Hiring a local CPA firm is a crucial step in strengthening your business’s financial health. Whether you’re a startup or a growing enterprise, choosing the right CPA firm can significantly influence your ability to manage taxes, financial planning, reporting, and compliance. Here’s everything you need to know before hiring a local CPA firm in 2025.

Table of Contents

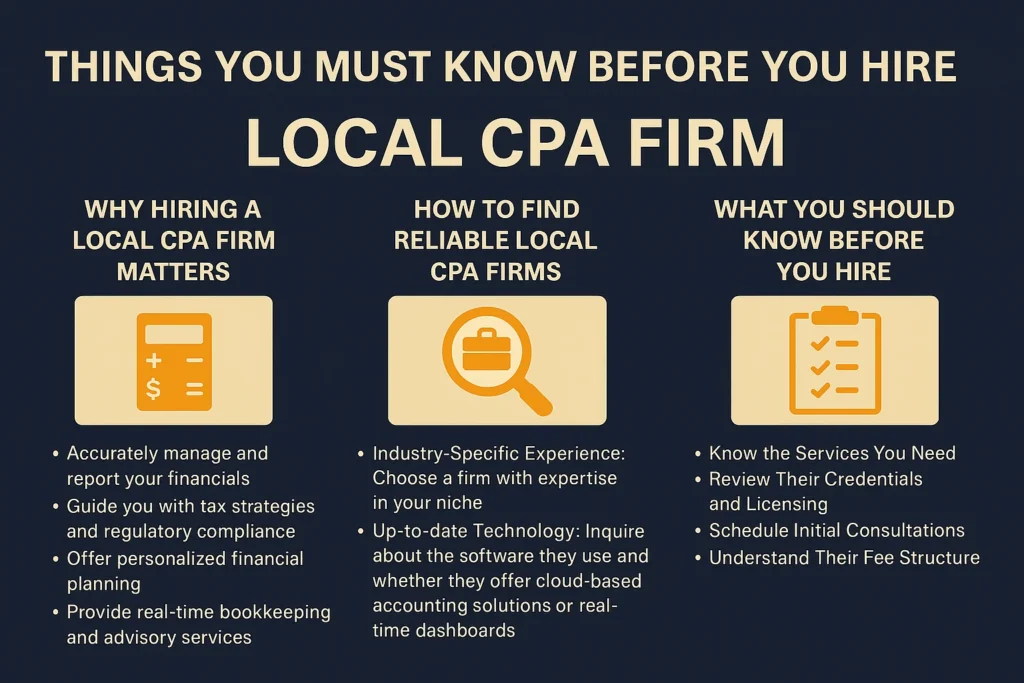

Why Hiring a Local CPA Firm Matters?

A reliable local CPA firm can:

- Accurately manage and report your financials

- Guide you with tax strategies and regulatory compliance.

- Offer personalized financial planning

- Provide real-time bookkeeping and advisory services.

The right firm can become a long-term strategic partner, not just a once-a-year tax preparer.

How to Find Reliable Local CPA Firms?

- Industry-Specific Experience: Choose a firm with expertise in your niche. Each industry has its own unique accounting standards and tax structures.

- Up-to-date Technology: Inquire about the software they use and whether they offer cloud-based accounting solutions or real-time dashboards.

- Referrals and Reviews: Ask for referrals from peers and check platforms like Google Reviews, Yelp, and Clutch for genuine client experiences.

What You Should Know Before You Hire?

- Know the Services You Need

- Are you looking for tax prep, payroll, monthly bookkeeping, or business consulting?

- Identify the scope to find firms that specialize in those services.

- Are you looking for tax prep, payroll, monthly bookkeeping, or business consulting?

- Review Their Credentials and Licensing

- Confirm they are certified by a recognized accounting board (such as AICPA in the US).

- Ask about the education and professional development of individual accountants.

- Confirm they are certified by a recognized accounting board (such as AICPA in the US).

- Schedule Initial Consultations

- Prepare questions about their experience, processes, and technology use.

- Gauge responsiveness, transparency, and professionalism.

- Prepare questions about their experience, processes, and technology use.

- Understand Their Fee Structure

- Determine whether they charge by the hour, per project, or offer retainer packages.

- Clarify billing practices and get everything in writing.

- Determine whether they charge by the hour, per project, or offer retainer packages.

- Ask About Their Communication Style

- How frequently will they update you?

- Are they available for consultations throughout the year or just during tax season?

- How frequently will they update you?

Key Benefits of Hiring Local CPA Firms

- Proximity and Accessibility: Face-to-face meetings and quicker response times.

- Understanding Local Tax Laws: Better insights into state and municipal regulations.

- Tailored Financial Planning: More aligned with the regional business environment.

- Support During Audits: Local presence offers hands-on audit representation.

5 Things to Scrutinize While Choosing a CPA Firm

- Industry Experience

- Firm Size and Capacity

- Client Testimonials and Case Studies

- Fee Transparency and Value for Money

- Technology Adoption and Automation Tools

Final Wrap-Up

Hiring a local CPA firm in 2025 requires a balanced approach between qualifications, experience, transparency, and compatibility. Choose a CPA firm that not only understands your numbers but also contributes to your business growth. Don’t hesitate to ask questions and evaluate multiple firms before making your final decision.If you’re ready to streamline your business’s financial processes, connect with Profitjets today. Our vetted and professional CPA experts are here to guide you every step of the way.

1. How do I know if a CPA firm is the right fit for my business?

Look for relevant industry experience, technology use, and positive client testimonials.

2. What should I bring to my first meeting with a CPA firm?

Be prepared with your most recent financial statements, tax filings, business goals, and a list of questions.

3. Are local CPA firms better than national ones?

Local firms often offer more personalized service and are better equipped to understand regional regulations, which is advantageous for small to mid-sized businesses.

4. How do CPA firms charge for services?

They may charge by the hour, by project, or offer monthly retainers. Always request a detailed pricing breakdown.

5. Can I switch CPA firms if I’m not satisfied?

Yes, just ensure a smooth transition by retrieving all documents and informing your current provider.