Understanding your business’s profitability is crucial to making informed decisions, attracting investors, and planning for sustainable growth. One of the most widely used metrics for evaluating operational performance is EBITDA.

In this 2025 guide, we’ll explore what EBITDA is, how to calculate it, its advantages and limitations, and how startups and small businesses can use it to strengthen their financial strategies—especially when working with outsourced accounting services.

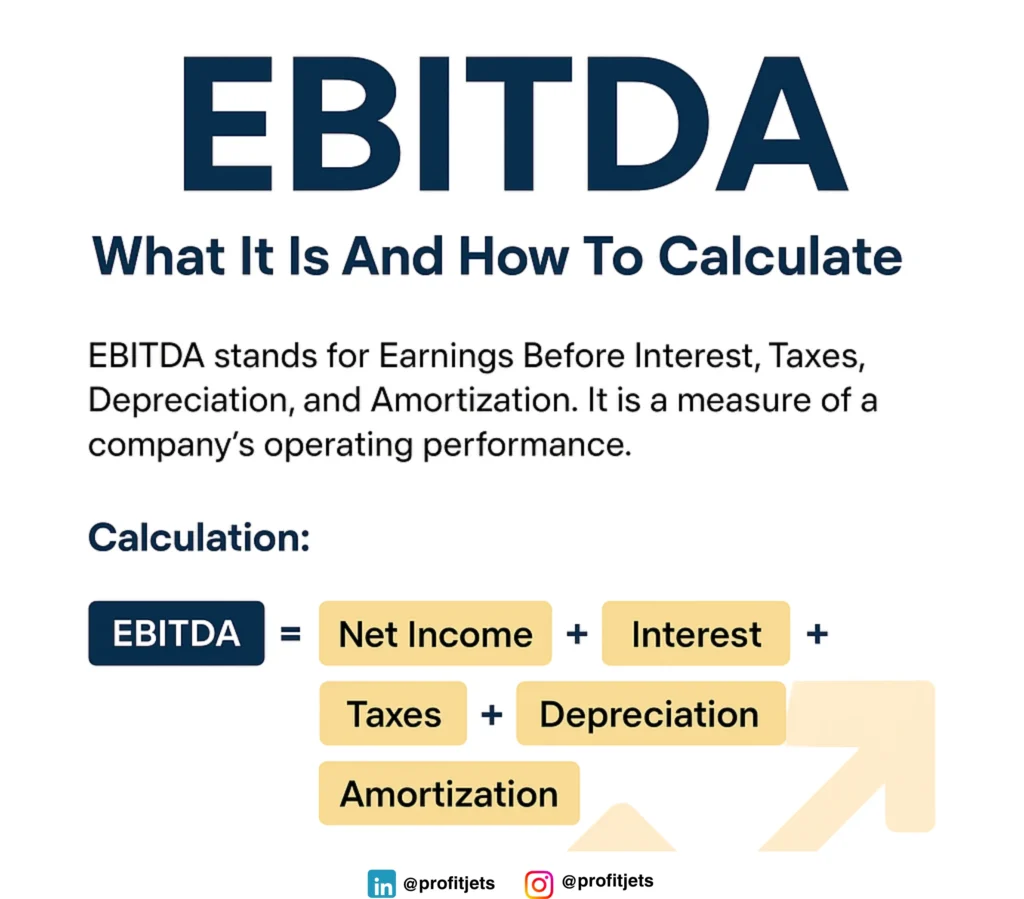

What Is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a financial metric used to measure a company’s operating performance by stripping out non-operational and non-cash expenses.

Put simply, EBITDA helps you understand how profitable your core business operations are—before financing and accounting choices come into play.

Why Is EBITDA Important?

- Removes financial distortions: It eliminates expenses like interest (which depends on your financing structure) and depreciation/amortization (non-cash charges).

- Enables apple-to-apple comparisons: Investors use EBITDA to compare businesses across industries.

- Highlights operational efficiency: It focuses solely on how well your business generates profit from operations.

- Investor & lender friendly: Many VCs, private equity firms, and banks rely on EBITDA as a key financial indicator.

If you’re working with an outsourced accounting firm for startups, EBITDA is one of the first metrics they’ll use to assess financial health.

How to Calculate EBITDA

The basic formula for EBITDA is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Let’s break this down:

- Net Income: The profit after all expenses

- Interest: The cost of debt financing

- Taxes: Income tax paid

- Depreciation: Non-cash expense for wear and tear of assets

- Amortization: Non-cash expense for intangible assets

Example:

Imagine a business has the following:

- Net Income = $200,000

- Interest = $15,000

- Taxes = $30,000

- Depreciation = $20,000

- Amortization = $10,000

EBITDA = 200,000 + 15,000 + 30,000 + 20,000 + 10,000 = $275,000

This shows your operating performance without financing and accounting methods skewing the picture.

How to Find EBITDA on Financial Statements

- Start with the income statement

- Look for: Net income, interest expense, tax expense

- Use footnotes or cash flow statements for depreciation and amortization

- Add them together as per the formula above

Working with outsourced bookkeeping services can automate this process through monthly financial reports and reconciliations.

What Is EBITDA Margin?

EBITDA Margin = (EBITDA ÷ Total Revenue) × 100

This margin tells you what percentage of revenue turns into EBITDA. It’s a powerful tool to measure operating profitability.

Example:

EBITDA = $275,000

Total Revenue = $1,000,000

EBITDA Margin = (275,000 / 1,000,000) × 100 = 27.5%

The higher the margin, the more efficiently a company operates.

EBITDA vs Other Profit Metrics

| Metric | Definition | Use Case |

| Net Income | Bottom-line profit after all expenses | Final profit for tax or dividend |

| Gross Profit | Revenue – Cost of Goods Sold (COGS) | Production efficiency |

| Operating Profit | Gross profit – Operating Expenses | Core business profitability |

| EBITDA | Earnings before interest, taxes, D&A | Clean view of operating performance |

While all metrics have value, EBITDA provides a clearer picture for startups and investors evaluating growth potential.

EBITDA and Outsourced Accounting Services

If you’re scaling a business or preparing for fundraising, EBITDA is one of the first numbers investors will ask for.

Here’s how an outsourced accounting service can help:

- Automate EBITDA tracking through cloud accounting tools

- Provide clean, investor-ready financial statements

- Assist in benchmarking your EBITDA margin vs industry averages

- Help prepare valuations based on EBITDA multiples

Outsourced teams also help keep your depreciation and amortization records organized—essential when calculating EBITDA accurately.

EBITDA Limitations You Should Know

Despite its usefulness, EBITDA isn’t perfect:

- Ignores debt: A business with large interest payments may look healthy on EBITDA but be under financial stress.

- Excludes capital expenditures: EBITDA doesn’t reflect money needed to maintain or grow operations.

- Can be manipulated: Non-GAAP, so companies may calculate it differently unless standardized.

That’s why outsourced accounting firms often present EBITDA alongside other metrics for a complete picture.

When Should Small Businesses Use EBITDA?

- When preparing financial reports for investors or lenders

- For internal performance benchmarking

- To compare operational efficiency across products or divisions

- During M&A discussions or exit planning

For startups, outsourced bookkeeping services help maintain consistent EBITDA data, crucial for due diligence and growth strategy.

Conclusion

EBITDA is more than just a financial acronym—it’s a powerful tool that gives a clear view of your business’s operating strength. Whether you’re seeking funding, tracking growth, or comparing performance, knowing how to calculate EBITDA and interpret it will put you ahead in 2025.

But don’t go at it alone. With outsourced accounting services like ProfitJets, you can simplify financial tracking, receive expert EBITDA insights, and ensure your books are audit- and investor-ready.

FAQs on EBITDA?

1. Is EBITDA the same as cash flow?

No. EBITDA excludes working capital changes and capital expenditures, while cash flow includes them. They’re related but not identical.

2. Why do investors focus on EBITDA?

Because it shows how well a company performs operationally without distortion from tax, financing, or accounting choices.

3. How can I improve my EBITDA margin?

Increase revenue, reduce direct and indirect operating expenses, and optimize pricing models.

4. Can EBITDA be negative?

Yes. A negative EBITDA means your operating expenses exceed your gross income, indicating a need for immediate financial review.

5. Should every small business track EBITDA?

Yes—especially if you’re scaling, seeking funding, or want to understand operational performance clearly.