Navigating tax forms can be daunting, especially for small business owners, startups, freelancers, and e-commerce entrepreneurs. One such form that often raises questions is Form 1099-R. As we step into 2025, understanding this form, its distribution codes, and its implications is crucial for accurate tax reporting and compliance.

Table of Contents

What is Form 1099-R?

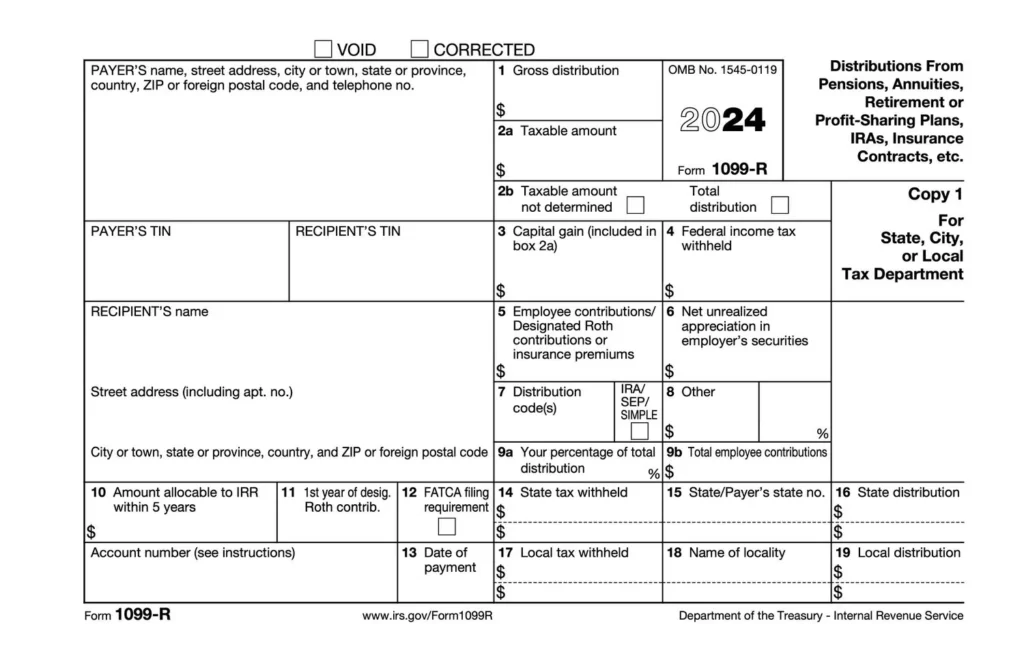

Form 1099-R is an IRS tax form used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other similar financial products. If you received a distribution of $10 or more from these sources in the previous tax year, you’ll likely receive this form. (Form 1099-R)

Key information on Form 1099-R includes:

- Gross distribution amount

- Taxable amount

- Federal income tax withheld

- Distribution codes (found in Box 7) (Form 1099-R Distribution Codes Explained Line by Line – TaxBandits)

Understanding each section is vital to ensure accurate tax filing and to avoid potential penalties.

Decoding Box 7: Distribution Codes

Box 7 on Form 1099-R contains distribution codes that indicate the type of distribution received. These codes help determine the taxability of the distribution. (Form 1099-R Distribution Codes Explained Line by Line – TaxBandits)

Some common distribution codes include: (Form 1099-R Distribution Codes for Defined Contribution Plans)

- 1: Early distribution, no known exception (under age 59½).

- 2: Early distribution, exception applies (under age 59½).

- 3: Disability.

- 4: Death.

- 7: Normal distribution (age 59½ or older).

- G: Direct rollover to a qualified plan or IRA.

- H: Direct rollover of a designated Roth account distribution to a Roth IRA.

- J: Early distribution from a Roth IRA, no known exception.

- Q: Qualified distribution from a Roth IRA.

- P: Excess contributions plus earnings/excess deferrals taxable in the prior year. (Form 1099-R, [PDF] F1099R.pdf – IRS.gov, Form 1099-R Distribution Codes for Defined Contribution Plans)

For a comprehensive list and explanations of all distribution codes, refer to the IRS Instructions for Forms 1099-R and 5498. ([PDF] 2024 Instructions for Forms 1099-R and 5498 – IRS)

Filing Deadlines for 2025

Staying aware of filing deadlines is essential to avoid penalties: (IRS Form 1099-R: Distributions from Pensions & Annuities)

- January 31, 2025: Deadline for payers to furnish Form 1099-R to recipients.

- February 28, 2025: Deadline for paper filing Form 1099-R with the IRS.

- March 31, 2025: Deadline for electronic filing of Form 1099-R with the IRS. (Form 1099-R, IRS Form 1099-R: Distributions from Pensions & Annuities)

Ensure timely filing to maintain compliance and avoid potential fines.

The Importance of Accurate Reporting

Misreporting or misunderstanding the information on Form 1099-R can lead to:

- Underpayment or overpayment of taxes

- IRS penalties and interest

- Delayed tax refunds

- Increased risk of audits

Accurate interpretation of distribution codes and taxable amounts is crucial. If you’re unsure about any aspect of the form, consulting with tax professionals or utilizing virtual bookkeeping services can provide clarity and ensure compliance. (Form 1099-R)

How Virtual Bookkeeping Services Can Help

Managing tax forms and ensuring accurate reporting can be overwhelming. Here’s how virtual bookkeeping services can assist:

- Expertise: Professionals stay updated with the latest tax laws and regulations.

- Accuracy: Ensures all forms, including Form 1099-R, are correctly interpreted and reported.

- Time-saving: Allows business owners to focus on core operations while experts handle financial documentation.

- Compliance: Reduces the risk of errors, penalties, and audits.

Consider partnering with outsourced bookkeeping services to streamline your financial processes and ensure peace of mind during tax season.

Conclusion

Understanding Form 1099-R and its implications is vital for accurate tax reporting in 2025. By familiarizing yourself with distribution codes and ensuring timely and correct filing, you can maintain compliance and avoid potential pitfalls. Leveraging virtual bookkeeping services can further streamline the process, allowing you to focus on growing your business.

Frequently Asked Questions

1. Who receives Form 1099-R?

Anyone who has received a distribution of $10 or more from pensions, annuities, retirement or profit-sharing plans, IRAs, or insurance contracts in the previous tax year.

2. What should I do if I receive a Form 1099-R with incorrect information?

Contact the issuer immediately to request a corrected form. Ensure all information is accurate before filing your tax return.

3. Are all distributions reported on Form 1099-R taxable?

Not necessarily. Some distributions, like qualified rollovers, may not be taxable. Refer to the distribution codes in Box 7 and consult with a tax professional for clarity.

4. Can I file Form 1099-R electronically?

Yes, electronic filing is available and is often faster and more efficient. The deadline for electronic filing is March 31.

5. How can virtual bookkeeping services assist with Form 1099-R?

They provide expertise in interpreting distribution codes, ensure accurate reporting, and help maintain compliance with IRS regulations, reducing the risk of errors and penalties.