Evaluating a company’s financial well-being often involves considering two critical metrics: Gross Margin and Gross Profit. While they may seem similar at first glance, these terms represent distinct financial concepts that provide unique insights into a business’s profitability and efficiency. In this blog, we’ll dive deep into the Gross Margin vs Gross Profit debate, breaking down the differences, how to calculate each, and their implications for your business.

Table of Contents

What is a Gross Margin?

The gross margin is the amount of revenue that exceeds the cost of goods sold. It indicates how efficiently a company is producing and selling its goods compared to its expenses.

Simply put, Gross Margin indicates a company’s profit after accounting for the expenses directly linked to manufacturing its products or providing its services. This percentage is crucial for assessing pricing strategies, controlling costs, and ensuring long-term profitability.

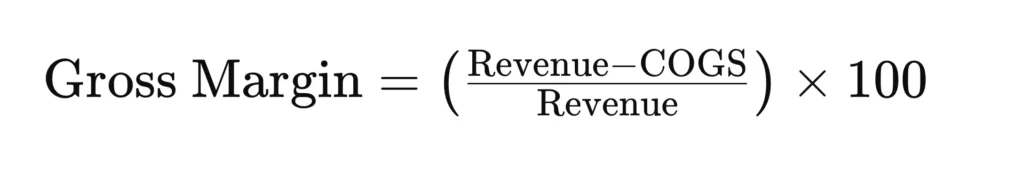

How to calculate Gross Margin?

Calculating Gross Margin is straightforward:

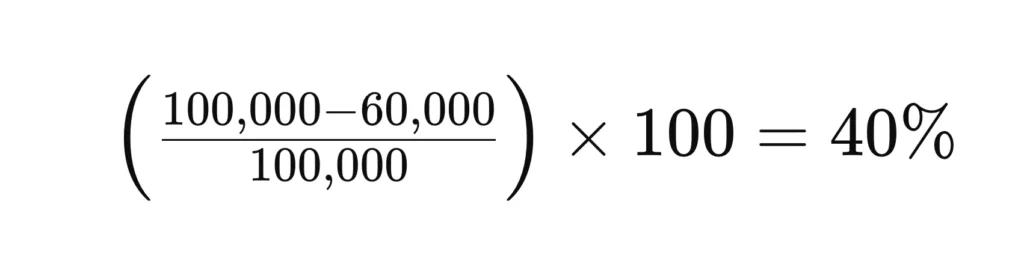

For example, if your company’s revenue is $100,000 and your COGS is $60,000, your Gross Margin would be:

This 40% indicates that for every dollar of revenue, the company retains $0.40 after covering the direct costs of production.

What is Gross Profit?

On the other hand, Gross Profit is the total revenue a company earns after subtracting the cost of goods sold. Unlike Gross Margin, which is expressed as a percentage, Gross Profit is a dollar amount that indicates how much money a company has left to cover operating expenses, taxes, and other costs.

Gross Profit is vital for understanding a business’s overall profitability. It helps companies identify how much money they have to reinvest in growth, pay off debts, or distribute to shareholders.

How to calculate Gross Profit?

The formula for Gross Profit is:

Gross Profit = Revenue − COGS

Using the same example as above, if your revenue is $100,000 and your COGS is $60,000, your Gross Profit would be:

100,000 − 60,000 = 40,000

This $40,000 is the amount your company has earned after covering production costs.

Gross Margin vs Gross Profit: Examples

Let’s look at a couple of examples to gain a better understanding of the distinction between Gross Margin and Gross Profit:

- Example 1:

- Revenue: $200,000

- COGS: $120,000

- Gross Profit: $80,000

- Gross Margin: 40%

- Example 2:

- Revenue: $500,000

- COGS: $300,000

- Gross Profit: $200,000

- Gross Margin: 40%

In both cases, the Gross Margin remains consistent at 40%, but the Gross Profit differs significantly, indicating the actual dollar amount earned after production costs.

Gross Margin vs Gross Profit: Key Differences

While both metrics provide insights into a company’s financial health, the key differences lie in their representation:

- Gross Profit is an amount, while Gross Margin is a percentage.

- Gross Profit shows the total profit after covering COGS, while Gross Margin reveals how efficiently a company is managing its production costs relative to revenue.

How to use Gross Margin vs Gross Profit?

Understanding when to use Gross Margin versus Gross Profit is critical for making informed financial decisions. For instance:

- Gross Margin is often used to assess pricing strategies and production efficiency. A higher margin indicates that a company is effectively controlling its costs.

- Gross Profit is more advantageous for budgeting and forecasting. It helps businesses determine how much money is available for reinvestment, paying off debts, or distributing to shareholders.

What’s the difference between Gross Margin and Profit Margin?

Gross Margin is focused on the percentage of income that surpasses the cost of goods sold, while Profit Margin includes all costs, including operating expenses, taxes, and interest. Profit Margin offers a more thorough insight into a company’s profitability.

Can a company have a high Gross Profit but a low Gross Margin?

A company can have a high Gross Profit but a low Gross Margin. This situation typically occurs in businesses with high revenue but also high production costs. While the company may be generating significant profit in dollar terms, its efficiency in managing costs relative to revenue might be lower, leading to a smaller margin.

What is a good Gross Margin percentage?

A “good” Gross Margin percentage varies by industry. However, a higher Gross Margin generally indicates better cost management and pricing strategies. For example, a Gross Margin of 40% or higher is often considered vital, as it suggests that a company is retaining a significant portion of its revenue after covering production costs.

How Profitjets Can Help You?

At Profitjets, we ensure your financial statements accurately track both gross profit and gross margin through our comprehensive bookkeeping services. Our expert CFO services help analyze these metrics and provide actionable insights for improving profitability. For businesses needing assistance with backlogged finances, our catch-up accounting service can quickly update your financial records. We also offer specialized support with bookkeeping for CPAs and handle tax planning through our tax services. Let Profitjets handle the numbers while you focus on growing your business.

Conclusion

To assess your business’s financial performance, it’s important to understand the key differences between Gross Margin and Gross Profit. Gross Profit shows the amount of profit in dollars, while Gross Margin gives a percentage reflecting how well you manage costs. Both metrics are crucial for making informed financial decisions, like setting prices and budgeting for growth. Mastering these concepts can help you navigate the financial aspects of your business and ensure its long-term success.