Your foreign corporation operates profitably in the home country, maintains clean books, and submits timely tax filings. However, when it comes to U.S. compliance, the deadline to file IRS Form 1120-F is missed by just a few months. The result? The IRS denies the corporation’s right to claim deductions, and instead of paying tax on net income, it is forced to pay U.S. tax on gross receipts. That’s not a small difference.

This, however, is not a rare occurrence. The IRS enforces strict rules around Form 1120-F filing deadlines, especially the 18-month protective return rule. Even if a foreign corporation isn’t sure it owes U.S. tax, not filing can lead to missing out on deductions, treaty benefits, and refunds that would otherwise be available.

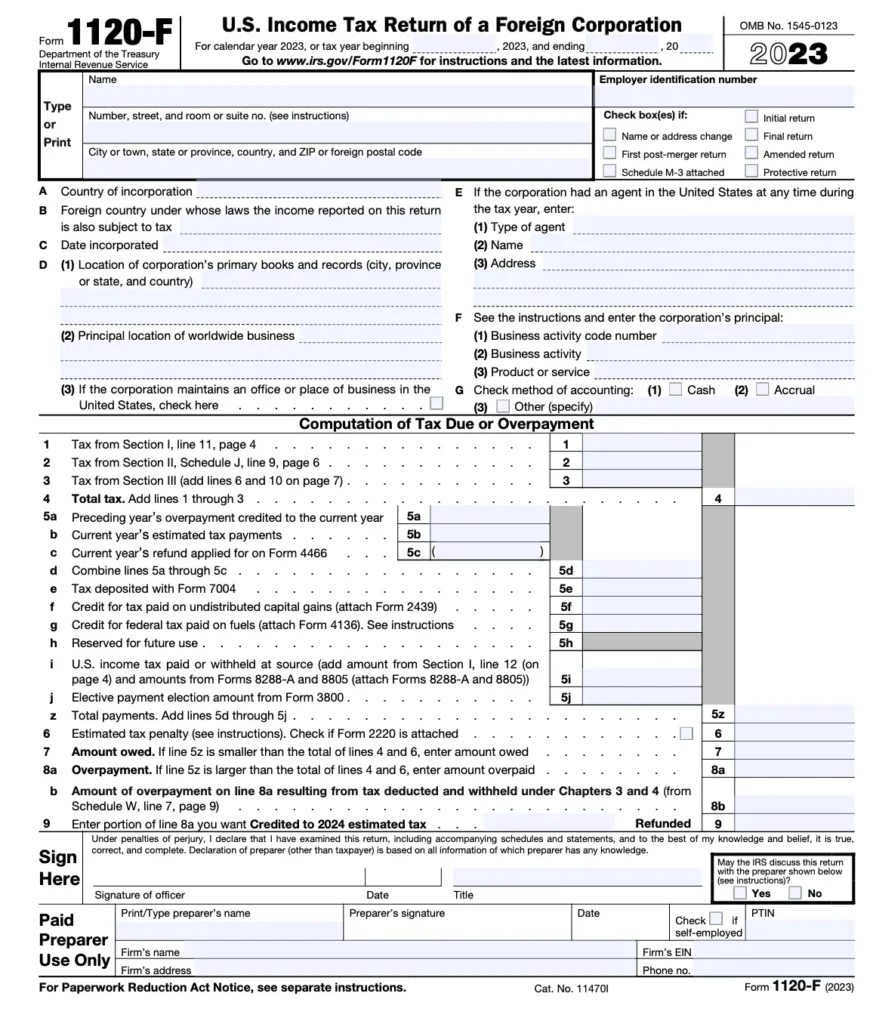

If you’ve ever wondered “what is 1120 F?”, the answer is that it’s the U.S. income tax return that foreign corporations must file if they are engaged in a trade or business within the United States or want to claim tax treaty benefits.

Being aware and in control of Form 1120-F instructions and IRS updates matters. While there are no major new legislative changes to IRS Form 1120-F this year, the IRS continues to issue draft schedules, update e-filing requirements, and clarify reporting obligations. For foreign corporations, the stakes are high: one oversight could lead to losing credits, paying penalties, or facing double taxation.

This article takes you through what’s new in 2025, how to correctly file IRS Form 1120-F, and the common mistakes to avoid.

Table of Contents

What Is Form 1120-F—and Why It Matters

IRS Form 1120-F is the U.S. income tax return filed by foreign corporations that are either engaged in trade or business in the United States or want to claim treaty-based benefits. Unlike a domestic C corporation filing Form 1120, this form specifically addresses effectively connected income (ECI) versus foreign-source income. Filing ensures that corporations can claim deductions and credits, rather than being taxed on gross income alone.

What’s New in 2025? And What Isn’t

While there are no significant legislative changes to Form 1120-F in 2025, the IRS has released draft updates to certain schedules, including Schedule I (interest expense allocation). These drafts can signal how the IRS expects corporations to report income and deductions in the near future. Following Form 1120-F instructions closely is essential since missing a new requirement, even a minor one, could cause your return to be flagged.

For 2025, while there are no sweeping legislative changes to IRS Form 1120-F, a few technical updates are worth noting:

- Draft Schedules Released: The IRS issued a 2025 draft of Schedule I (used for interest expense allocation). While this draft is not final and cannot yet be filed, it signals that the IRS is refining how corporations must document their U.S. and foreign income allocation.

- Federal Register Confirmation: The Federal Register reaffirmed that Form 1120-F continues to require multiple supporting schedules, such as Schedule H (deductions), Schedule I (interest allocation), Schedule M-3 (for corporations with $10M+ in assets), Schedule P (payments and credits), Schedule Q (investment income), Schedule S (treaty benefits), and Schedule V (taxes withheld). These schedules remain critical for full and accurate filing.

Why do these changes matter? Missing the well-known 18-month rule for protective filings could mean your company gets taxed on gross income rather than net taxable income, a costly mistake.

While IRS Form 1120-F hasn’t undergone drastic revisions in 2025, the fine print still matters. Treat each new draft schedule as a heads-up of what may become mandatory soon, and make sure your compliance team or CPA is watching for the finalized instructions.

Addressing Trending Questions about Form 1120-F

When people conduct online research about Form 1120-F, they’re not looking for IRS jargon. We’ve put together some straightforward answers to practical questions. Below are some of the most commonly asked queries that foreign corporations and their advisors are meant to address your 1120-F filing issues:

- What is “Effectively Connected Income (ECI)”?

ECI refers to income that a foreign corporation earns that is directly tied to business activities in the U.S. For example, profits from a U.S. branch office or sales generated by employees working in the U.S. generally count as ECI. ECI is subject to U.S. corporate income tax under Form 1120-F, and failing to classify income correctly can lead to double taxation or disallowed deductions. - When is Form 1120-F due, and how do you extend the deadline?

The due date depends on whether the foreign corporation has a physical presence in the U.S. If it does, Form 1120-F is generally due on the 15th day of the 4th month after the tax year ends (usually April 15 for calendar-year filers).

If the corporation does not maintain an office or place of business in the U.S., the deadline is the 15th day of the 6th month (June 15 for calendar-year filers).

Extensions are available by filing Form 7004; however, extensions push out the filing date, not the payment due date.

- What’s a “protective filing” for Form 1120-F?

A protective filing allows a foreign corporation to file Form 1120-F even if it’s not certain that its income is U.S.-connected. This is critical because it protects the right to claim deductions and credits later if the IRS determines the income is taxable in the U.S. Without this protective step, the corporation could lose those benefits and end up being taxed on gross income only. - Penalties—what’s really at stake?

Late or missed filings don’t just create paperwork headaches. A corporation may lose its ability to deduct expenses or claim treaty benefits, effectively increasing its tax liability. On top of that, the IRS can impose penalties of up to 25% of the unpaid tax, plus interest. - Can you e-file Form 1120-F?

Yes. The IRS now requires electronic filing for most corporations, especially those filing a high volume of returns. However, a waiver may be available in limited situations. Before asking “where to file Form 1120 F,” corporations should confirm if they meet the e-filing requirement, because mailing a paper return when e-filing is mandatory could delay processing or trigger compliance issues.

Form 1120-F Critical Questions from Taxpayers

Beyond trending queries, there are critical points every foreign corporation should understand about Form 1120-F. Presenting them as questions and answers makes the information both approachable and engaging:

- Do I even need to file Form 1120-F?

You must file if your corporation has ECI, FDAP income (fixed, determinable, annual, or periodic U.S. income), claims treaty benefits, or wishes to preserve deductions with a protective filing. Even corporations reporting no taxable income may still be required to file. - What happens if I miss the deadline?

Missing the deadline can be disastrous. Instead of being taxed on net income (income minus deductions), you may be taxed on gross income, leading to a much higher tax bill. Add in penalties and interest, and the cost quickly snowballs. - Are certain schedules always required with Form 1120-F?

Yes. Depending on the corporation’s size and activities, you may need to attach:- Schedule H – Deductions

- Schedule I – Interest allocation

- Schedule M-1/M-2 or M-3 – Reconciliation of income for corporations with $10M+ in assets

- Schedule P – Payments and credits

- Schedule V – Taxes withheld

- Schedule S – Treaty-based return positions

Missing any of these can delay processing or trigger IRS scrutiny.

Step-by-Step Form 1120-F Filing Guide

When following Form 1120-F instructions, here’s a practical sequence to stay organized:

- Gather financial records – gross receipts, deductions, and withholding tax statements.

- Determine ECI vs. foreign-source income – this affects taxable income.

- Attach required schedules – such as H, I, M-3, or others based on your corporation’s profile.

- Treaty benefits – if applicable, attach Form 8833 to disclose treaty positions.

- Choose filing method – most corporations must e-file Form 1120-F, but confirm before mailing.

Deductions, Credits & Attachments

A critical reason to file IRS Form 1120-F is to preserve deductions and credits:

- ECI allocations – properly allocate expenses tied to U.S. income.

- Foreign tax credit – avoid double taxation.

- Protective filings – file even if you’re unsure about U.S. tax liability, so you don’t lose future deductions.

- Treaty benefits – disclose and support them with proper documentation.

Common Mistakes & Red Flags

Even with clear Form 1120-F instructions, corporations often stumble on:

- Not attaching required schedules (H, I, P, or treaty disclosure).

- Misclassifying income as non-ECI when the IRS considers it ECI.

- Forgetting to attach Form 8833 when claiming treaty benefits.

- Filing late and forfeiting deductions.

Each mistake not only increases the risk of penalties but can also cost thousands in lost tax savings.

Advanced Considerations

1) For large corporations or those with complex activities, IRS Form 1120-F can be even more demanding:

- Schedule M-3 is required for corporations with assets over $10 million.

- Reporting derivatives, Qualified Opportunity Funds (QOFs), or partnership interests adds layers of complexity.

- Special rules apply to income from vessels and aircraft operating internationally.

These advanced issues often require professional tax support since they go beyond basic filing.

2) Reader’s Handbook / Checklist

Here’s a quick reference to simplify compliance:

- Should I file? → If you have ECI, FDAP income, treaty claims, or just want to preserve deductions, yes.

- When? → By the 4th or 6th month after year-end, depending on U.S. presence.

How? → Follow the latest Form 1120-F instructions, attach all required schedules, and file electronically unless exempt.

Final Thoughts

Filing IRS Form 1120-F doesn’t have to feel like navigating a maze of rules. The key is staying ahead of deadlines, following instructions carefully, and filing even when you’re unsure to preserve your rights. If you’re not certain whether your corporation must file, consider submitting a protective Form 1120-F to safeguard deductions and treaty benefits.

Profitjets is a trusted and preferred Tax Advisor and Tax consultant, where certified and experienced experts handle your tax strategy, Tax filing, and use all relevant deductions to manage your tax liability. We take pride in providing the end-to-end service from bookkeeping to taxation and even advisory services like Virtual CFO Services. The wide array of services we offer includes outsourced accounting services, outsourced bookkeeping for CPAs, tax filing and tax compliance services, and virtual CFO services. Get in touch with us so we can manage the filing of Form 1120 this tax season.

FAQs on IRS Form 1120-F

1. What is IRS Form 1120-F used for?

Foreign corporations use IRS Form 1120-F to report income that is effectively connected with a U.S. trade or business (ECI), U.S.-source income not fully satisfied by withholding, or to claim refunds and treaty benefits. Even if no U.S. income is reported, filing a protective return may be necessary to preserve deductions and credits.

2. Who must file Form 1120-F?

You must file Form 1120-F if your foreign corporation:

– Earned income is effectively in the U.S.

– Had U.S.-source FDAP income (like dividends or interest) not fully covered by withholding.

– Is claiming treaty benefits (often with Form 8833).

The individual wants to file a protective return to preserve deductions and credits in case the IRS later classifies income as ECI.

3. What are the filing deadlines for Form 1120-F?

– If your corporation has a U.S. office, the deadline is the 15th day of the 4th month after the tax year ends (April 15 for calendar-year filers).

– If your corporation does not have a U.S. office, the deadline is the 15th day of the 6th month (June 15 for calendar-year filers).

You can request an automatic extension by filing Form 7004 by the original due date.

4. What are Form 1120-F instructions for a protective return?

A protective return is filed when a foreign corporation believes it has no ECI but wants to safeguard deductions and credits in case the IRS disagrees. According to Form 1120-F instructions, the protective return must:

– Be filed timely (generally within 18 months of the due date).

– Clearly state it is being filed “protectively.”

– Include supporting schedules and forms (such as Form 8833 if relying on a treaty).

5. Can Form 1120-F be e-filed?

Yes, most corporations can e-file Form 1120-F and related attachments. The IRS strongly encourages electronic filing, and certain corporations are required to e-file if they file many returns. However, if paper filing is necessary, send the return to the IRS Service Center in Ogden, Utah (with different addresses depending on whether you use USPS or a private courier).

6. What are common mistakes when filing Form 1120-F?

Frequent errors with IRS Form 1120-F include:

– Missing required schedules (like Schedule I for interest allocation or Schedule P for partnership ECI).

– Not filing Form 8833 when claiming treaty benefits.

– Failing to file a protective return within the 18-month window.

– Incorrect classification of income as ECI vs. FDAP.

– Forgetting the branch profits tax (BPT) section when applicable.

7. Do foreign corporations need to attach other forms to Form 1120-F?

Yes. Depending on the situation, you may need to attach:

– Form 8833 (for treaty positions).

– Form 5472 (for related-party transactions).

– Form 1118 (foreign tax credit).

– Form 8991 (BEAT tax, if applicable).

– Schedule M-3 (if assets exceed $10 million).

Review the official Form 1120-F instructions to determine which schedules and forms are required.