In today’s dynamic business landscape, maximizing operational efficiency and controlling costs are paramount for accounting firms. One strategic approach that is gaining traction involves outsourcing bookkeeping services to India. This blog dives into bookkeeping outsourcing, exploring its advantages, cost benefits, and practical considerations for accounting firms contemplating this strategic move.

Table of Contents

What is Bookkeeping Outsourcing?

Bookkeeping outsourcing entails delegating specific bookkeeping tasks or the entire function to a qualified third-party service provider. This provider, often in a different country, handles tasks like data entry, bank reconciliations, accounts payable/receivable management, and payroll processing.

For accounting firms, outsourcing bookkeeping allows them to:

- Focus on Core Competencies: This will free up internal resources for higher-value activities like tax planning, financial analysis, and client advisory services.

- Enhance Scalability: Accommodate increased client volume without significantly expanding in-house staff.

- Reduce Operating Costs: Benefit from lower labor costs associated with outsourcing to India.

Reasons to Outsource Bookkeeping

Several compelling reasons entice accounting firms to consider outsourcing bookkeeping services to India:

- Cost Reduction: Labor costs in India are generally lower than in many developed countries. This translates to significant cost savings for accounting firms, allowing them to invest in other areas or offer more competitive pricing to clients.

- Access to a Skilled Talent Pool: India boasts a large pool of qualified, experienced bookkeeping professionals. Many Indian bookkeepers are adept at handling complex accounting tasks and possess strong analytical skills.

- Improved Efficiency: Outsourcing providers often leverage advanced accounting software and streamlined workflows, leading to faster turnaround times and increased efficiency.

- Enhanced Scalability: Outsourcing allows accounting firms to scale their bookkeeping services up or down seamlessly based on client needs. This flexibility is particularly beneficial for firms experiencing growth or seasonal fluctuations in workload.

- Time Zone Advantage: India operates in a time zone several hours ahead of many Western countries. This allows for extended workdays, enabling faster completion of bookkeeping tasks and improved client service turnaround times.

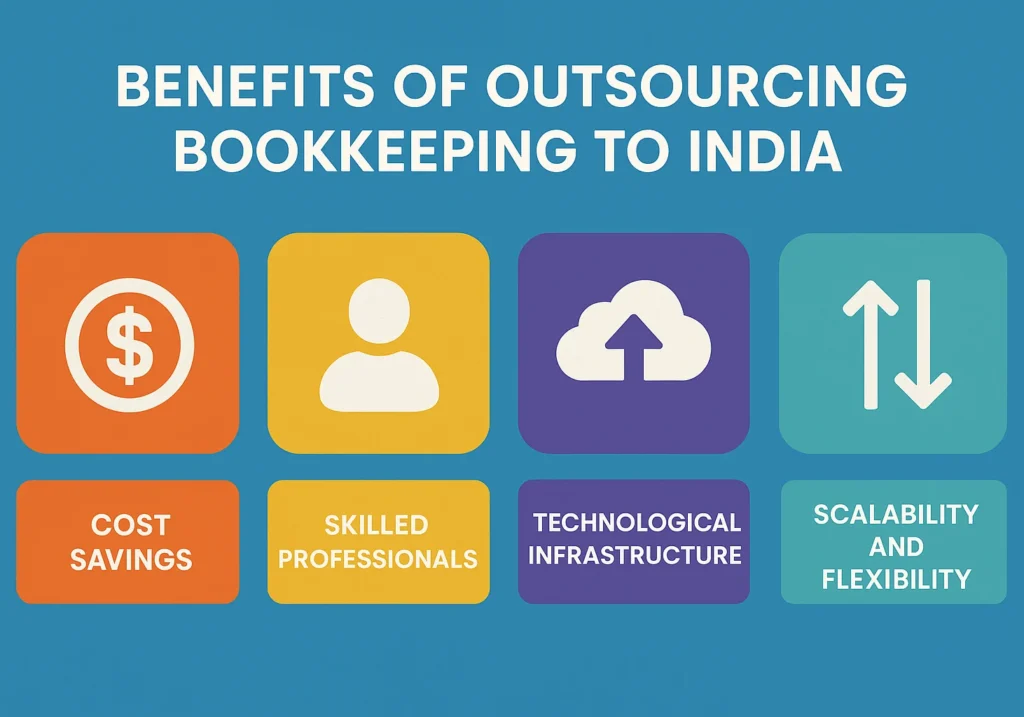

What Are the Benefits of Outsourcing Bookkeeping Services to India?

Outsourcing bookkeeping to India offers a multitude of benefits for accounting firms:

- Cost Savings: As mentioned earlier, lower labor costs in India translate to significant cost savings for accounting firms. These savings can boost profitability, allow firms to invest in technology, or offer more competitive rates to clients.

- Improved Efficiency: Outsourcing firms typically utilize advanced accounting software and streamlined processes, leading to faster turnaround times and increased efficiency in bookkeeping tasks.

- Enhanced Scalability: Accounting firms can scale their bookkeeping resources up or down effortlessly based on client needs. This flexibility is precious during periods of growth or fluctuating workload.

- Focus on Core Services: By outsourcing bookkeeping, accounting firms can free up internal resources to focus on higher-value services like tax planning, financial analysis, and client advisory services. This allows them to offer their clients a more comprehensive and strategic service portfolio.

- Access to Skilled Personnel: India boasts a large pool of qualified, experienced bookkeeping professionals. These professionals often handle complex accounting tasks and possess strong analytical skills.

- 24/7 Operations: The time zone difference between India and many Western countries can be leveraged to achieve near 24/7 operations. This can expedite bookkeeping tasks and improve client service responsiveness.

Summary of Benefits of Outsourcing Bookkeeping to India

| Benefit | Description |

| Cost Savings | Lower labor costs in India translate to significant cost advantages for accounting firms. |

| Improved Efficiency | Outsourced bookkeeping providers often use advanced software and efficient workflows, leading to faster turnaround times. |

| Enhanced Scalability | Accounting firms can seamlessly scale their bookkeeping resources based on client requirements. |

| Focus on Core Services | Outsourcing frees up internal resources to focus on higher-value services for clients. |

| Access to Skilled Personnel | India offers a large pool of qualified and experienced bookkeeping professionals. |

| 24/7 Operations | The time zone difference allows for extended workdays and faster completion of bookkeeping tasks. |

Outsourcing Bookkeeping Services to India – Cost Benefits

The cost savings associated with outsourcing bookkeeping to India are undeniably attractive. Here’s a breakdown of how outsourcing can potentially reduce your expenses:

- Lower Labor Costs: Salaries and benefits for qualified bookkeepers in India are generally lower compared to many developed countries. This translates to significant cost savings for accounting firms.

- Reduced Overhead Costs: Outsourcing eliminates the need to invest additional office space, equipment, and software for in-house bookkeeping staff.

- Improved Resource Utilization: By outsourcing bookkeeping, accounting firms can maximize the utilization of their existing staff by focusing them on core business functions.

- Reduced Training Costs: Accounting firms can avoid the costs associated with recruiting, onboarding, and training new in-house bookkeeping staff.

Quantifying Cost Savings:

It’s challenging to provide a definitive cost savings figure as it depends on several factors:

- Complexity of bookkeeping tasks: More complex tasks requiring higher expertise will incur slightly higher costs.

- Size of your accounting firm: Larger firms typically handle greater bookkeeping volumes, potentially leading to higher cost savings through outsourcing.

- Experience level of the outsourced team: More experienced bookkeepers in India might command slightly higher rates than entry-level professionals.

However, industry estimates suggest that outsourcing bookkeeping to India can result in cost savings of 30% to 50% compared to maintaining an in-house bookkeeping team. This can be a significant financial advantage for accounting firms seeking to optimize their operational efficiency and profitability.

Bookkeeping Services that can be Outsourced to India

A wide range of bookkeeping services can be successfully outsourced to India:

- Data Entry: Skilled Indian bookkeeping professionals can efficiently handle tasks like entering invoices, bills, and bank transactions.

- Accounts Payable/Receivable Management: Outsourcing providers can manage accounts payable and receivable functions, ensure timely payments, and maintain accurate records.

- Bank Reconciliation: Reconciling bank statements can be a time-consuming task. Outsourcing these tasks to India can free up valuable in-house resources.

- Payroll Processing: Outsourcing payroll processing to India can streamline your payroll operations and ensure timely and accurate employee payments.

- General Ledger Maintenance: Outsourced bookkeeping teams can efficiently manage general ledgers, ensure accurate transaction posting, and generate financial reports.

- Bookkeeping System Setup: Indian bookkeeping professionals can assist with setting up your accounting software and ensuring a smooth transition to outsourced bookkeeping services.

Important Note: While a wide range of bookkeeping tasks can be outsourced, it’s crucial to retain control over certain aspects, such as financial reporting, reviewing reconciliations, and maintaining oversight of internal controls.

Types of Bookkeeping Software used in India

Most Indian bookkeeping outsourcing providers utilize various accounting software to ensure efficient and accurate bookkeeping services. Some of the most commonly used software programs include:

- Xero: A popular cloud-based accounting platform offering user-friendly functionalities for bookkeeping tasks.

- QuickBooks Online: An industry-standard accounting software with robust functionalities for managing finances, receivables, and payables.

- Zoho Books: A comprehensive cloud-based accounting solution with strong features for managing bookkeeping, inventory, and taxes.

- Sage Business Cloud Accounting: A suite of accounting software solutions catering to businesses of various sizes, including features for bookkeeping, invoicing, and payroll.

Many outsourcing providers also utilize specialized bookkeeping software to automate repetitive tasks and enhance workflow efficiency.

Choosing the Right Outsourcing Partner

Selecting the right outsourcing partner for your bookkeeping needs is critical. Here are some key considerations:

- Experience and Expertise: Evaluate the provider’s experience handling bookkeeping tasks similar to your firm’s requirements. Look for a provider with a proven track record and a team of certified bookkeepers.

- Security and Data Protection: Ensure the provider has robust security protocols to safeguard sensitive financial data. Certifications like SOC 1 and SOC 2 should be considered, as they indicate strong internal controls and data security measures.

- Communication and Collaboration: Choose a provider with strong communication skills and a commitment to collaborating effectively with your team. Evaluate their communication channels and ensure they align with your preferences.

- Cost and Pricing Structure: Obtain clear pricing quotes from several potential providers and compare their fees based on the services offered and the level of expertise.

- Scalability and Flexibility: Choose a provider that can scale their services to accommodate your growing needs and adapt to evolving bookkeeping requirements.

By carefully considering these factors, accounting firms can select a reliable and qualified outsourcing partner to optimize their bookkeeping processes and achieve significant cost savings.

Conclusion

Outsourcing bookkeeping services to India presents a compelling opportunity for accounting firms to streamline operations, enhance efficiency, and achieve significant cost savings. This approach allows them to focus on core competencies like tax planning, financial analysis, and client advisory services. When carefully planned and executed, outsourcing bookkeeping to India can be a strategic move that strengthens an accounting firm’s competitive edge and positions it for long-term success.

Frequently Asked Questions

1. Is outsourcing bookkeeping to India suitable for small businesses?

Yes, small businesses can significantly benefit from outsourcing due to cost savings, access to expertise, and scalability.

2. How do I ensure data security when outsourcing?

Partner with firms that have robust security protocols, including data encryption, secure servers, and compliance with international data protection standards.

3. Can I outsource only specific bookkeeping tasks?

Absolutely. Businesses can choose to outsource specific functions like payroll processing, tax preparation, or financial reporting based on their needs.

4. How do time zone differences affect collaboration?

The time difference can be advantageous, allowing for tasks to be completed overnight, leading to faster turnaround times.

5. What should I look for in an outsourcing partner?

Look for experience, client testimonials, technological capabilities, data security measures, and a clear understanding of U.S. accounting standards.