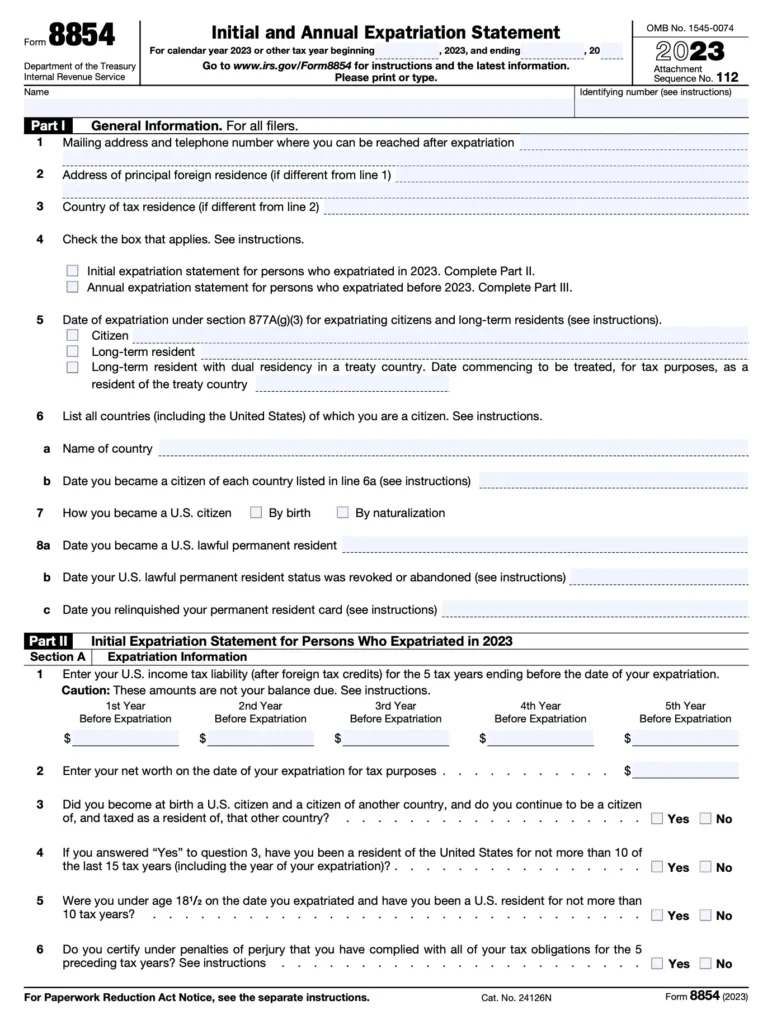

IRS Form 8854 (Expatriation Information Statement) is required for:

- “Covered expatriates” giving up U.S. citizenship

- Long-term residents ending U.S. residency

- Individuals subject to the “exit tax” under IRC 877A

Table of Contents

Who Must File Form 8854?

You must file if you are expatriated and meet any of these criteria:

- Net worth ≥ 2 million (2024 threshold) Average annual net income tax ≥ 190,000 (2024)

- Failed to certify 5-year tax compliance

- Are subject to special rules (e.g., dual citizens)

Important: Complex exceptions apply. Professional tax services can determine if you qualify as a covered expatriate.

Step-by-Step Guide to Completing Form 8854

Step 1: Determine Covered Expatriate Status

- Calculate net worth using financial statements

- Review 5-year tax compliance

- Assess alternative filing requirements

- Consider dual citizenship exceptions

Step 2: Gather Required Documentation

Prepare:

- Passport and immigration records

- Net worth calculations (assets/liabilities)

- Tax returns for the past 5 years

- Deferred compensation statements

- Trust and gift documentation

Step 3: Complete Part I – Expatriating Individual Information

- Line 1a: Full legal name

- Line 1b: U.S. taxpayer identification number

- Line 1c: Date of birth

- Line 1d: Expatriation date

Step 4: Complete Part II – Expatriation Tax Calculation

- Line 2: Worldwide assets (Form 8854, Schedule A)

- Line 3: Total liabilities

- Line 4: Net unrealized gains

- Line 5: Deferred compensation items

- Line 6: Trust interests

Step 5: Complete Part III – Tax Compliance

- Line 7: 5-year tax certification

- Line 8: Alternative filing requirements

- Line 9: Dual citizen exceptions

Step 6: Complete Relevant Schedules

- Schedule A: Asset valuation

- Schedule B: Deferred compensation

- Schedule C: Trust interests

- Schedule D: Tax deferral elections

Step 7: Sign and File

- Sign under penalties of perjury

- Mail to:

Internal Revenue Service

3651 South I-H 35

Austin, TX 78741

- Deadline: Due with Form 1040 for the expatriation year

Common Mistakes to Avoid

- Missing valuation dates – Must use expatriation date values

- Incomplete asset reporting – Includes worldwide assets

- Improper net worth calculations – Requires professional valuations

- Failing to reconcile with financial statements – Must document all figures

- Missing filing deadlines – Strict penalties apply

For high-net-worth individuals, professional tax services are essential for compliance.

Advanced Considerations

Asset Valuation Challenges

- Business valuation methods

- Hard-to-value assets

- Foreign real estate appraisals

- Currency conversion rates

Tax Planning Strategies

- Pre-expatriation planning

- Trust structuring options

- Deferred compensation elections

- Gift and estate tax implications

International Compliance

- FATCA reporting

- Foreign tax credit planning

- Dual citizenship complications

- Tax treaty considerations

Final Thoughts

Proper completion of IRS Form 8854 is critical for U.S. expatriates to comply with exit tax regulations. Individuals can navigate this complex process by maintaining meticulous asset records, obtaining professional valuations, and carefully following the latest Form 8854 instructions. For high-net-worth individuals, those with business interests, or complex financial situations, partnering with specialized tax services provides the expertise needed to ensure full compliance while minimizing tax liabilities.