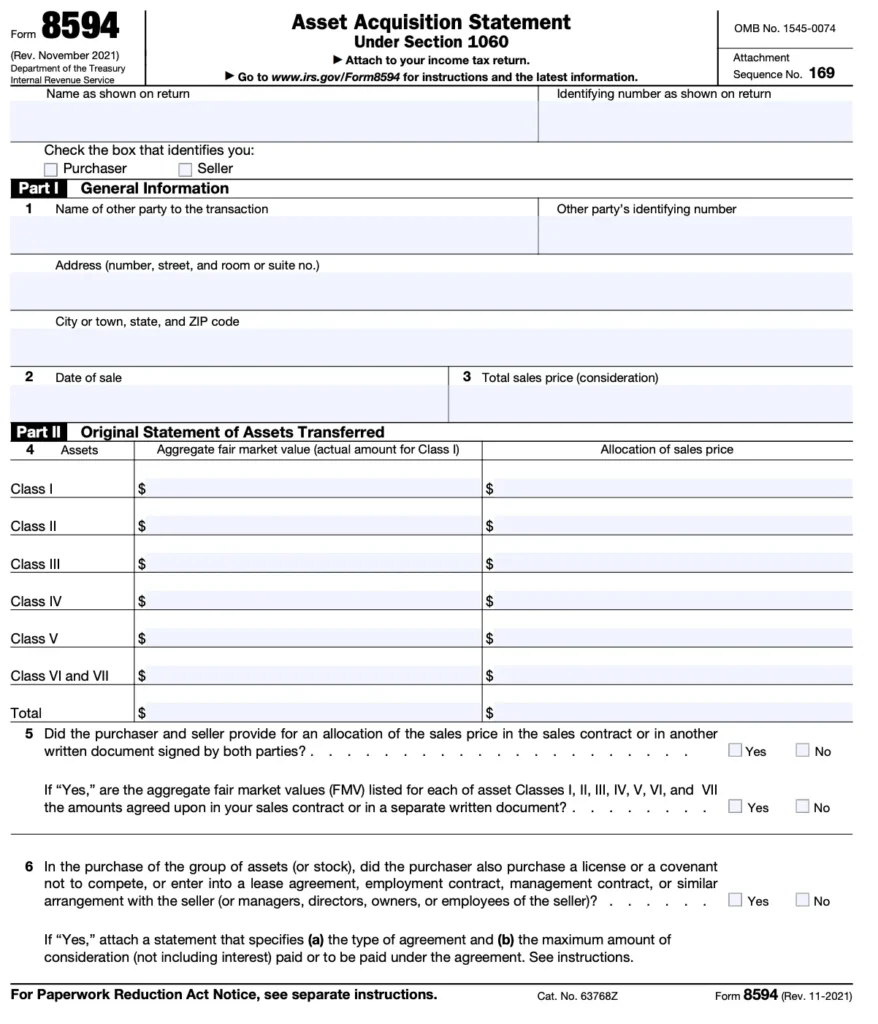

Proper reporting of a transaction is crucial for both buyers and sellers when selling or purchasing a trade or business. Form 8594, the Asset Acquisition Statement Under Section 1060, is a critical IRS document used to report the allocation of the purchase price among the assets acquired as part of a business sale. Filing Form 8594 accurately helps ensure compliance with IRS regulations and avoids costly penalties.

In this guide, we break down the process into clear, manageable steps and provide detailed Form 8594 instructions to help you complete every section. Whether you manage your own tax filings or prefer the support of professional tax services, our step-by-step guide will streamline your filing process.

What is Form 8594?

Form 8594 is the IRS form that must be filed by both the buyer and seller when a group of assets that constitute a trade or business is transferred as a result of a sale or exchange. The form allocates the purchase price among the assets acquired, which can affect the calculation of gain or loss for tax purposes. Under Section 1060 of the Internal Revenue Code, proper allocation is necessary to ensure that each party reports the correct tax consequences on their return.

Who Must File Form 8594?

Both buyers and sellers are required to file Form 8594 when a business transaction qualifies as a reportable asset acquisition. Specifically, if you sell or purchase a group of assets that make up an entire trade or business, you must complete this form. The allocation of the purchase price among the various classes of assets (such as tangible property, goodwill, and intangibles) is critical and must be agreed upon by both parties. If you’re unsure whether your transaction requires Form 8594, consult the Form 8594 instructions or contact a professional tax service for guidance.

Why Accurate Filing of Form 8594 is Important

Completing Form 8594 accurately is essential for several reasons:

- Tax Compliance: Accurate allocation of the purchase price among assets ensures that both the buyer and seller meet IRS requirements under Section 1060.

- Proper Tax Reporting: Misallocations can lead to incorrect calculations of gain or loss, potentially resulting in additional taxes or penalties.

- Audit Preparedness: A correctly completed form provides a clear audit trail, which is invaluable during an IRS examination.

- Financial Planning: Clear documentation of asset values assists with future depreciation and capital gain calculations, aiding long-term financial planning.

By carefully following our step-by-step instructions and considering professional tax services, you can avoid common pitfalls and ensure that your Form 8594 is completed accurately.

Step-by-Step Instructions for Completing Form 8594

Below is a detailed guide to help you fill out Form 8594 correctly.

Step 1: Gather All Necessary Documentation

Before you begin, make sure you have all the required information at hand:

- Transaction Documents: Obtain copies of the purchase agreement or sales contract, closing statements, and any other documents that outline the terms of the business sale.

- Asset Details: Collect detailed descriptions of all assets involved in the transaction, including tangible property, goodwill, and any intangibles.

- Financial Records: Gather financial statements and valuation reports to determine the total purchase price and its allocation among the assets.

- Taxpayer Identification: Ensure you have your Employer Identification Number (EIN) or Social Security Number (SSN) as applicable, along with the legal name and address of your business.

Having these documents organized will make the process smoother and help you accurately complete every section of the form.

Step 2: Enter Identification Information

Start by providing your basic identification details:

- Line 1 – Business or Individual Name: Enter the legal name of the seller or buyer precisely as it appears in your official records.

- Line 2—Taxpayer Identification Number: Input your EIN or SSN. The IRS needs this information to match your submission with your tax records.

- Line 3 – Address: Provide the current mailing address of your business or yourself if you’re an individual.

- Line 4 – Transaction Description: Briefly describe the nature of the transaction, noting that it involves a like-kind asset acquisition as part of a business sale.

Double-check that all identification details are correct to avoid processing delays.

Step 3: Report the Total Purchase Price

In this section, you need to enter the total purchase price for the business:

- Line 5 – Total Purchase Price: Write the full amount agreed upon in the transaction. This is the total consideration paid by the buyer for all the assets.

- Line 6 – Allocation Basis: Indicate the basis used to allocate the purchase price among the assets. This may be determined by independent valuations or by mutual agreement between the buyer and seller.

Accurate reporting of the purchase price is essential for proper tax treatment of the transaction.

Step 4: Allocate the Purchase Price Among the Assets

Now, break down the purchase price into the various asset categories:

- Line 7 – Tangible Assets: List all tangible assets (such as equipment, inventory, and real estate) along with their allocated purchase price.

- Line 8 – Intangible Assets: Report the value assigned to intangible assets, such as goodwill, patents, and trademarks.

- Line 9 – Other Assets: If applicable, include other categories of assets as specified in your transaction documents.

- Line 10 – Total Allocation: Verify that the sum of the allocated amounts from Lines 7, 8, and 9 equals the total purchase price reported on Line 5.

Make sure each allocation is supported by your financial documentation and reflects the actual value of each asset category.

Step 5: Provide Additional Transaction Details

Include any supplemental information that is required:

- Line 11 – Method of Allocation: Describe the method used to determine the allocation (e.g., appraisals, market values, or negotiated agreements).

- Line 12 – Adjustments: If there were any adjustments made to the purchase price (such as cash received or liabilities assumed), report these adjustments here.

- Line 13—Supporting Documentation: Indicate that additional schedules or attachments provide a detailed breakdown of the allocation.

This section helps clarify the basis for your calculations and provides transparency for the IRS.

Step 6: Review, Sign, and Date the Form

Before finalizing your filing:

- Review: Go through every section of Form 8594 to ensure that all numbers are correct and that there are no omissions.

- Sign and Date: Sign and date the form in the appropriate sections. For electronic filings, follow the IRS guidelines to complete the digital signature process.

- Attach Supporting Documents: Make sure that any supplemental schedules or supporting documentation are securely attached to your form.

A careful review minimizes the chance of errors and ensures your form will be processed without delay.

Step 7: Submit Your Form 8594

After you have completed and reviewed the form:

- Electronic Submission: If you file electronically, ensure that Form 8594 is included with your overall tax return. E-filing typically results in faster processing times and confirmation.

- Mail Submission: If you prefer to file by paper, send the completed Form 8594 along with your other tax forms to the IRS address specified in the current instructions. Consider using a certified mail service for delivery confirmation.

- Record Keeping: Keep a copy of your completed form and all supporting documents for your records. These may be necessary in case of an IRS audit or if further clarification is required.

Following the correct submission process is vital to ensure your filing is accepted and processed promptly by the IRS.

Additional Tips and Best Practices

- Organize Your Records: Consistently maintain detailed documentation of the transaction. Organized records make it easier to complete Form 8594 accurately.

- Double-Check Your Calculations: Reconcile your allocated amounts with the total purchase price. Use spreadsheets or accounting software to verify all numbers.

- Stay Updated: Always consult the latest Form 8594 instructions available on the IRS website. Tax laws and requirements may change, so using current guidelines is critical.

- Consult Professional Tax Services: If you have any doubts or your transaction involves complex allocations, professional tax services can offer expert guidance. Their assistance can ensure that your form is error‑free and compliant with all IRS regulations.

Leveraging Professional Tax Services

Navigating a complex business sale and the allocation of asset values can be challenging. Professional tax services can simplify the process by providing:

- Expert Advice: Tax professionals have up-to-date knowledge of IRS regulations and can help you accurately complete Form 8594.

- Time Savings: Outsource the preparation and review process to experts, freeing you to focus on other aspects of your business.

- Personalized Support: Customized solutions for your specific transaction can reduce the risk of errors and ensure that your allocated amounts are correctly determined.

- Peace of Mind: Professional guidance means you can file with confidence, knowing that your return is compliant and accurately reflects your transaction.

Investing in expert tax services is particularly beneficial when dealing with complex asset acquisitions and business sales.

Final Thoughts

Filing Form 8594 is a critical step when reporting the sale or purchase of a business. By following the comprehensive, step-by-step guide provided above, you can ensure that your Form 8594 is completed accurately and submitted on time. Each step—from gathering the necessary documentation and entering identification details to allocating the purchase price and reviewing your calculations—is essential for proper tax reporting and compliance.

Whether you manage your tax filings independently or decide to leverage professional tax services, the key is to remain organized and thorough. A well-prepared Form 8594 not only facilitates compliance with IRS requirements but also establishes a clear audit trail for your business transactions. Accurate reporting can prevent costly penalties and simplify future tax planning.

By carefully completing every section of Form 8594 and seeking professional assistance if needed, you can confidently report your foreign business sale or purchase and focus on growing your enterprise.