In the fast-paced world of small business, keeping track of finances is crucial, but the complexity of accounting can feel overwhelming. That’s where single-entry bookkeeping comes in, offering a more straightforward approach to recording your financial transactions. This blog post will demystify this method, exploring its definition, mechanics, and relevance for your growing business.

Table of Contents

What is Single Entry Bookkeeping?

As the name suggests, single-entry bookkeeping records each financial transaction in a single entry. Unlike its double-entry counterpart, which tracks every transaction’s dual impact on different accounts, this method focuses on recording income and expenses as they occur. Think of it as a streamlined logbook capturing the flow of your business’s finances.

Related Read: What is Bookkeeping: A Step-by-Step Guide

How does the Single Entry Bookkeeping System work?

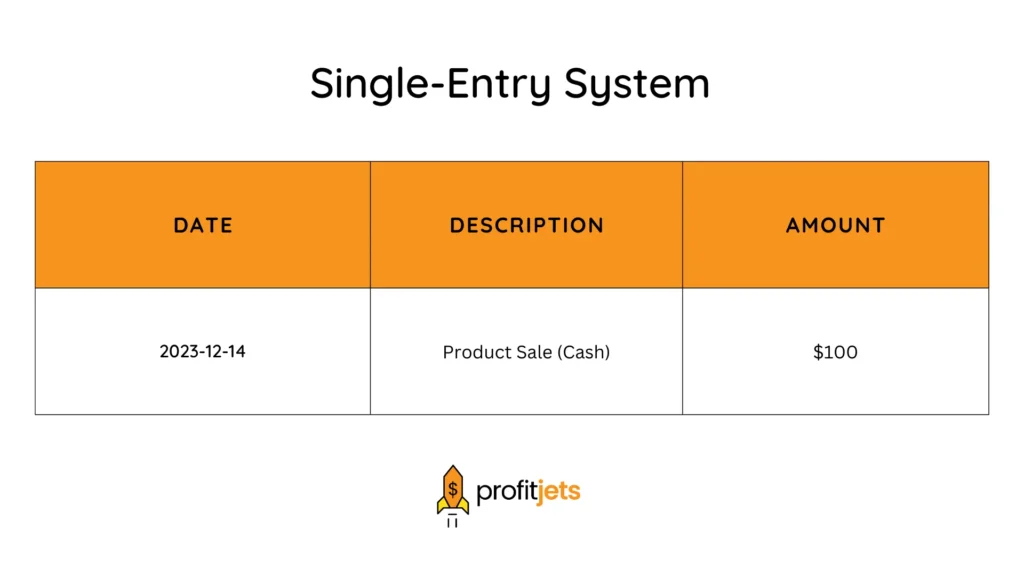

Imagine a transaction where you sell a product for $100 in cash. In single-entry bookkeeping, you would simply record this in your journal as:

This approach keeps things simple, making it ideal for individuals and small businesses with limited financial activity.

How to Do Single-Entry Bookkeeping

Single-entry bookkeeping, while less complex than double-entry, requires consistent record-keeping practices. Here’s a breakdown of the basic steps involved:

- Choose a Bookkeeping System: Decide on your record-keeping method. Popular options include paper-based cash books, spreadsheets, or cloud accounting software for single-entry bookkeeping.

- Record Every Transaction: Every income and expense, no matter how small, needs to be recorded. Develop a habit of entering transactions daily or weekly to avoid backlogs.

- Categorize Transactions: Classify each transaction into relevant categories like income, expenses (further categorized as rent, utilities, supplies, etc.), and owner’s equity (withdrawals or investments made by the owner).

- Maintain a Running Balance: For each category (income, expenses, owner’s equity), keep a running total to track how much money has flowed in and out. This helps you understand your overall financial position.

- Reconcile Bank Statements Regularly: Regularly compare your records with your bank statements to identify discrepancies or missing transactions. This ensures the accuracy of your financial data.

- Generate Reports: While single-entry doesn’t provide a formal balance sheet, you can generate basic reports to understand your profitability. These reports can include income statements summarizing your revenue and expenses over a period or cash flow statements tracking your cash inflows and outflows.

Remember, consistency is key! Regularly recording transactions and reconciling your accounts will give you a clearer picture of your business’s financial health.

Who uses Single-Entry Bookkeeping?

While not suitable for complex financial operations, single-entry bookkeeping shines for various business types:

- Freelancers and sole proprietors: Track income and expenses for tax purposes

- Small retail shops: Record daily sales and purchases

- Independent contractors: Monitor project-related income and expenses

- Home-based businesses: Keep tabs on their financial activity effectively

What documents are used to record Single-Entry Bookkeeping?

Single-entry bookkeeping relies on a few key documents to capture and record financial transactions:

- Sales Receipts: These document the sale of goods or services to customers, typically including details like date, customer information, item description, and sales amount.

- Purchase Receipts: This document purchases the business makes, including details like date, vendor information, item description, and purchase amount.

- Bank Statements: Bank statements record all deposits, withdrawals, and other banking activity associated with your business bank account(s). Regularly reconcile your bank statements with your bookkeeping records to ensure accuracy.

- Check Registers: If you use checks for payments, maintain a check register to record the check number, date, payee, payment amount, and purpose of the payment.

- Cash Flow Log: This optional document can be helpful for businesses that handle a significant amount of cash transactions. It lets you track all cash inflows (sales, deposits) and outflows (payments, withdrawals) daily or weekly.

While the specific documents used may vary depending on the business, maintaining clear and organized records of these essential documents is crucial for accurate single-entry bookkeeping. Some cloud-based accounting software designed for single-entry bookkeeping can also help streamline the document management process.

Example of Single-Entry Bookkeeping

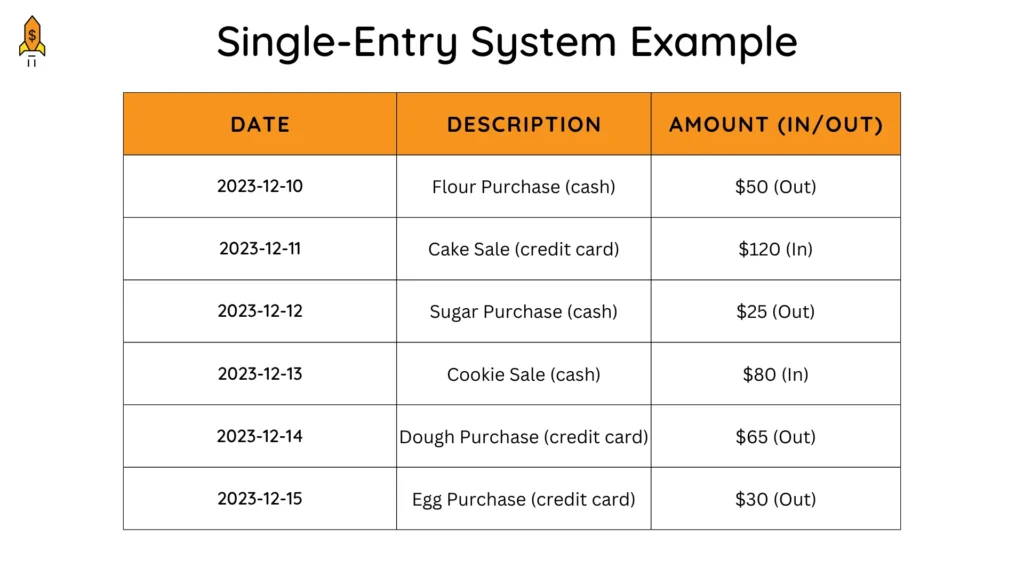

Let’s delve deeper with a practical example. Mary runs a small bakery and uses single-entry bookkeeping. Here’s a glimpse into her records for a week:

By analyzing this simplified log, Mary can quickly track her weekly income and expenses, enabling her to make informed decisions about her business.

Importance of Single-Entry Bookkeeping for Small Business

For small businesses, the benefits of single-entry bookkeeping are undeniable:

- Simplicity: Easy to learn and implement, even for non-accounting professionals

- Time-saving: Saves valuable time compared to double-entry bookkeeping methods.

- Cost-effective: Eliminates the need for expensive accounting software or personnel

- Provides basic financial insights: Tracks income, expenses, and cash flow effectively

Is single-entry bookkeeping right for you? Schedule a free consultation with our financial expert to discuss your specific needs. We create a custom Bookkeeping service plan for your business!

Advantages of Single-Entry Bookkeeping System

While simplicity is its core strength, single-entry bookkeeping offers several additional advantages:

- Suitable for cash-based businesses: Efficiently tracks cash transactions, which are predominant for many small businesses.

- Easy to adapt: Can be readily adjusted to your specific business needs.

- Provides a starting point: Can be upgraded to double-entry bookkeeping as your business grows.

Single-Entry Bookkeeping vs. Double-Entry Bookkeeping

While single-entry bookkeeping offers ease of use, double-entry bookkeeping provides a more comprehensive picture of your finances:

| Feature | Single-Entry Bookkeeping | Double-Entry Bookkeeping |

| Complexity | Simpler | More Complex |

| Transactions Recorded | Once | Twice (Debit and Credit) |

| Financial Insights | Basic (cash flow, income/expenses) | Detailed(assets, liabilities, owner’s equity) |

| Suitable For | Small business with low transaction volume | Businesses of all sizes, especially those with multiple accounts and complex transactions |

| Recording Method | Focuses on cash-based transactions (income received, expenses paid) | Uses the accounting equation (Assets = Liabilities +Owners Equity) to record all economic events (accrual, prepayments) |

| General Ledger | Not required; may use a cash register or basic spreadsheet | Mandatory: a central record of all financial accounts with debits and credits |

| Financial Statements | Limited to basic reports like income statements and basic cash flow statements | Provides a complete picture through balance sheets, income statements, cash flow statements, and statements of owner’s equity |

| Internal Controls | Stronger internal controls like separate duties for recording and reconciliation minimize errors and fraud | Stronger internal controls like separate duties for recording and reconciliation minimize errors and fraud. |

| Scalability | Limited scalability as business grows and transactions become more complex | Highly scalable; accommodates growth and complex financial activities |

Wrapping Up: Choosing the Right Bookkeeping System

Single-entry bookkeeping offers a clear path for small businesses to keep track of their finances without getting bogged down in accounting complexities. Its simplicity, affordability, and focus on cash flow make it an ideal choice for freelancers, sole proprietors, and other small operations. However, it’s crucial to understand its limitations and be prepared to switch to double-entry when your business expands.

Choosing between single-entry and double-entry bookkeeping depends on your needs and financial complexity. If you’re unsure which method suits your business, consider seeking professional advice.