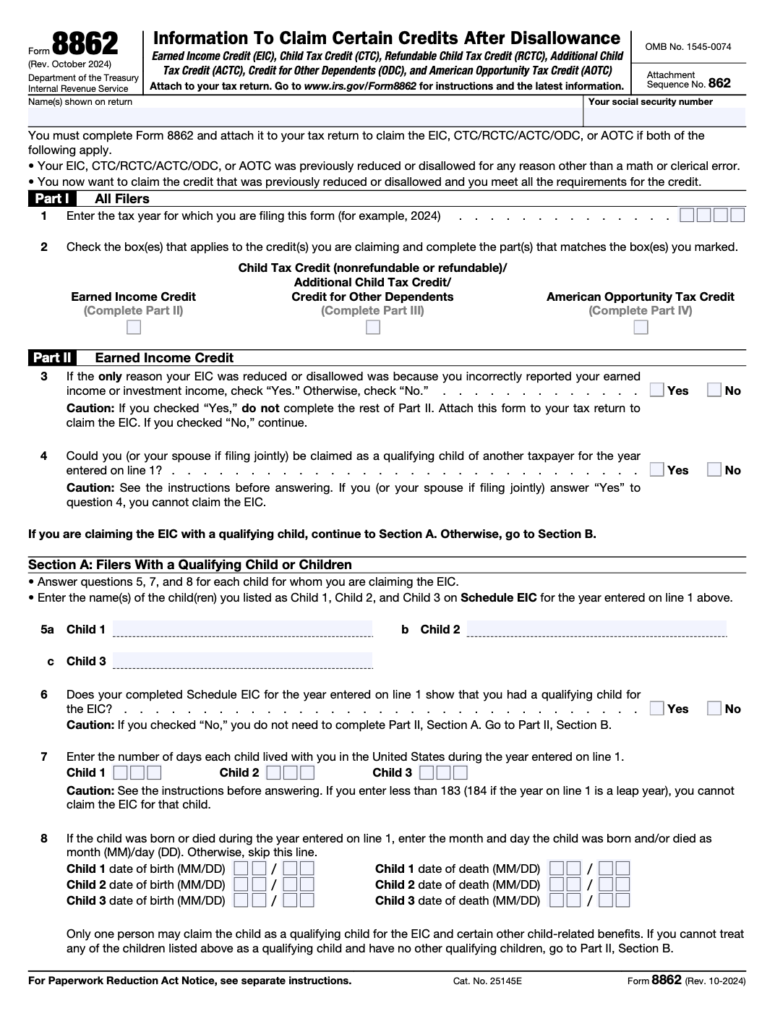

For taxpayers who previously had certain tax credits reduced or disallowed, filing Form 8862 is a critical step to reestablish eligibility. Form 8862, “Information to Claim Certain Credits After Disallowance,” is designed to allow you to reclaim credits like the Earned Income Credit (EIC), Child Tax Credit (CTC), and American Opportunity Tax Credit (AOTC) if you now meet the requirements.

In this comprehensive guide, we break down the process into easy-to-follow steps and provide helpful tips along the way. Whether you’re managing your taxes independently or seeking assistance from professional tax services, our guide ensures you complete the entire form accurately.

Table of Contents

What is Form 8862?

Form 8862 is used by taxpayers to reapply for valuable tax credits after the previous disallowance, except when the disallowance was due to a math or clerical error. Essentially, if you have experienced a reduction or disallowance of credits such as the EIC, CTC, Additional Child Tax Credit, Credit for Other Dependents, or the American Opportunity Tax Credit, and you now qualify for these credits, you need to file Form 8862 with your tax return. It helps the IRS confirm that you now meet all necessary eligibility requirements for these credits.

Who Must File Form 8862?

You are required to file Form 8862 if, in a prior year, your claim for the Earned Income Credit or one of the other disallowed credits was reduced or denied (for reasons other than math or clerical errors), and you now meet all the requirements to claim that credit. In other words, if you want to reclaim your eligibility for these tax credits after a previous disallowance, you must attach this form to your current return.

Taxpayers who had their credit disallowed due to issues like improperly reported income or failure to meet specific qualifying tests must submit this form. However, if the credit was disallowed solely because of a math or clerical error, you do not need to file Form 8862.

Tax Filing Deadlines and Due Dates for Form 8862

Unlike many tax forms, Form 8862 does not carry a direct payment requirement. Instead, it acts as a certification of your eligibility for previously disallowed credits. Although the IRS does not specify distinct due dates for Form 8862 on its own, remember that it must be attached to your tax return and filed by the return’s deadline. Ensure you have a valid taxpayer identification number (SSN or ITIN) on your return, as this is required to claim the credits.

There is no separate late payment penalty for Form 8862; however, failing to include it when necessary may cause the IRS to reject your claim for these valuable credits, potentially lowering your refund.

Step-by-Step Instructions for Completing Form 8862

Below is a detailed breakdown of how to fill out Form 8862. Follow these steps carefully to ensure your return is accurate and complete.

Step 1: Enter Basic Information (Part I – All Filers)

Begin by entering the tax year for which you are filing this form in Line 1. It is essential that you enter the current tax year (for example, “2024”) and not the year the credit was previously disallowed. Then, check the boxes in Line 2 for each credit you are now eligible to claim (e.g., EIC, CTC, AOTC).

Also, provide your details, such as your full name and Social Security Number (or ITIN if applicable). If you are filing jointly, include your spouse’s information as well.

Step 2: Claiming the Earned Income Credit (Part II)

Complete Part II if you are reapplying for the Earned Income Credit (EIC):

- Line 3: If the only issue in the previous year was an error in reporting earned or investment income, check “Yes.” In that case, you do not need to complete the remaining sections in Part II—simply attach Form 8862 to your return.

- Line 4: Answer the question regarding whether another taxpayer can claim you or your spouse as a qualifying child. If “Yes,” then you are not eligible for the EIC.

If you are eligible to claim the EIC, proceed based on your situation:

- Section A: For those with a qualifying child, ensure you have completed Schedule EIC. Then, list your qualifying child(ren)’s name and the number of days each lived with you in the United States. Enter any additional required information, such as dates of birth or death if applicable.

- Section B: For taxpayers without a qualifying child, enter the number of days your main home (and, if filing jointly, your spouse’s main home) was in the United States. Also, record your age (and your spouse’s, if applicable). These details help determine your eligibility for the EIC without a qualifying child.

Step 3: Reapplying for the Child Tax Credit and Other Dependent Credits (Part III)

If you are seeking to claim the Child Tax Credit (CTC), the Additional Child Tax Credit (ACTC), or the Credit for Other Dependents (ODC), complete Part III:

- Line 12: Enter the names of the children for whom you are claiming the CTC. (If you have more than four qualifying children, attach an additional statement with the required details.)

- Line 13: Enter the names of other dependents for whom you are claiming the ODC.

- Line 14: Indicate whether each child lived with you for at least half of the tax year (temporary absences count).

- Line 15: Confirm that each child meets the CTC qualifying criteria, including relationship, age, support, and residency tests.

- Line 16: State whether the child is claimed as your dependent.

- Line 17: Confirm the citizenship status of each child (a qualifying child must be a U.S. citizen, national, or resident alien).

If any of these criteria are not met, you cannot claim the associated credits.

Step 4: Reclaiming the American Opportunity Tax Credit (Part IV)

Complete Part IV if you are reapplying for the American Opportunity Tax Credit (AOTC):

- Line 18: Provide the name(s) of the student(s) for whom you are claiming the AOTC. These should match the names on any educational credit forms you’ve already submitted.

- Line 19: Answer whether the student meets the eligibility requirements for the AOTC. This includes not having used the credit in four previous tax years, being enrolled at least half-time, and meeting other criteria, such as not having completed the first four years of post-secondary education. If the student fails to meet these requirements, you cannot claim the AOTC.

Step 5: Handling Special Situations (Part V – Qualifying Child of More Than One Person)

If there is another taxpayer who might also claim your qualifying child, complete Part V:

- Line 20: List the names of any children who could be claimed by another taxpayer.

- Line 21: Provide the addresses where you and your child lived during the tax year. If you moved, attach a list of addresses.

- Line 22: If someone else (other than your spouse, in the case of a joint return) lived with your child for more than half the year, check “Yes” and provide that person’s information.

Step 6: Review and Sign the Form

After you have completed all applicable parts, carefully review each section to ensure that all data is accurate and consistent with your records. Check for typographical errors and verify all calculations. Once you are satisfied, sign and date Form 8862. Although the IRS does not require a handwritten signature if filing electronically, your submission must be validated as complete.

Step 7: Attach Form 8862 to Your Tax Return

Make sure that you attach the completed Form 8862 to your tax return when you file it. If you are filing electronically, follow your tax software’s procedures to include Form 8862. For paper returns, ensure that it is included with your other forms before mailing.

Leveraging Professional Tax Services

Filing Form 8862 can seem complex, especially if you have multiple credits at issue. Consider using expert tax services to help you navigate the process. Whether you’re an individual or a small business owner, professional tax services can review your financial documents, verify that you meet all eligibility requirements, and ensure that your return is accurate. Utilizing tax services not only minimizes errors but also saves you time and stress.

Additionally, if you need support with your overall tax filing, many taxpayers turn to reliable tax services to get maximum refunds and better understand their financial statements. A knowledgeable tax advisor can offer personalized insights and handle any complications that arise, giving you peace of mind.

Final Thoughts

Filing Form 8862 is a vital step for reclaiming tax credits that were previously disallowed. By following our step-by-step guide, you can confidently complete each section of the form and demonstrate your eligibility for credits such as the Earned Income Credit, Child Tax Credit, and American Opportunity Tax Credit. Remember that accuracy is key—double-check every field, and consider engaging professional tax services to assist you. This will help ensure that your return is processed smoothly and that you receive the tax benefits you’re entitled to.

Taking the time to file Form 8862 correctly can ultimately lead to a larger refund or a reduction in your tax liability. Don’t let past disallowances hold you back from claiming credits that can significantly impact your financial well-being.