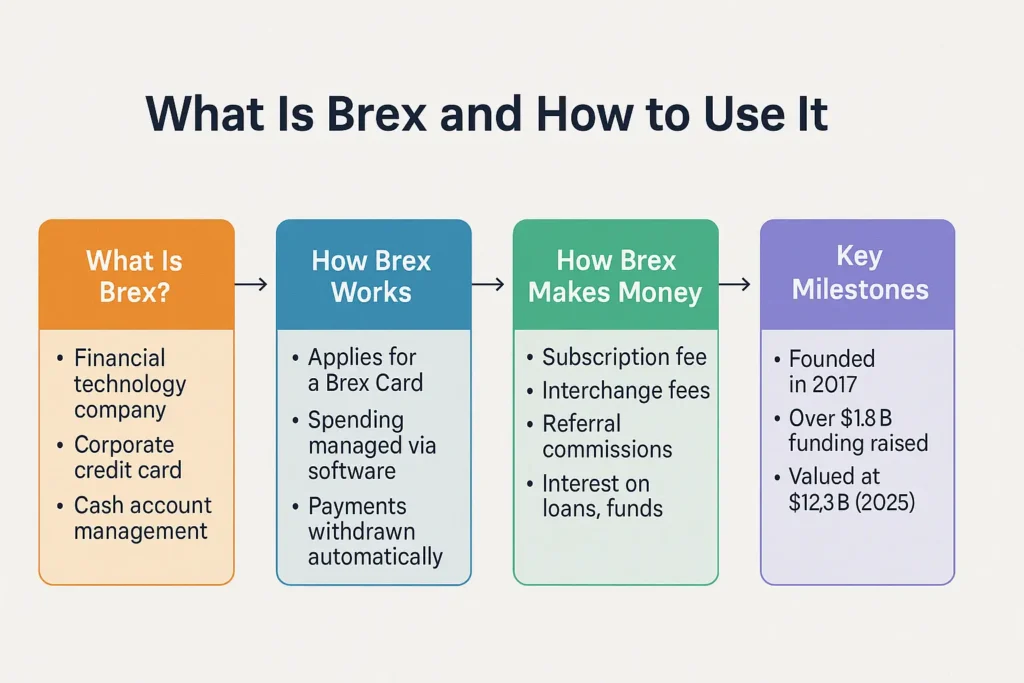

In 2025, Brex has become one of the most trusted financial tools for startups, e-commerce brands, life sciences companies, and venture-backed businesses. Initially launched in 2017, Brex began as a corporate card provider for early-stage companies. Today, it has evolved into a comprehensive financial platform offering cash management, spend controls, bill pay, and venture debt solutions.

This guide walks you through what Brex is, how it works, how it generates revenue, and why it’s a popular choice for modern businesses.

Table of Contents

What Is Brex?

Brex is a financial technology company that provides businesses with a corporate charge card, cash management account (Brex Cash), and an integrated expense management platform. It focuses primarily on startups, venture-backed companies, and high-growth businesses.

Brex offers services like:

- Corporate charge cards with no personal guarantees

- Smart expense tracking tools

- Bill pay and reimbursements

- Spend policies and controls.

- Venture debt financing

- Integrations with tools like QuickBooks, Xero, and NetSuite

How Does Brex Work?

Brex eliminates the need for traditional banking relationships by combining business credit cards and cash accounts under one digital roof. Here’s how it works:

Credit Approval

- Credit decisions are made based on a company’s cash flow, spending behavior, and bank balance, not its credit score.

- There is no personal liability on the Brex Card.

Brex Card Features (2025)

- Works like a charge card (paid in full every 30 days)

- Automatically debits payments from linked business accounts.

- Integrates with Brex Cash or external bank accounts

Platform Tools

- Real-time expense tracking

- Receipt capture and matching

- Integration with ERP and accounting tools

- Employee card management with role-based controls

Rewards

- Earn up to 7x points on categories like rideshare, dining, and software.

- Redeem for partner rewards (e.g., AWS, Slack, Zoom)

How Brex Makes Money

Brex operates a multi-revenue model focused on fintech services:

1. Subscription Fees

- Brex Premium (2025) costs $49/month per company for unlimited users

- Includes bill pay, spend rules, and accounting integrations

2. Interchange Fees

- Brex earns a share of merchant fees (via Mastercard) when users spend with the Brex Card.

3. Cashback Partnerships

- Points earned through Brex reward programs generate referral commissions when redeemed through partnered vendors.

4. Loan Interest (Brex Venture Debt)

- Offers non-dilutive venture debt to high-growth businesses with transparent interest rates

5. Brex Cash Interest

- Brex earns interest on user deposits, which are invested in low-risk government funds.

- Users earn yield while Brex lends deposits to institutions at a margin.

Brex Cash Account

Brex Cash is a digital business account offering:

- No minimum balance

- Unlimited ACH, wire, and check payments

- Seamless connection with the Brex Card

- Interest yield on idle balances (0.10% APY in 2025)

It’s a one-stop solution to manage operating expenses without needing a traditional bank.

Brex in 2025: Key Stats

- Funding Raised: $1.8 Billion

- Valuation: $12.3 billion (as of January 2022)

- Major Investors: Y Combinator, Peter Thiel, DST Global, Kleiner Perkins, Barclays

- Customer Base: 100,000+ businesses across the U.S.

Conclusion

Brex has redefined how modern companies manage money. By combining credit, cash management, and financial controls into a single platform, Brex offers a flexible, secure, and scalable solution for growth-focused businesses.

If you’re looking to simplify finance operations and empower your team with more innovative tools, Brex might be your ideal fintech partner.

Frequently Asked Questions

1. Is Brex a bank?

No. Brex is a fintech platform, not a bank. Brex Cash accounts are offered in partnership with FDIC-insured banking partners.

2. Can startups with no revenue use Brex?

Yes. Startups with strong funding or stable cash flow can be approved. Brex does not use personal credit checks.

3. Does Brex offer loans?

Yes. Brex Venture Debt is a non-dilutive loan offering for eligible high-growth startups.

4. How is Brex different from a traditional corporate card?

Brex doesn’t require a personal guarantee, and it provides real-time controls, automated bookkeeping, and software integrations.

5. Can I integrate Brex with QuickBooks?

Absolutely. Brex integrates with QuickBooks, Xero, NetSuite, and other accounting platforms for seamless bookkeeping.