If you’re involved in real estate or other passive income ventures, Form 8582 might apply to you. This IRS form helps taxpayers calculate and report passive activity losses that can’t be deducted due to IRS limitations.

Passive losses often come from real estate rentals or business activities where you’re not actively involved. But just because these losses can’t always be used right away doesn’t mean they’re gone for good. Filing Form 8582 correctly lets you track these losses and carry them forward.

In this guide, we’ll walk you through filling out Form 8582 line by line, explaining who needs to file, what to prepare, and how to avoid common errors.

Table of Contents

What Is IRS Form 8582 For?

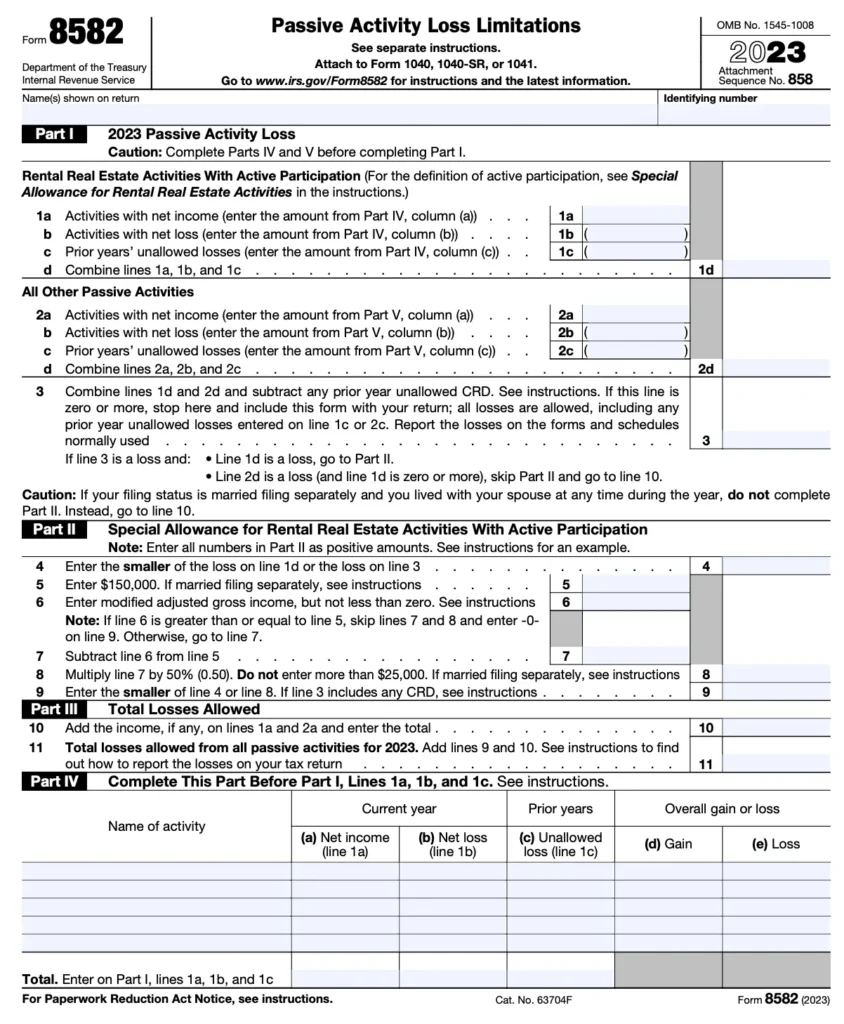

Form 8582 is officially titled Passive Activity Loss Limitations. Individuals, estates, and trusts use it to report losses from passive activities and determine how much of those losses can be deducted from other income.

According to IRS rules, you can only deduct passive losses to the extent you have passive income. Any leftover losses are suspended and carried forward to future years.

Who Needs to File Form 8582 and When?

You need to file Form 8582 if:

- You have passive losses that you cannot fully deduct

- You’re an individual, estate, or trust (corporations use a different form)

- You received income from passive sources (e.g., rental properties, limited partnerships)

- You have adjusted gross income (AGI) above certain thresholds.

This form must be filed with your tax return, Form 1040, by the standard IRS tax deadline (typically April 15 unless extended).

If you’re not sure whether you have passive losses or what counts as passive income, it’s a smart move to consult with a tax service.

Before You Begin: Information and Documents to Collect

Before starting Form 8582, make sure you have:

- Financial statements from rental or passive activities

- Schedule K-1s from partnerships, S corps, or trusts

- Details of any suspended losses from prior years

- Total passive income and expenses for the tax year

- Records of any property dispositions (sales)

Proper preparation can prevent headaches during tax season. Organizing your financial statements ahead of time ensures your numbers are accurate and easily traceable.

Filling Out IRS Form 8582: A Section-by-Section Breakdown

Form 8582 is made up of three parts. Here’s how to complete each section.

Step 1: Report Your Passive Income and Losses – Part I

In Part I, you’ll list all passive income and losses from your current and prior year activities. These are separated into two categories:

- Special allowance rental real estate activities with active participation

- All other passive activities

You’ll need to:

- Enter income and loss amounts for each activity

- Combine totals for income and losses

- Determine your net passive loss or gain.

This section is key to figuring out how much, if any, of your losses can be deducted this year.

Step 2: Apply the Passive Activity Loss Limits – Part II

Part II is where the IRS puts the brakes on how much passive loss you can claim. You’ll:

- Calculate your modified adjusted gross income (MAGI)

- Compare your MAGI to IRS thresholds ($100,000 phase-out for most filers)

- Determine if you qualify for the $25,000 special allowance for rental losses.

If your MAGI exceeds $150,000, your allowable loss may be zero. Make sure you read the instructions on Form 8582 or use professional tax help to apply these rules correctly.

Step 3: Allocating Losses – Part III

In Part III, you’ll decide which of your passive losses can be deducted and which needs to be carried forward. The IRS uses a formula to allocate your allowable loss across different activities proportionally.

Steps include:

- Listing each passive activity

- Indicating whether it’s a current-year or carryover loss

- Allocating allowable losses based on IRS guidelines

Losses not deducted this year are carried forward and tracked year over year.

Step 4: Attach Supporting Forms and Schedules

Once Form 8582 is filled out, you’ll also need to attach:

- Schedule E (Supplemental Income and Loss)

- Form 6198 if you have at-risk limitations

- Schedule K-1s if you received income from partnerships or S corps

These forms back up your numbers and help the IRS verify your calculations.

Step 5: Submit Form 8582 With Your Tax Return

Finally, include Form 8582 with your tax return (Form 1040 or 1040-SR). Double-check that:

- Totals match your financial documents

- Attachments are included

- Your calculations comply with Form 8582 instructions.

If you’re not confident about the math, consider using tax services to ensure accuracy and compliance.

Common Mistakes to Avoid When Filing Form 8582

Filing errors can delay refunds or trigger IRS notices. Here are some mistakes to watch out for:

- Mixing active and passive income: Only include passive activities

- Incorrect MAGI calculations: This affects the $25,000 rental allowance

- Forgetting carryover losses: These can’t be deducted unless tracked properly

- Using old forms or outdated IRS tables

Stay updated with the latest Form 8582 instructions from the IRS website, or get professional guidance.

Wrapping Up: Stay Ahead by Filing Form 8582 Correctly

Passive losses don’t disappear—they roll forward and could reduce future tax bills. Filing Form 8582 helps you take control of these losses, especially if you’re involved in real estate or investments with limited involvement.

By following this guide, organizing your financial statements, and understanding IRS limits, you’ll be ready to file with confidence. If you’re unsure, trust reliable tax services to make sure nothing is missed.