When tax season rolls around, one form stands out as the centerpiece of federal income tax filing: IRS Form 1040. Whether you are a first-time filer or an experienced taxpayer, understanding what the 1040 Form is and how it impacts your tax obligations is essential. This form is the official way individuals report their annual income to the Internal Revenue Service (IRS), apply deductions and credits, and calculate whether they owe more taxes or qualify for a refund.

Form 1040 is the backbone of the U.S. tax system for individuals. Filing it correctly ensures compliance with federal law and can make the difference between a smooth tax season and unexpected penalties. This blog provides a Q&A format to help you navigate the details of Form 1040, skipping to the most relevant section.

Table of Contents

What is Federal Tax Form 1040?

IRS Form 1040, also called the U.S. Individual Income Tax Return, is the standard form most Americans use to file their annual federal income taxes. It provides a detailed picture of your financial year, including wages, self-employment income, investment earnings, deductions, credits, and taxes paid.

One common point of confusion is the difference between Form 1040 and other tax documents, like a W-2 or 1099. A W-2 reports wages earned from an employer, while a 1099 reports other types of income, such as freelance earnings, dividends, or interest. These forms provide the information you need to complete your 1040, but they are not the same thing. Form 1040 is where all of this income information comes together to determine your overall tax liability.

Is Form 1040 the same as my tax return?

Yes, when people say “filing a tax return,” they’re generally referring to filing Form 1040 (and any required schedules). Other IRS forms, such as W-2s or 1099s, are supporting documents, but Form 1040 is the actual return submitted to the IRS.

What is the Purpose of Form 1040?

The primary purpose of IRS Form 1040 is to reconcile what you earned with what you owe. Using this form, the IRS determines:

- Your total income: wages, self-employment, investments, rental income, retirement distributions, and more.

- Your deductions and credits: either the standard deduction or itemized deductions, along with credits like the Child Tax Credit or Education Credits.

- Your tax liability: the total amount of tax you’re responsible for paying based on your income and adjustments.

- Your balance due or refund: whether you’ve already paid enough through paycheck withholdings and estimated payments, or if you owe additional tax.

What happens if I don’t file Form 1040?

If you don’t file Form 1040, the IRS can impose penalties, interest, and even legal consequences. More importantly, not filing could mean losing out on a refund you’re entitled to—since the IRS won’t issue refunds without a tax return on record.

Who Must File Form 1040?

Not every individual is required to file, but most U.S. taxpayers will. The IRS sets filing thresholds each year based on age, filing status (single, married filing jointly, etc.), and gross income. For example, if your income exceeds the threshold for your category, you must file.

Special situations also require filing even if your income falls below the standard threshold:

- Self-employed individuals who earn $400 or more in net income.

- Dependent children with unearned income (like investment earnings) above a certain limit.

- Individuals who owe special taxes, such as self-employment tax or alternative minimum tax.

Some people also file voluntarily even if they don’t technically have to, so they can claim valuable refunds from tax credits like the Earned Income Tax Credit (EITC) or the Child Tax Credit.

Do I need to file if I made very little income?

In many cases, you might not be legally required to file if your income is below the filing threshold. However, it’s often in your best interest to file anyway—especially if taxes were withheld from your paycheck or if you qualify for refundable credits that could put money back in your pocket.

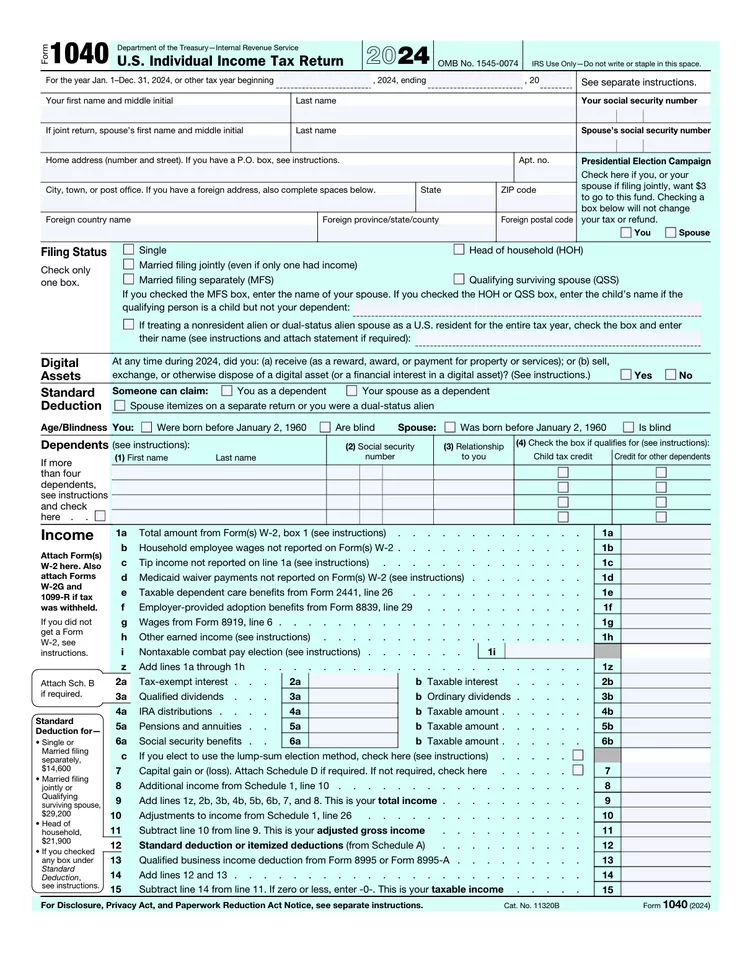

Key Components of Form 1040

Understanding the 1040 tax form is easier when you know what each section covers. The form is divided into clear parts that walk you through the entire process of reporting income, applying deductions, and calculating taxes. Here’s a quick breakdown:

- Personal Information – Your name, Social Security Number (SSN), filing status, and dependent information. Accuracy here is critical—any mismatch with IRS records could delay processing.

- Income Section – This is where you report wages (W-2), self-employment earnings, interest, dividends, retirement income, rental income, and other taxable sources.

- Adjustments & Deductions – You can take the standard deduction or itemize (mortgage interest, medical expenses, charitable contributions). These reduce your taxable income.

- Tax and Credits – The IRS uses this section to calculate your total tax liability. You can also claim credits such as the Child Tax Credit or the American Opportunity Credit to lower your final tax bill.

- Payments – Here, you report taxes withheld from paychecks, estimated tax payments, or refundable credits.

- Refund or Amount Owed – Based on the above calculations, the IRS determines if you are due a refund or if you owe additional taxes.

How to File the Federal Tax Form 1040?

Once you understand the 1040 tax form, the next step is learning how to file it. The IRS provides multiple filing options:

- E-file: Fast, secure, and the most common way to file. Refunds usually arrive in less than three weeks.

- IRS Free File: Available for eligible taxpayers with adjusted gross income (AGI) under a certain threshold.

- Tax Software or CPA: Using software like TurboTax, H&R Block, or working with a tax professional simplifies the filing process, especially for complex returns.

- Paper Filing (Mail): Still accepted, though slower in terms of processing and refunds.

Step-by-Step Form 1040 Filing Process

- Gather documents – W-2s, 1099s, prior year return, receipts for deductions, and other tax forms.

- Follow Form 1040 instructions – Line-by-line guidance from the IRS ensures accuracy.

- Attach required schedules – Such as Schedule 1 for additional income or Schedule A for itemized deductions.

- Submit return – Either electronically or by mail.

- Track refund/payment – Use the IRS “Where’s My Refund?” tool or confirm payment if taxes are owed.

Should I e-file or paper-file Form 1040?

E-filing is strongly recommended by the IRS as it’s faster, reduces errors, and ensures quicker refunds. Paper filing may be necessary in rare cases (like when attaching certain supporting documents), but it often leads to delays.

How to Correct Mistakes on Form 1040?

Mistakes happen, but the IRS provides a way to fix them. If you discover an error on your 1040 tax form after filing, like forgetting a W-2 or misreporting income, you can file an amended return.

- Form 1040-X: This is the official form for corrections.

- What You Can Fix: Income errors, filing status, deductions, or credits.

- What You Cannot Fix: Simple math mistakes, the IRS usually corrects those automatically.

Timeline for Corrections and Refunds

You generally have three years from the original filing date (or two years from the date taxes were paid, whichever is later) to file Form 1040-X. Refunds from amended returns may take up to 16 weeks to process.

What if I forgot a W-2 or 1099 on my return?

If you left out a form, file a Form 1040-X as soon as possible. The IRS may eventually detect the missing income through matching systems, which could trigger penalties. Filing an amended return voluntarily reduces potential issues.

Versions of Form 1040 (Which One Do You Need?)

While most people file the standard Form 1040, the IRS has created different versions to meet the needs of specific taxpayers. Understanding the right version for you is crucial.

- Form 1040 (Standard) – Used by the majority of taxpayers.

- Form 1040-SR – Tailored for seniors (65+), with larger print and a standard deduction chart included.

- Form 1040-NR – For nonresident aliens with U.S. income.

- Form 1040-X – For amended returns when you need to correct a mistake.

What is the difference between Form 1040 and 1040-SR?

Both forms calculate taxes the same way. The main difference is presentation—Form 1040-SR was designed for seniors, with bigger text and a simplified format that includes a deduction chart right on the form. Functionally, it’s identical to the standard Form 1040.

Schedules in Federal Tax Form 1040

Filing the IRS Form 1040 often requires additional schedules, depending on your financial situation. These schedules provide extra detail to ensure all income, credits, and deductions are accurately reported. Here’s a breakdown of the most common ones:

- Schedule 1: Additional Income & Adjustments

Used to report income not included on the main 1040 tax form, such as unemployment compensation, business income, rental income, or alimony. It also covers adjustments like student loan interest or self-employed health insurance deductions. - Schedule 2: Additional Taxes

Covers taxes beyond regular income tax, such as the Alternative Minimum Tax (AMT) or repayment of excess advance premium tax credits. - Schedule 3: Additional Credits & Payments

Allows you to claim nonrefundable credits (like the foreign tax credit or education credits) and refundable credits (such as the net premium tax credit). - Other Common Schedules:

- Schedule A: Itemized deductions (medical expenses, mortgage interest, charitable contributions).

- Schedule B: Interest and dividend income.

- Schedule C: Self-employment income and expenses.

- Schedule D: Capital gains and losses.

- Schedule E: Rental income, royalties, partnerships, and S corporations.

- Schedule SE: Self-employment tax.

How do I know which schedules I need?

It depends on your income sources and tax situation. For example, if you only earn wages reported on a W-2, you may not need any schedules. However, if you’re self-employed, own rental property, or claim itemized deductions, you’ll likely need to attach the appropriate schedules to your IRS Form 1040. Always refer to the official Form 1040 instructions for guidance.

Deadlines & Penalties for Filing Form 1040

Filing your 1040 tax form on time is critical to avoid costly penalties. Here are the key dates and consequences every taxpayer should know:

- Standard Deadline: April 15 is the annual due date for filing IRS Form 1040. If April 15 falls on a weekend or holiday, the deadline is moved to the next business day.

- Extensions: You can file Form 4868 for an automatic six-month extension to file, moving the deadline to October 15. However, this is an extension to the file, not to pay. Any taxes owed are still due by April 15.

- Penalties for Failure to File vs. Failure to Pay:

- Failure to File: Generally, 5% of unpaid taxes per month (up to 25%).

- Failure to Pay: Usually 0.5% of unpaid taxes per month (up to 25%).

These penalties can stack, making timely filing essential.

- Interest Accrual: In addition to penalties, the IRS charges interest on any unpaid balance starting from the due date until payment is made.

Does filing an extension give me more time to pay taxes?

No. Filing Form 4868 only extends the time to submit your 1040 tax form—not the time to pay your tax bill. To avoid interest and penalties, make an estimated payment by April 15.

Conclusion

The IRS Form 1040 is the foundation of individual tax filing in the United States. Whether your return is simple or complex, understanding how the 1040 tax form works—along with its schedules, deadlines, and correction procedures—is key to staying compliant and maximizing your refund.

Filing late or incorrectly can lead to penalties, interest, and delays in receiving your refund. On the other hand, filing accurately and on time ensures peace of mind and may even put extra money back in your pocket.

Taxation can be daunting; handing it to professionals can ease the process a lot and help you file correctly the first time to avoid penalties. Profitjets is a trusted and preferred Tax Advisor and Tax consultant, where certified and experienced experts handle your tax strategy, Tax filing, and use all relevant deductions to manage your tax liability. We take pride in providing the end-to-end service from bookkeeping to taxation and even advisory services like Virtual CFO Services. The wide array of services we offer includes outsourced accounting and bookkeeping, outsourced bookkeeping for CPAs, tax filing and tax compliance services, and virtual CFO services. Contact us today to streamline your Form 1040 filing and avoid unnecessary penalties.

Frequently Asked Questions About Federal Form 1040

1. What is Federal Form 1040 used for?

Federal Form 1040, also called the IRS Form 1040, is the primary tax document individuals use to report their annual income, claim deductions and credits, and calculate their tax liability or refund. Every U.S. taxpayer, regardless of income level, generally files some version of the 1040 tax form.

2. Who needs to file IRS Form 1040?

Most U.S. citizens and residents with taxable income must file a Form 1040. Whether you’re a salaried employee, self-employed freelancer, small business owner, or retiree, you’ll likely need to file. Some nonresident aliens must file Form 1040-NR instead.

3. Where can I get a copy of my past Form 1040?

You can obtain copies of past Form 1040 tax returns directly from the IRS:

– Download a tax transcript (free) through the IRS Get Transcript tool.

– Request a full copy of your filed Federal Form 1040 using Form 4506, though this comes with a fee.

4. Do dependents file their own 1040?

Yes, dependents may need to file their own IRS Form 1040 if they earn income above certain thresholds. For example, a dependent with earned income from a part-time job or unearned income like dividends may be required to file. However, their filing requirements are different from those of independent taxpayers.

5. How can I access my Form 1040 online?

You can securely access and download your current or prior-year 1040 tax form through your IRS online account. Many tax software providers also store past returns if you filed through their platforms.

6. What happens if I file Form 1040 late?

Filing IRS Form 1040 late may result in:

– Failure-to-file penalty: 5% of unpaid taxes per month (up to 25%).

– Failure-to-pay penalty: 0.5% of unpaid taxes per month (up to 25%).

– Interest charges: Applied on unpaid balances until fully paid.

Even if you cannot pay in full, it’s always better to file on time to minimize penalties.

7. Is Form 1040 the same as my tax return?

Yes. When people refer to their “tax return,” they’re usually talking about Form 1040 plus any attached schedules and supporting forms submitted to the IRS.

8. What are the different versions of Form 1040?

The IRS provides several versions of the Federal Form 1040:

– Form 1040: Standard version for most taxpayers.

– Form 1040-SR: Tailored for seniors (larger font, easier-to-read layout).

– Form 1040-NR: For nonresident aliens.

– Form 1040-X: For amended returns.

9. Can I e-file my 1040 Tax Form?

Yes. Most taxpayers can e-file their Federal Form 1040 using IRS Free File, commercial tax software, or through a tax professional. E-filing is faster, more secure, and typically results in quicker refunds than paper filing.

10. How do I correct mistakes on my Form 1040?

If you discover errors after filing, submit an Amended Return using Form 1040-X. Common corrections include missed income, incorrect deductions, or updated filing status.