Profitjets specializes in delivering comprehensive accounting services tailored for rental businesses. Our expertise allows you to manage your finances efficiently, ensuring that you can devote your time and energy to expanding and enhancing your property portfolio.

Effectively managing finances for rental properties demands a high level of precision and a deep understanding of industry standards. Our comprehensive accounting services for the rental business are tailored specifically for landlords, property managers, and real estate investors. We focus on addressing the unique financial challenges faced in this sector, ensuring our clients achieve clear insights into their financial standing while maintaining compliance with regulatory requirements. With our expertise, you can confidently and easily navigate the complexities of property management.

When it comes to managing rental properties, accounting for rental businesses is essential for achieving success. This approach enables you to gain a clear and comprehensive view of your finances, allowing you to identify areas for cost reduction, optimize rental income, and maximize profitability across your entire rental portfolio. Moreover, effective accounting for rental businesses provides valuable data and insights into property performance, vacancy rates, and maintenance costs, facilitating data-driven decisions regarding pricing strategies, marketing efforts, and property maintenance to optimize returns on investments. Additionally, accounting for rental businesses ensures tax compliance, accurate record-keeping, and financial reporting, minimizing the risk of tax audits and penalties.

Managing a rental business involves various financial responsibilities that can be quite intricate. Accounting for rental businesses requires efficient record-keeping and expense tracking across multiple properties. It involves keeping track of recurring costs such as property taxes, utilities, insurance premiums, and maintenance expenses. Moreover, it is essential to accurately calculate and track depreciation on rental properties for tax purposes. Additionally, managing tenant interactions, including rent payments, late fees, and security deposits, also falls under the purview of accounting for rental businesses. Clear processes for tenant communication and accurate financial transaction records are imperative in rental business accounting.

Profitjets delivers an extensive range of specialized accounting services designed specifically for rental businesses. Our offerings include expert Chief Financial Officer (CFO) services, meticulous tax planning and preparation, and detailed bookkeeping solutions. Whether you oversee a handful of properties or manage an expansive portfolio, our team is committed to providing the financial insight and transparency necessary for your success. We understand the unique challenges of the rental market and strive to empower your business with the clarity it needs to thrive.

01.

With our team working daily on the accounting tasks, we categorize numbers correctly and with the detail you need to make decisions.

02.

We set everything you need to pay bills quickly and easily. All you need to worry about is approval while getting the benefit of stronger internal controls.

03.

Get paid quickly and accurately with rental business invoicing support. Show the details to your clients to answer any questions ahead of time.

04.

The right accounting software support shaves time off repeatable tasks and better connects your business operations.

We will work with you to identify the best accounting software solutions for your rental business account. With Profitjets by your side,

you can confidently navigate the complexities of rental business accounting, optimize your finances for maximum profitability, and

make data-driven decisions to create an unforgettable homing experience for your clients. Profitjet’s team is proficient in a variety

of industry-leading accounting software programs designed for rental business accounting some softwares include:

Up-to-date Rental Business financials makes it easier to build the strategy. We can provide you with CFOs with experience in all the nuances of Rental Business.

Profitjets understands the unique challenges and opportunities of the real estate industry, going beyond basic accounting to provide comprehensive solutions.

At Profitjets, effective accounting is the backbone of a successful marketing agency. It empowers firms to make intelligent decisions and maintain a healthy financial line.

Profitjets understands the travel industry's distinct challenges, like tourism taxes. We tackle these tasks by offering customized accounting solutions.

Profitjet’s effective accounting empowers rental businesses to gain valuable insights into their properties, make data-driven decisions, and ensure financial stability.

Profitjet’s accounting management for lawyers encompasses critical components like meticulous record-keeping, segregation of client funds, and ethical compliance.

We assist Advertising Agencies in accurately tracking project costs, employee time, software licenses, media buys, transparent billing, and all other project-related expenses.

Profitjets assists non-profit organizations with tracking grants, donations, communications, and stewardship efforts to build and maintain donor relationships.

"Good business leaders create a vision, articulate the vision, passionately own the vision, and relentlessly drive it to completion."

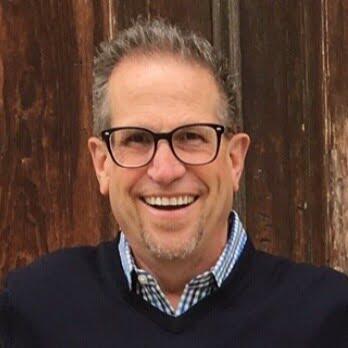

Abhinav Gupta

CEO Profitjets

Let's Connect

It is highly recommended to separate your personal and rental finances for several reasons. Firstly, having a dedicated business account simplifies record-keeping for rental income and expenses, making tax filing and financial analysis easier. Additionally, a business account may offer some liability protection in case of lawsuits related to your rental property. Moreover, certain tax deductions may be easier to track and claim with a separate business account, providing potential tax advantages.

When considering options for managing rental income, it's important to remember that there's no single "best" account. However, there are several options to consider. A business checking account can provide easy access to funds for managing rental property expenses and offer a clear record of transactions. On the other hand, a savings account can be used to accumulate funds for future maintenance or repairs, but it may have limited transaction features. Another option is a money market account, which allows you to earn some interest on rental income while maintaining liquidity for managing expenses. Each option has its pros and cons, so it's important to carefully consider which best aligns with your specific needs and goals.

When deciding on the best business structure for rental properties, it's important to consider your specific circumstances. You have a few options to consider, including sole proprietorship, limited liability company (LLC), and real estate investment trust (REIT). A sole proprietorship is the simplest structure but offers limited liability protection. On the other hand, an LLC provides more liability protection than a sole proprietorship and is relatively easy to maintain. A REIT is a more complex structure that is better suited for large-scale rental property portfolios. It's best to consult with a tax advisor or financial professional to determine the most suitable business structure for your rental properties based on your individual situation.

Rental properties can be profitable, but it depends on factors like location, property type, rental income, and operating expenses. Careful management, cost control, and understanding your local rental market are crucial for profitability.

Rental income is generally considered business income for tax purposes. The specific tax treatment may vary depending on your business structure (sole proprietorship, LLC, etc.). Consult with a tax advisor for accurate tax guidance.

When it comes to managing rental properties, there are several accounting software options tailored to meet the specific needs of property owners and managers. QuickBooks Online stands out for its user-friendly interface and scalability, offering features for managing income, expenses, and tenants, and generating comprehensive reports. For those seeking a simpler solution with tax filing integration, TurboTax Home & Business is a good option, although it’s important to consider its limitations for more complex portfolios. Cozy, a cloud-based property management software, provides functionalities for rent collection, tenant screening, maintenance requests, and basic accounting. Meanwhile, Avail offers a platform specifically designed for rental property management, including marketing, tenant screening, and basic accounting features. It's essential to carefully consider the number of properties you manage, the complexity of your needs, and your budget when choosing the best software for your rental business. Consulting with an accountant can also provide valuable insights into selecting the most suitable option.

Profitjets offers a full range of services, including CFO services, tax services, and bookkeeping services tailored specifically for rental businesses. These help with day-to-day financial management and long-term planning.

Getting started is easy. Contact Profitjets today to discuss the accounting needs of your rental business. Let us provide you with the right financial solutions, from bookkeeping services to tax preparation and CFO services.

Help Center

Have more Doubts?

Our experts can help you find the right solutions. Provide a bit of information and we’ll be in touch.

We offer business owners a strong team of accounting professionals to create and manage a competent accounting department to maximize growth and profits. We help businesses looking to save on their finances by providing a clear financial plan for every quarter and also help with all financial tasks. Don’t hesitate; reach out now!

Get Closer

2803 Philadelphia Pike Suite B #205 Claymont, DE 19703

Work With Us

hello@profitjets.com

For Consulting

+91 9868468738