We all make mistakes—especially during tax season. Whether you forgot to report some income, missed out on a deduction, or simply used the wrong filing status, the IRS gives you a second chance through Form 1040-X.

This guide explains how to file Form 1040-X step by step. From understanding when to file to walking through each section of the form, you’ll find everything you need to correct your federal tax return confidently.

Table of Contents

What Is Form 1040-X and Why Do You Need It?

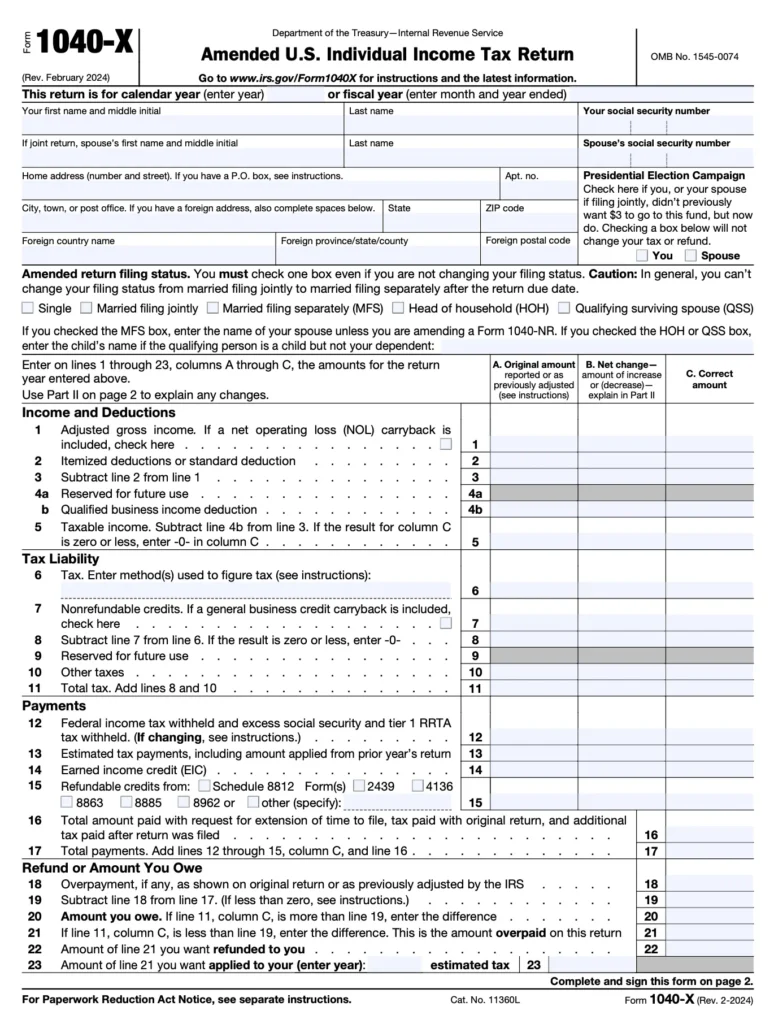

Form 1040-X, titled Amended U.S. Individual Income Tax Return, is used to make corrections to a previously filed federal tax return. It allows you to adjust your income, credits, deductions, filing status, or even the number of dependents.

Use this form to:

- Fix errors or omissions on Form 1040, 1040-SR, or 1040-NR

- Claim tax credits you missed (like the Earned Income Credit or Child Tax Credit)

- Update your filing status or change deductions.

When Should You File an Amended Return Using Form 1040-X?

The IRS allows you to amend a return for up to three years from the date you filed or two years from the date you paid the tax—whichever is later.

Here’s when you should consider filing:

- You received new tax documents (like a corrected 1099)

- You forgot to include income or deductions.

- You incorrectly reported your filing status.

- You need to correct your dependent information.

- You want to claim a retroactive tax credit.

Just remember: Do not file Form 1040-X if the IRS has already corrected a math error on your return—you’ll receive a notice instead.

What You Need Before Filling Out Form 1040-X

Before you start, gather the following:

- A copy of the original tax return you filed

- All new or corrected tax forms (W-2s, 1099s, etc.)

- Updated financial statements

- IRS notices (if you received any)

- Supporting documents for any changes (receipts, updated schedules, etc.)

Having organized financial statements and your original return on hand ensures you’re making precise corrections.

Step-by-Step Instructions for Completing Form 1040-X

Form 1040-X is broken into three primary columns and a section for explanations. Here’s how to complete it:

Step 1: Fill Out Personal Details

At the top of the form, enter:

- Your name and Social Security Number

- Current address

- Filing status (should match or update the original)

- Tax year being amended.

Tip: Each amended return must be submitted separately for each year being corrected.

Step 2: Update Income, Deductions, and Taxes—Columns A–C

This is the core of the form. You’ll report changes in three columns:

- Column A: Original numbers from your previously filed return

- Column B: Net changes you’re making

- Column C: Corrected amounts (Column A + B)

You’ll go line-by-line through:

- Adjusted gross income (Line 1)

- Itemized or standard deductions (Line 2)

- Taxable income (Line 3)

- Total tax (Line 5)

- Payments and credits (Line 6)

- Refund or balance due (Line 10)

Use current IRS Form 1040-X instructions to ensure accuracy.

Step 3: Explain Your Corrections

In Part III of the form, clearly explain the reason for each change. Keep it simple but specific:

“Amending return to include previously unreported freelance income of $4,000 (Form 1099-NEC). Adjusted Schedule 1 and total income accordingly.”

If the explanation isn’t clear, the IRS may delay processing—or worse, reject your amendment.

Step 4: Attach Additional Schedules or Forms

Depending on what you’re amending, you may need to include:

- Form W-2 or 1099 (for income updates)

- Schedule A or Schedule C (if changing deductions or self-employment income)

- Any relevant IRS letters or corrected tax documents

Always attach any forms that back up your new numbers.

Step 5: Sign and Submit the Form

Once the form is complete:

- Sign and date it

- If filing jointly, both spouses must sign

- Mail it to the IRS address listed in the instructions on Form 1040-X for your state.

Alternatively, you can e-file Form 1040-X for the 2019 tax year and later if you originally e-filed the return.

How to Track the Status of Your Amended Return

The IRS can take up to 20 weeks to process an amended return. To check the status:

- Go to Where’s My Amended Return

- Provide your SSN, DOB, and ZIP code.

Processing times may vary depending on the complexity of the changes and whether you’ve submitted all supporting documents.

Mistakes to Avoid When Filing Form 1040-X

Here are some common pitfalls and how to avoid them:

- Not attaching necessary forms or schedules

- Filing too soon (wait until the IRS processes your original return)

- Failing to explain changes clearly

- Using the wrong tax year’s form

- Ignoring state returns (you may need to amend those, too)

Professional tax services can help you review your return before submitting it to avoid delays and rejections.

Final Thoughts: Correcting a Tax Return the Smart Way

Mistakes happen, but they don’t have to cost you. Filing Form 1040-X gives you a chance to fix errors, claim missed deductions, and adjust incorrect details—before they become more significant issues.

Use accurate financial statements, review the latest Form 1040-X instructions, and seek professional tax services if you’re unsure where to begin.