When running a partnership or multi-member LLC, staying compliant with federal tax rules is essential. One of the most critical filings for these businesses is the 1065 tax form, or the U.S. Return of Partnership Income. This return is how the IRS monitors the income, deductions, and credits of partnerships, even though the business itself doesn’t directly pay federal income tax.

The importance of Form 1065 is about compliance. Filing it correctly also helps avoid costly IRS penalties and ensures that each partner receives accurate Schedule K-1 forms. Without this, partners may struggle to report their share of profits, losses, and deductions on their personal tax returns.

IRS Form 1065 acts as the bridge between a partnership’s financial activity and the IRS, ensuring transparency in pass-through taxation. If your business operates as a partnership or LLC taxed as a partnership, understanding this filing requirement is pivotal.

Table of Contents

What is Form 1065 & Who Must File It?

The IRS Form 1065 is an informational partnership tax return. Unlike a corporate tax form, which determines and pays tax at the business level, the 1065 tax form reports income, expenses, and distributions. The IRS uses this information to verify that partners are accurately paying their share of taxes through their individual returns.

Who Must File Form 1065?

- Domestic Partnerships: General partnerships and limited partnerships operating in the U.S. must file.

- Multi-Member LLCs: If your LLC has two or more members and hasn’t elected to be taxed as a corporation, you’re required to file Form 1065.

- Foreign Partnerships: Partnerships formed outside the U.S. may also need to file if they earn income effectively connected with a U.S. trade or business.

Common Exceptions

Not every business entity needs to file a 1065 tax form. Exceptions include:

- Single-Member LLCs (disregarded entities)—instead, these are reported on the owner’s individual return, often using Schedule C.

- Qualified Joint Ventures—Some married couples in community property states can elect to report income jointly rather than filing Form 1065.

Do I need to file Form 1065 if my partnership had no income?

It is necessary to file Form 1065 even if your partnership had no income or expenses. The IRS still expects a Form 1065 to be filed, unless your business had zero activity for the year. It’s always best to confirm with a tax professional before skipping a filing.

Key Components of Form 1065

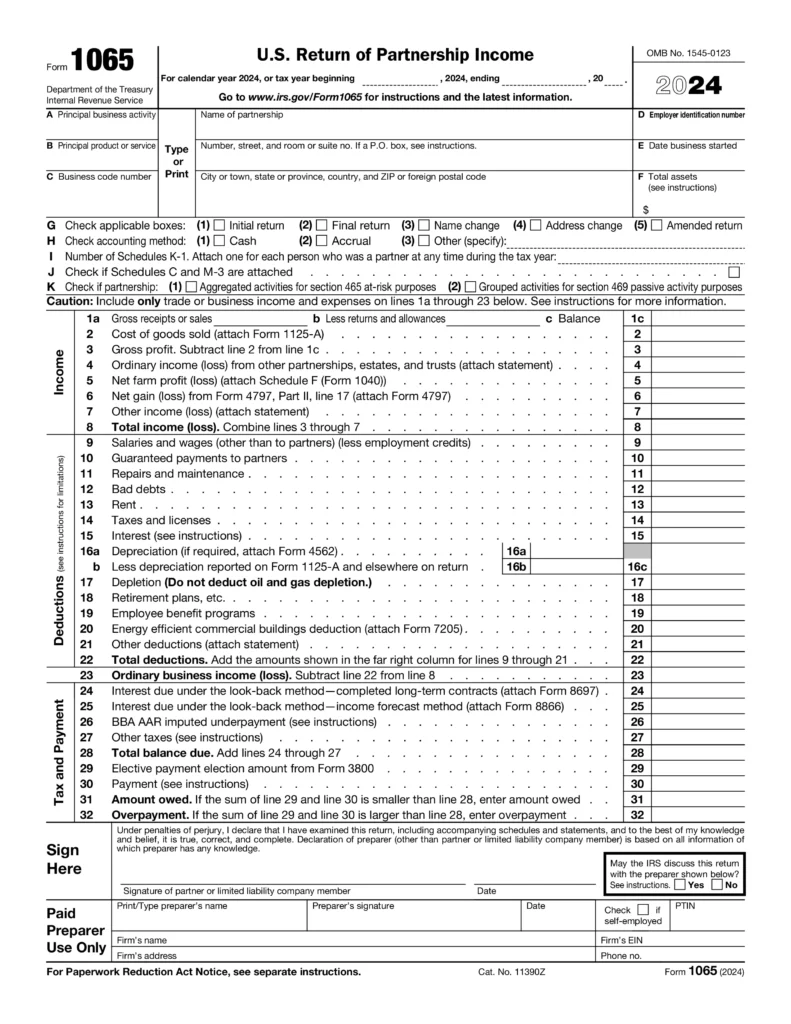

The 1065 tax form contains multiple parts, each serving a different purpose in reporting partnership activity. Understanding these sections is critical for accuracy:

- Income & Deductions Section: This part records the partnership’s gross receipts, cost of goods sold, operating expenses (like rent, salaries, and insurance), and interest expenses. It gives the IRS a clear picture of the partnership’s overall financial performance.

- Schedule B – Other Information: Here, the IRS collects detailed information about the partnership, including ownership structure, accounting method, foreign partners, and certain compliance elections.

- Schedule K – Partner Summary: This section summarizes the partnership’s total income, deductions, credits, and other items before they’re allocated to individual partners via Schedule K-1.

- Schedule L – Balance Sheet: Required for partnerships that meet certain thresholds, this provides a snapshot of assets, liabilities, and equity, ensuring that the partnership’s financial position matches reported income.

- Schedule M-1 & M-2 – Reconciliation:

- Schedule M-1 reconciles differences between book income (financial statements) and tax income (IRS rules).

- Schedule M-2 tracks changes in partners’ capital accounts during the year.

By carefully completing each part of Form 1065, partnerships provide the IRS with full transparency while also creating accurate K-1s for partners to use on their own tax filings.

Filing Deadlines & Penalties for Noncompliance

Timely filing of Form 1065 is crucial to avoid penalties that can quickly add up, especially for partnerships with multiple partners.

Filing Deadlines

- Calendar-Year Partnerships: Most partnerships operate on a calendar year. In this case, the 1065 tax form is due on March 15 of the following year.

- Fiscal-Year Partnerships: If your partnership follows a fiscal year, the due date is the 15th day of the 3rd month after the close of the fiscal year.

Double-checking the IRS Form 1065 instructions for the most current due dates and mailing addresses, as the IRS periodically updates them.

Penalties for Late Filing

- If a partnership fails to file Form 1065 on time, the IRS assesses a penalty of $220 per partner, per month, for up to 12 months.

- For partnerships with multiple partners, this penalty can add up fast.

Schedule K-1 Penalties

- If the partnership fails to provide accurate Schedule K-1 forms to each partner by the filing deadline, additional penalties apply.

- Incorrect or missing K-1s may cause delays for partners filing their personal returns, which may also trigger IRS notices.

Extensions with Form 7004

If your partnership needs more time to prepare the return, you can file Form 7004 to request a 6-month extension. For calendar-year filers, this extends the deadline to September 15.

Keep in mind that an extension to the filing does not extend the time to furnish K-1s to partners. The partnership must still provide partners with the necessary information to meet their own tax filing obligations.

Where to Mail Form 1065?

If you file by paper, the mailing address depends on your business location and whether you include a payment. The exact address is listed in the Form 1065 instructions published by the IRS. However, most partnerships now prefer electronic filing, which is faster, secure, and provides faster confirmation.

Schedule K-1: The Partner’s Tax Report

The Form 1065 Schedule K-1 is one of the most important outputs of filing a partnership return. Each partner receives a K-1, which reports their share of the partnership’s income, deductions, and credits.

Why It Matters

The K-1 ensures that each partner pays taxes on their share of the partnership’s income, even if profits weren’t distributed in cash. This pass-through system is the foundation of how partnerships are taxed.

How Partners Use It

- Partners transfer the information from the K-1 to their personal tax returns (Form 1040 or corporate returns if the partner is another business).

- Items like rental real estate income, interest income, or Section 179 deductions flow directly to the partner’s individual filings.

Do I file Schedule K-1 with my tax return?

- No. Partners don’t file the K-1 itself with their return. Instead, they use the K-1 data to complete their return and keep the form for records in case of an IRS inquiry.

Newer International Reporting: Schedules K-2 and K-3

Since tax year 2021, partnerships with international tax items must also file Schedule K-2 (Form 1065) and Schedule K-3. These forms expand on the information previously reported on Schedule K and K-1, ensuring the IRS receives standardized international reporting.

For 2025, it’s especially important to understand if your partnership has foreign partners, foreign-source income, or foreign tax credits, as this will trigger the requirement to file these newer schedules.

Do all partnerships need to file Schedule L, M-1, and M-2?

Not always. Smaller partnerships meeting certain thresholds may be exempt from filing some of these schedules. However, larger or more complex partnerships typically must complete them. Always check the IRS Form 1065 instructions for current filing requirements.

Electronic Filing Requirements: 2025 Update

The IRS continues to expand electronic filing requirements for partnerships, making e-filing the preferred and, in some cases, mandatory method to file Form 1065.

Mandatory E-Filing for Large Partnerships

As of 2025, any partnership with 100 or more partners must electronically file Form 1065. This requirement ensures accuracy and faster processing of returns. Large partnerships are also required to e-file their Schedules K-1, which means every partner receives a digital version of their tax statement.

E-Filing for Smaller Partnerships

Even if your partnership has fewer than 100 partners, the IRS strongly encourages electronic filing. Benefits include:

- Faster confirmation: E-filing provides immediate acknowledgment that your return was received.

- Reduced errors: The IRS software catches many common mistakes before submission.

- Convenience: No need to track down mailing addresses from the Form 1065 instructions or worry about delays in postal delivery.

For partnerships that prefer paper filing, the IRS still allows it, but e-filing is steadily becoming the standard across most tax forms.

Common E-Filing Issues & Solutions

- Incorrect Partner Information: Ensure Social Security numbers (SSNs) or Employer Identification Numbers (EINs) are correct before e-filing.

- K-1 Transmission Errors: If K-1s fail to generate or transmit, verify formatting and software compatibility.

- Late Filing Concerns: If you know you cannot meet the deadline to file Form 1065, submit Form 7004 to request a 1065 Form extension. This grants you an additional six months to file, though you must still provide partners with the necessary K-1 information by the original due date.

Note: While an extension buys more time to file Form 1065, it does not extend the deadline to provide Schedule K-1s to partners. Partnerships should plan accordingly to avoid penalties.

Conclusion

Filing the 1065 tax form is a critical responsibility for partnerships and multi-member LLCs. From understanding filing deadlines to managing complex schedules like K-1, K-2, and K-3, accuracy is non-negotiable. Electronic filing in 2025 makes the process faster and more reliable, but it also comes with compliance requirements that partnerships cannot afford to ignore.

Adhering to deadlines, using the proper Form 1065 instructions, and requesting a 1065 Form extension when needed, partnerships can avoid costly penalties and ensure every partner’s tax reporting is accurate.

If you’re unsure how to file Form 1065 correctly or need guidance on partnership taxation, our team of tax professionals can help. We specialize in partnership compliance and can ensure your return is filed accurately, on time, and in full compliance with the latest IRS rules.

Profitjets is a trusted and preferred Tax Advisor and Tax consultant, where certified and experienced experts handle your tax strategy, Tax filing, and use all relevant deductions to manage your tax liability. We take pride in providing the end-to-end service from bookkeeping to taxation and even advisory services like Virtual CFO Services. The wide array of services we offer includes outsourced accounting and bookkeeping, outsourced bookkeeping for CPAs, tax filing and tax compliance services, and virtual CFO services. Contact us today to streamline your Form 1065 filing and avoid unnecessary IRS headaches.

Frequently Asked Questions About Form 1065

1. What happens if I don’t file Form 1065?

If you do not file Form 1065, the IRS can assess significant penalties. As of 2025, the penalty is $220 per partner, per month, up to 12 months. Missing or incorrect Schedule K-1s can also trigger additional fines. Even if your partnership had no income, the IRS generally requires a Form 1065 filing to keep your entity in compliance.

2. Is Form 1065 filed at the state level as well?

Yes, in many cases, partnerships must file at both the federal and state levels. While Form 1065 is submitted to the IRS, certain states require their own version of partnership returns, often with additional forms or fees. Since rules vary widely by state, always review state-specific Form 1065 filing requirements or consult a tax professional to ensure compliance.

3. Do LLCs always need to file Form 1065?

Not always. Multi-member LLCs taxed as partnerships are required to file Form 1065 each year. However, a single-member LLC is considered a disregarded entity for federal tax purposes, which means its income is reported directly on the owner’s Schedule C (or another applicable schedule), not on Form 1065.

4. Can Form 1065 be amended if mistakes are found?

Yes. If you discover an error after submitting your partnership return, you can file an Amended Form 1065 using the “Amended Return” box at the top of the form. The IRS also requires you to provide updated Schedule K-1s to each partner. Amending promptly helps minimize the risk of penalties, interest, or partner-level filing issues.

5. How do foreign partnerships handle Form 1065?

Foreign partnerships may also need to file Form 1065 if they earn income effectively connected with a U.S. trade or business. They may also be subject to additional reporting, including Schedules K-2 and K-3, especially if international income or foreign partners are involved. Because foreign partnership filings can be complex, it’s best to consult the official IRS Form 1065 instructions or seek professional tax guidance.