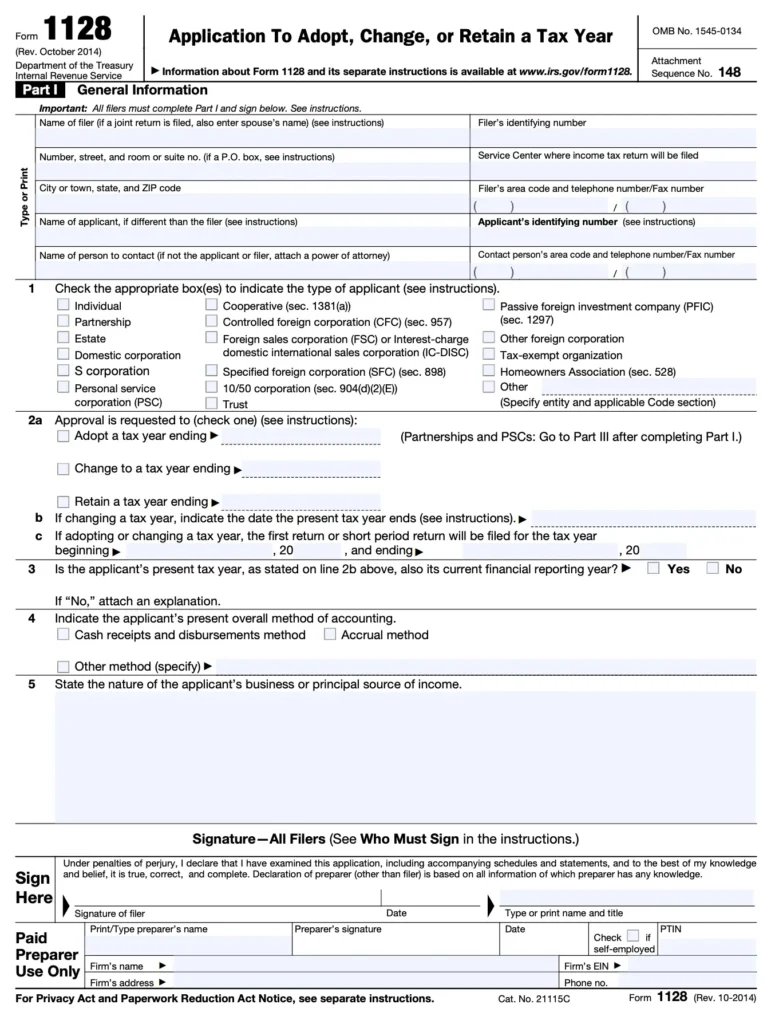

IRS Form 1128 (Application to Adopt, Change, or Retain a Tax Year) is the official document businesses must file when:

- Adopting a new tax year

- Changing from one accounting period to another

- Requesting IRS approval for a non-calendar year

- Maintaining an existing fiscal year

Table of Contents

Who Must File Form 1128?

You should file if your business:

- Wants to switch from calendar to fiscal year (or vice versa)

- Needs IRS approval for a 52-53 week tax year

- Is changing its existing accounting period

- Merged with or acquired another business

- It needs to align with the parent company’s fiscal year

Important: Some changes require IRS consent. Professional tax services can determine if your change qualifies for automatic approval.

Step-by-Step Guide to Completing Form 1128

Step 1: Determine Your Accounting Period Change

Identify:

- Current tax year-end date

- Proposed new tax year-end date

- Business purpose for the change

- IRS revenue procedures that apply

Step 2: Gather Required Documentation

Prepare:

- Financial statements for the past 3 years

- Detailed business purpose statement

- Corporate organizational documents

- Ownership structure details

- Any relevant IRS rulings

Step 3: Complete Part I – General Information

- Line 1a: Business name and EIN

- Line 1b: Current tax year-end date

- Line 1c: Proposed tax year-end date

- Line 1d: Type of entity (corporation, partnership, etc.)

Step 4: Complete Part II – Reason for Change

- Line 2: Explain the business purpose for change

- Line 3: Describe the natural business year (if applicable)

- Line 4: Provide supporting facts and circumstances

Step 5: Complete Part III – Automatic Approval

For automatic changes:

- Line 5: Revenue procedure being followed

- Line 6: Scope limitations

- Line 7: Transition period details

Step 6: Complete Part IV – Signature

- Line 8: Taxpayer signature

- Line 9: Paid preparer information (if applicable)

Step 7: File the Form

- Automatic changes: File with tax return

- Non-automatic changes: File as a stand-alone application

- Mail to:

Internal Revenue Service

Ogden, UT 84201-0027

- Deadlines: Vary by change type (typically tax return due date)

Common Mistakes to Avoid

- Missing filing deadlines – Strict timelines apply for changes

- Incomplete business purpose – Must demonstrate valid reasons

- Improper change classifications – Automatic vs. non-automatic

- Failing to maintain documentation – Must support method change

- Not reconciling with financial statements – Must align with books

Professional tax services ensure proper compliance with complex accounting changes.

Advanced Considerations

Financial Statement Impacts

- Short-period return requirements

- Income deferral implications

- Comparative reporting challenges

- Disclosure requirements

Special Situations

- Partnership tax year restrictions

- S corporation calendar year requirements

- Consolidated group alignment

- International parent company coordination

State Compliance

- State tax year conformity

- Composite return implications

- Estimated payment timing

- Franchise tax considerations

Final Thoughts

Proper completion of IRS Form 1128 is essential for businesses changing accounting periods to maintain compliance and optimize their tax position. By keeping detailed business records and accurate financial statements and carefully following the latest Form 1128 instructions, companies can successfully navigate tax year changes. For organizations with complex structures, international operations, or multiple entities, partnering with professional tax services provides the expertise needed to implement changes properly and maximize tax benefits.