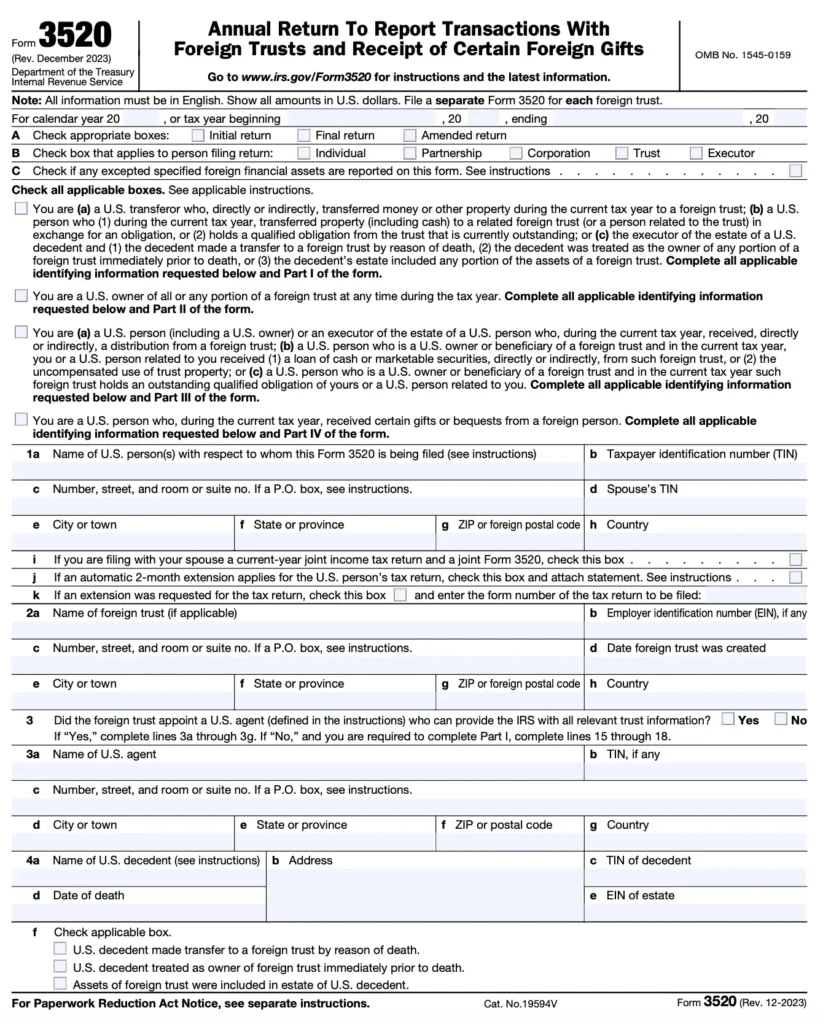

For U.S. taxpayers involved with foreign trusts or who receive significant foreign gifts, filing Form 3520 is a critical requirement. Form 3520, the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts helps the IRS track these international transactions and ensure compliance with U.S. tax law.

In this guide, we break down the process into clear, manageable steps and provide detailed Form 3520 instructions to help you complete every section of the form. Whether you handle your own taxes or work with professional tax services, this step-by-step guide will simplify your filing process and help you avoid costly errors.

What is Form 3520?

Form 3520 is an IRS document used by U.S. persons to report:

- Transactions with foreign trusts: This includes transfers to or from a foreign trust.

- Receipt of large foreign gifts or bequests: This applies if you receive gifts or bequests from foreign individuals or entities that exceed the reporting thresholds.

The form is designed to ensure that U.S. taxpayers disclose their foreign trust transactions and significant foreign gifts, thereby preventing tax evasion and promoting transparency. Failing to file Form 3520 when required can lead to substantial penalties, so it’s crucial to follow the Form 3520 instructions carefully.

Who Must File Form 3520?

You must file Form 3520 if you meet any of the following criteria:

- Transactions with a Foreign Trust: U.S. persons who create, transfer assets to, or receive distributions from a foreign trust must file the form.

- Receipt of Foreign Gifts: If you receive gifts or bequests from a foreign person or entity that exceed the IRS threshold (for example, more than $100,000 from a non-resident alien or foreign estate during the tax year), you must report these transactions on Form 3520.

- Beneficiaries of Foreign Trusts: If you are a beneficiary of a foreign trust and receive distributions from it, you are required to file this form.

Before filing, review the current Form 3520 instructions or consult a tax professional to confirm your filing obligations.

Why Accurate Filing of Form 3520 is Important

Correctly completing Form 3520 is essential for several reasons:

- Regulatory Compliance: The IRS uses the information to monitor international transactions and enforce U.S. tax laws.

- Avoidance of Penalties: Inaccuracies or omissions can result in significant penalties, sometimes a percentage of the amount involved.

- Transparency: Accurate reporting provides a clear record of foreign transactions and gifts, which is essential in the event of an audit.

- Financial Planning: Detailed disclosure assists in managing your overall tax liability and planning for future financial events.

Following the detailed Form 3520 instructions and, if necessary, seeking professional tax services will help you file accurately and avoid penalties.

Step-by-Step Instructions for Completing Form 3520

Below, we outline each step required to complete Form 3520 accurately. Each section is designed to guide you through the process from start to finish.

Step 1: Gather Required Documentation

Before you begin, ensure you have all the necessary documents:

- Foreign Trust Documents: Collect copies of the trust agreement, any amendments, and correspondence related to the trust.

- Gift or Bequest Records: Obtain documentation of any foreign gifts or bequests received, including the source and amount.

- Financial Statements: Gather statements or appraisals that provide the value of the assets transferred or received.

- Personal Identification: Ensure you have your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as the legal name and address shown on your tax records.

- Supporting Schedules: Prepare any additional schedules or worksheets that detail the transactions.

Having these records ready will simplify the process and help ensure the accuracy of your filing.

Step 2: Begin with the Identification Section

Start filling out the form by providing your personal and trust-related details:

- Line 1 – Taxpayer Information: Enter your full legal name and SSN (or ITIN). Make sure the information matches your IRS records.

- Line 2 – Address: Provide your current mailing address.

- Line 3 – Filing Year: Specify the tax year for which you are filing Form 3520.

- Line 4 – Transaction Type: Indicate whether you are reporting a foreign trust transaction or receipt of a foreign gift.

This initial section sets the foundation for your form and must be filled out accurately.

Step 3: Provide Information About the Foreign Trust (if applicable)

If your filing relates to a foreign trust transaction, complete this section:

- Line 5 – Trust Name: Enter the name of the foreign trust as it appears in the trust document.

- Line 6—Trust Identification: If available, provide the trust’s identification number or other identifying details.

- Line 7 – Trust Address: List the foreign address of the trust.

- Line 8 – Date of Transaction: Specify the date on which the transaction with the trust occurred.

- Line 9 – Description of Transaction: Briefly describe the nature of the transaction (e.g., transfer of property, distribution from the trust).

Accurate reporting here is critical to ensure the IRS understands the nature of your involvement with the foreign trust.

Step 4: Report the Receipt of Foreign Gifts (if applicable)

If your filing is due to receipt of a foreign gift or bequest, complete the following:

- Line 10 – Donor Information: Provide the name, address, and identification details of the foreign donor.

- Line 11 – Date of Receipt: Enter the date you received the gift or bequest.

- Line 12 – Description and Value: Detail the description and fair market value of the gift received.

- Line 13 – Total Gift Amount: If you received multiple gifts, sum the total value.

This section is crucial for transparency and accurate reporting of the amounts involved.

Step 5: Calculate the Total Reportable Amount

Summarize the total amounts for the foreign transactions:

- Line 14 – Total Transactions: Add up the values from the trust transactions and/or foreign gifts. This should represent the total reportable amount.

- Line 15 – Comparison to Thresholds: Verify that the total amount meets or exceeds the IRS reporting thresholds applicable to your filing status.

Ensuring these totals are correct is essential for proper compliance with IRS rules.

Step 6: Provide Additional Details and Explanations

In this section, include any additional information required:

- Line 16 – Adjustments or Exclusions: Detail any adjustments or exclusions applicable to your report. For example, explain if certain items are not subject to reporting.

- Line 17 – Attach Supplemental Schedules: Indicate that additional schedules or documents are attached to provide further details on your transactions.

This additional information supports your figures and helps the IRS understand your situation in depth.

Step 7: Review, Sign, and Date the Form

Before submission, carefully review the entire form:

- Review: Check every line to ensure that all information is accurate and that your calculations are correct.

- Sign and Date: Sign and date the form in the appropriate section. For electronic submissions, follow the IRS guidelines for e-signatures.

- Include Attachments: Ensure that all supporting documentation and additional schedules are correctly attached.

A meticulous review helps prevent mistakes that could result in penalties or processing delays.

Step 8: Submit Your Form 3520

After completing and reviewing the form, it’s time to file:

- Electronic Filing: If you file your tax return electronically, make sure Form 3520 is included in your submission package.

- Mailing: If you are submitting a paper return, mail the completed Form 3520 along with your other tax forms to the IRS address specified in the current instructions.

- Keep Copies: Retain a copy of the completed form and all supporting documents for your records. These records are essential in case of an IRS audit or future correspondence.

Following the proper submission process ensures your filing is processed quickly and accurately.

Additional Tips and Best Practices

- Organize Your Documentation: Keeping detailed records of all foreign financial transactions throughout the year will make completing Form 3520 much more manageable.

- Double-Check Your Calculations: Verify your figures using reliable accounting software or spreadsheets before entering them on the form.

- Stay Current with Instructions: Always refer to the most recent Form 3520 instructions on the IRS website, as thresholds and requirements may change.

- Consult Professional Tax Services: If your foreign transactions are complex or you are unsure about any aspect of the form, seek advice from professional tax services. Expert guidance can help you avoid errors and ensure full compliance with IRS regulations.

Leveraging Professional Tax Services

Filing Form 3520 can be challenging, especially if you have multiple foreign trusts or have received significant foreign gifts. Professional tax services can simplify the process by offering:

- Expert Guidance: Tax professionals can provide up-to-date insights on IRS requirements and help you navigate complex transactions.

- Efficient Filing: Outsourcing Form 3520 preparation and review to experts saves time and reduces the risk of mistakes.

- Personalized Support: Tailored solutions for your specific financial situation ensure that every detail is accurately reported.

- Peace of Mind: With professional assistance, you can file your return confidently, knowing that your reporting is compliant and complete.

Investing in professional tax services is particularly beneficial if you have complicated international transactions or if you simply want to ensure that your filing is error‑free.

Final Thoughts

Filing Form 3520 is a critical responsibility for U.S. taxpayers with interests in foreign trusts or those who receive large foreign gifts. By following this comprehensive, step-by-step guide, you can confidently complete every section of the form and ensure that your reporting is accurate and compliant with IRS regulations. Taking the time to gather all necessary documentation, review your calculations, and follow the latest Form 3520 instructions not only prevents potential penalties but also supports your overall financial planning.

Whether you choose to file on your own or with the assistance of professional tax services, being meticulous with Form 3520 is essential. A well-prepared Form 3520 provides a clear audit trail and reinforces your commitment to tax compliance, allowing you to focus on your financial goals without worrying about IRS issues.

By leveraging these detailed instructions and expert support, you can ensure that your foreign financial transactions are reported correctly and that you benefit from full compliance with U.S. tax law.