If you’re searching for the best bookkeeping software, you likely want a tool that helps track income, manage expenses, automate reports, and stay tax-ready without hiring a full-time accountant. In 2026, small businesses and startups need more than spreadsheets, they need cloud-based systems that automate financial records, integrate with banks, and provide real-time insights.

The right bookkeeping solution can reduce manual errors, improve cash flow visibility, simplify payroll processing, and ensure compliance. Whether you’re a Freelancer, E-Commerce seller, SaaS founder, or local service provider, choosing the right platform can save hours every month and prevent costly mistakes.

This guide compares the top 10 bookkeeping software options based on features, pricing, scalability, automation, and ease of use, so you can confidently choose the best fit for your business.

Why Bookkeeping Software Matters for Small Businesses

Accurate bookkeeping is the foundation of financial health. Without organized records, businesses struggle with tax filing, forecasting, and investor reporting.

Modern bookkeeping systems help with:

- Expense tracking

- Invoice management

- Bank reconciliation

- Payroll integration

- Financial reporting

- Sales tax tracking

- Cash flow monitoring

Cloud bookkeeping tools also integrate with payment processors, CRMs, and inventory management systems making them ideal for growing startups.

Top 10 Bookkeeping Software in 2026

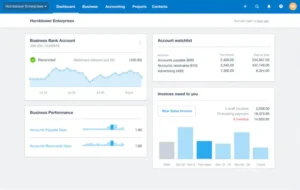

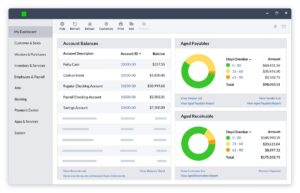

QuickBooks

Best for: All-in-one small business bookkeeping

QuickBooks remains a market leader due to its comprehensive features, payroll integration, tax tools, and strong reporting capabilities. It works well for startups and scaling businesses that need reliable bookkeeping automation.

Key Features:

- Automated bank feeds

- Expense categorization

- Payroll add-ons

- Real-time reporting

Xero

Best for: Growing startup

Xero offers strong collaboration tools and unlimited users on most plans. Its clean interface makes bookkeeping simple for non-accountants.

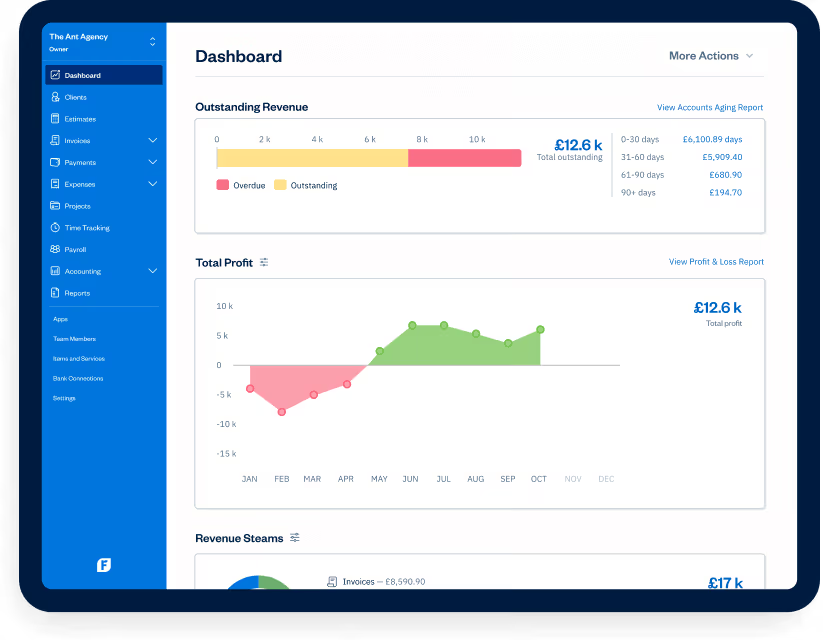

FreshBooks

Best for: Freelancers and service businesses

FreshBooks focuses heavily on invoicing and time tracking while still offering solid bookkeeping functionality.

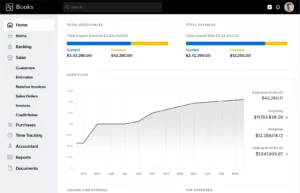

Zoho Books

Best for: Budget-conscious small businesses

Zoho Books offers automation workflows, tax compliance tools, and strong integration within the Zoho ecosystem.

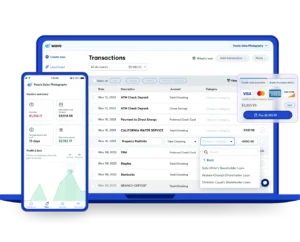

Wave

Best for: Free bookkeeping solution

Wave provides free accounting and bookkeeping tools, making it ideal for Solopreneurs.

Sage

Best for: Established small to mid-sized businesses

Sage offers advanced reporting and inventory features.

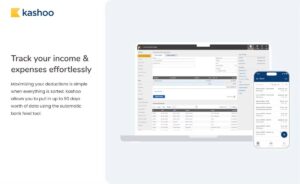

Kashoo

Best for: Simplicity and automation

Kashoo uses machine learning to auto-categorize transactions.

Patriot Software

Best for: Payroll-focused businesses

Combines payroll and bookkeeping in one system.

Bench

Best for: Outsourced bookkeeping services

Bench combines software with human bookkeepers.

FreeAgent

Best for: Freelancers and consultants

FreeAgent simplifies tax estimates and cash flow tracking.

How to Choose the Right Bookkeeping Software

Evaluate Your Business Size

Freelancers need simple bookkeeping tools, while startups may require advanced reporting and integrations.

Consider Automation Features

Look for bank feeds, expense categorization, and invoice automation.

Check Integration Capabilities

Your bookkeeping system should integrate with payment gateways, payroll systems, and CRM tools.

Compare Pricing

Affordable bookkeeping services are ideal for early-stage businesses, but scalability matters.

Assess Support & Compliance

Make sure the software supports U.S. tax compliance and financial reporting standards.

Should You Use Software or Outsourced Bookkeeping?

While software improves efficiency, some businesses prefer outsourced bookkeeping services for accuracy and compliance. A hybrid approach software plus professional oversight often works best for growing companies.

Frequently Asked Questions

Q1: What is bookkeeping and why is it important?

Bookkeeping is the process of recording financial transactions, managing expenses, and maintaining accurate business records. It ensures tax compliance and supports financial decision-making.

Q2: What is the best bookkeeping software for small businesses?

QuickBooks and Xero are popular choices due to automation, reporting, and integration features.

Q3: Can I do bookkeeping myself?

Yes, small businesses can manage bookkeeping using cloud software. However, professional support reduces errors and improves compliance.

Q4: How much does bookkeeping software cost?

Pricing ranges from free (Wave) to $20–$80 per month depending on features and users.

Q5: Is outsourced bookkeeping better than software?

Outsourced bookkeeping offers expert oversight, while software provides automation. Many businesses use both for maximum efficiency.

Final Thoughts

Choosing the right bookkeeping software in 2026 depends on your business size, growth goals, and budget. Modern bookkeeping tools automate tasks, reduce errors, and provide real-time insights—helping small businesses stay financially organized and tax-ready.

If you’re unsure which solution fits your business needs, our experts at Profitjets can help you implement the right bookkeeping system or provide outsourced support.

Ready to simplify your bookkeeping? Contact us today