U.S. taxpayers who earn income abroad often face double taxation—once by the foreign country and again by the IRS. Luckily, the IRS offers a way to claim a credit for foreign taxes paid: Form 1116.

Whether you’re an individual, trust, or estate with foreign income, this guide will show you exactly how to file Form 1116, what documentation you need, and how to navigate the sections of the form accurately using your financial statements.

Table of Contents

Understanding Form 1116: What It’s Used For

Form 1116, officially titled “Foreign Tax Credit,” allows eligible taxpayers to reduce their U.S. tax liability by the amount of foreign income tax they’ve already paid. If you’ve paid taxes to a foreign government and also owe U.S. taxes on that same income, this form helps ensure you’re not taxed twice.

This is especially useful for:

- U.S. citizens working or investing abroad

- Freelancers or contractors paid by foreign clients

- Individuals with foreign dividends, interest, or royalties

Who Should File Form 1116?

You must file Form 1116 if:

- You paid or accrued foreign taxes on income that is also subject to U.S. tax.

- You wish to claim the foreign tax credit instead of a deduction.

- Your foreign income tax exceeds the IRS’s thresholds for automatic exclusion.

This form is filed alongside your Form 1040 during tax season.

Before You Start: What You’ll Need

Before diving into the form, gather the following:

- Your financial statements showing foreign income earned and taxes paid

- Foreign tax documents (e.g., Form 1099-DIV, 1099-INT, foreign tax slips)

- Documentation of currency exchange rates

- A record of deductions or expenses directly related to your foreign income

Make sure the figures align accurately—mistakes can delay your return or reduce your credit.

When and Where to File Form 1116

Form 1116 is filed with your annual tax return (Form 1040). You must submit it by the standard tax deadline (typically April 15).

If you’re using tax software or e-filing, the form is usually included as part of your return. If filing by mail, attach the completed Form 1116 behind your Form 1040.

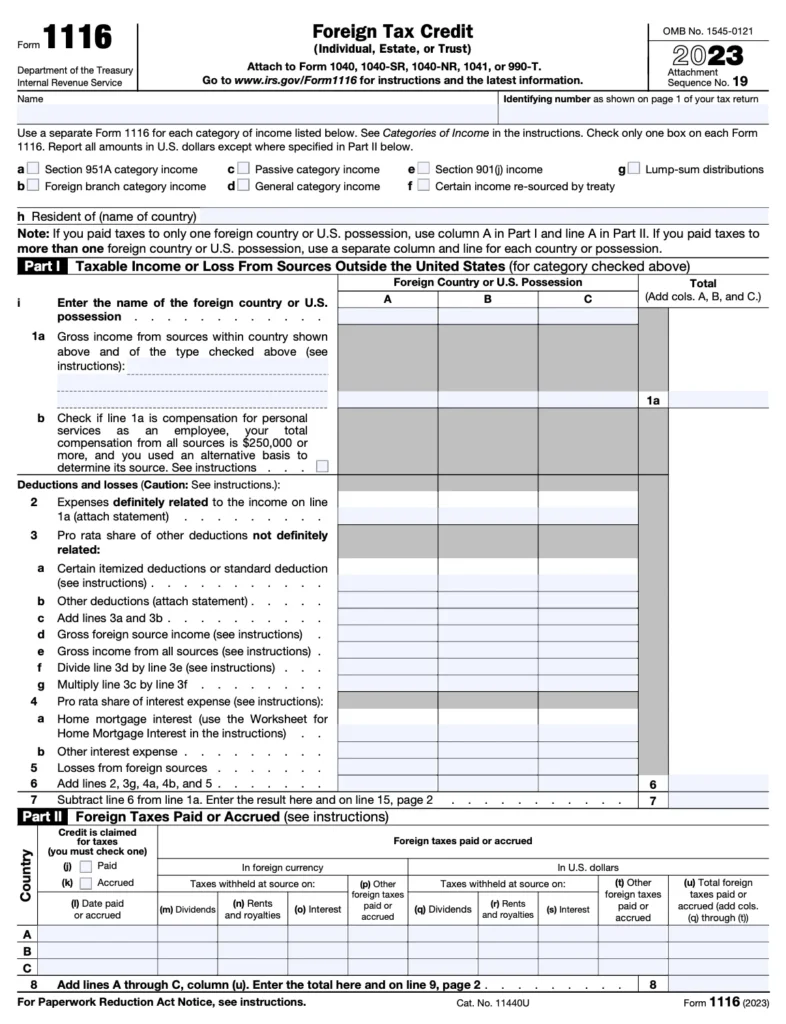

Step-by-Step Breakdown: How to Complete Form 1116

Let’s go line-by-line to help you fill out Form 1116 correctly.

Step 1: Fill Out Basic Information (Top Section)

Start by entering your:

- Name and Social Security Number (SSN)

- Type of income (check only one box: passive, general, Section 901(j), etc.)

- Whether you’re filing for a carryback or carryover (if applicable)

If you’re claiming credits for different types of income (e.g., dividends and earned income), you must file a separate Form 1116 for each category.

Step 2: Reporting Income from Foreign Sources (Part I)

In Part I, list all foreign income sources for which you paid taxes.

- Line 1a – 1h: Include country name, income amount, deductions, and net foreign income

- Use your financial statements to confirm the gross and net amounts

- If you’re using exchange rates, list the quantity foreign first, then convert to USD using IRS-approved rates.

Be accurate and consistent. Errors here can trigger audits.

Step 3: Claiming Foreign Taxes Paid (Part II)

This is where you declare the taxes paid or accrued:

- Line 8: Total foreign taxes paid (by country)

- Line 9: Taxes withheld at the source (like dividends or interest)

- Line 12: Total foreign taxes available for the credit

You must convert all amounts to U.S. dollars and support them with documentation.

Step 4: Calculating the Allowable Credit (Part III)

Here’s where things get a little complex—but we’ve broken it down simply:

- Line 14: Your U.S. tax liability (from your Form 1040)

- Line 15: Multiply your total U.S. tax by the ratio of your foreign taxable income

- Line 21: The smaller of line 12 or line 15 is the maximum foreign tax credit you can claim

This calculation ensures you don’t receive more credit than your U.S. tax liability allows.

Step 5: Handling Carrybacks or Carryovers (Part IV)

Foreign tax credits that can’t be used this year might be carried back one year or forward for up to ten years.

- Line 22: Enter any unused credit from previous years

- Keep records of your unused credits in your financial statements for audit support

Bonus Section: Supporting Schedules and Documentation

Depending on your situation, you might also need to:

- Attach Schedule B if you’re claiming foreign interest or dividends.

- Complete Form 2555 if you’re excluding foreign-earned income.

- Submit currency conversion tables and foreign tax returns if requested.

Avoid These Common Errors on Form 1116

Even seasoned filers can make mistakes. Watch out for:

- Incorrectly categorized income (e.g., capital gains vs. passive income)

- Using average exchange rates instead of IRS spot rates

- Failing to separate credits by income type (you must use separate forms)

- Missing foreign tax documentation

Using professional tax services can reduce the risk of these errors.

How Form 1116 Impacts Your U.S. Tax Return

Once filed, Form 1116 reduces your overall tax liability by the foreign taxes you’ve already paid. This can lead to a smaller tax bill—or even a refund—if you qualify.

- The credit appears on Schedule 3 of your Form 1040.

- You may also reduce your adjusted gross income (AGI) if you choose to deduct instead.

However, keep in mind that the Foreign Tax Credit generally offers more savings than a deduction.

Final Thoughts: Make the Most of Your Foreign Tax Credit

Filing Form 1116 may seem complicated, but it offers substantial tax savings if done correctly. It protects you from double taxation and ensures you’re not overpaying Uncle Sam for income already taxed abroad.

If your financial situation is complex or if you’re unsure how to calculate your allowable credit, it’s worth seeking help from trusted tax services. They’ll ensure that every box is filled accurately and all financial statements are in line with IRS expectations.