Whether you’re managing a 529 college savings plan or a Coverdell ESA, accurate reporting is crucial. The IRS requires certain educational distributions to be reported using Form 1099-Q. If you’re the plan administrator or custodian, this form helps track how funds are used and whether taxes apply.

In this guide, you’ll learn how to file Form 1099-Q, what each section means, and how to avoid common errors using your financial statements and supporting documents.

Table of Contents

What Is IRS Form 1099-Q and Why It Matters

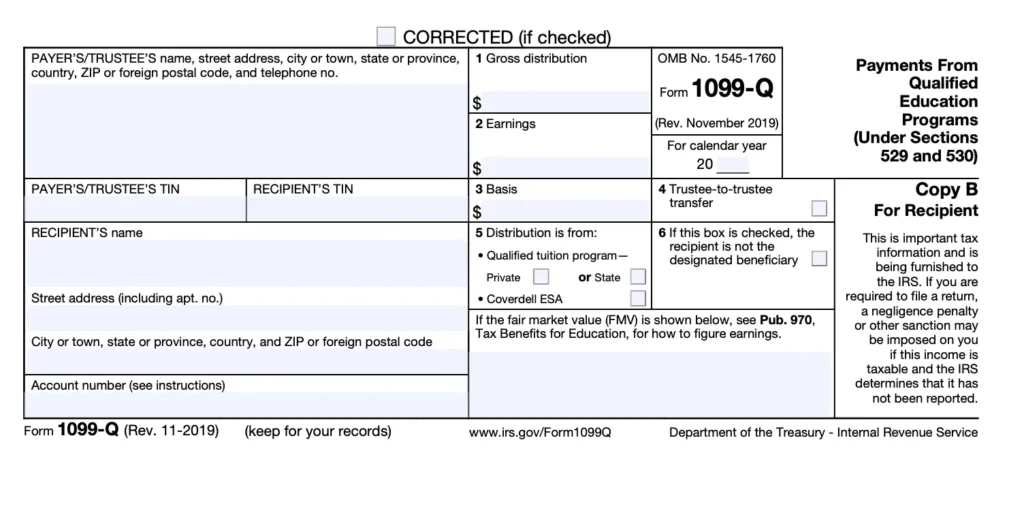

Form 1099-Q, officially titled Payments From Qualified Education Programs (Under Sections 529 and 530), is issued by a 529 plan or ESA custodian to report distributions made during the year.

You’ll need to file this form if:

- You’re the trustee or custodian of a 529 plan or ESA

- Distributions were made to the account holder or beneficiary

- Funds were used for educational expenses (or not)

It’s a crucial piece of information for both the IRS and the recipient to determine whether a distribution is taxable or tax-free.

When Is the Right Time to File Form 1099-Q?

You must file Form 1099-Q annually, covering all reportable distributions made within the calendar year. The key deadlines are:

- To the recipient (student/beneficiary): January 31

- To the IRS: February 28 (paper) or March 31 (e-file)

Failure to meet these deadlines can result in penalties, so it’s important to plan ahead and organize your financial statements early.

What You’ll Need to Prepare the Form

Before you get started, collect the following documents:

- Plan details (account number, plan name, and type)

- Total distribution amount

- The earnings portion and basis portion of the distribution

- Recipient’s and payer’s financial information

- Beneficiary’s name, SSN, and address

- Records of qualified educational expenses

These details should align with your financial statements to ensure accurate reporting.

Step-by-Step Guide: Completing IRS Form 1099-Q

Let’s walk through the form, box by box.

Step 1: Enter Payer and Recipient Details

At the top of the form, fill out:

- Payer’s name, address, and TIN (Taxpayer Identification Number)

- Recipient’s name, address, and SSN

The payer is usually the 529 plan or ESA administrator, and the recipient is either the student (beneficiary) or account holder who received the funds.

Step 2: Provide Account and Plan Information

- Include the account number (especially if multiple forms are being filed for the same recipient).

- Specify the plan type—whether it’s a Section 529 or a Coverdell ESA.

This helps distinguish the nature of the distribution for tax reporting.

Step 3: Report the Distribution Amount (Box 1)

Box 1 is where you enter the total amount distributed during the year. This includes:

- Payments to the beneficiary

- Transfers to other accounts

- Direct educational institution payments

Even if the entire amount was used for qualified education expenses, it must still be reported in full.

Step 4: Break Down Earnings and Contributions (Box 2 & Box 3)

- Box 2: The portion of the distribution that represents earnings

- Box 3: The part that represents the basis or original contributions

This is important because only the earnings portion may be taxable if the funds weren’t used for qualified expenses.

Use your financial statements to ensure this split is correct.

Step 5: Identify Distributions Not Subject to Tax (Box 4)

If the distribution was made due to the death or disability of the beneficiary or if the student received a scholarship, check Box 4.

This lets the IRS know why taxes may not apply, even if the funds weren’t used strictly for educational expenses.

Step 6: Indicate Trustee-to-Trustee Transfers (Box 5)

If the funds were transferred directly from one 529 plan to another (for the same or a related beneficiary), check Box 5.

These transfers are not taxable and don’t count as reportable distributions.

Step 7: Specify the Type of Account (Box 6)

Select the code that describes the account type:

- 1 for a qualified tuition program (529)

- 2 for a Coverdell ESA

- 3 for a designated Roth account distribution

This helps both the recipient and the IRS understand how the account is treated under tax law.

Step 8: Review and File

Once all boxes are filled in:

- Review for accuracy

- Double-check amounts using your financial statements.

- Send Copy B to the recipient by January 31

- File Copy A with the IRS by the appropriate deadline.

You can submit the IRS copy either electronically or by mail, depending on your filing preference.

Common Mistakes to Watch Out For

Here are a few pitfalls to avoid:

- Reporting the wrong amount in Box 1

- Failing to separate basis and earnings correctly

- Not checking the correct account type in Box 6

- Filing late or omitting necessary forms

Consider using professional tax services to reduce the risk of errors, especially if you manage multiple accounts or beneficiaries.

Wrap-Up: Filing Form 1099-Q the Right Way

Filing Form 1099-Q accurately helps both the IRS and your plan participants understand how education funds were used. It ensures compliance and avoids unnecessary tax issues.

With the proper documents in place—including your financial statements—you can complete the form smoothly. Still, if you’re feeling unsure, don’t hesitate to work with expert tax services that specialize in IRS reporting for education savings plans.