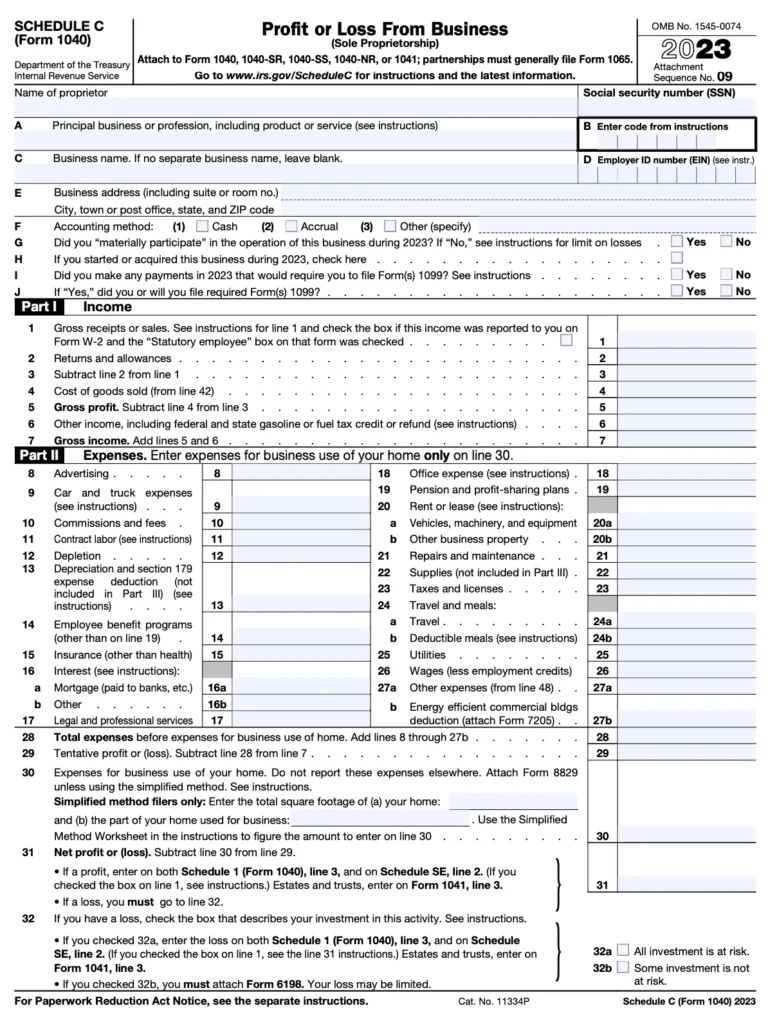

IRS Form 1040 Schedule C (Profit or Loss From Business) is the essential form for sole proprietors and single-member LLCs to report their business income and deductible expenses. Form 1040-C determines your net business profit, which flows to your tax return.

Table of Contents

Who Must File Schedule C?

You need to complete this form if you:

- Operate as a sole proprietor or single-member LLC

- Earned $400 or more in self-employment income

- Have business expenses to deduct

- Need to calculate self-employment tax

Important: Even if you operate at a loss, you may still need to file. Professional tax services can help determine your filing requirements.

Step-by-Step Guide to Completing Schedule C

Step 1: Gather Your Business Records

Before starting, collect:

- Income statements (1099s, invoices, payment records)

- Expense receipts and documentation

- Bank and credit card statements

- Prior year tax return (if applicable)

- Financial statements for reconciliation

Step 2: Complete Part I – Income

- Line 1: Gross receipts or sales

- Line 2: Returns and allowances

- Line 3: Subtract Line 2 from Line 1 for net income

- Line 4: Cost of goods sold (if applicable)

- Line 5: Gross profit (Line 3 minus Line 4)

Tip: Match these amounts to your financial statements for accuracy.

Step 3: Complete Part II – Expenses

Deductible expenses include:

- Line 8: Advertising

- Line 9: Car and truck expenses

- Line 11: Commissions and fees

- Line 12: Contract labor

- Line 13: Depreciation (attach Form 4562 if needed)

- Line 18: Office expenses

- Line 20: Rent on business property

- Line 25: Utilities

- Line 27a: Home office deduction (if applicable)

- Line 30: Total expenses

Step 4: Complete Part III – Cost of Goods Sold

If you sell products:

- Line 35: Inventory at the beginning of the year

- Line 36: Purchases

- Line 37: Cost of labor

- Line 39: Other costs

- Line 41: Inventory at the end of the year

- Line 42: Calculate the total cost of goods sold

Step 5: Complete Part IV – Vehicle Information

If claiming vehicle expenses:

- Line 43: Total miles driven

- Line 44: Business miles

- Line 45: Percentage of business use

Step 6: Complete Part V – Other Expenses

List additional expenses not covered elsewhere:

- Line 48: Description and amount

Step 7: Calculate Net Profit or Loss

- Line 31: Net profit (Line 7 minus Line 30)

- Transfer this amount to Form 1040-C

Common Mistakes to Avoid

- Mixing personal and business expenses – Keep separate accounts

- Missing deductible expenses – Track all potential deductions

- Incorrect home office calculations – Follow IRS guidelines carefully

- Failing to reconcile with financial statements – Must match your records

- Missing deadlines – Due April 15 (or October 15 with extension)

For complex business situations, professional tax services ensure proper reporting.

Advanced Reporting Considerations

Financial Statement Reconciliation

- Compare tax returns to bookkeeping records

- Document differences between book and tax income

- Maintain supporting documentation

Special Situations

- Business use of home calculations

- Vehicle expense tracking methods

- Startup cost amortization

- Inventory valuation methods

State Compliance

- State business tax requirements

- Local business license fees

- Sales tax obligations

Final Thoughts

Proper completion of IRS Form 1040-C is crucial for accurately reporting your self-employment income and expenses. By maintaining organized records, reconciling with financial statements, and carefully following the latest Schedule C instructions, you can maximize legitimate deductions while remaining compliant. For business owners with complex operations, multiple income streams, or significant expenses, partnering with professional tax services provides peace of mind. It ensures you take advantage of all available tax benefits.