If your U.S. corporation earns income from international sources and pays taxes abroad, you might be eligible to claim a foreign tax credit, and Form 1118 is how you do that. Filing this form helps reduce double taxation and ensures you aren’t overpaying on your U.S. tax obligations.

This guide explains how to fill out Form 1118 in clear, actionable steps. We’ll also cover who needs to file, what documents to gather, and how to avoid mistakes that can delay your tax reporting.

Table of Contents

What Is IRS Form 1118 Used For?

Form 1118—Foreign Tax Credit—Corporations, is used by U.S. corporations to claim credits for taxes paid to foreign governments. If your business operates globally and pays income tax overseas, the IRS allows you to use this form to offset your U.S. tax liability.

This credit is available only to C corporations (not individuals or pass-through entities) and helps reduce the tax burden associated with double taxation on the same income.

Who Needs to File Form 1118 and When?

Any U.S.-based corporation that earns foreign-sourced income and pays foreign income tax can file Form 1118 to claim a foreign tax credit. This form must be submitted with your corporate income tax return (Form 1120).

Filing Deadline:

- Must be filed by the due date of your Form 1120 (including extensions)

- Submit your paper or tax return.

If you have multiple foreign jurisdictions or complex tax treaties, it’s a good idea to consult with professional tax services.

What to Gather Before You Start Filing

Before jumping into Form 1118, gather the following:

- Accurate Financial Statements showing foreign-sourced income

- Breakdown of foreign taxes paid by country and by type

- Exchange rates used to convert foreign currency to USD

- Supporting schedules for deductions, credits, and carryovers

- Any tax treaties that apply to your business activities

Pro tip: If you’ve never filed this form before, use professional tax services to guide you through it the first time.

How to Complete IRS Form 1118: Section-by-Section Breakdown

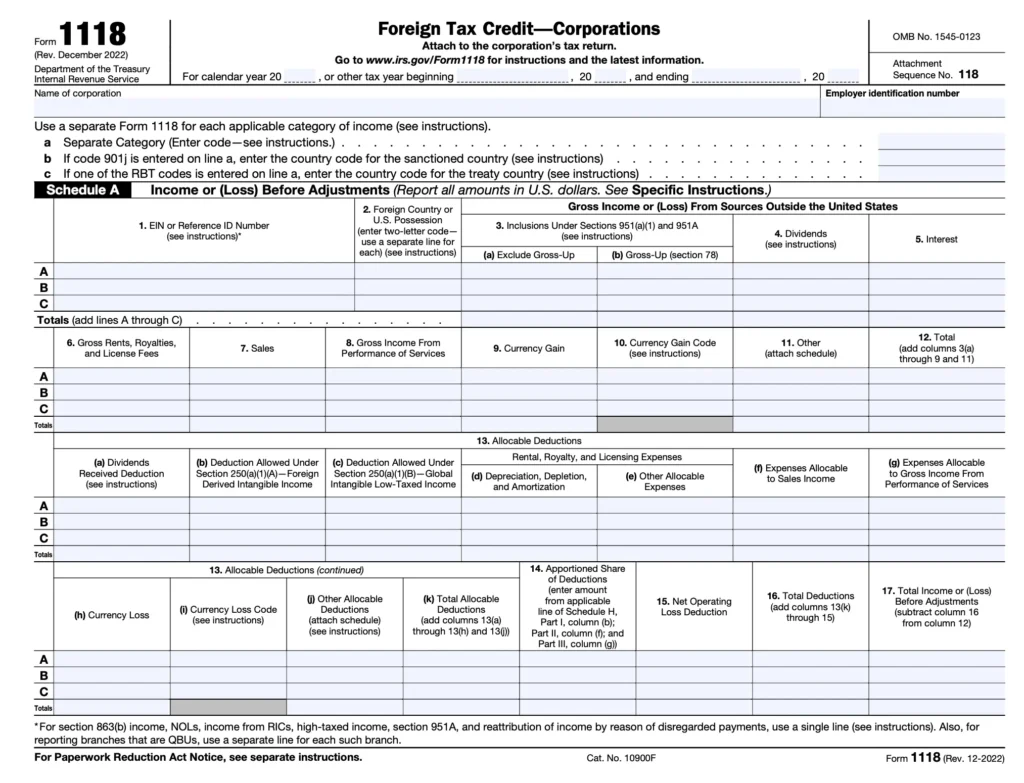

Form 1118 consists of a main form and 10 accompanying schedules (A through K). Here’s how to fill it out step by step.

Step 1: Start With Basic Company Information

At the top of the form, provide your:

- Corporation name

- EIN (Employer Identification Number)

- Type of filer (check the correct box)

- IRS office where you file

- Total foreign taxes paid or accrued

- Tax year

Step 2: Identify the Category of Foreign Income

The IRS requires you to categorize foreign income to ensure the proper allocation of credits. Choose one of the following income baskets:

- General category income

- Passive category income

- Foreign branch income

- Section 901(j) income (restricted countries)

- Lump-sum distributions

- Other (as specified)

Each category may require a separate Form 1118 if your company receives different types of income.

Step 3: Fill Out Schedule A – Gross Income and Deductions

Schedule A helps you calculate net income from foreign sources by income category.

You’ll need to:

- Enter total gross foreign income

- Allocate and apportion deductions (like interest and R&D expenses)

- Subtract to determine taxable income for each category.

This step relies heavily on your financial statements, so ensure everything is accurate and well-documented.

Step 4: Complete Schedule B – Taxes Paid or Accrued

In this section, report:

- All foreign income taxes paid or accrued

- The country where each tax was paid

- The type of tax (withholding, income, excess profits, etc.)

- Dates of payment

Each row should represent a different country and income type. Use exchange rates to convert values into U.S. dollars.

Step 5: Tackle Schedule C – Foreign Tax Credit Limitation

This schedule limits your credit to the U.S. tax amount that would have been imposed on the same foreign income. It’s calculated by:

- Taking net foreign-source taxable income

- Dividing it by your total taxable income

- Multiplying this ratio by your total U.S. tax

The result is your foreign tax credit cap.

Step 6: Work Through Schedule G – Foreign Tax Carryovers

If you paid more in foreign taxes than you can use this year, you may carry the unused portion forward or backward (within a 10-year carryforward, 1-year carryback window).

Schedule G helps track:

- Unused credits from prior years

- This year’s excess

- How much you’re carrying into future tax years

Step 7: Fill Out Schedules D to K (As Needed)

These optional schedules address specific situations, such as:

- Schedule D: For distributions from foreign corporations

- Schedule E/F: For income re-sourced by treaty or Section 865

- Schedule H/I/J/K: Additional worksheets for advanced filers

Only complete the schedules that apply to your business.

Step 8: Final Review and Submission

Once all sections are filled out:

- Double-check your math and income classifications

- Attach supporting documents and schedules

- Submit Form 1118 with your corporate tax return (Form 1120)

Remember, filing errors or missing documentation can delay credit approval or lead to IRS scrutiny. Consider using expert tax services to avoid these issues.

Best Practices for Filing Form 1118 Without Errors

- Stay Organized: Keep a digital file of foreign tax documents and relevant financial statements.

- Update Exchange Rates: Use official IRS-approved currency rates when converting

- Track Deadlines: Late filings may lead to disallowed credits

- Use Tax Software or Services: Filing Form 1118 manually is complex—automating the process reduces errors.

Final Thoughts: Mastering the Form 1118 Filing Process

Filing Form 1118 can be time-consuming and technically demanding—but it offers significant tax savings for corporations earning income abroad. By following this step-by-step guide and reviewing your financial statements, you can avoid common mistakes and claim your full credit without trouble.

When in doubt, let a qualified tax advisor or tax service handle the heavy lifting, mainly if you operate in multiple jurisdictions.