5: Mortgage Origination Date (Box 4)

Provide the original date the mortgage was initiated.

Make sure this date matches the loan agreement on file and is supported by your documentation.

Step 6: Property Details (Box 5)

Enter the full property address for which the mortgage interest applies. This may differ from the recipient’s mailing address.

Step 7: Indicate If Property Is Secured (Box 6)

Check this box if the loan was secured by real estate. Most residential mortgages will qualify here.

Step 8: Additional Interest Received (Box 7)

Use this box to note if interest was received in advance for the following year.

Step 9: Include Other Details (Boxes 8-11)

- Box 8: For reporting mortgage insurance premiums

- Box 9: Number of properties securing the loan

- Box 10: Other – This is optional and can be used for state-specific data

- Box 11: Amount paid to the lender for acquisition of property

These sections are beneficial for specialized cases or when reporting to certain state tax agencies.

Filing Form 1098-E: Reporting Student Loan Interest

If you’re reporting interest payments for student loans, you’ll use Form 1098-E. The key box here is:

- Box 1: Total interest paid by the borrower during the tax year

This form allows students or graduates to deduct up to $2,500 in interest on their tax returns.

Ensure the loan qualifies under federal regulations and the student was enrolled at least half-time.

Avoid These Common Mistakes When Filing Form 1098

- Reporting incorrect TINs or SSNs

- Mismatched totals between form and internal financial statements

- Leaving boxes blank that require data (especially Boxes 1–3)

- Missing the filing deadline

Working with professional tax services can minimize these errors and ensure full compliance with IRS standards.

Final Thoughts: Mastering Form 1098 Reporting

Filing Form 1098 correctly is essential for both IRS compliance and helping taxpayers claim rightful deductions. Whether you’re reporting mortgage interest, student loan payments, or tuition expenses, accurate data sourced from financial statements will ensure the process runs smoothly.

Still unsure? Consider consulting a tax expert. Professional tax services can help manage bulk filings, cross-check records, and keep you compliant, saving you time and stress.