Did you know that thousands of homeowner’s associations (HOAs) across the U.S. rely on a single IRS form to simplify their taxes every year? That form is Form 1120-H. Introduced as a way to streamline tax filing for HOAs, condominium associations, and similar community organizations, it provides a straightforward path for groups that aren’t run for profit but still collect dues, fees, and assessments.

Form 1120-H allows these associations to separate their exempt income (like member dues used for maintenance) from taxable income (like interest or rental revenue). This helps HOAs stay compliant without wading through the complexities of a standard corporate tax return. In short, Form 1120-H is designed to keep community organizations focused on maintaining neighborhoods—not getting buried in tax paperwork.

Table of Contact

What Is Form 1120-H?

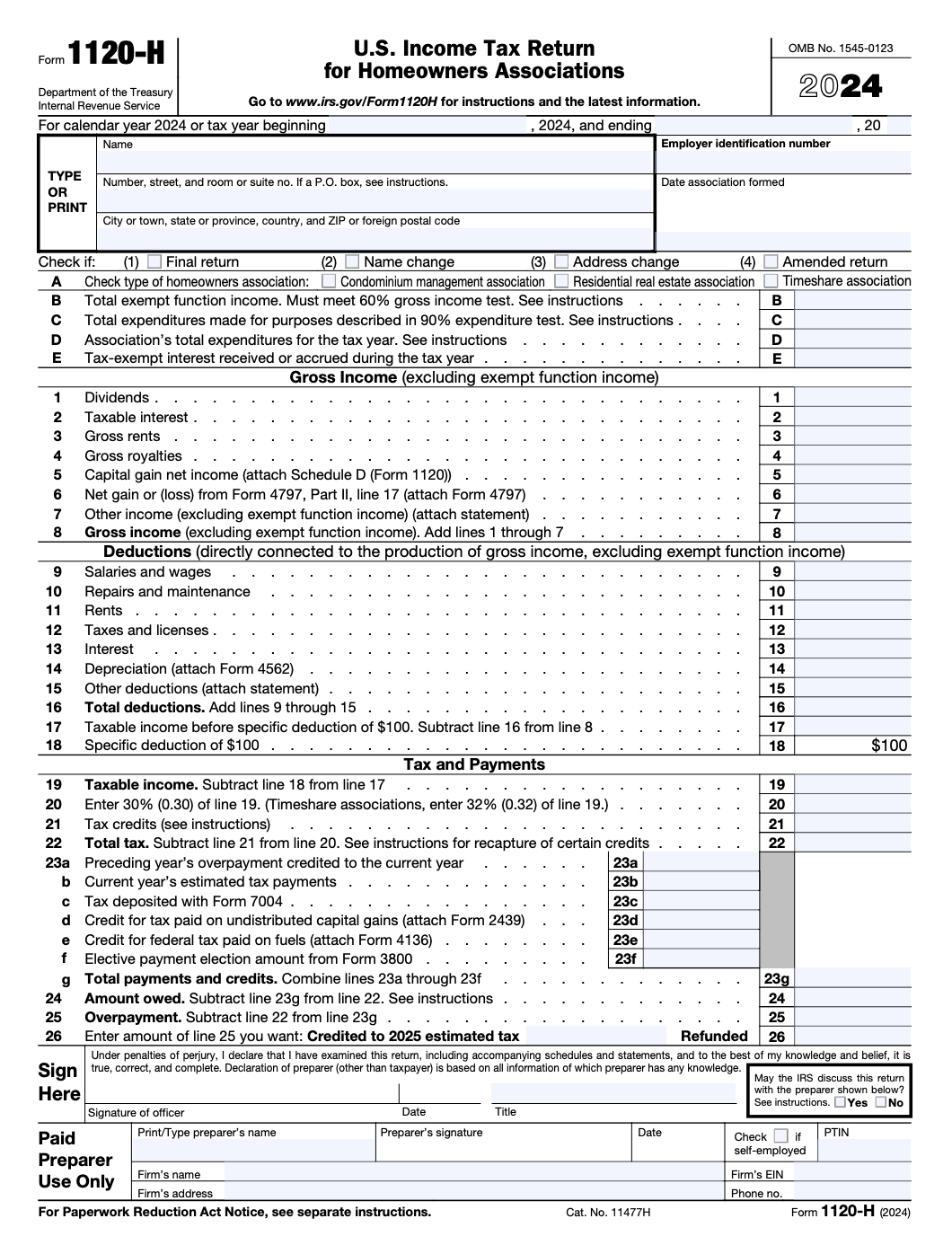

Form 1120-H is the U.S. Income Tax Return used by homeowners’ associations and other tax-exempt organizations to report income and claim allowable deductions. This form provides a simpler alternative to the standard corporate tax return, especially for organizations that meet specific membership and income criteria. By filing Form 1120-H, an HOA can report its exempt function income, calculate any taxable income, and determine the related tax liability without getting bogged down in complex corporate tax rules.

Who Should File Form 1120-H?

If you’re wondering, “Do HOAs have to file a tax return?” the answer is yes. Even though homeowners associations (HOAs), condo associations, and timeshare associations aren’t traditional businesses, the IRS still requires them to file an annual return. This is where IRS tax form 1120-H comes in.

Any qualifying association can elect to file Form 1120-H if it meets these criteria:

- At least 60% of the association’s income must come from members through dues, assessments, or fees.

- At least 90% of expenses must go toward acquiring, building, managing, or maintaining association property.

- No private shareholders or individuals may benefit from the association’s income (beyond its exempt purpose).

By meeting these conditions, HOAs and similar associations can take advantage of the simplified process outlined in Form 1120-H instructions, avoiding the complexity of a corporate return. Understanding what Form 1120-H is and how it works is the first step to ensuring that your tax filing process is smooth and compliant.

Here’s an explanation on how to file Form 1120-H:

Step 1: Gather Your Required Documents

Before you begin filling out Form 1120-H, it’s essential to collect all the necessary documents. Being well-prepared will make the process much smoother.

- Organization Details: Have your HOA’s name, address, and Employer Identification Number (EIN) ready.

- Financial Statements: Gather records of income and expenses, including bank statements and bookkeeping records.

- Previous Tax Returns: Keep copies of prior tax returns, which may help ensure consistency.

- Supporting Documentation: Collect receipts, invoices, and other evidence for any expenses or deductions you plan to claim.

This preparation lays the groundwork for following the Form 1120-H instructions accurately and helps avoid last-minute scrambling.

Step 2: Enter Basic Information

The first section of Form 1120-H requires you to fill in basic information about your organization. Accuracy in this step is critical as it sets the stage for the rest of the form.

- Organization Details: Enter your HOA’s legal name and EIN precisely as they appear on your official documents.

- Address and Tax Year: Provide the current mailing address and clearly indicate the tax year for which you are filing.

- Filing Status and Information: Verify your filing status and other identifying details. These items ensure that the form is correctly linked to your organization’s tax records.

Taking your time in this section helps prevent errors that could delay processing.

Step 3: Report Your Exempt Function Income

Form 1120-H is primarily used to report the income derived from your organization’s exempt functions.

- Detail Your Income: List all income related to your exempt activities. This typically includes membership fees, assessments, and income from activities that further the organization’s exempt purposes.

- Adjust for Non-Exempt Income: If your organization has any income that does not qualify as exempt function income, report it separately. Make sure to follow the specific instructions provided in Form 1120-H.

By accurately reporting your income, you set the stage for correctly calculating your taxable income and deductions.

Step 4: Claim Allowable Deductions

After listing your income, the next step is to claim any allowable deductions that your organization is entitled to.

- Expense Reporting: Document expenses directly related to the operation of your exempt functions, such as maintenance costs, administrative fees, and other operating costs.

- Depreciation and Other Adjustments: Include any depreciation or adjustments as allowed under the IRS guidelines.

- Summarize Deductions: Total all the deductions to be applied against your exempt function income. This total will reduce your organization’s overall taxable income.

Following these steps ensures that you take full advantage of the deductions available, ultimately lowering your tax liability.

Step 5: Calculate Your Taxable Income and Tax Liability

Once you have reported your income and deductions, you must calculate your organization’s taxable income.

- Determine Net Income: Subtract your total deductions from your exempt function income to arrive at your net income.

- Apply Tax Rates: Use the IRS guidelines to apply the appropriate tax rate to your net income. This calculation will give you your total tax liability.

- Review Tax Credits: If applicable, check whether your organization qualifies for any tax credits that could further reduce your tax bill.

Accurate calculations in this step are critical for ensuring that your tax liability is correctly determined.

Step 6: Review, Sign, and File Your Form

Before submitting Form 1120-H, it’s vital to review every section to ensure accuracy.

- Double-Check Your Entries: Verify that all numbers and information match your supporting documents and financial records.

- Ensure Consistency: Confirm that your organization’s details, income, deductions, and tax calculations are consistent with your other tax filings.

- Sign and Date: The form must be signed and dated by an authorized representative of the organization.

- File on Time: Attach Form 1120-H to your complete tax return and file by the IRS deadline to avoid penalties.

A final review can prevent errors that trigger delays or audits, ensuring a smooth filing process.

Form 1120-H Filing Requirements & Deadlines

Filing IRS tax form 1120-H correctly is all about timing and accuracy. Here’s what associations need to know:

- Filing Deadline: The return is due on the 15th day of the 4th month after the end of the association’s tax year. For calendar-year associations, this usually means April 15.

- Extension Option: If you need more time, you can file Form 7004 to request a six-month extension. Remember, this extends the filing deadline but not the time to pay any taxes owed.

- Late Filing Penalties: Missing the deadline can trigger IRS penalties and interest on unpaid taxes. In some cases, an HOA could also lose its ability to elect Form 1120-H for that tax year, forcing it to file the more complex Form 1120 instead.

Understanding these filing requirements ensures your association avoids unnecessary penalties and stays compliant.

1120-H vs. 1120: Which Should You File?

Associations can choose between filing Form 1120-H or the regular Form 1120 (U.S. Corporation Income Tax Return). Here’s a quick comparison to help board members make an informed choice:

| Feature | Form 1120-H | Form 1120 |

| Tax Rate | Flat 30% (32% for timeshare associations) on non-exempt income | Graduated corporate tax rates, often lower than 30% |

| Complexity | Simple filing with clear Form 1120-H instructions | More complicated, it requires detailed record-keeping |

| Risk | Lower audit risk; designed specifically for HOAs | Higher audit risk; stricter IRS scrutiny |

| Flexibility | Must be elected annually | Automatically applies if 1120-H is not elected |

Most associations choose IRS tax form 1120-H for its simplicity and compliance safety, even if the tax rate is slightly higher. However, very large HOAs with significant non-exempt income may sometimes benefit from filing Form 1120.

Common Mistakes HOAs Make When Filing

Even with simplified Form 1120-H instructions, many associations make errors that can lead to IRS issues or unexpected tax bills. Here are the most common mistakes:

- Misclassifying Income: Confusing exempt income (like member dues used for property upkeep) with non-exempt income (like rental revenue, dividends, or interest) can lead to inaccurate tax reporting.

- Forgetting to Elect Form 1120-H Annually: The election isn’t automatic—you must make it each year by filing IRS tax form 1120-H on time. Skipping a year could lock you into Form 1120 instead.

- Missing the Deadline: Late filings often mean penalties and the potential loss of the 1120-H election. HOAs that miss the April 15 deadline without an extension could face extra compliance headaches.

Avoiding these mistakes is crucial for keeping your HOA or condo association in good standing with the IRS.

How Profitjets Can Help with Your Form 1120-H Filing

At Profitjets, we understand that filing Form 1120-H can be complex, especially for busy homeowners’ associations and tax-exempt organizations. Our experienced team offers comprehensive financial services to simplify the process.

Bookkeeping Services:

Our outsourced bookkeeping services help you maintain accurate financial records, ensuring that all income and expenses are tracked and documented precisely.

Tax Services:

Our dedicated tax professionals guide you through every step of filing Form 1120-H, helping you maximize your deductions and stay compliant with IRS regulations.

Virtual CFO Services:

Our virtual CFO services provide strategic financial oversight, assisting with budgeting, cash flow management, and long-term planning to enhance your organization’s financial health.

Let Profitjets take the hassle out of your tax filing so you can focus on managing your organization effectively.

Conclusion

Filing Form 1120-H is crucial for homeowners’ associations and similar tax-exempt organizations. By following a systematic, step-by-step approach—from gathering documents and entering basic information to calculating income, claiming deductions, and finalizing your form—you can ensure accurate and compliant reporting. Detailed record-keeping and careful review are essential for maximizing deductions and reducing tax liability.

If you find the process challenging, professional tax services, CFO services, and bookkeeping services from Profitjets can help streamline your filing and secure your organization’s financial well-being. With expert support, you can navigate the complexities of Form 1120-H with confidence and efficiency.

Frequently Asked Questions about Form 1120-H

1. What is IRS Form 1120-H used for?

Form 1120-H is the IRS tax return specifically designed for homeowners associations (HOAs), condominium associations, and similar community organizations. It allows them to report exempt income (like member assessments) and pay tax only on non-exempt income (like rental income, dividends, or interest).

2. Who is eligible to file Form 1120-H?

An HOA or condo association can file Form 1120-H if at least 60% of its income comes from members (dues, assessments, fees) and at least 90% of its expenses are used for managing, maintaining, or caring for association property.

3. What is the filing deadline for Form 1120-H?

Form 1120-H is due by the 15th day of the 4th month after the end of the tax year (usually April 15 for calendar-year filers). Associations can also request an automatic 6-month extension by filing Form 7004.

4. What happens if an HOA doesn’t file Form 1120-H?

Failure to file can lead to IRS penalties, interest on unpaid taxes, and the risk of being forced to file the more complicated Form 1120 (corporate tax return), which may result in higher taxes.

5. What is the tax rate for Form 1120-H?

Non-exempt income reported on Form 1120-H is taxed at a flat 30% rate (32% for timeshare associations), which is often higher than regular corporate tax rates. That’s why many HOAs carefully review whether filing Form 1120 or 1120-H is more beneficial.

6. Is it better to file Form 1120 or 1120-H?

It depends. Form 1120 may sometimes result in lower taxes, but it comes with stricter rules and more complicated record-keeping. Form 1120-H offers simplicity and fewer risks, which is why many associations prefer it despite the higher flat tax rate.

7. Can a homeowners’ association prepare Form 1120-H on its own?

While smaller associations might try, tax compliance for HOAs can get tricky—especially with mixed income sources. Working with professionals like Profitjets ensures accurate filing, maximized deductions, and IRS compliance.

8. Where do I mail Form 1120-H?

The mailing address for IRS tax form 1120-H depends on whether your homeowners association (HOA) or condo association is sending the return with a payment or without a payment, and also on the state where the association is located. The IRS provides updated addresses each year in the official Form 1120-H instructions.

– If payment is enclosed, the form is mailed to the IRS address designated for your state’s payment submissions.

– If no payment is enclosed, it should be sent to the IRS address listed for filing returns without payment.

Since IRS mailing addresses can change, it’s always best to double-check the most recent Form 1120-H instructions on the IRS website or work with a tax professional like Profitjets to avoid delays.