If you manage a retirement plan like a 401(k), compliance is critical. When errors happen—whether it’s a late deposit, prohibited transaction, or failure to meet plan minimums—the IRS expects you to make it right. That’s where Form 5330 comes in.

In this guide, you’ll learn how to file Form 5330, including a detailed breakdown of each section. Whether you’re correcting a mistake under ERISA or resolving an excise tax issue, this form is essential to protect your plan’s tax-advantaged status.

Table of Contents

What Is Form 5330 and Why It’s Important for Retirement Plans

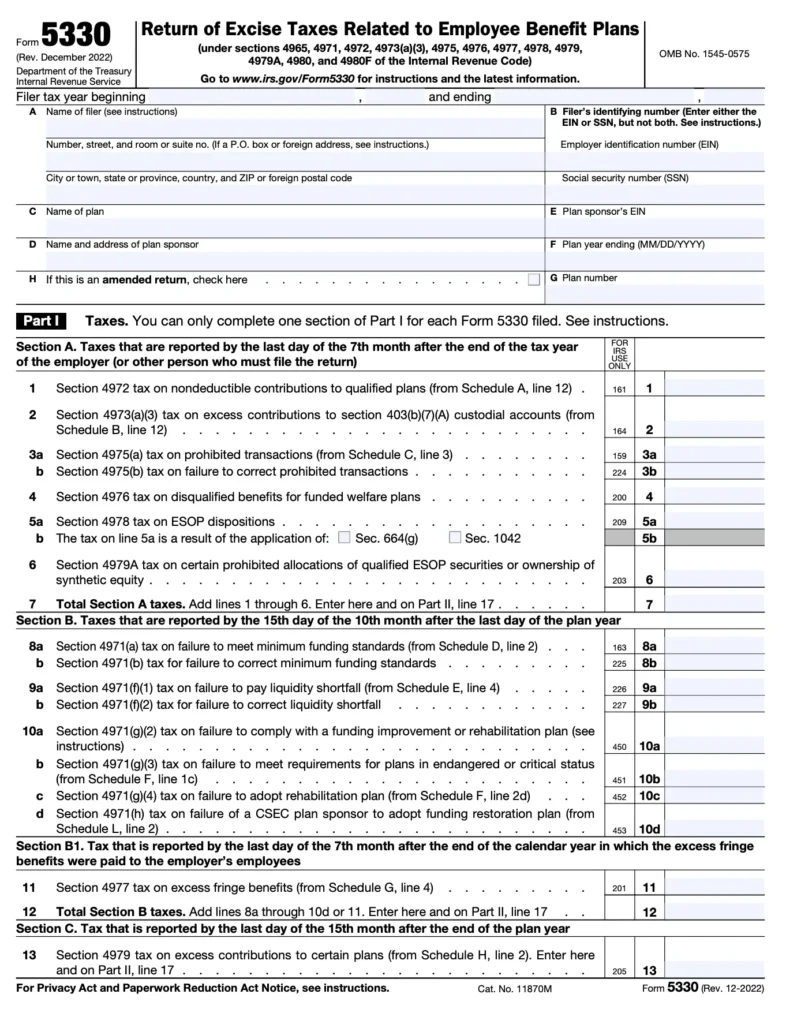

Form 5330, officially titled Return of Excise Taxes Related to Employee Benefit Plans, is used by plan sponsors to report and pay excise taxes tied to retirement plans and benefit arrangements.

You might need to file this form if you:

- Made a late 401(k) contribution

- Committed a prohibited transaction

- Failed to meet minimum funding standards

- Overfunded a pension plan

- Didn’t meet required minimum distributions

Ignoring these mistakes could result in additional IRS penalties—so filing Form 5330 correctly is essential.

When Should You Submit Form 5330?

The deadline depends on the type of excise tax you’re reporting. For example:

- Late deposits or prohibited transactions: Due by the last day of the seventh month after the plan year ends

- Minimum funding failures: Due 30 days after the funding deadline

Failure to file on time may result in extra interest and penalties. Consult current Form 5330 instructions for timelines based on your situation.

Documents You’ll Need Before Starting

Gather the following before you begin filling out the form:

- The original financial statements of your benefit or retirement plan

- Prior Form 5500 filings (if applicable)

- Records of the error or violation (e.g., transaction logs, deposit records)

- A clear explanation of how and when the issue occurred

- Calculations for the excise tax due

Having your financial statements organized can make the filing process much smoother and help you avoid further mistakes.

Step-by-Step Guide to Completing IRS Form 5330

Now, let’s break down how to complete each section of Form 5330.

Step 1: Fill in Basic Plan and Filer Details

At the top of the form, you’ll be asked to provide:

- Name and address of the filer

- Employer Identification Number (EIN)

- The plan name and plan number

- Calendar or fiscal year for which you’re filing

- Contact information for the plan administrator or responsible party

Double-check this section—errors here can delay processing or trigger IRS questions.

Step 2: Identify the Type of Excise Tax You’re Reporting (Part I)

This section asks why you’re filing Form 5330. You’ll select the applicable excise tax types by checking boxes. Common issues include:

- Prohibited transactions (Section 4975)

- Late contributions (Section 4975)

- Minimum funding deficiency (Section 4971)

- Excess contributions (Section 4973 or 4979)

- Reversion of excess assets

Use the Form 5330 instructions to determine which sections of the form are required based on your selections.

Step 3: Provide Tax and Penalty Calculations (Part II & Beyond)

Each part of the form corresponds to a specific type of excise tax. Only fill out the parts that apply to your situation. Here are a few common ones:

- Part II: Tax on failure to meet minimum funding standards

- Part III: Tax on prohibited transactions

- Part IV: Tax on excess contributions

- Part V: Tax on reversions of excess assets

- Part VI: Section 4965 tax-exempt organization managers or entities

For each section:

- Enter the amount subject to tax

- Multiply by the applicable tax rate

- Provide a detailed explanation or worksheet if needed.

If the violation spans multiple plan years, you may need to file various forms or enter supplemental data.

Step 4: Total the Tax Owed (Summary Section)

At the end of the form:

- Add up all applicable excise taxes from previous parts

- Enter any payments already made (if applicable)

- Calculate the net tax due.

Include a check or money order made out to the “United States Treasury,” or follow IRS guidelines for electronic payment options.

Step 5: Sign and File the Form

Finally, sign and date the form. The signature must be from a person authorized to act on behalf of the plan sponsor, usually the administrator or employer.

Mail the completed Form 5330 to the address listed in the instructions for your state or situation.

Tip: Unlike other IRS forms, Form 5330 cannot be e-filed—it must be submitted by mail.

Avoid These Common Filing Mistakes

Here are some pitfalls to steer clear of:

- Filing the wrong version of the form (use the latest from IRS.gov)

- Not completing all required parts based on your excise tax type

- Forgetting to attach schedules or worksheets to support your calculations

- Missing the deadline based on your plan year

- Not reviewing your financial statements to verify tax liability.

If you’re unsure, consider working with professional tax services that specialize in retirement plan compliance.

Final Thoughts: Stay Ahead of IRS Compliance with Form 5330

While Form 5330 can be complex, it plays a key role in correcting benefit plan errors and staying compliant. Filing the form accurately and on time ensures your plan keeps its tax-advantaged status and helps you avoid unnecessary penalties.

If you’re dealing with excise taxes due to late deposits, prohibited transactions, or funding shortfalls, follow these Form 5330 instructions and gather the proper documents—especially your financial statements—to file with confidence.

When in doubt, work with experienced tax services that understand the intricacies of retirement plan corrections.