For U.S. taxpayers with specified foreign financial assets, Form 8938 is an essential reporting tool. Often required under the Foreign Account Tax Compliance Act (FATCA), Form 8938, the Statement of Specified Foreign Financial Assets ensures that the IRS receives accurate details regarding your overseas investments. In this guide, we break down the process into clear, manageable steps, providing you with comprehensive Form 8938 instructions to help you complete the form correctly. Whether you handle your tax filings or rely on professional tax services, this guide will help you navigate every aspect of the process.

What is Form 8938?

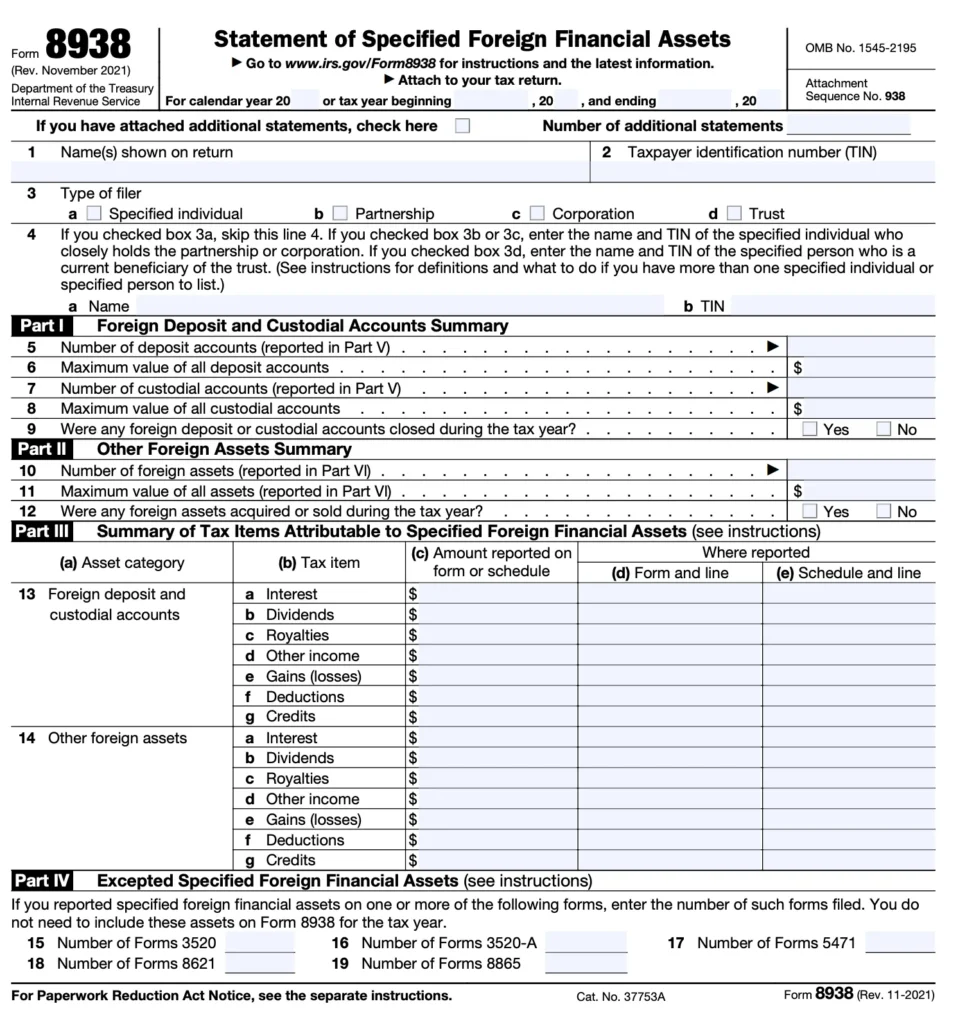

Form 8938 is an IRS document used by specified U.S. taxpayers to report foreign financial assets. These assets include foreign bank accounts, stocks, mutual funds, and other financial instruments held outside the United States. The form is part of your annual income tax return and is designed to help the IRS track offshore financial assets, ensuring compliance with U.S. tax laws.

The form requires you to disclose details such as the type of asset, the maximum value during the tax year, and the income generated by these assets. Filing Form 8938 is mandatory if the total value of your foreign financial assets exceeds certain thresholds, which vary depending on your filing status.

Who Should File Form 8938?

You must file Form 8938 if you are a specified individual, which generally includes U.S. citizens, resident aliens, and certain non-resident aliens who have an interest in specified foreign financial assets. The filing threshold depends on your filing status and where you live:

- For Single or Married Filing Separately: If the total value of your foreign financial assets exceeds $50,000 on the last day of the tax year or $75,000 at any time during the year.

- For Married Filing Jointly: If the combined value exceeds $100,000 on the last day of the tax year or $150,000 at any time during the year.

- For taxpayers living abroad: The thresholds are generally higher.

If you meet these criteria, you should complete and attach Form 8938 to your tax return. Even if you do not exceed the threshold, it is a good idea to review the instructions on Form 8938 to determine your filing requirements.

Why Accurate Filing of Form 8938 is Important

Completing Form 8938 accurately is vital for several reasons:

- Compliance: Correct reporting helps ensure you comply with FATCA and IRS regulations, reducing the risk of penalties.

- Transparency: Providing detailed information about your foreign financial assets allows the IRS to maintain openness and enforce tax laws.

- Avoiding Penalties: Inaccurate or incomplete reporting can lead to significant fines and increased scrutiny from the IRS.

- Financial Recordkeeping: A correctly filed Form 8938 creates a clear audit trail for your foreign investments, which is helpful for future tax planning and audits.

- Enhanced Credibility: Filing your forms accurately demonstrates your commitment to tax compliance, enhancing your credibility with financial institutions and regulators.

By following our step-by-step guide and leveraging professional tax services when necessary, you can ensure that your Form 8938 is completed correctly and submitted on time.

Step-by-Step Instructions for Completing Form 8938

Below, we outline each step required to complete Form 8938 accurately. Follow these steps closely to ensure that all sections are correctly filled out.

Step 1: Gather All Required Information

Before you start, collect all the necessary documents and data:

- Foreign Financial Asset Details: Documentation of bank accounts, stocks, mutual funds, and other foreign financial instruments.

- Asset Valuations: Records showing the maximum value of each asset during the tax year.

- Income Documentation: Information on income generated by these foreign assets, such as dividends, interest, or capital gains.

- Personal Identification: Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) and current mailing address.

- Supporting Documents: Copies of statements, account records, and any other relevant documentation.

Having these records readily available will streamline the process and help avoid errors.

Step 2: Begin with the Identification Section

Start filling out the top portion of Form 8938:

- Line 1 – Taxpayer Information: Enter your full legal name and SSN (or ITIN) exactly as they appear on your official records.

- Line 2 – Mailing Address: Provide your current mailing address. Make sure this matches the address on file with the IRS.

- Line 3 – Foreign Asset Reporting Threshold: Indicate your filing status and verify whether you meet the reporting thresholds based on your filing status and residence.

Accurate entry in this section is essential to ensure your form is processed without delay.

Step 3: Provide Details of Foreign Financial Assets

Next, report the details of each specified foreign financial asset:

- Line 4 – Description of Assets: List each type of asset you own, such as foreign bank accounts, securities, or partnership interests.

- Line 5 – Maximum Value: For each asset, report the maximum value during the tax year. Use official financial statements or appraisals to determine these values.

- Line 6 – Income Generated: Enter the total income generated by each asset, including dividends, interest, and any other related earnings.

- Line 7 – Aggregate Totals: Sum up the values of all your foreign financial assets to determine whether you exceed the filing threshold.

Using precise figures and referencing your documentation is critical for ensuring accuracy.

Step 4: Calculate the Total Foreign Financial Assets

In this section, aggregate the information:

- Line 8 – Total Value: Add up the maximum values of all specified foreign financial assets.

- Line 9 – Compare to Thresholds: Ensure that your total meets or exceeds the applicable reporting threshold. If not, you may not need to file Form 8938.

- Line 10 – Additional Disclosures: If you hold assets in foreign entities or through complex arrangements, provide additional details as required in the supplementary instructions.

This step is crucial to confirm your filing requirement under the law.

Step 5: Complete Any Required Supplemental Information

Depending on your specific situation, you may need to attach additional schedules:

- Line 11 – Supplemental Schedules: Attach any additional documentation or financial statements required to detail complex asset structures or additional income information.

- Explanation Statements: If any asset values are based on estimates, include a brief statement explaining the basis for your calculations.

Ensure that all supplemental documentation is clearly labeled and referenced in your Form 8938.

Step 6: Review, Sign, and Date the Form

Before finalizing your submission:

- Thorough Review: Carefully read through the entire form to ensure that all entries are accurate and complete. Cross-check your numbers with your financial records.

- Sign and Date: Sign and date the form in the designated areas. If filing electronically, follow the IRS guidelines for digital signatures.

- Prepare Attachments: Verify that all supplemental schedules and supporting documents are attached to your form.

A final review is essential to catch any errors that might result in IRS penalties.

Step 7: Submit Your Form 8938

After reviewing, submit your completed form:

- Electronic Filing: Many taxpayers now choose to e-file Form 8938 as part of their annual tax return. Ensure your software includes Form 8938 in your submission package.

- Mail Submission: If filing a paper return, mail the form along with your other tax forms to the appropriate IRS address as listed in the current Form 8938 instructions.

- Record Keeping: Always keep a copy of the completed form and all supporting documentation for your records. These records may be necessary in case of an IRS audit or future inquiries.

Following the proper submission process ensures that your Form 8938 is processed quickly and accurately.

Additional Tips and Best Practices

- Organize Your Documentation: Keep detailed records of all your foreign financial assets and corresponding income throughout the year. This practice makes the reporting process much more manageable.

- Double-Check Your Calculations: Use accounting software or spreadsheets to verify your figures before entering them on the form.

- Stay Updated: Always refer to the most current Form 8938 instructions on the IRS website, as thresholds and requirements may change.

- Seek Professional Help: If you have complex foreign asset holdings or are unsure about any aspect of the form, consult with professional tax services to ensure accurate and compliant filing.

Leveraging Professional Tax Services

Navigating the intricacies of Form 8938 can be challenging, particularly if you have multiple foreign financial assets or complicated investment structures. Professional tax services can offer:

- Expert Review: Tax professionals can carefully review your Form 8938 to ensure every detail is correct and complete.

- Efficient Filing: They help streamline the process, saving you time and reducing the risk of errors.

- Customized Guidance: Expert advice tailored to your specific financial situation can be invaluable in maximizing your tax benefits.

- Peace of Mind: With professional support, you can rest assured that your reporting is compliant and that you have minimized the risk of IRS penalties.

Investing in professional tax services can make a significant difference, especially for taxpayers with complex international financial portfolios.

Final Thoughts

Filing Form 8938 is an essential task for any U.S. taxpayer with specified foreign financial assets. By following the step-by-step guide outlined above, you can ensure that your Form 8938 is completed accurately and submitted on time. Each step—from gathering the required documentation and entering detailed asset information to reviewing your entries and submitting the form—is crucial for compliance with IRS requirements.

Whether you manage your tax filings independently or use professional tax services, being meticulous with Form 8938 helps protect you from potential penalties and ensures that your international investments are adequately reported. A well-organized and accurately completed Form 8938 not only supports your tax return but also contributes to your overall financial transparency and planning.

By adhering to these detailed Form 8938 instructions and considering the assistance of expert tax services when needed, you can confidently file your return and maintain compliance with U.S. tax law. Enjoy the peace of mind that comes from knowing your foreign financial assets are correctly reported, allowing you to focus on growing your investments and achieving your financial goals.