Lately, companies are choosing to outsource certain services at a massive rate, especially after globalization and digitalization. CPA and bookkeeping services are a part of any business that has been repeatedly outsourced. There are many reasons for choosing to outsource, such as reduced time, tax bills, and error prevention.

If you have the skills and time required to perform the accounting tasks, then it’s completely okay. However, most businesses require additional support as they grow and pitch to more audiences. When hiring, you must first decide whether you want a CPA or a bookkeeper, considering the business requirements.

General accounting tasks include accounts receivable, cash flow forecast, and hiring consultants. CPA and bookkeeping services can provide a broad range of functions, while others are keen on special area-driven services. Hence, different CPA and bookkeeping services exist, especially for small or medium-sized businesses looking for part-time assistance; we will discuss those briefly.

Understanding Bookkeeping for Small Businesses

Bookkeeping involves the systematic recording, organizing, and managing of financial transactions. Accurate bookkeeping provides insights into a business’s financial health, aids in strategic planning, and ensures compliance with tax regulations.

Types of Bookkeeping Services

1. Traditional Bookkeeping

Traditional bookkeeping involves manual recording of financial transactions, often using physical ledgers or basic software. While this method offers control, it can be time-consuming and prone to errors.

2. Virtual Bookkeeping Services

Virtual bookkeeping services utilize cloud-based software, allowing bookkeepers to manage finances remotely. Benefits include real-time data access, scalability, and cost-effectiveness.

3. Outsourced Bookkeeping Services

Outsourcing bookkeeping involves hiring external professionals or firms to handle financial records. This approach provides expertise, reduces overhead costs, and allows business owners to focus on core operations.

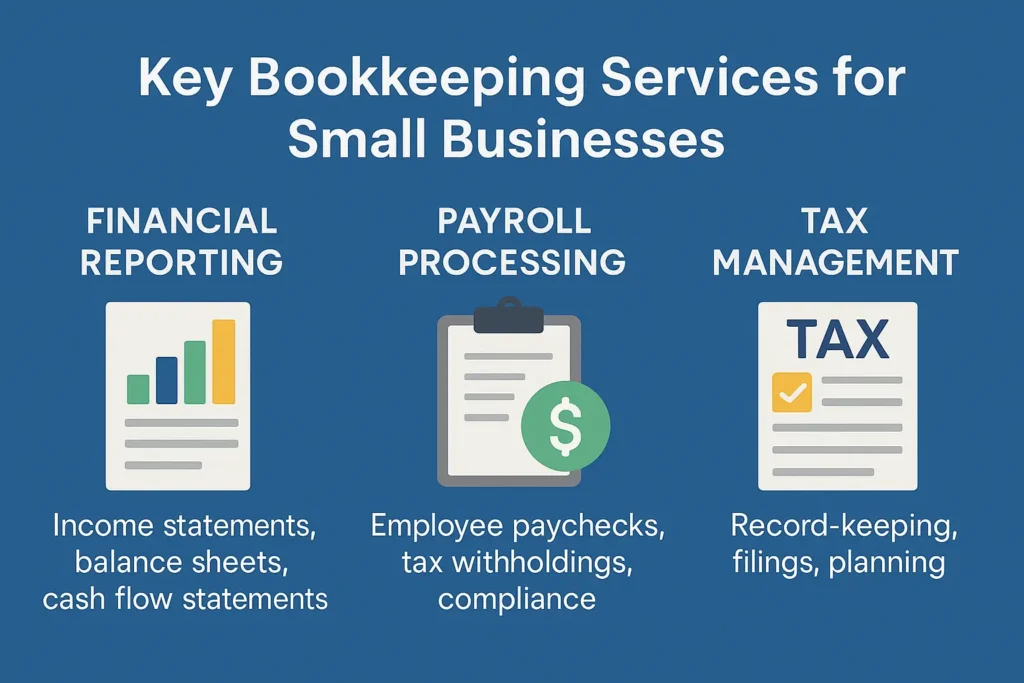

Key Bookkeeping Services for Small Businesses

1. Financial Reporting

Regular financial reports, including income statements, balance sheets, and cash flow statements, offer insights into business performance and aid in decision-making.

2. Payroll Processing

Efficient payroll processing ensures timely and accurate employee compensation, tax withholdings, and compliance with labor laws.

3. Tax Management

Proper tax management involves accurate record-keeping, timely filings, and strategic planning to minimize liabilities and avoid penalties.

Choosing the Right Bookkeeping Service

When selecting a bookkeeping service, consider the following:

- Business Needs: Assess the complexity of your financial transactions and reporting requirements.

- Budget: Determine the affordability of in-house, virtual, or outsourced services.

- Technology: Ensure compatibility with existing systems and the ability to integrate with other business tools.

Expertise: Evaluate the qualifications and experience of potential service providers.

Benefits of Professional Bookkeeping Services

- Accuracy: Professional bookkeepers ensure precise financial records, reducing errors and discrepancies.

- Compliance: Stay updated with tax laws and financial regulations, avoiding legal issues.

- Time-Saving: Delegate time-consuming tasks, allowing focus on business growth.

- Financial Insights: Gain valuable analysis and advice for strategic planning.

Profitjets: Your Partner in Comprehensive Financial Management

Profitjets specialises in providing a full suite of financial solutions tailored for small business ventures. Our bookkeeping services ensure accurate and timely management of your financial records, allowing you to stay organised and make informed decisions. From tracking expenses to preparing financial reports, we handle the details so you can focus on business growth.

For businesses looking to optimise costs, our outsourced bookkeeping services are the perfect solution. By outsourcing, you gain access to expert bookkeeping without the expense of maintaining an in-house team. We manage your daily financial operations, ensuring accuracy, efficiency, and compliance with industry standards.

Profitjets also offers CFO services, providing strategic financial guidance that helps small businesses plan for long-term success. Our experienced CFOs deliver insights on cash flow management, budgeting, and financial forecasting, ensuring your business remains on a path to sustainable growth.

Additionally, our Tax Services ensure your business stays compliant with tax regulations while maximising deductions and minimising liabilities. We help you navigate complex tax requirements, ensuring timely and accurate filings to avoid penalties.

With Profitjets, you gain a trusted partner committed to helping your business thrive through expert financial management, tailored to your specific needs.

Conclusion

Outsourcing CPA and bookkeeping services can give the business the support required to perform well in the market. As an expanding business, upgrading accounting operations is often considered necessary. However, things should not be rushed, and the business must carefully look for the right service provider for the job.

Frequently Asked Questions

1. What is the difference between bookkeeping and accounting?

Bookkeeping involves recording daily financial transactions, while accounting encompasses interpreting, classifying, and summarizing financial data for reporting and analysis.

2. How often should I update my financial records?

Regular updates, preferably weekly or monthly, ensure accuracy and timely financial insights.

3. Can virtual bookkeeping services handle tax preparation?

Many virtual bookkeeping services offer tax preparation and filing assistance, ensuring compliance with current tax laws and regulations.

4. Are outsourced bookkeeping services cost-effective for small businesses?

Yes, outsourcing can be more affordable than maintaining in-house staff, providing expertise without the associated overhead costs.

5. What software is commonly used in virtual bookkeeping?

Popular software includes QuickBooks Online, Xero, FreshBooks, and Zoho Books, offering various features tailored to small business needs.