Obtaining an Employer Identification Number (EIN) is a crucial step for any business or organization. The IRS Form SS‑4 is your application for an EIN, which identifies your business for tax purposes. Whether you’re starting a new venture, opening a bank account, or handling payroll, filing Form SS‑4 accurately is essential. In this guide, we’ll walk you through each step of filling out the form, explain what information you’ll need, and share tips to avoid common mistakes. Plus, we’ll highlight how partnering with professional tax services can simplify the process.

What is Form SS‑4?

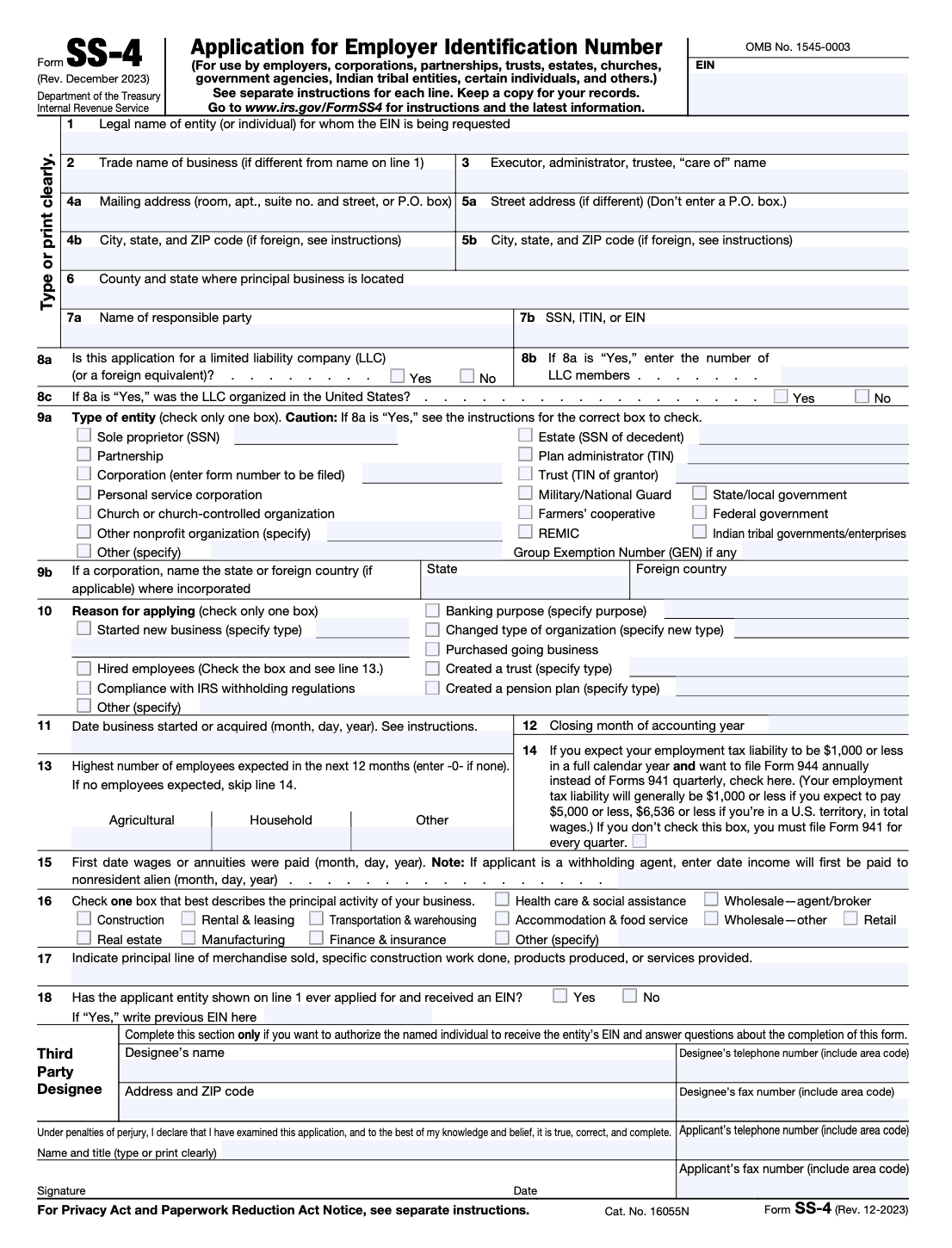

Form SS‑4 is the official IRS document used to apply for an Employer Identification Number. Your EIN is a unique nine-digit number that the IRS assigns to your business. It’s required for various activities, such as opening a business bank account, hiring employees, filing business tax returns, and even applying for specific licenses or permits. By completing this form, you provide the IRS with the necessary details about your business structure and operations so that they can issue your EIN.

Who Should File Form SS‑4?

Filing Form SS‑4 is necessary for most businesses, including:

- New businesses and startups: Whether you’re a sole proprietor, partnership, corporation, or LLC, you need an EIN for tax filing and reporting.

- Non-profit organizations: Registered charities and non-profits use the EIN to manage tax-exempt status and filing requirements.

- Other entities, such as trusts, estates, and government agencies, also file Form SS‑4 when they require an EIN for their operations.

If you are uncertain whether your organization qualifies, review the Form SS‑4 instructions or consult with a tax professional for clarity.

Why You Need to File Form SS‑4

An EIN is more than just a number. It serves as the unique identifier for your business when dealing with the IRS and other government agencies. Here are some reasons why obtaining an EIN through Form SS‑4 is essential:

- Tax Reporting: Your EIN is used on all tax filings, including payroll, income, and excise taxes.

- Business Banking: Most banks require an EIN to open a business bank account.

- Hiring Employees: When you hire staff, you need an Employer Identification Number to process payroll and tax withholdings properly.

- Legal Requirements: Some business structures are legally required to have an EIN.

- Credit Purposes: Establishing credit for your business is easier with an EIN on file.

By filing Form SS‑4 correctly, you ensure that your business complies with federal regulations and is positioned for future growth.

Step-by-Step Instructions for Completing Form SS‑4

Follow these steps to complete Form SS‑4 accurately. This guide is designed to mirror the format of the original Pilot blog while ensuring that every field is addressed.

Step 1: Gather Required Information

Before you start filling out the form, compile all the necessary details:

- Business Details: Legal name, trade name (if applicable), physical address, and mailing address.

- Entity Type: Choose your business structure (e.g., sole proprietorship, partnership, corporation, LLC, or non-profit).

- Reason for Applying: Know why you need an EIN (starting a new business, hiring employees, banking, etc.).

- Responsible Party: The name and Social Security Number (SSN) of the individual who controls the funds and assets of the business.

- Date of Formation: The date your business was legally established.

- Closing Month of Accounting Year: Typically, it is December for most businesses unless you operate on a fiscal year.

Having these details on hand will streamline the process and minimize errors.

Step 2: Begin with the Top Section of the Form

Start by filling out the top portion of Form SS‑4:

- Line 1: Enter the legal name of your business exactly as it appears in your official documents.

- Line 2: If you operate under a different trade name (DBA), enter it here.

- Line 3: Specify the mailing address where you want to receive correspondence from the IRS. If your mailing address differs from your physical address, be sure to provide both.

- Line 4: Enter your street address if it is different from your mailing address.

Step 3: Provide Your Business Structure and Entity Information

In this section, indicate the nature of your business:

- Line 5: Select the appropriate box that describes your business entity. Options include sole proprietor, partnership, corporation, LLC, or non-profit organization.

- Line 6: Provide the reason for applying. Common reasons include “Started a new business,” “Banking purposes,” or “Hiring employees.”

- Line 7: Enter the date your business was created or acquired. Use the MM/DD/YYYY format.

- Line 8: State the closing month of your accounting year (most often December).

Step 4: Identify the Responsible Party

The responsible party is the person who ultimately controls, manages, or directs the entity’s funds and assets:

- Line 9: Write the name of the responsible party. This is often the owner or principal officer.

- Line 10: Enter this person’s SSN (or Individual Taxpayer Identification Number, ITIN).

- Line 11: Provide the title or position of the responsible party (e.g., owner, president, or CEO).

This information is crucial, as the IRS uses it to contact the individual most accountable for the business’s operations.

Step 5: Provide Additional Details

Continue filling out the remaining sections of the form:

- Line 12: Specify the type of entity by checking the appropriate box. If you’re forming an LLC, include the number of members.

- Line 13: Answer whether you expect your employment tax liability to be zero after closing your accounting year. This line helps the IRS determine if your business will have future tax reporting responsibilities.

- Line 14: If your business was created outside the United States or has foreign addresses, provide the necessary information. Otherwise, leave it blank.

- Line 15: This line may ask for any additional details relevant to your business type. Provide clear and concise answers.

Step 6: Review and Sign the Form

Before submitting your Form SS‑4:

- Review Every Entry: Carefully double-check all the information you’ve entered. Ensure that the legal name, addresses, and dates are correct and consistent with your official documents.

- Sign and Date: Although the form does not require a handwritten signature if applying online, if you are mailing it, be sure to sign and date the form in the designated area.

Step 7: Submit Form SS‑4

There are multiple ways to file your completed Form SS‑4:

- Online Submission: Many businesses prefer to file electronically through the IRS website. E-filing can expedite the processing time, and you’ll typically receive your EIN within minutes.

- Mail Submission: If you choose to submit a paper form, mail your completed SS‑4 to the IRS address provided in the instructions. Ensure you use the correct address for your state.

- Fax Submission: Some applicants may also fax their form to the IRS. Check the current instructions for the appropriate fax number.

Always retain a copy of your completed Form SS‑4 and any confirmation or EIN assignment documents for your records.

Leveraging Professional Tax Services

If you’re unsure about any part of the process, consider enlisting professional tax services:

- Expert Guidance: Tax professionals can help verify that your Form SS‑4 is filled out correctly, ensuring that you meet all legal requirements.

- Efficient Processing: With the help of experienced advisors, you can avoid common pitfalls that delay EIN issuance.

- Comprehensive Support: From initial review to final submission, professional tax services can handle every aspect of your filing, letting you focus on running your business.

Partnering with reliable tax services not only saves time but also gives you peace of mind, knowing that your EIN application is in expert hands.

Final Thoughts

Filing Form SS‑4 is an essential step in establishing your business identity. By following our detailed, step-by-step guide, you can confidently complete every section of the form and secure your Employer Identification Number. A correctly filed Form SS‑4 paves the way for smoother business operations—whether you need to open a bank account, hire employees, or fulfill tax reporting obligations.

Remember, accuracy is key. Take the time to review your entries, double-check your data, and consult the latest IRS instructions. And if you’re ever in doubt, professional tax services are available to guide you through the process and ensure you meet all requirements.

Taking the time to get Form SS‑4 right from the start not only helps you avoid delays and complications but also sets a strong foundation for your business’s financial future. An adequately filed EIN application is the first step toward full compliance and operational success.