When it comes to tax planning and healthcare savings, Health Savings Accounts (HSAs) offer one of the most tax-advantaged strategies. If you made contributions to an HSA, received distributions, or need to report excess contributions during the 2025 tax year, filing IRS Form 8889 is mandatory. Here’s an overview of Form 8889.

Table of Contents

What Is IRS Form 8889?

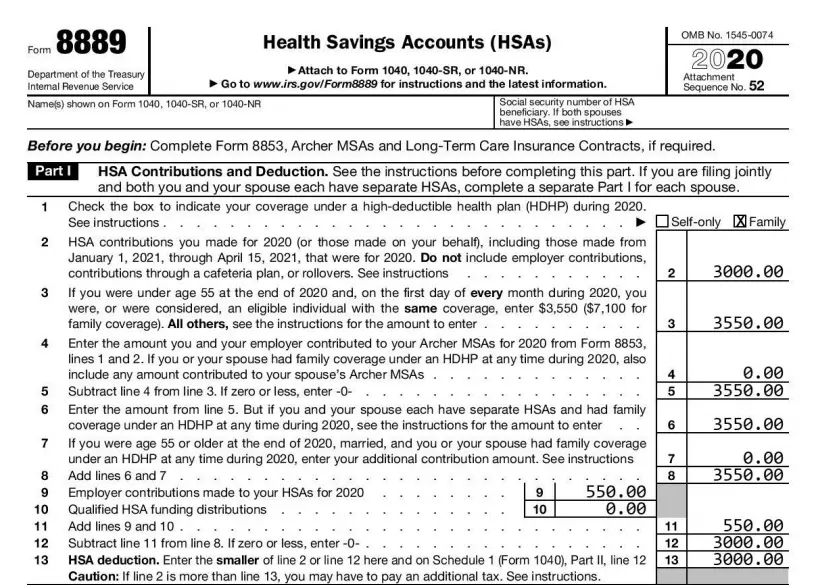

The official IRS tax form, called Health Savings Accounts (HSAs), is also called Form 8889

Taxpayers use this to report contributions to, and distributions from, a Health Savings Account (HSA). If you have an HSA, you are required to file Form 8889 with your individual income tax return along with IRS Form 1040, 1040-SR, or 1040-NR.

Who Must File Form 8889?

You need to file if you:

- Made or received HSA contributions

- Took HSA distributions (qualified or non-qualified)

- Have an HSA account (even if inactive)

- Need to report excess contributions

- Want to claim HSA deductions

Important: Even if your employer handles contributions, you may still need to file. Professional tax services can assess your specific requirements.

What is Form 8889 used for? What is the Purpose of Form 8889?

IRS Form 8889 serves four key purposes:

1. Report Contributions to an HSA

This includes your contributions through payroll, employer contributions, and any others made on your behalf. The form helps calculate the HSA deduction you may be eligible to claim on your tax return.

2. Report Distributions from the HSA

If you have withdrawn money from your HSA, it must be reported. You also have to report how the funds were utilized, for qualified medical expenses or any other purpose. They are tax-free if they have been used towards qualified medical expenses. If not, the withdrawal is taxable and may incur a 20% penalty if you’re under age 65.

What Is the Last-Month Rule?

The last-month rule allows you to contribute the full annual HSA contribution limit for the year—even if you only became eligible partway through the year—as long as you were HSA-eligible on December 1st of that tax year.

Let’s say you became eligible for an HSA (i.e., enrolled in a High Deductible Health Plan) on December 1, 2025.

What Is the Testing Period?

If you use the last-month rule to make a full-year contribution, you must remain HSA-eligible for the entire “testing period,” which is:

December 1 of the current tax year through December 31 of the following tax year

3. Track Excess Contributions

You need to determine whether you or your employer has contributed more than the annual IRS limit. If you have contributed in excess, it must be reported. The excess is subject to a 6% excise tax per year until corrected.

4. Reconcile Eligibility Rules

If you used the ‘Last-Month Rule’ to claim the full-year contribution but didn’t remain eligible during the “testing period,” you may have to report and pay tax on the ineligible amount.

Who should file IRS Form 8889 for 2025?

You need to file IRS Form 8889 if any of the following apply in 2025:

- You or someone on your behalf (e.g., a family member or employer) contributed to your HSA

- You received HSA distributions during the tax year

- You need to report excess contributions or correct ineligibility during the testing period

This form must be attached to your Form 1040, 1040‑SR, or 1040‑NR.

2025 HSA Contribution Limits & HDHP Thresholds

What are the Form 8889 contribution limits?

The coverage for an individual per annum is up to $4,300

The Family coverage per annum is up to $8,550

The Catch-up contribution for individuals aged above 55: an additional $1,000

What are the HDHP requirements for 2025?

- Minimum deductible: $1,650 for yourself and $3,300 for your family

- Maximum out-of-pocket: $8,300 for yourself and $16,600 for your family

How to Fill Out IRS Form 8889, or Form 8889 Instructions (Part by Part)

Part I: Contributions & Deductions

- Line 2: Enter after-tax or outside payroll contributions (those not reported on W‑2)

- Line 9: Enter employer or cafeteria-plan contributions (Box 12 code W)

- Calculate your deductible contribution and identify any excess contributions

If you exceed limits and don’t withdraw the excess by April 15, 2026, you’ll owe a 6% excise tax per year on each excess amount.

Part II: Distributions

- Report all HSA withdrawals (line 14a)

- Distinguish amounts used for qualified medical expenses (line 15)

- Non-qualified distributions (if you’re under 65) are taxed as income + 20% penalty

Part III: Income & Penalties

- Report excise tax on uncorrected excess contributions

- Adjustments for last-month rule or testing-period failures (e.g., subsequent ineligibility)

Important Deadlines for 2025

- The contribution deadline is April 15, 2026 (unless extended due to exceptional circumstances)

- To avoid the 6% penalty, you must withdraw any excess contributions (and earnings) by this date.

What are Some Common Pitfalls & Clarifications while filing IRS Form 8889

- Wrong contribution limits cited: Ensure you’re using the latest (2025) values. i.e., $4,300 self, $8,550 family, not 2024 figures.

- Confusing penalties: 6% tax applies to unwithdrawn excess contributions—not the 20% penalty (that’s for non-qualified withdrawals)

- Mixing up contribution lines: Employer contributions are reported separately (Box W → line 9), not with your contributions on line 2

Ignoring the last‑month rule (if you were eligible only part of the year): this might change your permitted limit.

Advanced Considerations

Financial Statement Reconciliation

- HSA account balance tracking

- Contribution limit calculations

- Distribution documentation

- Taxable vs. non-taxable distributions

Special Situations

- Last-month rule applications

- Testing period requirements

- Medicare enrollment impacts

- Death and divorce scenarios

State Tax Implications

- State HSA deductions

- Taxable distributions

- State-specific contribution limits

- Reporting requirements

Final Thoughts

Accurately completing IRS Form 8889 ensures you secure valuable tax deductions, avoid excise taxes or penalties, and comply with IRS reporting requirements. We understand that the process of tax calculation, understanding eligibility, tax filing, and coordination can be cumbersome. Here’s where Profitjets’ expertise comes into play. We are a trusted tax expert that can handle your tax filing, planning, and tax advisory needs with proficiency and accuracy.

We will ensure there are no errors or delays in the processing of your property tax. We also provide outsourced accounting and bookkeeping services, as well as virtual CFO services. We are your one-stop solution for all accounting, bookkeeping, and tax needs. Contact us for a customized quote.

FAQs for IRS Form 8889

1. What is Form 8889 used for?

Form 8889 is used to report contributions to and distributions from a Health Savings Account (HSA). It helps calculate your HSA deduction, determine if you owe taxes or penalties for excess contributions, and report eligible medical expenses paid using HSA funds.

2. Can I file IRS Form 8889 separately?

No, Form 8889 cannot be filed separately. It must be attached to your individual tax return—Form 1040, 1040-SR, or 1040-NR. If you had an HSA activity during the year, filing Form 8889 is required as part of your complete federal return.

3. Where does Form 8889 go on Form 1040?

The HSA deduction calculated on Form 8889 (Line 13) is entered on Schedule 1, Line 13, which then flows into IRS Form 1040, Line 10 as an “above-the-line” deduction, reducing your adjusted gross income (AGI).

4. When is Form 8889 required?

You are required to file Form 8889 if:

– You or your employer contributed to an HSA during the tax year

– You took distributions from your HSA

– You need to report excess contributions, or

– You used the last-month rule, but didn’t stay HSA-eligible during the testing period

5. What is the deadline to file Form 8889 for 2025?

Form 8889 must be filed by April 15, 2026, along with your federal income tax return. If you request an extension for your return, Form 8889 gets automatically extended too.

6. What happens if I don’t file Form 8889?

Failing to file Form 8889 when required can lead to:

– Disallowed HSA deductions

– Tax penalties for unreported excess contributions

– IRS delays or notices for incomplete tax returns

It’s essential to file this form correctly if you have any HSA activity.

7. What is the penalty for excess HSA contributions on IRS Form 8889?

If you overcontribute to your HSA and don’t withdraw the excess by the tax deadline, you’ll owe a 6% excise tax on the excess amount each year until it is corrected and removed.