If you’ve made non-deductible contributions to a traditional IRA or converted a traditional IRA to a Roth IRA, you’ll need to file Form 8606 with your tax return. This form ensures that you don’t pay taxes twice on the same money when withdrawing funds from your IRA in the future.

But if you miss this form, the IRS might assume all your distributions are taxable—even when they are not.

Let’s break down how to file Form 8606, walk through each part of the form, and explain when and why it’s necessary. We’ll also talk about what documents you’ll need and how tax professionals and clean financial statements can help.

Table of Contents

Understanding IRS Form 8606: What It Does and Who Needs It

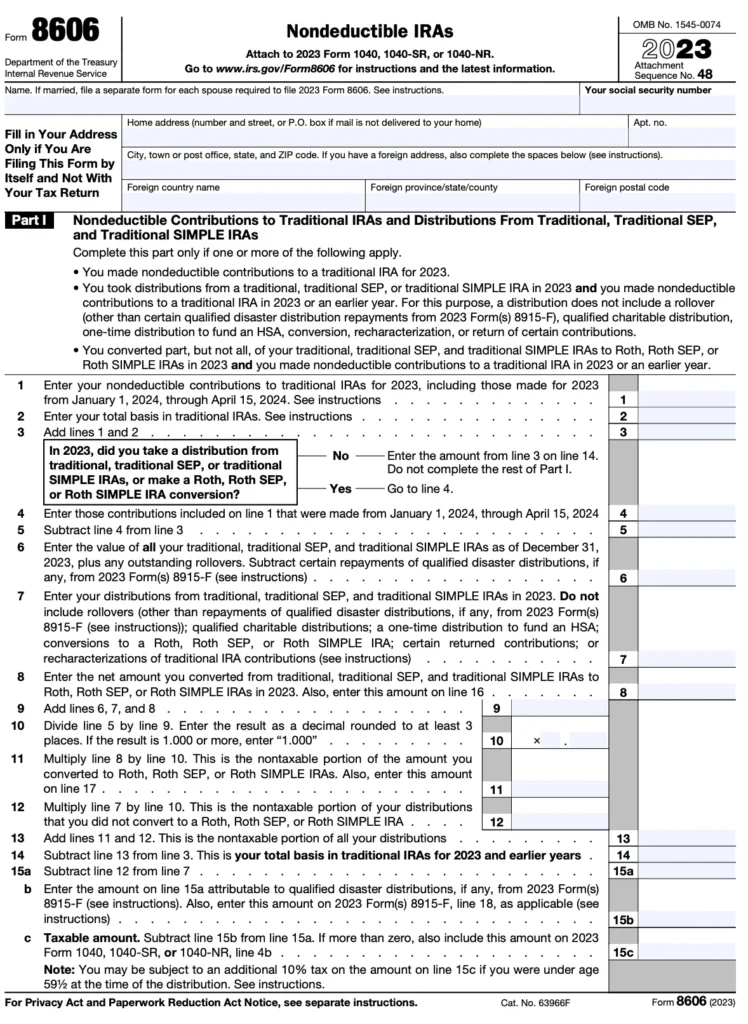

Form 8606 is titled Nondeductible IRAs. It tracks after-tax contributions to traditional IRAs and ensures that your basis (i.e., already-taxed money) is not taxed again when withdrawn.

You must file Form 8606 if any of the following apply:

- You made non-deductible contributions to a traditional IRA

- You converted funds from a traditional IRA to a Roth IRA

- You took a distribution from a traditional, SEP, or SIMPLE IRA that includes non-deductible contributions

- You took a Roth IRA distribution.

This form helps the IRS separate taxable and non-taxable amounts.

Who Should File Form 8606, and When Is It Due?

Form 8606 must be filed annually with your federal income tax return (Form 1040 or 1040-SR) if you had qualifying transactions during the year. You don’t need to file it every year—only in years when there’s relevant IRA activity.

Scenarios that trigger Form 8606:

- You contributed to a traditional IRA and didn’t deduct the contribution on your tax return

- You rolled over or converted pre-tax IRA funds to a Roth IRA

- You withdrew money from an IRA that includes non-deductible contributions.

If you don’t file Form 8606 when required, you could face IRS penalties and pay tax twice on the same income.

Gather This Information Before You Start

Before completing the form, collect the following:

- Financial statements from your brokerage or IRA provider

- Prior-year Form 8606 (if applicable)

- Form 5498 (shows IRA contributions)

- Form 1099-R (reports distributions or conversions)

- Records of Roth or Traditional IRA contributions

Organizing financial statements makes it easier to track expenses, especially if you’ve been contributing non-deductible amounts for several years.

Step-by-Step Instructions to Fill Out Form 8606

Now, let’s go through Form 8606 section by section.

Step 1: Non-Deductible Traditional IRA Contributions – Part I

This part applies if you contributed to a traditional IRA and didn’t deduct the full amount on your tax return.

You’ll report:

- The total non-deductible contributions for the current year (Line 1)

- Your basis in traditional IRAs from previous years (Line 2)

- Total IRA value at year-end plus distributions (Lines 6–9)

- Your non-taxable portion of distributions using the pro-rata rule

Be accurate: Overstating your basis could reduce your tax now but cause IRS issues later.

Step 2: Conversions to a Roth IRA – Part II

If you converted any pre-tax IRA funds to a Roth IRA, this is where you report it. You’ll indicate:

- Total amount converted (Line 16)

- The taxable portion of that conversion (Line 18)

Important: Even though Roth IRA conversions are popular, the IRS still taxes the pre-tax portion. This section prevents over- or under-reporting income.

Step 3: Distributions from a Roth IRA – Part III

If you withdrew from a Roth IRA this year, Part III determines whether your distribution is taxable. You’ll report:

- Total Roth distributions

- Contributions and conversion basis

- The taxable amount, if any

If you’ve had a Roth for more than 5 years and are over 59½, most distributions are tax-free. However, younger withdrawals may trigger taxes and penalties.

Attach Required Forms and Schedules

Depending on your situation, you might also need to attach:

- Form 1099-R (for IRA distributions or conversions)

- Prior Form 8606 to show cumulative basis

- Form 1040 or 1040-SR to report total IRA activity

Attaching these documents ensures consistency across returns.

Tips for Avoiding Mistakes When Filing Form 8606

Here are some of the most common mistakes to avoid:

- Forgetting to file when making non-deductible contributions

- Incorrect basis calculation from prior years

- Omitting Roth conversion amounts

- Assuming distributions are tax-free without considering pro-rata rules

Using professional tax services or software can reduce the risk of misreporting.

Why You Should File Form 8606 Even If It’s Not Required

Filing voluntarily (even when not required) can help:

- Maintain a record of the basis

- Prevent future confusion

- Simplify IRA withdrawal tracking.

Many tax professionals recommend filing Form 8606 proactively when you’ve made after-tax contributions, even if you haven’t withdrawn funds yet.

Final Thoughts: File Form 8606 Right to Protect Your Retirement Savings

Filing Form 8606 correctly is more than a tax form—it’s a strategy to avoid double taxation and protect your retirement savings. It’s beneficial for anyone using backdoor Roth conversions or contributing to both deductible and non-deductible IRAs.

With organized financial statements and the proper Form 8606 instructions, you can avoid unnecessary taxes and simplify future withdrawals.

Still unsure? It may be time to explore professional tax services that specialize in IRA-related filings.