Filing Form 8960 is crucial for taxpayers subject to the Net Investment Income Tax (NIIT). Whether you are an individual, estate, or trust, accurately reporting your net investment income can help ensure compliance and prevent costly penalties. In this guide, we break down the process of completing Form 8960 into clear steps.

Our detailed Form 8960 instructions will walk you through gathering the necessary documents, entering the required information, calculating the tax, and finalizing your submission. We also explain how partnering with professional tax services can streamline the process and provide you with peace of mind.

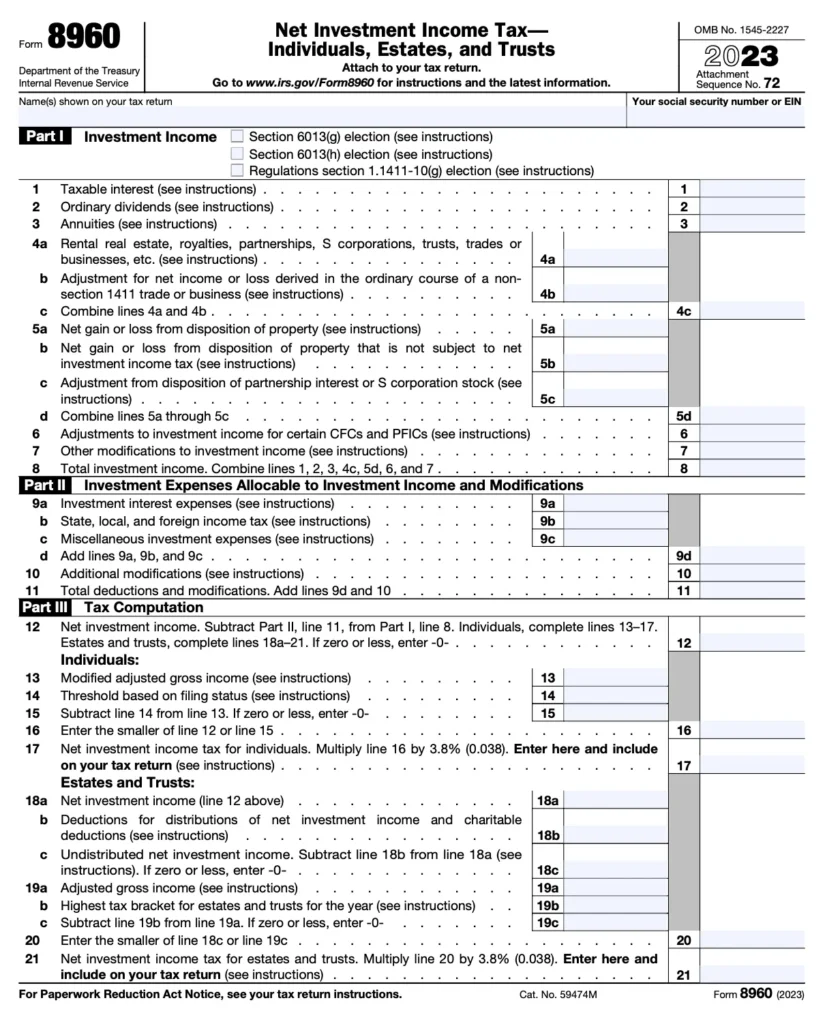

What is Form 8960?

Form 8960 is the IRS document used to calculate and report the Net Investment Income Tax (NIIT). This tax applies to certain investment income for individuals, estates, and trusts that exceed specific thresholds. The NIIT is imposed at a rate of 3.8% on the lesser of your net investment income or the excess of modified adjusted gross income over the statutory threshold. Filing Form 8960 accurately is essential for ensuring that you pay the correct amount of tax and receive any credits or adjustments you’re eligible for.

Who Must File Form 8960?

Taxpayers who must file Form 8960 include:

- Individuals: U.S. citizens or resident aliens whose modified adjusted gross income exceeds the applicable threshold and have net investment income.

- Estates and Trusts: Those that generate net investment income and meet the filing thresholds as defined by the IRS.

If your income falls within the range subject to the NIIT, you will need to complete Form 8960 as part of your annual tax return. It is essential to review the instructions on Form 8960 to determine if you are required to file based on your specific circumstances.

Why Accurate Filing of Form 8960 is Important

Filing Form 8960 correctly is crucial for several reasons:

- Regulatory Compliance: Accurate reporting ensures that you meet IRS requirements and avoid potential penalties.

- Correct Tax Liability: Proper calculation of the NIIT helps you avoid overpayment or underpayment, which could result in additional interest and penalties.

- Transparency: Detailed documentation creates a clear audit trail in case the IRS requests additional information.

- Financial Planning: Knowing your net investment income tax liability aids in better overall financial planning and budgeting.

By following our detailed Form 8960 instructions and, if needed, enlisting professional tax services, you can complete your filing with confidence and accuracy.

Step-by-Step Instructions for Completing Form 8960

Below are the detailed steps to help you accurately complete Form 8960.

Step 1: Gather All Required Documentation

Before you begin filling out Form 8960, compile all necessary documents:

- Financial Statements: Collect your income statements, investment account summaries, and brokerage reports that show dividends, interest, capital gains, and other investment income.

- Tax Returns: Have a copy of your most recent tax return for reference.

- Additional Records: Gather documentation related to adjustments, deductions, or credits that affect your net investment income.

- Threshold Data: Know the applicable income thresholds for your filing status.

Having these records organized will simplify the process and help ensure accurate reporting.

Step 2: Complete the Identification Section

Start by providing your personal and filing information:

- Line 1 – Taxpayer Identification: Enter your full legal name and Social Security Number (SSN) or Employer Identification Number (EIN) as it appears on your tax return.

- Line 2 – Filing Status: Indicate your filing status (single, married, filing jointly, etc.) since the NIIT thresholds vary by filing status.

- Line 3 – Tax Year: Specify the tax year for which you are filing Form 8960.

Double-check these details to ensure they match your other tax forms.

Step 3: Report Your Net Investment Income

Next, report the income that is subject to the NIIT:

- Line 4 – Investment Income: List all income from investments, including interest, dividends, capital gains, rental income, and any other net investment income.

- Line 5 – Adjustments: Enter any adjustments or deductions directly related to your net investment income. This might include investment expenses, certain losses, or other applicable adjustments.

Use your financial statements and tax records to verify the figures you enter here.

Step 4: Calculate Your Modified Adjusted Gross Income (MAGI)

Your modified adjusted gross income is critical in determining your NIIT liability:

- Line 6 – MAGI Calculation: Enter your modified adjusted gross income as reported on your tax return. This figure will be compared to the statutory threshold for your filing status.

- Line 7 – Excess MAGI: Subtract the applicable threshold from your MAGI to determine the excess amount. This step is crucial as the NIIT is imposed on the lesser of your net investment income or this excess.

Accurate calculation is essential to ensure you pay the correct tax amount.

Step 5: Determine the Taxable Amount of Net Investment Income

Now, determine the amount on which the NIIT will be applied:

- Line 8 – Lesser of Net Investment Income or Excess MAGI: Compare the net investment income from Line 4 with the excess MAGI from Line 7. Enter the lesser amount in this field.

- Line 9 – Apply the NIIT Rate: Multiply the amount from Line 8 by 3.8% (the NIIT rate) to calculate the tax liability. Enter the result on the appropriate line.

These calculations are the heart of Form 8960. It is essential to use precise figures to avoid miscalculations.

Step 6: Enter Any Additional Adjustments or Credits

If you are eligible for any adjustments or credits that affect your NIIT liability:

- Line 10 – Adjustments: Enter any additional adjustments that may reduce your NIIT, such as credits or carryovers from previous years.

- Line 11 – Final NIIT Liability: Recalculate your NIIT liability after applying these adjustments. Ensure this final figure is correct and supported by your documentation.

Step 7: Review, Sign, and Date the Form

Before submitting, perform a thorough review:

- Review: Go through each line of the form carefully. Verify that all entries are correct and that calculations are accurate.

- Sign and Date: Sign and date the form in the designated areas. If you’re e-filing, follow the electronic signature procedures as per IRS guidelines.

- Prepare Attachments: If the instructions require supporting documentation (such as detailed schedules of investment income), attach these documents securely.

A meticulous review is key to avoiding errors that could result in penalties or delays in processing.

Step 8: Submit Your Form 8960

Finally, submit your completed Form 8960:

- Electronic Filing: If you file your tax return electronically, ensure that Form 8960 is included in your digital submission package.

- Mailing: If you’re submitting a paper return, mail your Form 8960 along with your other tax forms to the IRS address indicated in the current instructions. Consider using certified mail or a trackable delivery service.

- Record Keeping: Retain a copy of your completed form and all supporting documentation. This record is vital in case of any future IRS inquiries or audits.

Following these submission procedures will ensure your filing is processed accurately and on time.

Additional Tips and Best Practices

- Organize Your Documents: To simplify your Form 8960 preparation, keep a well-maintained record of all your investment income and related expenses throughout the year.

- Double-Check Your Numbers: Use spreadsheets or tax software to verify your calculations before entering them on the form.

- Stay Updated: Always refer to the latest Form 8960 instructions available on the IRS website. Tax laws and thresholds can change, and using the current guidelines is essential.

- Consult Professional Tax Services: If you have complex investment income or are unsure about any part of the form, consider consulting expert tax services. Professional guidance can save time and reduce the risk of errors.

Leveraging Professional Tax Services

Navigating the intricacies of Form 8960 may be challenging, especially if your investment portfolio is diverse or if you have complicated tax situations. Professional tax services can offer:

- Expert Review: Skilled tax professionals can examine your Form 8960 to ensure every detail is accurate and that your calculations comply with IRS regulations.

- Time Efficiency: With expert assistance, you can streamline the process and avoid common pitfalls that lead to delays.

- Customized Solutions: Professional tax advisors can tailor their services to your specific needs, providing you with personalized strategies for managing your tax liability.

- Peace of Mind: Knowing that an experienced professional has reviewed your filing gives you confidence that your tax reporting is accurate and complete.

Investing in professional tax services can be particularly beneficial when dealing with complex financial situations, ensuring that your tax filings are both accurate and optimized for your monetary benefit.

Final Thoughts

Filing Form 8960 accurately is essential for taxpayers subject to the Net Investment Income Tax. By following this detailed, step-by-step guide, you can confidently complete every section of the form and ensure your tax liability is correctly calculated. Whether you choose to handle your tax filing independently or with the assistance of professional tax services, careful attention to detail and adherence to the latest Form 8960 instructions will help you avoid costly errors and potential IRS penalties.

A well-prepared Form 8960 not only supports compliance with IRS regulations but also plays a crucial role in your overall financial planning strategy. Precise and accurate reporting of your investment income enables you to manage your tax obligations better and plan for future economic growth.

By taking the time to organize your documentation, verify your calculations, and consider professional assistance when necessary, you can streamline the process and enjoy the peace of mind that comes with knowing your tax reporting is managed with precision and expertise.