Filing taxes on the sale or exchange of business property can be complex, but Form 4797 helps you report these transactions accurately. In this guide, we’ll walk you through the process of filling out Form 4797 step by step. Whether you’re disposing of depreciable property, involuntary conversions, or other business property, following these clear instructions will help you complete the form correctly. If you need additional support, our expert tax services are available to assist you every step of the way.

What Is Form 4797?

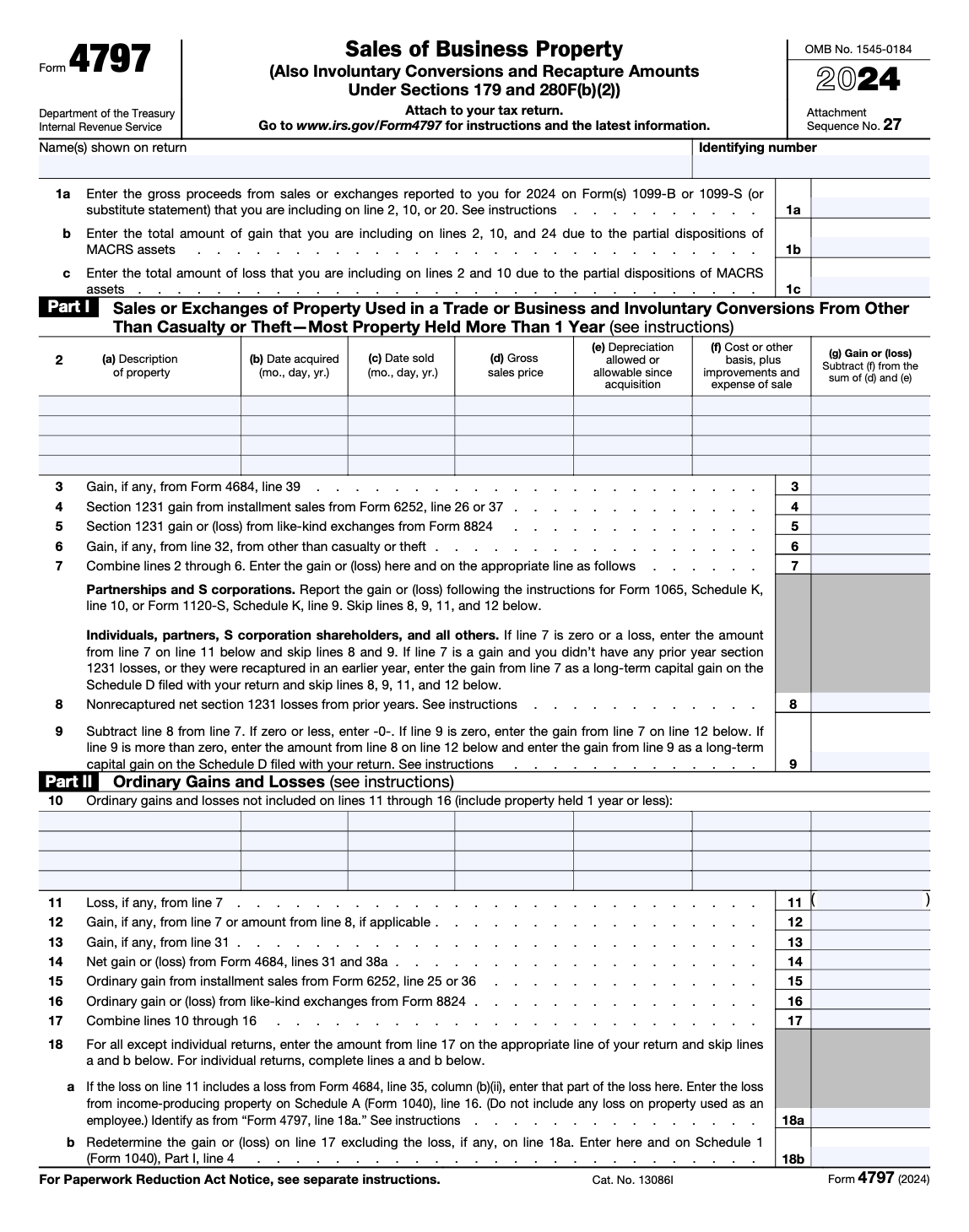

Form 4797 is used to report the sale, exchange, or involuntary conversion of business property. This form is crucial if you’re disposing of depreciable assets, selling business equipment, or transferring real estate used in your business. Understanding Form 4797 instructions is key because the form requires detailed reporting of gains, losses, and depreciation recapture. Properly filing Form 4797 ensures that you accurately reflect your capital gains or losses and comply with IRS requirements.

Step 1: Gather Your Documentation

Before you begin filling out Form 4797, collect all necessary documentation:

- Sales and Purchase Records: Gather documents related to the sale or exchange, such as the sales contract, purchase receipts, and any appraisals.

- Depreciation Records: Obtain records that show the depreciation claimed on the property over the years.

- Previous Tax Returns: Have copies of prior tax filings where the property was reported.

- Financial Statements: These can provide additional context and support for adjustments or recaptured depreciation.

Being well-prepared with all relevant documents will make it easier to follow the instructions on Form 4797 and reduce the risk of errors.

Step 2: Complete Part I – Sales of Business Property

Part I of Form 4797 focuses on the sale or exchange of property used in your business.

Description of the Property:

Enter a brief description of the property sold or exchanged. Include details like the type of asset and any identifying information.

- Dates and Amounts:

- Date Acquired and Sold: Provide the dates when the property was acquired and when it was sold.

- Sales Price: Record the total sales price of the property.

- Cost or Adjusted Basis: Enter the property’s original cost adjusted for any depreciation over the years.

- Depreciation Recapture:

Calculate the depreciation recapture by determining the total depreciation claimed on the property. This figure is crucial because it may be taxed at a higher rate.

- Gain or Loss Calculation:

Subtract the adjusted basis (cost minus depreciation) from the sales price to determine your gain or loss. This number will be carried forward for further calculations.

Step 3: Complete Part II – Ordinary Gains and Losses

If your transaction involves ordinary gains or losses (typically when recapture applies), you’ll need to fill out Part II.

- Report Adjustments:

Detail any adjustments that affect your gain or loss calculation. This may include improvements or adjustments for depreciation differences.

- Enter Ordinary Income:

Report the amount that qualifies as ordinary income, particularly any depreciation recapture that needs to be taxed at ordinary income rates.

- Net Calculations:

Compute the net ordinary gain or loss by combining the figures from Part I and any applicable adjustments. This net figure is crucial for your overall tax liability.

Step 4: Review, Sign, and File

Before submitting your tax return, ensure that Form 4797 is complete and accurate.

- Review All Entries:

Verify that every section of the form is filled out correctly and all calculations match your supporting documentation.

- Consistency Check:

Ensure that the numbers you report on Form 4797 are consistent with your other tax forms, such as Schedule D, where capital gains and losses are summarized.

- Sign and Date the Form:

Although Form 4797 itself may not require a signature, ensure that your final tax return (Form 1040) is signed and dated correctly.

- Attach Supporting Documents:

Include copies of all necessary documentation that supports your reported figures, such as sales records and depreciation schedules.

- File on Time:

Submit your completed tax return, including Form 4797, by the IRS deadline to avoid any late filing penalties.

How Profitjets Can Help with Your Form 4797 Filing

At Profitjets, we specialize in helping individuals and businesses navigate the complexities of tax filing. Our comprehensive services include:

Bookkeeping Services:

With our outsourced bookkeeping services, we ensure that your financial records are precise and up-to-date, providing the foundation needed to complete Form 4797 accurately.

Tax Services:

Our experienced tax professionals guide you through every step of filing Form 4797, ensuring that you claim all eligible deductions and that your calculations are correct.

CFO Services:

Our CFO services offer strategic financial guidance to help you manage your overall tax strategy and optimize your financial performance.

Let Profitjets simplify your tax filing process, help you maximize your benefits, and ensure full compliance with IRS requirements.

Conclusion

Filing Form 4797 is a critical task for reporting the sale or exchange of business property, and following a step-by-step process can help ensure accuracy and compliance. By gathering the necessary documents, carefully entering your data, and reviewing your work, you can effectively report your gains or losses and manage depreciation recapture. If the process seems overwhelming, professional tax services, CFO services, and bookkeeping services can provide the expert guidance you need.

With a systematic approach and professional support, you can take control of your tax filing process, reduce the risk of errors, and maximize your deductions.