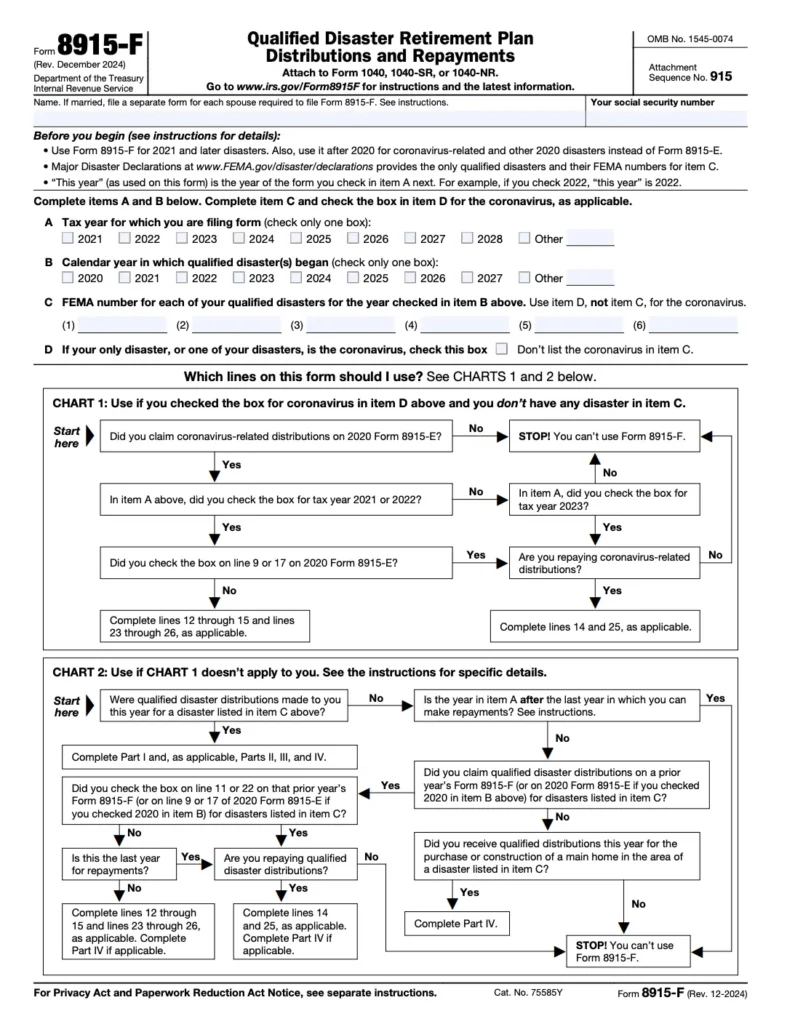

IRS Form 8915-F (Qualified Disaster Retirement Plan Distributions and Repayments) is used to report special distributions taken from retirement accounts following federally declared disasters. This form helps taxpayers:

- Avoid early withdrawal penalties

- Spread taxable income over 3 years

- Report repayments of qualified distributions

Table of Contents

Who Needs to File Form 8915-F?

You must complete this form if you:

- Took a qualified disaster distribution from a retirement plan

- Live in a federally declared disaster area

- Want to spread the tax liability over 3 years

- Are you repaying a qualified disaster distribution

Important: Not all disasters qualify. Professional tax services can verify if your situation applies.

Step-by-Step Guide to Completing Form 8915-F

Step 1: Verify Eligibility

Confirm your distribution meets all requirements:

- Taken after the disaster declaration date

- From an eligible retirement account (IRA, 401k, etc.)

- Within the designated disaster area

- Within the allowable period (typically 180 days post-declaration)

Step 2: Gather Required Documents

Collect:

- Financial statements showing distribution amounts

- Disaster declaration details

- Proof of residence in disaster area

- Repayment documentation (if applicable)

Step 3: Complete Part I – General Information

- Line 1: Enter disaster name and declaration date

- Line 2: Check if this is your first year reporting the distribution

- Line 3: Enter total qualified disaster distributions

Step 4: Complete Part II – Taxable Amount Calculation

- Line 4: Enter 1/3 of the total distribution (default 3-year spread)

- Line 5: Include any amounts from prior years

- Line 6: Calculate the current year taxable amount

Step 5: Complete Part III – Repayments

- Line 7: Enter any repayments made

- Line 8: Calculate the net taxable amount

Step 6: Transfer to Your Tax Return

- Include the taxable amount on Form 1040

- Attach Form 8915-F to your return

- Keep copies of all financial statements

Common Mistakes to Avoid

- Missing repayment deadlines – Typically 3 years from the distribution date

- Incorrect income spreading – Must report 1/3 each year unless electing full inclusion

- Failing to document disaster area residency – Keep proof with tax records

- Missing the 180-day window – Distributions must be timely

For complex situations, professional tax services can ensure proper reporting.

Final Thoughts

Properly completing IRS Form 8915-F is essential for taking advantage of disaster-related retirement distribution benefits. By carefully documenting your qualified distributions, maintaining accurate financial statements, and following the 3-year income inclusion rules, you can navigate this special tax provision effectively. For taxpayers facing multiple disaster events or complex repayment situations, professional tax services can provide valuable guidance and ensure compliance.