Assessing your business’s performance over time is crucial for informed decision-making. One effective method for evaluating this is calculating Year-Over-Year (YoY) growth formula. This metric compares a statistic from one period to the same period in the previous year, providing insights into trends and growth patterns.

In this guide, we’ll examine the year-over-year growth formula, explain how to calculate it, and discuss its significance in business analysis. We’ll also explore the benefits of using professional bookkeeping services, tax, and CFO services to ensure accurate financial tracking and strategic planning.

Table of Contents

What Is Year-Over-Year (YoY) Growth?

Year-over-year (YoY) growth is a method of evaluating two or more measurable events on an annualized basis. It compares the value of a metric at one time period to the value of the same metric at the same period in the previous year. This comparison helps understand whether performance indicators are improving, declining, or remaining constant over time.

Understanding the (YoY) Growth Formula

- Eliminates Seasonal Variations: By comparing the same periods year over year, YoY analysis neutralizes the effects of seasonality, providing a clearer picture of underlying performance trends.

- Simplifies Trend Analysis: YoY comparisons make it easier to identify long-term trends without the noise of short-term fluctuations.

- Facilitates Benchmarking: Businesses can benchmark their current performance against past data to set realistic goals and strategies.

How to Calculate YoY Growth Formula

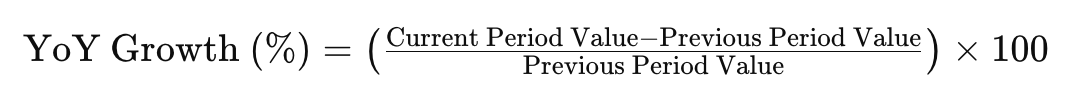

Calculating YoY growth involves a straightforward formula:

Steps to Calculate:

- Identify the Metric: Choose the specific metric you want to analyze (e.g., revenue, profit, customer count).

- Determine the Time Frame: Select the current period and the corresponding period from the previous year.

- Apply the Formula: To calculate the percentage growth, subtract the previous period’s value from the current period’s value, divide the result by the last period’s value, and multiply by 100

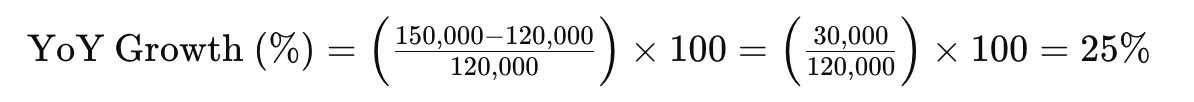

Example Calculation:

Assume your business had a revenue of $150,000 in Q1 2025 and $120,000 in Q1 2024.

This indicates a 25% increase in revenue in Q1 2025 compared to Q1 2024.

Interpreting YoY Growth Results

Understanding the implications of YoY growth calculations is essential for strategic planning:

- Positive YoY Growth: Indicates improvement and suggests that the business strategies are effective.

- Negative YoY Growth: Signals a decline, prompting a need to investigate potential issues and implement corrective measures.

- Zero YoY Growth: Reflects stagnation, highlighting an opportunity to innovate or optimize operations.

Considerations:

- Contextual Analysis: Always consider external factors such as market conditions, economic changes, or industry trends that could influence performance.

- Data Accuracy: Ensure that the data used for calculations is accurate and consistent to avoid misleading conclusions.

Utilizing YoY Growth in Business Strategy

Incorporating YoY growth analysis into your business strategy can provide valuable insights:

- Performance Benchmarking: Compare current performance against historical data to assess progress toward goals.

- Trend Identification: Recognize emerging trends to capitalize on opportunities or mitigate risks.

- Resource Allocation: Make intelligent decisions about where to allocate resources for maximum impact.

Example Applications:

- Sales Analysis: Evaluate product performance and identify growth opportunities.

- Expense Management: Monitor operating expenses to ensure they are in line with revenue growth.

- Customer Retention: Analyze customer retention rates to improve loyalty programs.

The Role of Professional Services in YoY Analysis

Accurate YoY analysis requires meticulous financial record-keeping and strategic insight. Engaging professional services can enhance the effectiveness of your analysis:

- Bookkeeping Services: Making sure accurate and up-to-date financial records, providing a reliable foundation for YoY calculations.

- Tax Services: Understand the tax implications of your financial performance and plan accordingly.

- CFO Services: Gain strategic insights to interpret YoY data and inform decision-making.

By leveraging these services, businesses can make data-driven decisions that promote sustainable growth.

Conclusion

The Year-Over-Year (YoY) growth formula is a powerful tool for assessing business performance over time. By understanding how to calculate YoY growth and interpreting the results within the context of your industry and market conditions, you can make informed decisions to drive your business forward. Incorporating professional bookkeeping, tax, and CFO services can further enhance your ability to analyze and act upon YoY growth data, ensuring long-term success.