Small business owners running an S corporation are focused on the day-to-day operations. Businesses can sometimes be overwhelming, and you could miss filing IRS Form 1120-S or make mistakes in the filing. Missing the deadline to file Form 1120-S leads to notices from the IRS and penalties. What could have been a simple filing turns into a costly mistake.

This article walks you through the essentials of Form 1120-S, explains the IRS rules in plain language, and highlights common pitfalls to avoid. Think of it as a brief guide, complete with Form 1120-S instructions, to help you stay compliant and avoid penalties.

Table of Contents

What is Form 1120-S and Why Does It Matter?

Form 1120-S is the annual U.S. income tax return that an S corporation must file with the IRS. Unlike a C corporation, an S corporation itself usually doesn’t pay federal income tax. Instead, income, deductions, and credits “pass through” to the individual shareholders, who then report them on their personal tax returns. This structure makes the S corporation an attractive option for many small and mid-sized businesses.

Why do S Corps File It?

- To report income, losses, credits, and deductions to the IRS.

- To generate Schedule K-1 forms for each shareholder, showing their share of income and deductions.

- To remain in compliance, even if there was no business activity or income during the year.

Difference Between Form 1120 and Form 1120-S

| Form | Who Uses It | How Tax Is Applied |

| Form 1120 | C corporations | Corporation pays taxes on profits; shareholders may pay tax again on dividends (double taxation). |

| Form 1120-S | S corporations | Business income passes through to shareholders and is taxed only once on their personal returns. |

If your business is structured as an S corporation, Form 1120-S is the backbone of your tax reporting.

Who Must File Form 1120-S?

Not every business files this form, but if you’ve elected S corporation status with the IRS, you’re required to submit it annually.

Eligibility: Who Files

- Any domestic corporation with a valid S election (filed via Form 2553).

- Some LLCs have elected to be taxed as an S corporation.

Who Doesn’t File

- LLCs that did not elect S corporation status.

- Partnerships (they use Form 1065).

- C corporations (they use Form 1120).

Even if your S corporation had zero income or no business activity during the year, you still must file Form 1120-S. The IRS requires this to maintain your S corp status, and failing to do so could result in penalties or jeopardize your election.

Key Features & Benefits of Filing Form 1120-S

If you’ve ever wondered, “What is Form 1120-S, and why is it such a big deal?” the answer lies in its unique features that separate S corporations from other business entities. IRS Form 1120-S is the foundation of how your S corporation reports income and passes benefits to its owners.

Pass-Through Taxation

Unlike a C corporation that pays tax at the entity level, S corporations enjoy pass-through taxation. This means:

- The business itself generally doesn’t pay federal income tax.

- Profits (or losses) are reported on each shareholder’s personal tax return.

- This avoids the dreaded “double taxation” of C corporations.

Schedule K-1: Why Shareholders Care

Each shareholder receives a Schedule K-1 (Form 1120-S) that shows their share of income, deductions, and credits. Without this, shareholders can’t accurately report taxes on their individual returns. For investors and owner-operators alike, the K-1 is critical.

Liability Protection + Tax Savings

Filing as an S corporation offers two big advantages:

- Liability protection – Shareholders are generally shielded from personal liability for business debts.

- Tax savings – Shareholder-employees can split income between salary (subject to payroll taxes) and distributions (not subject to self-employment tax), creating potential tax efficiency.

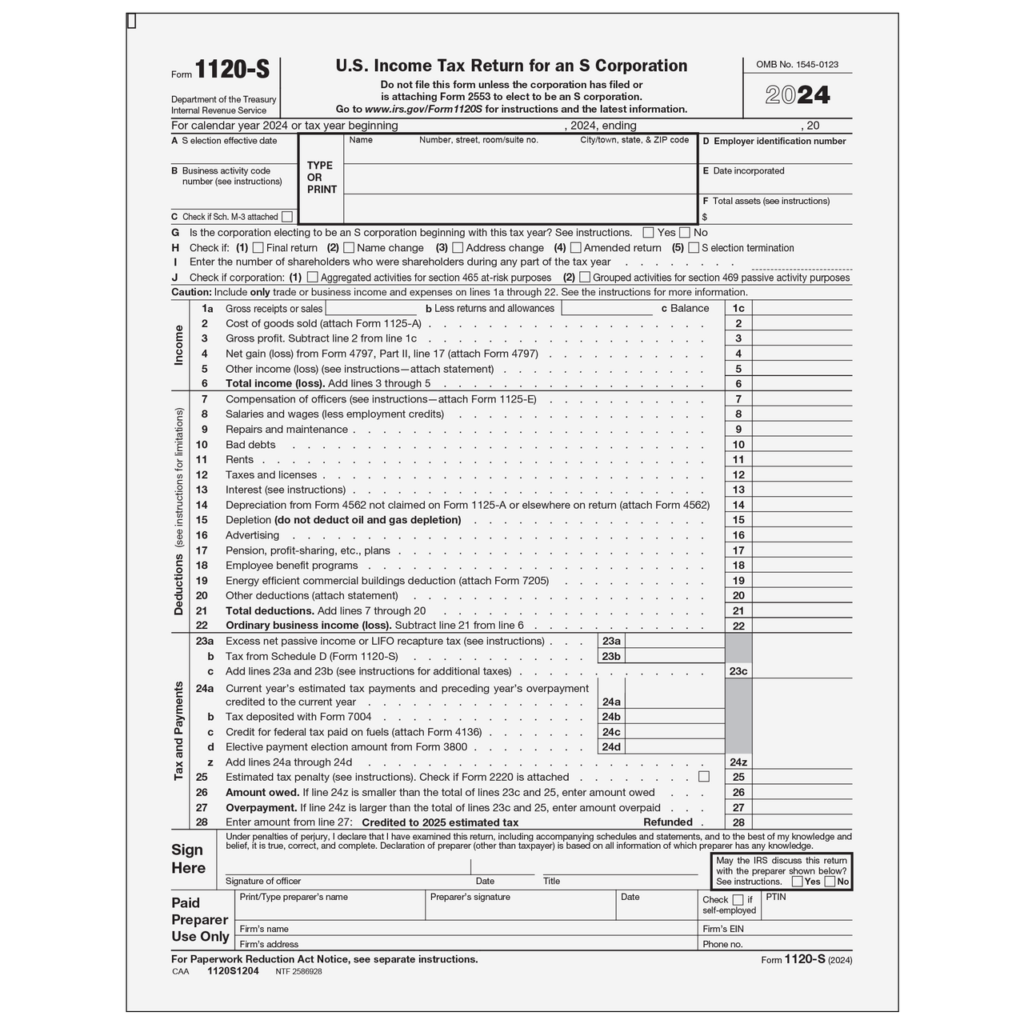

What Information and Schedules Are Included?

IRS Form 1120-S isn’t a single-page return—it includes multiple schedules and attachments. Understanding these is key to avoiding mistakes.

Key Schedules

- Schedule K – A summary of the corporation’s total income, deductions, and credits.

- Schedule K-1 – Shows each shareholder’s allocated share of income, losses, and credits.

- Schedule L – Balance sheet information.

- Schedule M-1 – Reconciliation of income (book vs. tax).

- Schedule M-2 – Analysis of accumulated adjustments account (AAA) and other accounts.

- Schedules K-2 & K-3 – Required for international items such as foreign income or credits (effective for most corporations beginning in 2021, with some exceptions).

Why does Schedule K-1 Matter the Most?

Shareholders rely on Schedule K-1 to file their personal tax returns. An inaccurate or late K-1 can delay individual filings and create IRS headaches.

A Simple Flow Chart

IRS Form 1120-S (corporate return)

↓

Schedule K (summary of total items)

↓

Schedule K-1 (individual shareholder allocations)

↓

Personal Tax Return (Form 1040 for each shareholder)

This visual shows how information flows from the corporation to individual shareholders, underscoring why accuracy matters.

Filing Procedure and Deadlines

Knowing when and how to file is just as important as knowing what to file. Missing deadlines for IRS Form 1120-S can be costly.

Filing Deadline

- Due: The 15th day of the 3rd month after the end of the tax year.

- For calendar-year corporations, that’s March 15.

Extensions

- File Form 7004 to request a 6-month extension.

- Important: The extension gives you more time to file, but not more time to pay any taxes owed (e.g., payroll or other applicable taxes).

E-Filing Requirements in 2025

As of 2025, most businesses filing IRS Form 1120-S must e-file if they submit 10 or more returns (including W-2s, 1099s, etc.). This rule aims to streamline IRS processing and reduce errors.

Penalties for Missing the Deadline

If you file late, the IRS imposes penalties that add up quickly:

- $220 per shareholder per month (for up to 12 months).

- A minimum penalty of $510 if the return is more than 60 days late.

- Shareholders may also face delays in filing their personal returns without timely K-1s.

Common Mistakes to Avoid with Form 1120-S

Filing IRS Form 1120-S may look straightforward, but small errors can trigger penalties, IRS notices, or even hamper your S corporation status. Here are the most common pitfalls business owners make with the 1120-S tax form—and how you can avoid them:

1. Forgetting to File Even with Zero Income

Many S corporation owners mistakenly believe that if the company has no activity or revenue, there’s no need to file. In reality, the IRS requires the 1120-S tax form every year, regardless of income. Skipping it can lead to unnecessary penalties.

2. Errors in Shareholder Allocations (K-1 Mismatches)

Each shareholder’s Schedule K-1 must accurately reflect their ownership percentage. Even small errors in income or deduction allocations can create problems with shareholders’ individual returns. This not only frustrates shareholders but also increases the risk of IRS audits.

3. Not Paying Yourself a “Reasonable Salary”

S corp owners often try to save on self-employment taxes by paying themselves a low salary and taking the rest as distributions. The IRS scrutinizes this closely. If your compensation isn’t “reasonable” for your role, the IRS may reclassify distributions as wages, resulting in back taxes and penalties.

4. Mixing Business and Personal Expenses

Using business funds for personal expenses is one of the fastest ways to get into trouble. Not only does it complicate the IRS Form 1120-S filing process, but it also risks piercing the corporate veil, which can remove your liability protection. Keep business and personal finances separate at all times.

5. Filing Late → Penalties Add Up Fast

Missing the IRS Form 1120-S deadline (March 15 for calendar-year S corps) can be expensive. Penalties are typically $220 per shareholder, per month for up to 12 months. On top of that, late K-1s can delay shareholders from filing their personal returns, leading to frustration and potential conflicts.

To summarize, accuracy and timeliness are everything when it comes to the 1120-S tax form. Staying organized, tracking shareholder data, and working with a professional can prevent these mistakes from costing you money and peace of mind.

Conclusion

Filing IRS Form 1120-S is a critical step in protecting your S corporation status, keeping your shareholders compliant, and avoiding costly penalties. From proper K-1 allocations to meeting deadlines, small missteps can have big consequences.

At Profitjets, our team specializes in preparing and filing the 1120-S tax form, ensuring your return is accurate, timely, and optimized for your business’s needs.

Profitjets is a trusted and preferred Tax Advisor and Tax consultant, where certified and experienced experts handle your tax strategy, Tax filing, and use all relevant deductions to manage your tax liability. We take pride in providing the end-to-end service from bookkeeping to taxation and even advisory services like Virtual CFO Services. The wide array of services we offer includes outsourced accounting and bookkeeping, outsourced bookkeeping for CPAs, tax filing and tax compliance services, and virtual CFO services. Get in touch with us so we can manage the filing of Form 1120 this tax season.

Frequently Asked Questions About IRS Form 1120-S

1. What happens if I file Form 1120-S late?

If you miss the filing deadline for IRS Form 1120-S, the IRS will impose penalties that add up quickly. The penalty is typically $220 per shareholder, per month, for up to 12 months. In addition, filing late delays the issuance of Schedule K-1 to shareholders, which can prevent them from filing their own tax returns on time.

2. Do I need to file Form 1120-S if there’s no income?

Yes. Even if your S corporation had no income or no business activity during the year, you must still file the 1120-S tax form. The IRS requires annual filing to maintain your S corporation status. Skipping the filing could result in penalties and put your S Corp election at risk.

3. Is Form 1120-S the same as a K-1?

No, they are not the same. Form 1120-S is the corporate tax return filed by the S corporation. A Schedule K-1 (Form 1120-S) is an attachment generated from the return that shows each shareholder’s share of the corporation’s income, deductions, and credits. The corporation files Form 1120-S with the IRS, while shareholders use the K-1 to complete their personal tax returns.

4. Can a single-member LLC file Form 1120-S?

Yes, but only if the LLC elects to be taxed as an S corporation by filing Form 2553 with the IRS. By default, a single-member LLC is taxed as a disregarded entity (reported on Schedule C of the owner’s personal return). Once the S corp election is approved, the LLC must file Form 1120-S every year.

5. How do I convert from Form 1120 to 1120-S?

If your business is currently taxed as a C corporation (filing Form 1120), you can convert to S corporation status by filing Form 2553 (Election by a Small Business Corporation). Once approved, your company will begin filing IRS Form 1120-S instead of Form 1120. Be mindful of eligibility rules, shareholder limits, and deadlines for making the election.

6. What’s the penalty for not filing Form 1120-S?

The penalty for failing to file IRS Form 1120-S is steep: $220 per shareholder, per month, for a maximum of 12 months. If your return is more than 60 days late, the IRS may impose a minimum penalty of $510 or 100% of the tax due, whichever is smaller. These fines can escalate quickly, making timely filing critical.

7. What is the purpose of Form 1120, Form 1120-H & Form 1120-F?

– Form 1120 – This is the tax return for C corporations, reporting business income, gains, losses, and credits.

– Form 1120-H – Used by homeowners’ associations (HOAs) to report exempt-function income while benefiting from special tax rules.

– Form 1120-F – Filed by foreign corporations doing business in the U.S. to report U.S.-sourced income and claim deductions.

Each of these forms serves a different type of corporation, while Form 1120-S specifically applies to S corporations.