Filing Form 8865 is essential for U.S. taxpayers who are involved with foreign partnerships. This form, officially known as the Return of U.S. Persons With Respect to Certain Foreign Partnerships, is used to report the information required by the IRS regarding foreign partnerships in which you have an interest. Whether you’re a partner in a foreign entity or need to comply with international reporting requirements, understanding how to complete Form 8865 accurately is crucial.

In this guide, we’ll break down the process into clear, manageable steps and explain the necessary details so you can file your return with confidence. We’ll also show you how leveraging professional tax services can further streamline the process.

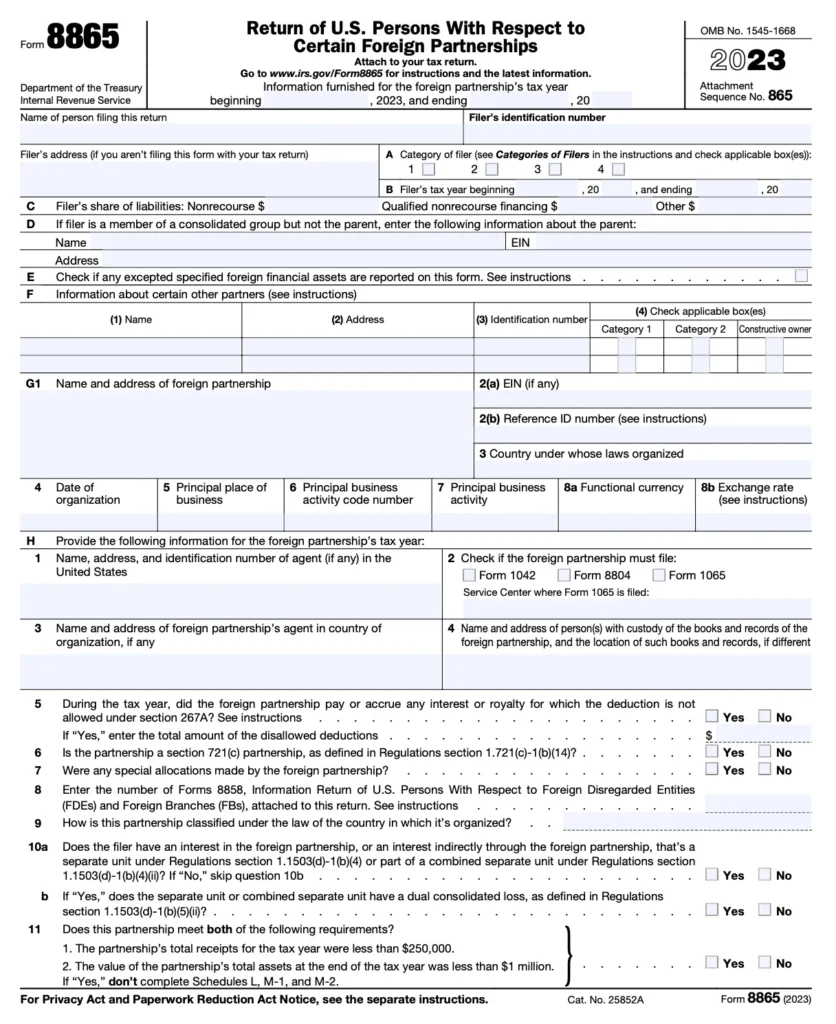

What is Form 8865?

Form 8865 is the IRS document used by U.S. persons to report information related to specific foreign partnerships. This form is required if you have a significant interest in a foreign partnership or if you are treated as a partner for U.S. tax purposes. The form collects data on the partnership’s financial activities, your share of the income, deductions, credits, and other items. Filing Form 8865 helps ensure that the IRS has accurate information on foreign business interests and income. Failure to file this form, when required, can result in substantial penalties.

Who Should File Form 8865?

Generally, Form 8865 must be filed by U.S. persons who:

- Own, directly or indirectly, a significant interest in a foreign partnership.

- Are considered partners under U.S. tax law for foreign partnerships.

- Meet specific thresholds of ownership or involvement as defined by the IRS.

If you have received any notice from the IRS regarding your foreign partnership interests or if you participate in the management of a foreign partnership, you may be required to complete Form 8865. Always review the instructions for Form 8865 and consult with a tax professional to determine your filing obligations.

Why Accurate Filing of Form 8865 is Important

Filing Form 8865 correctly is vital for several reasons:

- Compliance: It ensures you comply with U.S. tax regulations regarding foreign partnerships.

- Avoid Penalties: Inaccuracies or failure to file may lead to significant penalties.

- Transparency: A properly completed form provides transparency about your foreign partnership interests, which is crucial for both tax reporting and regulatory purposes.

- Audit Trail: Accurate records help maintain a clear audit trail in case of IRS examinations.

- Optimized Tax Reporting: Correct reporting ensures that you receive any applicable credits and avoid double taxation on foreign income.

Following our step-by-step instructions and considering professional tax services will help you avoid errors and streamline the filing process.

Step-by-Step Instructions for Completing Form 8865

Below, we detail each step required to complete Form 8865 accurately.

Step 1: Gather All Necessary Documentation

Before you start, make sure you have all the required information:

- Partnership Information: Obtain the legal name, address, and Employer Identification Number (EIN) of the foreign partnership.

- Ownership Details: Document your ownership percentage and the nature of your interest (direct or indirect).

- Financial Statements: Collect relevant financial data from the partnership, such as income, deductions, credits, and balance sheet details.

- Supporting Documentation: Have copies of any agreements, organizational documents, or correspondence related to your foreign partnership interest.

Having these documents on hand will make it easier to complete each section of the form accurately.

Step 2: Complete the Identification Section

Start filling out the top portion of Form 8865:

- Line 1 – Name of U.S. Person: Enter your full legal name as it appears on your tax records.

- Line 2 – Address: Provide your current mailing address.

- Line 3 – Social Security Number (SSN) or EIN: Enter your SSN (or EIN if applicable).

- Line 4 – Foreign Partnership Information: Input the legal name, address, and EIN of the foreign partnership.

- Line 5 – Type of Interest: Clearly indicate the nature of your interest in the foreign partnership (e.g., direct ownership, indirect interest, etc.).

Accuracy in this section is crucial as it establishes your identity and relationship with the foreign partnership.

Step 3: Provide Details About the Foreign Partnership

Next, you’ll need to include specific information about the foreign partnership:

- Line 6 – Date of Organization: Enter the date the foreign partnership was organized.

- Line 7 – Principal Place of Business: List the primary business address of the partnership.

- Line 8 – Country of Organization: Specify the country where the partnership is organized.

- Line 9 – Percentage Interest: Indicate your percentage of ownership in the partnership.

This information helps the IRS understand the structure and origin of the foreign partnership, ensuring your return is processed correctly.

Step 4: Report Income, Deductions, and Credits

Form 8865 requires detailed financial information:

- Line 10 – Income Items: Enter your share of the partnership’s income. This may include ordinary business income, interest, dividends, and other revenue.

- Line 11 – Deductions and Losses: Report your allocated share of the partnership’s deductions and losses.

- Line 12 – Credits: Include any tax credits allocated to you from the partnership.

Please ensure that these figures match the partnership’s financial statements and reconcile any differences with your records.

Step 5: Calculate Your Share of the Partnership’s Capital

Your interest in the partnership’s capital is an essential part of the filing:

- Line 13 – Capital Contributions: Report any capital contributions you have made to the partnership.

- Line 14 – Distributions Received: Enter the amount of distributions you have received from the partnership.

- Line 15—Adjusted Basis: Calculate and report your adjusted basis in the partnership, taking into account income, deductions, and distributions.

Accurate calculation of these amounts ensures that your investment in the partnership is correctly reflected in your tax return.

Step 6: Provide Supplemental Information

In some cases, additional details may be required:

- Line 16 – Additional Information: Use this section to provide any supplemental details about changes in your interest or other relevant information regarding the foreign partnership.

- Attachments: Attach any additional schedules or financial statements as required by the instructions on Form 8865.

Ensure that you include all necessary supporting documentation to validate your figures.

Step 7: Review, Sign, and Date the Form

Before finalizing your submission:

- Review: Carefully review every section of your Form 8865 and compare your entries with your supporting documents to ensure accuracy.

- Sign and Date: Sign and date the form in the designated area. If you are filing electronically, follow the e-signature instructions provided by your tax software.

A thorough review can help prevent errors that might trigger IRS inquiries or penalties.

Step 8: Submit Your Form 8865

After completing the form, it’s time to submit:

- Electronic Filing: Many taxpayers now prefer to e-file, as it generally speeds up processing. If you file electronically, ensure that your Form 8865 is attached to your tax return.

- Mail Submission: If you choose to submit a paper return, mail the completed Form 8865 along with your other tax forms to the appropriate IRS address provided in the instructions.

- Record Keeping: Keep a copy of the completed form and all supporting documents for your records. This documentation is essential for future reference or potential audits.

Following these steps ensures that your Form 8865 is completed in full and filed on time.

Additional Tips and Best Practices

- Stay Organized: Maintain consistent records throughout the year to make the process of completing Form 8865 easier.

- Double-Check Figures: Verify every number against your partnership’s financial statements and your records.

- Use Reliable Software: To reduce manual errors, consider using accounting or payroll software that integrates with tax filing tools.

- Consult Professional Tax Services: If you are unsure about any part of the form, seeking help from expert tax services can save time and ensure that you meet IRS requirements.

Leveraging Professional Tax Services

Navigating Form 8865 can be complex, especially if your foreign partnership has multiple financial transactions or if your interest has changed over time. Professional tax services offer:

- Expert Guidance: Tax professionals stay updated on the latest regulations and can help ensure your form is completed accurately.

- Efficient Processing: With expert help, you can avoid common mistakes and file your form quickly.

- Personalized Support: Whether you’re an individual investor or a significant partnership, professional tax services can tailor their approach to meet your specific needs.

- Peace of Mind: Knowing that a seasoned expert has reviewed your filing minimizes the risk of errors and IRS penalties.

Investing in professional tax services is a wise decision for many taxpayers dealing with the complexities of international partnership reporting.

Final Thoughts

Filing Form 8865 is a crucial responsibility for any U.S. taxpayer with an interest in a foreign partnership. By carefully following the step-by-step instructions outlined above, you can ensure that your return is complete, accurate, and compliant with IRS regulations. Taking the time to gather all necessary information, review your calculations, and use reliable methods for reporting income, deductions, and capital details will save you from potential headaches later on.

Whether you handle your taxes on your own or decide to use professional tax services, the key is to remain organized and diligent. A correctly filed Form 8865 not only helps avoid costly penalties but also provides a clear record of your foreign partnership interests and financial activities. This, in turn, supports your overall tax strategy and financial planning.

By following this comprehensive guide and leveraging expert tax services when needed, you can confidently file Form 8865 and ensure your international tax reporting is handled with precision. Enjoy the peace of mind that comes with knowing your filing is complete and accurate, allowing you to focus on growing your investments and business opportunities.