IRS Form 709 is the form you file when you transfer a significant amount/an estate/an asset in part or in full, or forgive a loan. IRS Form 709 stands for “United States Gift (and Generation-Skipping Transfer) Tax Return” and is used to report taxable gifts exceeding the annual exclusion limit ($19,000 per recipient in 2025). This form ensures compliance with federal gift tax laws and calculates any tax owed on transfers exceeding the exclusion amount. Filing Form 709 is mandatory for donors who exceed the annual gift limit.

Key Points to Remember

- If you file Form 709, it doesn’t mean you owe taxes.

- You file it if you give a gift worth more than $19,000 (in 2025) to one person in a year.

- It does not exclude transfers to trusts or forgiving large debts.

In essence, you are telling the IRS that I’ve given something valuable away this tax year, and the form helps the IRS keep a record of it.

Gifting in the US and its tax implications involve the annual gifting limit, lifetime exemption, what you can gift as a married couple, and deductions you can claim through charitable donations. These scenarios need professional help. Profitjets is a trusted tax adviser and a trustworthy partner for those looking to simplify the process.

Table of Contents

Who Needs to File Form 709?

The person gifting must file Form 709 if:

- If you transfer more than $19,000 to a single recipient in 2025 (or $38,000 if splitting gifts with a spouse).

- You made gifts of future interests (e.g., trusts) regardless of value.

- You transferred assets subject to the generation-skipping transfer (GST) tax.

Large Gifts to a Non-Citizen Spouse

- The limit for gifts to a non-U.S. citizen spouse is $190,000 in 2025.

- If you exceed that, you must file Form 709.

- Gifts to a U.S. citizen spouse are unlimited and do not require the form.

Here’s Profitjets giving you a step-by-step manual for filling out and filing Form 709

Step-by-Step Guide to Filling Out Form 709

Start by considering if Form 709 is essential

- Did you give more than $19,000 per person in 2025?

- Was it a future interest gift, or did you gift-split with your spouse?

- Have you used up your lifetime gift and estate tax exemption?

Note: Only the amount above the annual exclusion counts as a taxable gift.

Track Your Lifetime Exemption Use

- If you’re still under the $13.99 million exemption, no gift tax is due yet. However, filing is mandatory to report the transfer.

- If you ever exceed the $13.99 million exemption, then the gift tax applies.

Steps to File Form 709

Step 1: Gather Necessary Information

- Recipient details (name, address, relationship to donor).

- Gift descriptions (cash, property, stocks, etc.).

- Appraisals for non-cash gifts over $5,000.

- Prior-year Form 709 (if applicable) for lifetime gift tax exemptions.

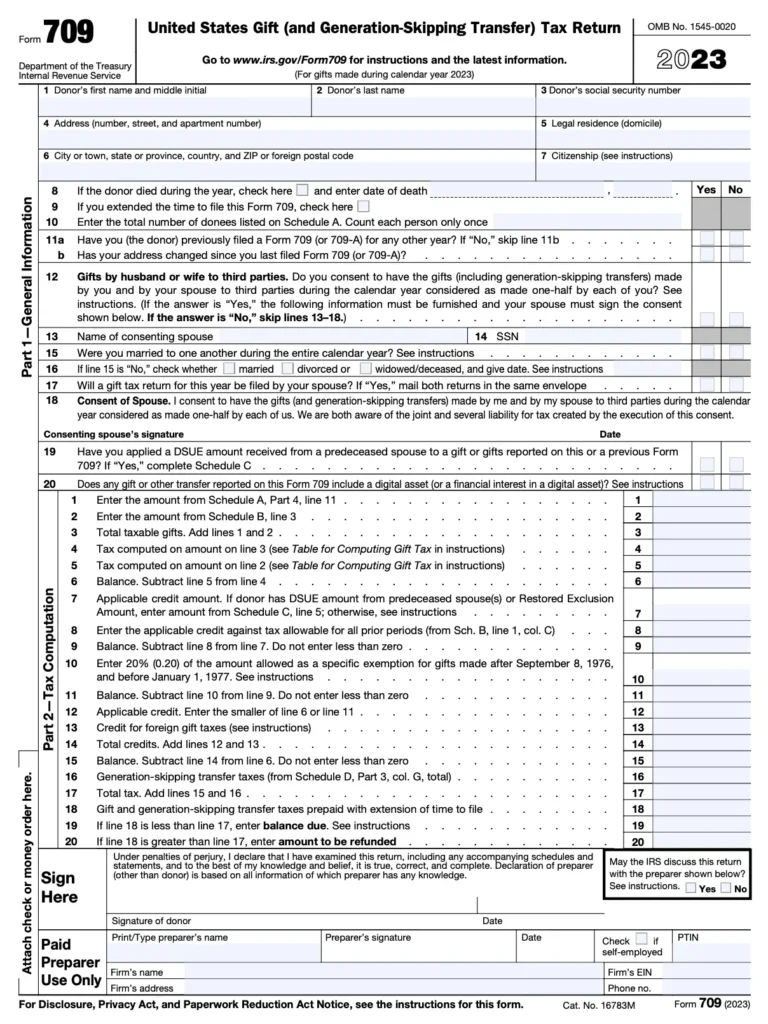

Step 2: Complete Part 1 – Donor Information

- Line 1: Enter your name, Social Security Number (SSN), and address.

- Line 2: If married and splitting gifts, include your spouse’s name and SSN.

Step 3: Complete Part 2 – Gifts

- Schedule A: List all taxable gifts made during the year. Include:

- Recipient’s name and relationship.

- Gift description and value.

- Date of transfer.

- Schedule B: Report gifts of future interests (e.g., trusts).

Step 4: Complete Part 3 – Generation-Skipping Transfer Tax

- Schedule C: If gifts skip a generation, for instance, if something is directly passed on to grandchildren, calculate GST tax using IRS valuation tables.

Step 5: Calculate Tax Liability

- Line 10: Total taxable gifts.

- Line 11: Subtract the annual exclusion ($19,000 per recipient).

- Line 12: Apply the lifetime gift tax exemption ($13.99 million in 2025).

- Line 13: Calculate tentative tax using IRS rate schedules.

- Line 14: Subtract prior-year gift taxes paid (if applicable).

Step 6: Sign and Submit

- Sign and date the form. If married and splitting gifts, both spouses must sign the agreement.

- Mail to:

- Department of the Treasury

- Internal Revenue Service

- Cincinnati, OH 45999-0025

Deadline: File by April 15 of the year following the gift (October 15 with an extension).

Common Mistakes to Avoid

- Missing the deadline: Penalties apply for late filing ($210/month, up to 25% of tax owed).

- Undervaluing gifts: Use appraisals for non-cash assets to avoid IRS disputes.

- Failing to report joint gifts: Spouses splitting gifts must both sign Form 709.

Final Thoughts

If you give more than the exclusion limit, forgive loans, or transfer property to someone in a single year (excluding your spouse), the IRS wants to keep track of it. The IRS tracks lifetime gift and estate tax limits. That’s when you consider filing Form 709. Filing Form 709 doesn’t always mean you are paying a tax; you may have to report a transaction to the IRS. Filing IRS Form 709 is essential for reporting taxable gifts and avoiding penalties. By following these steps, you can accurately report gifts, apply for exemptions, and calculate tax liabilities. Tax calculations, calculating relevant deductions, and minimizing tax liability require professional advice.

Profitjets is a trusted tax planning, advisory, and filing expert. We have over 15 years of experience and have more than 600 satisfied customers. We also provide end-to-end accounting services., We are a reliable and proficient partner for outsourced bookkeeping, outsourced accounting, and Expert CFO services. Contact us for a custom quote.

For complex gifts or generation-skipping transfers, professional tax services ensure compliance and peace of mind.