If you’re a parent whose child has earned income from interest and dividends, you can include that income on your tax return using Form 8814. This can simplify the filing process and potentially reduce the overall tax liability. In this guide, we’ll walk you through the process of completing Form 8814, ensuring you understand each step and the associated requirements.

Table of Contents

Understanding Form 8814

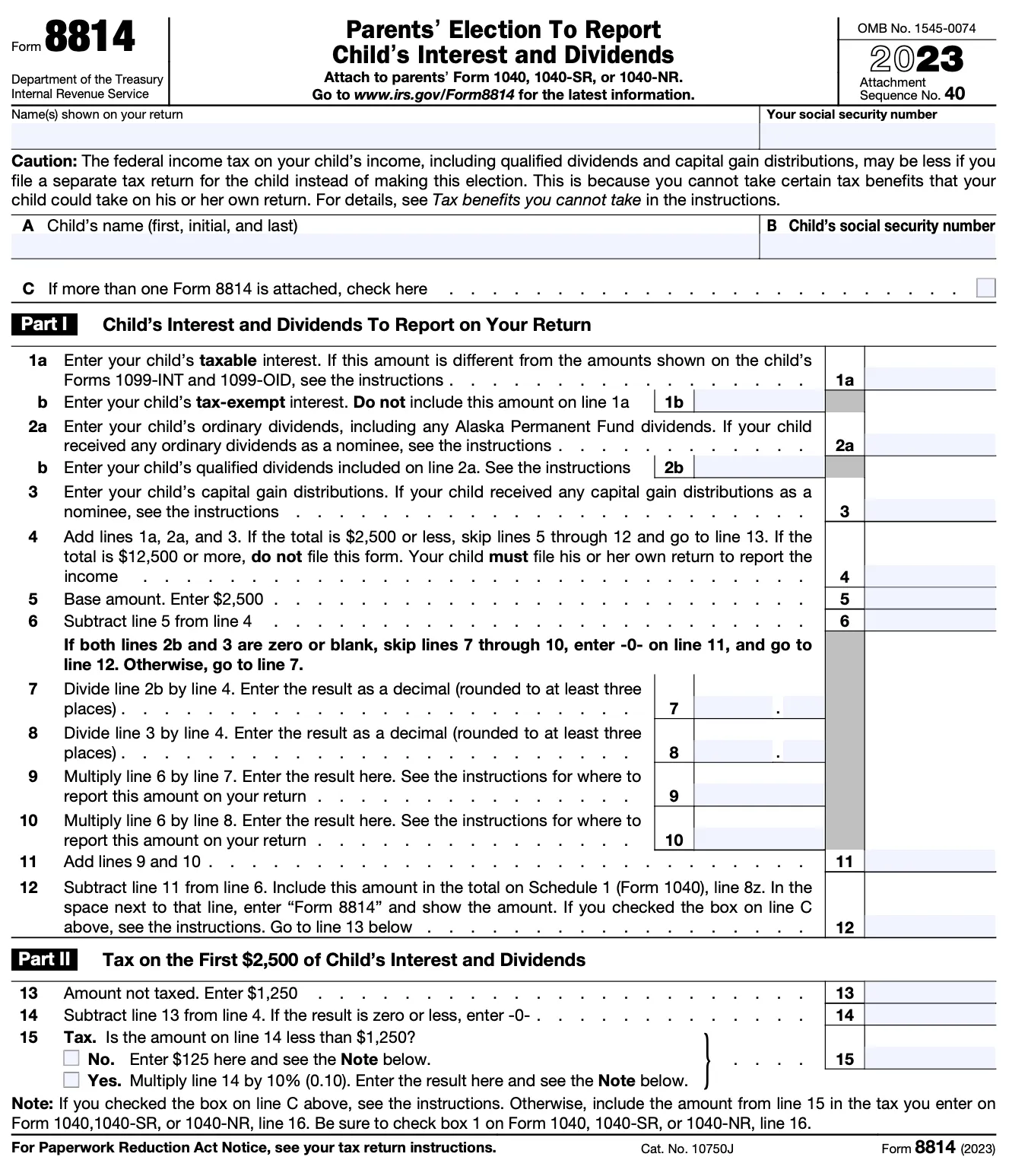

Form 8814, titled Parent’s Election to Report Child’s Interest and Dividends, allows parents to report their child’s income directly on their tax return. This election means the child may not need to file a separate return, streamlining the tax process for families.

Eligibility Criteria for Using Form 8814

Before opting to use Form 8814, ensure both you and your child meet the following conditions:

- Child’s Age: The child was under age 19 (or under age 24 if a full-time student) at the end of the tax year.

- Income Type: The child’s income solely consists of interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends.

- Gross Income: The child’s gross income for the year was less than $12,500.

- Filing Status: The child is not filing a joint return for the year.

- Estimated Tax Payments: No estimated tax payments were made for the child, and no federal income tax was withheld from the child’s income.

If all these conditions are met, you can elect to report your child’s income on your return using Form 8814.

Step-by-Step Instructions for Completing Form 8814

Follow these steps to complete Form 8814 accurately:

- Child’s Information:

- Enter your child’s name and Social Security Number (SSN) in the designated fields at the top of the form.

- Interest Income:

- Line 1a: Report your child’s taxable interest income.

- Line 1b: Report any tax-exempt interest income your child received.

- Dividend Income:

- Line 2a: Enter your child’s ordinary dividends.

- Line 2b: Enter the portion of the dividends that are qualified dividends.

- Capital Gain Distributions:

- Line 3: Report any capital gain distributions your child received.

- Total Child’s Income:

- Line 4: Add the amounts from lines 1a, 2a, and 3 to determine your child’s total income.

- Base Amount:

- Line 5: Enter the base amount, which is $2,500, for the tax year.

- Subtract Base Amount:

- Line 6: Subtract the amount on line 5 from the amount on line 4. If the result is zero or less, enter “0.”

- Tax on Base Amount:

- Line 7: Calculate the tax on the base amount ($2,500) based on the tax rates applicable to your filing status.

- Tax on Excess Over Base Amount:

- Line 8: Multiply the amount on line 6 by 10% (0.10) to determine the tax on the income exceeding the base amount.

- Total Tax:

- Line 9: Add the amounts from lines 7 and 8. This is the total tax attributable to your child’s income that you’ll include on your return.

- Alternative Minimum Tax (AMT) Consideration:

- Line 10: If your child received any tax-exempt interest from private activity bonds issued after August 7, 1986, enter that amount here. This is necessary for AMT calculations.

Ensure all calculations are accurate and that you’ve transferred the appropriate amounts to your primary tax return.

Potential Tax Implications

While using Form 8814 can simplify the filing process, be aware of potential tax implications:

- Higher Tax Rates: The income between $1,250 and $2,500 may be taxed at a higher rate than if the child filed separately.

- Loss of Certain Deductions: By including your child’s income on your return, you might forfeit certain deductions or credits that the child could have claimed on their own return.

It’s essential to weigh these factors when deciding whether to use Form 8814.

Deadlines and Penalties

Form 8814 should be filed alongside your regular tax return, typically due by April 15. Failure to file on time or pay the necessary tax can result in penalties and interest. If you need more time, consider filing for an extension to avoid late filing penalties.

Seek Professional Tax Services

Navigating tax forms can be challenging, especially when dealing with additional forms like 8814. Professional tax services can provide guidance tailored to your situation, ensuring compliance and optimizing your tax outcomes. Consulting with tax professionals can help you make informed decisions and avoid potential pitfalls.