Growing a business is a rewarding but complex journey. While many business owners focus heavily on marketing, operations, and customer acquisition, one critical pillar often gets overlooked: bookkeeping. Without accurate financial records, a business can face cash flow issues, tax problems, and missed growth opportunities. In 2025, leveraging bookkeeping is no longer optional – it’s essential for long-term success.

Table of Contents

Why Is Bookkeeping Essential for Growing Businesses?

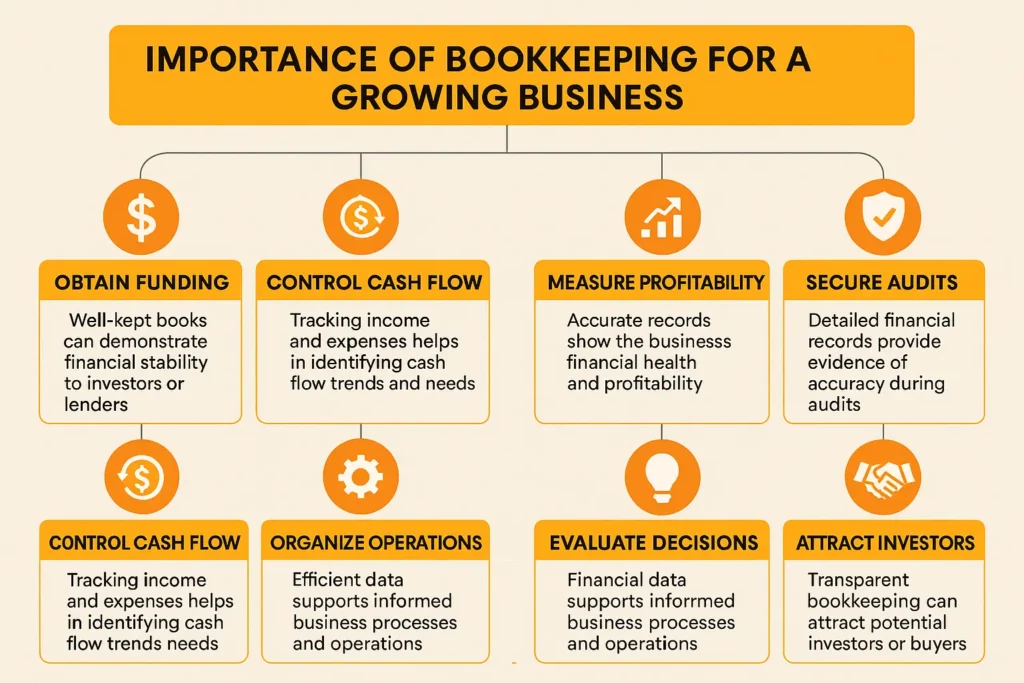

Bookkeeping does far more than record numbers. It provides clarity, control, and credibility, allowing business owners to make smarter decisions, avoid financial pitfalls, and scale with confidence.

Let’s explore the most critical functions of bookkeeping and how it supports growth:

1. Easy Access to Funding

Up-to-date books make your business more appealing to investors, banks, and financial institutions. Accurate financial records clearly showcase your company’s revenue, expenses, and profitability. This transparency boosts your chances of securing loans or attracting equity investment.

2025 Tip: Automate your financial reports using cloud software like QuickBooks or NetSuite for quick access when applying for credit.

2. Cash Flow Management

Your cash flow is your business’s lifeblood. Without proper bookkeeping, you can’t monitor how much cash you have or forecast upcoming expenses. Keeping records current allows you to calculate burn rate, set budgets, and avoid overdrafts.

2025 Tip: Set up real-time bank feeds and daily reconciliations using accounting automation tools.

3. Track Profitability & Optimize Costs

You might be making sales, but are you truly profitable? Bookkeeping helps you break down your cost structure, analyze margins, and make data-backed decisions to increase profits.

2025 Tip: Use class or project-based tracking to identify which products, services, or departments are most (or least) profitable.

4. Monitor KPIs and Business Health

Want to measure net profit, gross margin, or your break-even point? Clean books allow you to calculate KPIs quickly and accurately.

2025 Tip: Use dashboards to display real-time KPIs like customer acquisition cost (CAC), return on investment (ROI), and operating margins.

5. Tax Compliance & Accuracy

Timely bookkeeping makes it easy to file taxes correctly and on time. You avoid interest, penalties, and surprises from the IRS or local tax authorities.

2025 Tip: Track deductible expenses year-round to maximize write-offs at tax time.

6. Audit Readiness

Whether you’re being audited or just want peace of mind, organized financials reduce audit stress. Good bookkeeping allows you to provide clear documentation instantly.

2025 Tip: Store digital copies of receipts and invoices in cloud-based folders labeled by date or category.

7. Improved Operational Decisions

Bookkeeping helps you assess performance regularly. You’ll know when to hire, invest, scale back, or pivot.

2025 Tip: Review monthly financial statements with your accountant or outsourced CFO.

8. Business Valuation & Exit Strategy

If you’re preparing for a buyout or investment round, financial clarity is non-negotiable. Accurate books demonstrate the value of your business and attract serious buyers.

2025 Tip: Prepare a 3-year historical P&L, balance sheet, and cash flow projection.

Implementing Bookkeeping for Your Business

There are two main ways to handle bookkeeping:

- In-House Bookkeeper: Ideal for large teams but often costly when factoring in salaries, benefits, and training.

- Outsourced Bookkeeping Services: Cost-effective for startups and SMEs. Provides access to experts and scalable support without overhead.

At Profitjets, we offer 24/7 virtual bookkeeping and accounting services, powered by human experts and innovative technology. Whether you use QuickBooks, NetSuite, Xero, or others, we ensure complete financial visibility at an affordable cost.Ready to take control of your finances? Contact Profitjets and let us help you grow with confidence.

1. What is the difference between bookkeeping and accounting?

Bookkeeping involves recording daily transactions; accounting consists of analyzing, summarizing, and interpreting that data to make business decisions.

2. How often should bookkeeping be done?

Weekly or daily is ideal for fast-growing businesses. At a minimum, it should be done monthly.

3. Can I use bookkeeping software on my own?

Yes, but many business owners prefer outsourcing to professionals to save time and avoid mistakes.

4. What bookkeeping software is best for small businesses in 2025?

QuickBooks Online, Xero, FreshBooks, and Zoho Books are popular bookkeeping software. Profitjets supports all of them.

5. Is outsourcing bookkeeping cost-effective?

Absolutely. You reduce payroll costs and gain access to expertise without the burden of hiring and training in-house staff via outsourcing bookkeeping services.