Understanding the financial statements of your business is crucial for informed decision-making and strategic planning. One key element that often puzzles business owners is accumulated depreciation on balance sheet. In this guide, we will explore everything you need to know about accumulated depreciation—from its definition and calculation methods to its classification on the balance sheet. We’ll also answer common questions such as what accumulated depreciation is, how to calculate accumulated depreciation, and what type of account accumulated depreciation is.

Additionally, we’ll clarify whether accumulated depreciation is considered an asset or a liability. Finally, we’ll explain how professional support, including outsourced bookkeeping services, bookkeeping services, tax services, and CFO services, can help you manage and optimize your financial reporting.

Table of Contents

What Is Accumulated Depreciation?

Accumulated depreciation represents the total amount of depreciation expense recorded against an asset since it was acquired. It is a critical component of accumulated depreciation on the balance sheet, as it shows the reduction in the value of a company’s fixed assets over time.

Key Concepts

- Definition:

Accumulated depreciation is the cumulative total of depreciation charges that have been applied to an asset during its useful life. It reduces the asset’s book value on the balance sheet.

- Purpose:

Accumulated depreciation allocates the cost of a tangible asset over its useful life. This allocation helps match the expense with the revenue generated by the asset.

- Contra Asset Account:

Accumulated depreciation is classified as a contra asset account. This means that it is recorded on the balance sheet alongside the related asset but is subtracted from the asset’s total value. As a contra asset, it does not represent an asset itself but rather a reduction in the asset’s value.

Why It Matters

Knowing what accumulated depreciation is is important because it affects how much of your asset’s cost remains on your books. For example, if a piece of equipment was purchased for $50,000 and has accumulated $20,000 in depreciation, the net book value of the equipment on your balance sheet is $30,000. This net figure is critical for financial analysis, tax reporting, and making informed decisions about asset replacement or investment.

How to Calculate Accumulated Depreciation

Calculating accumulated depreciation accurately is essential for maintaining reliable financial records. The calculation typically involves the depreciation formula and depends on the method chosen by your business. Below, we discuss the most common methods used to calculate accumulated depreciation and provide examples to illustrate the process.

Common Depreciation Methods

Straight-Line Depreciation

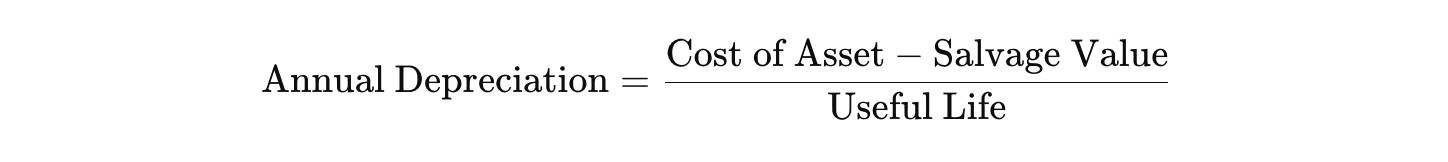

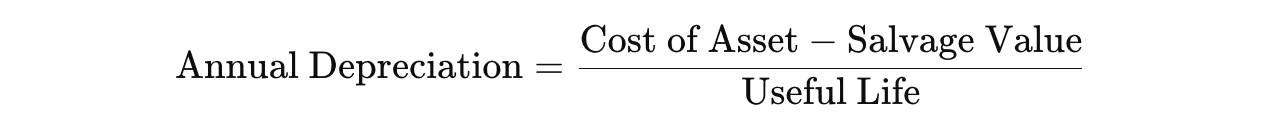

This is the simplest and most widely used method. It spreads the cost of an asset evenly over its useful life. The formula is:

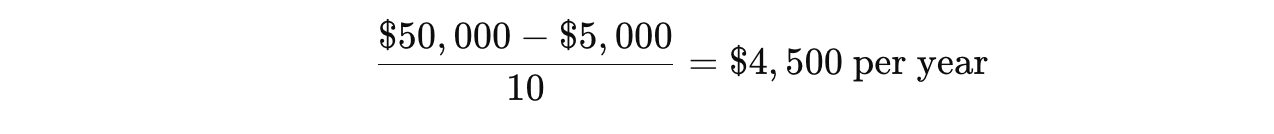

Example:

If you purchase machinery for $50,000 with a salvage value of $5,000 and a useful life of 10 years, the annual depreciation is:

After 3 years, the accumulated depreciation would be:

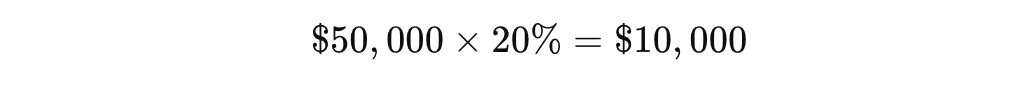

Declining Balance Method

This method accelerates depreciation, meaning that more depreciation is recorded in the earlier years of the asset’s life. It is calculated by applying a fixed depreciation rate to the asset’s book value at the beginning of each period.

Example:

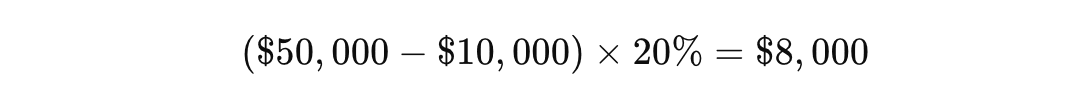

The second-year depreciation would be calculated on the remaining book value:

Accumulated depreciation after 2 years would be $18,000.

Units of Production Method

This method bases depreciation on actual usage rather than time. It is helpful for assets whose wear and tear depend on usage rather than age.

Formula:

This method is particularly beneficial when asset usage varies significantly from year to year.

Practical Steps for Calculation

- Step 1: Determine the cost of the asset and its salvage value.

- Step 2: Determine the asset’s useful life based on industry standards and your business’s experience.

- Step 3: Choose a depreciation method that best reflects the asset’s consumption over time.

- Step 4: Apply the chosen depreciation method to calculate the annual depreciation expense.

- Step 5: Sum the annual depreciation expenses to determine the accumulated depreciation on balance sheet.

Using these steps and the relevant depreciation formula, you can accurately compute accumulated depreciation, ensuring that your financial records reflect the true value of your assets.

What Type of Account Is Accumulated Depreciation?

A common question among business owners is what type of account accumulated depreciation is. The answer is that accumulated depreciation is classified as a contra asset account.

Characteristics of a Contra Asset Account

- Purpose:

Contra asset accounts are used to reduce the value of a related asset account. In this case, accumulated depreciation reduces the gross value of fixed assets on the balance sheet.

- Presentation:

Accumulated depreciation is reported on the balance sheet as a deduction from the asset’s cost, resulting in the net book value.

- Impact on Financial Statements:

This classification helps present a more realistic view of an asset’s worth. For example, if an asset initially costs $50,000 and has accumulated $20,000 in depreciation, its net book value is $30,000.

Why It Matters

Understanding that accumulated depreciation is a contra asset account clarifies how it impacts your balance sheet. It’s not an asset in itself, nor is it a liability—it simply represents the reduction in the value of your assets over time. This distinction is essential when analyzing financial statements and making decisions about asset management and replacement.

By correctly categorizing accumulated depreciation, you can ensure that your financial reporting is accurate and that stakeholders have a clear understanding of your company’s net asset value.

How to Find Accumulated Depreciation on Your Balance Sheet

Finding and understanding accumulated depreciation on the balance sheet is crucial for evaluating asset values and overall financial health. Here’s how to locate and interpret this key figure.

Steps to Locate Accumulated Depreciation

Review the Balance Sheet:

Begin by obtaining your business’s latest balance sheet. Look under the assets section for fixed assets, such as property, plant, and equipment.

Identify the Contra Asset Account:

Accumulated depreciation is typically listed directly below the related asset accounts. It is presented as a negative figure or a deduction from the gross asset value.

Calculate the Net Book Value:

The net book value of an asset is determined by subtracting the accumulated depreciation from its original cost. This provides a realistic value after accounting for wear and tear.

Compare Over Time:

Tracking accumulated depreciation over multiple periods can give you insight into your assets’ usage and aging. This information is valuable for planning asset replacements and evaluating the need for additional investments.

Interpreting the Data

Understanding how to find accumulated depreciation on your balance sheet is essential for assessing the financial health of your business. It provides a clear picture of how much of your assets’ value has been consumed and how much remains. This, in turn, affects your company’s net worth and overall profitability.

For instance, if your accumulated depreciation is high relative to your asset values, it might indicate that your assets are aging and may soon require replacement. Conversely, low accumulated depreciation could suggest that your assets are relatively new or that you are using accelerated depreciation methods.

Professional bookkeeping services can help you accurately track and report accumulated depreciation, ensuring that your balance sheet reflects the actual value of your assets. Additionally, CFO services provide strategic insights into asset management, helping you plan for future investments and optimize your overall financial performance.

The Impact of Accumulated Depreciation on Financial Statements

Accumulated depreciation plays a critical role in shaping your financial statements, particularly the balance sheet and income statement.

Balance Sheet Implications

On the balance sheet, accumulated depreciation reduces the gross value of fixed assets to show the net book value. This presentation provides a more accurate reflection of the asset’s current worth. Investors and lenders use this information to assess your business’s financial health.

Income Statement Impact

Depreciation expense is recorded on the income statement, reducing your net income. This expense, accumulated over time, reflects the cost of using the asset. While it reduces taxable income, it does not affect cash flow directly, making it a non-cash expense. Understanding this distinction is crucial for financial planning and cash management.

Strategic Considerations

Proper management of accumulated depreciation is vital for:

- Asset Replacement Decisions: Determining when it’s time to replace aging equipment.

- Tax Planning: Optimizing depreciation methods to maximize deductions.

- Financial Analysis: Providing insights into the efficiency and longevity of your assets.

Using a clear depreciation formula and accurate financial recording practices can help ensure that your financial statements are both compliant and informative. Professional tax services and CFO services can further enhance these efforts, providing you with strategic advice on managing your assets and planning for future growth.

What is accumulated depreciation on balance sheet?

Accumulated depreciation on the balance sheet represents the total amount of depreciation expense recorded for an asset since its acquisition. It is presented as a contra asset account, which reduces the overall book value of the asset. This figure is crucial for understanding the net worth of your fixed assets and plays a key role in financial analysis and decision-making.

How do you calculate accumulated depreciation?

Calculating accumulated depreciation involves applying a depreciation formula based on the chosen method (e.g., straight-line, declining balance, or units of production). The formula for straight-line depreciation is:

To determine accumulated depreciation, multiply the annual depreciation by the number of years the asset has been in use. For more complex methods, the calculation might require applying a fixed percentage to the asset’s remaining book value each year.

What type of account is accumulated depreciation?

Accumulated depreciation is classified as a contra asset account. Unlike regular asset accounts, it carries a credit balance that offsets the debit balance of the related asset account, resulting in the asset’s net book value. This classification helps provide a clear picture of the asset’s remaining value on the balance sheet.

Is accumulated depreciation an asset or a liability?

Accumulated depreciation is neither an asset nor a liability. It is a contra asset account that reduces an asset’s value on the balance sheet. It represents the portion of an asset’s cost that has been expensed over time, and thus, while it impacts the asset’s value, it is not itself an asset or a liability.

How Professional Services Can Enhance Your Depreciation Management

Managing accumulated depreciation accurately is essential for effective financial reporting. However, handling these calculations and ensuring compliance with accounting standards can be challenging. Professional support can make all the difference:

Outsourced Bookkeeping Services

By outsourcing your bookkeeping, you ensure that all transactions are recorded accurately and consistently. Professional bookkeepers can manage your depreciation schedules, update your financial records regularly, and ensure that your balance sheet accurately reflects the net value of your assets.

Tax Services

Professional tax services can help you optimize your depreciation methods to maximize tax benefits. They stay current with tax regulations and can advise you on the most efficient ways to calculate depreciation, ensuring that you take full advantage of available deductions while maintaining compliance.

CFO Services

A skilled CFO provides strategic oversight of your financial management, including asset management and depreciation. They can offer insights into when to replace assets, how to leverage depreciation for tax planning, and ways to improve your overall financial performance. Their expertise is invaluable for long-term planning and ensuring that your financial statements are both accurate and informative.

How Profitjets Can Help with Your Financial Management

At Profitjets, we specialize in providing comprehensive financial solutions designed to support small businesses. Our services include:

We ensure that all your financial transactions, including depreciation calculations, are recorded accurately and consistently. Our experienced team uses advanced accounting software to keep your records up-to-date, giving you clear insights into the net value of your assets.

Our expert tax professionals help you navigate complex tax regulations, optimize your depreciation strategies, and ensure compliance. We work diligently to maximize your deductions and reduce your overall tax burden.

Our CFO experts provide strategic financial guidance that goes beyond day-to-day bookkeeping. They help you analyze your financial data, plan for future growth, and make informed decisions that enhance your business’s profitability.

By partnering with Profitjets, you gain access to a team of professionals dedicated to optimizing your financial management. We take care of the intricate details—such as tracking accumulated depreciation on your balance sheet—so you can focus on growing your business.

Conclusion

Understanding and managing accumulated depreciation on the balance sheet is essential for accurately reflecting your company’s asset value and making informed financial decisions. By knowing what accumulated depreciation is, how to calculate it using the proper depreciation formula, and its classification as a contra asset account, you gain valuable insights into your business’s financial health.

Accurate depreciation management affects your financial statements and plays a critical role in tax planning and strategic decision-making. By leveraging professional outsourced bookkeeping, tax, and CFO services, you can ensure that your financial records are precise, compliant, and optimized for long-term success.

Investing in robust financial management practices today sets the foundation for a stable and prosperous future. Let Profitjets be your trusted partner in navigating the complexities of accumulated depreciation and enhancing your overall financial strategy.