Tax-exempt organizations—like charities, trusts, and foundations—still have to file annual returns with the IRS. But what happens if you’re running behind? That’s where Form 8868 comes in. This form gives your organization more time to file the necessary documents without facing penalties.

In this guide, we’ll walk you through how to file Form 8868, explain when you need it, how to complete it correctly, and which financial statements you should have on hand. Plus, we’ll help you avoid common mistakes that could cause delays or trigger penalties.

Table of Contents

What Is IRS Form 8868 and What Is It Used For?

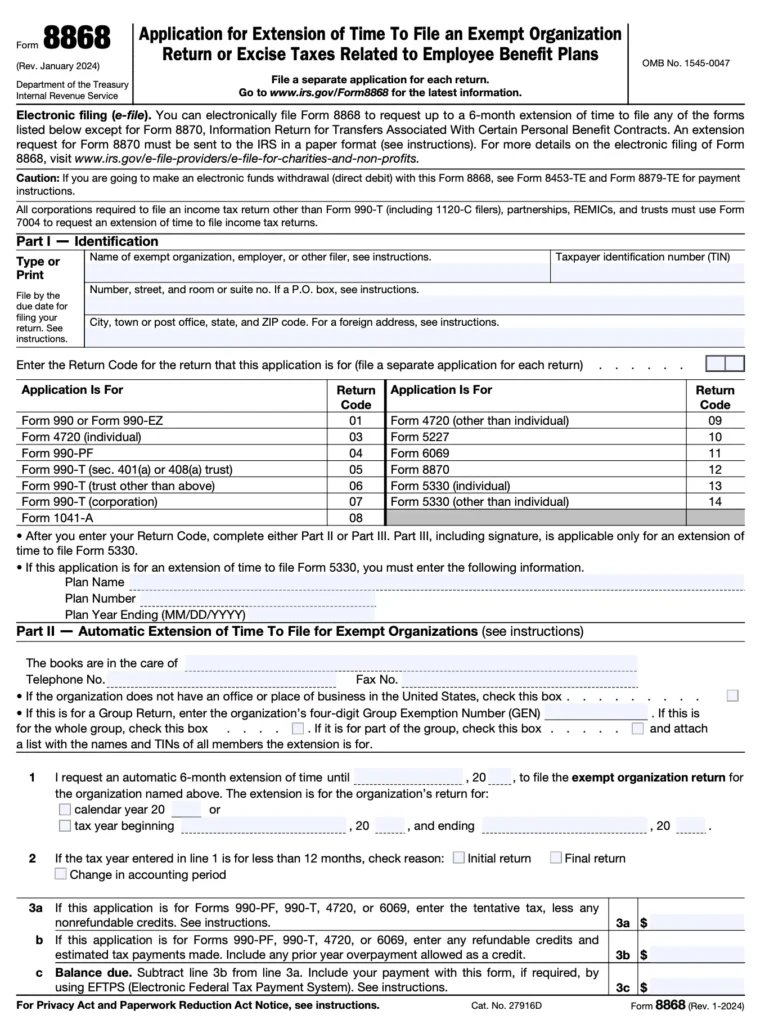

Form 8868, officially titled Application for Automatic Extension of Time to File an Exempt Organization Return, is used to request an extension of time to file IRS returns such as Form 990, Form 990-EZ, Form 990-PF, and others related to tax-exempt organizations.

Filing this form allows you to:

- Get an automatic 6-month extension to file your annual return

- Avoid late penalties

- Organize your financial statements properly before final filing.

However, keep in mind that Form 8868 does not extend the time to pay any taxes owed—only the time to file the return.

Who Should File Form 8868?

You should file Form 8868 if your organization needs more time to file any of the following IRS forms:

- Form 990, 990-EZ, or 990-PF

- Form 990-T (tax-exempt business income)

- Form 4720 (excise tax returns)

- Form 1041-A, 5227, and others listed in the Form 8868 instructions

This applies to:

- Nonprofits

- Private foundations

- Charitable trusts

- Religious organizations

When Is Form 8868 Due?

You must submit Form 8868 on or before the original due date of your return. For most tax-exempt organizations, that means the 15th day of the 5th month after your fiscal year ends.

- For calendar-year organizations, the deadline is May 15, 2025

- For fiscal-year filers, it’s five months after year-end.

You’ll need to submit the form either electronically or by mail, depending on your filing method.

Documents to Have Before Filing

Before completing Form 8868, gather the following:

- Legal name and EIN of the organization

- Contact information and mailing address

- Copy of the original IRS return you’re extending

- A summary of relevant financial statements

- Estimate of any taxes due

Even though payment has not been extended, including accurate numbers based on your financial records is critical for tax planning and compliance.

Step-by-Step Instructions to Complete IRS Form 8868

Now, let’s go through the form section by section so you can file confidently.

Step 1: Identify the Organization (Part I)

In the top portion of the form:

- Enter the legal name of your organization

- Include the address and Employer Identification Number (EIN)

- If the organization has changed its name since the last return, check the relevant box

- Check the box if your return is for a short tax year.

This section confirms who is filing and when your tax period ends.

Step 2: Choose the Return You’re Requesting an Extension For

On Line 1, check the box next to the IRS return you want to extend. Options include:

- Form 990, 990-EZ

- Form 990-PF

- Form 990-T

- Form 4720

- Others are listed in the instructions on Form 8868.

If you’re filing for more than one return type (such as Form 990 and 4720), you must submit separate Form 8868s for each.

Step 3: Fill in the Tax Year Details

On Line 2, indicate the beginning and ending dates of your organization’s tax year.

For calendar-year organizations, enter:

Jan 1, [Year] – Dec 31, [Year]

For fiscal-year filers, input the appropriate range that matches your financial reporting cycle.

Step 4: Estimate Tax Due (If Applicable)

If you’re filing for an extension on Form 990-T or Form 4720, you must estimate any taxes due:

- Enter the estimated total tax liability

- Subtract any payments already made

- Indicate any balance due and submit payment with the extension if needed.

Note: You can pay via check, EFTPS (Electronic Federal Tax Payment System), or IRS Direct Pay.

Step 5: Sign and Submit the Form

The form must be signed by an authorized officer or representative of the organization.

If someone other than an employee (like a CPA or tax preparer) is completing the form, they must check the box to indicate they are authorized to represent the filer.

Submission methods:

- E-file: Mandatory for Form 990 series filers

- Mail: For certain exceptions or non-990 forms

Refer to the instructions on Form 8868 for the correct IRS mailing address based on your location.

Avoid These Common Mistakes When Filing Form 8868

Here are some pitfalls to avoid:

- Missing the original due date (you must file before your return is due)

- Estimating taxes inaccurately for Form 990-T or 4720

- Filing the wrong form year (always use the current version)

- Forgetting to verify your EIN or organization name

- Not keeping a copy of your confirmation or a timestamp if e-filing

To prevent issues, ensure your financial statements are updated and reviewed ahead of time. Better yet, work with expert tax services to handle the process for you.

Final Thoughts: Stay Compliant by Filing Form 8868 Early

Form 8868 gives nonprofits and other exempt organizations the time they need to ensure complete, accurate filings. Whether you’re still reconciling your financial statements, awaiting external documents, or managing a significant return, requesting an extension can help you avoid costly penalties and rushed work.

To ensure everything is filed correctly and on time, consider working with experienced tax services that can guide your organization through every step, from the extension to the final return.