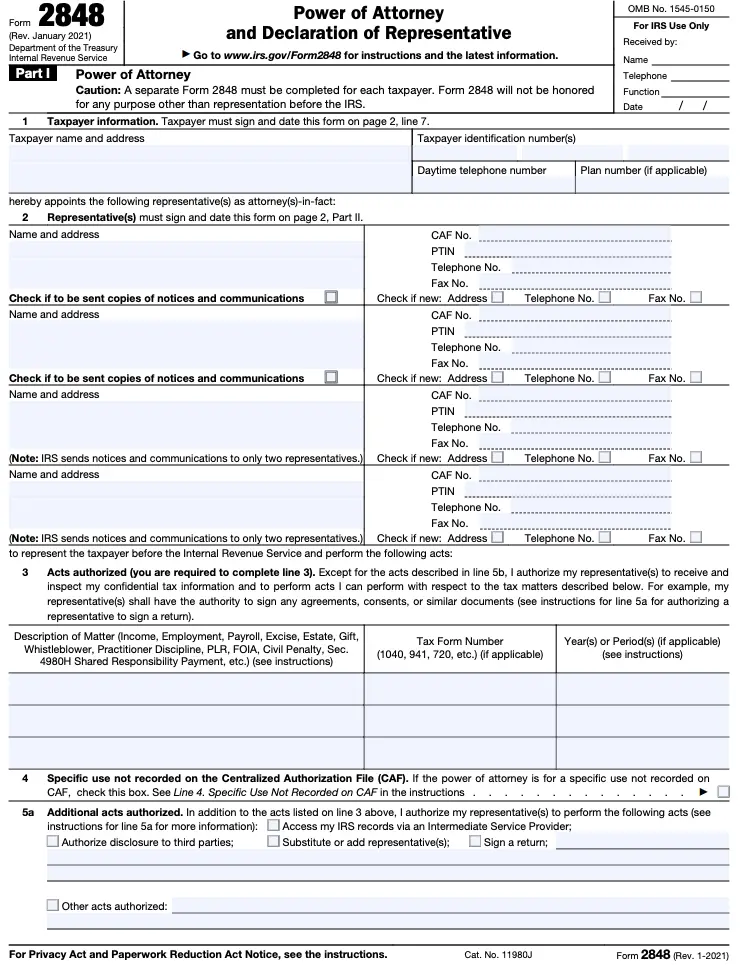

IRS Form 2848 (Power of Attorney and Declaration of Representative) is the official document that allows taxpayers to:

- Designate authorized representatives

- Specify representation scope

- Grant access to confidential tax information

- Handle IRS communications and disputes

Table of Contents

When Should You File Form 2848?

Consider filing if you need to:

- Have a tax professional represent you before the IRS

- Authorize someone to access your tax records

- Handle complex audits or disputes

- Manage tax matters while unavailable

- Coordinate with multiple representatives

Important: This form doesn’t authorize financial transactions. Professional tax services can advise on additional forms needed for full representation.

Step-by-Step Guide to Completing Form 2848

Step 1: Identify Your Representative

Choose a qualified professional with:

- Active PTIN (Preparer Tax Identification Number)

- Valid professional credentials (CPA, attorney, EA)

- Specific expertise for your tax situation

Step 2: Gather the Required Information

Prepare:

- Your personal information (SSN, address)

- Representative’s details (name, CAF number)

- Specific tax matters needing representation

- Relevant years/periods to be covered

- Any financial statements related to representation

Step 3: Complete Section I – Taxpayer Information

- Line 1a: Your full legal name

- Line 1b: Your SSN, EIN, or other taxpayer ID

- Line 1c: Your current address

- Line 1d: Your daytime phone number

Step 4: Complete Section II – Representative Information

- Line 2a: Representative’s name/firm

- Line 2b: Representative’s PTIN or CAF number

- Line 2c: Representative’s contact information

- Line 2d: Representative’s professional designation

Step 5: Complete Section III – Authorization Details

- Line 3: Tax form numbers (1040, 1120, etc.)

- Line 4: Specific tax matters (audit, appeal, etc.)

- Line 5: Years/periods covered

- Line 6: Special limitations or restrictions

Step 6: Complete Section IV – Signature

- Line 7: Your signature and date

- Line 8: Representative’s signature (if applicable)

- Line 9: Notary section (if required by state)

Step 7: Submit the Form

- File by mail or fax to the appropriate IRS office

- Keep copies for your records

- Allow 2-4 weeks for processing

- Verify acceptance through the IRS CAF system

Common Mistakes to Avoid

- Incomplete representative information – Missing CAF numbers delay processing

- Overly broad authorizations – Specify exact matters and years

- Missing taxpayer signature – Invalidates the authorization

- Expired authorizations – Typically valid for 3-5 years

- Failing to update for new matters – Requires new forms for additional issues

For complex representation needs, professional tax services ensure proper authorization.

Advanced Considerations

Documentation Requirements

- Supporting financial statements for specific matters

- Additional forms for certain representation types

- State-level power of attorney requirements

- Record retention policies

Representation Scope

- Audit representation limits

- Collection matter authorizations

- Tax court procedures

- Confidentiality restrictions

Multiple Representatives

- Lead representative designation

- Team representation rules

- Conflict of interest considerations

- Communication protocols

Final Thoughts

Proper completion of IRS Form 2848 is essential for establishing authorized tax representation and protecting your rights before the IRS. By carefully selecting qualified representatives, specifying the exact authorization scope, and maintaining proper documentation, including relevant financial statements, you can ensure adequate representation for your tax matters. For complex cases, ongoing representation needs, or sensitive tax situations, partnering with professional tax services provides the expertise and authorization management needed for successful IRS interactions.