If you’re a small business owner or self-employed individual, you might be eligible for the Qualified Business Income (QBI) deduction. This deduction allows eligible taxpayers to reduce their taxable income, ultimately lowering the amount they owe to the IRS. To claim this deduction, you must file Form 8995 with your tax return.

In this guide, we’ll walk you through how to file Form 8995 in 2025, what changes to expect, and how to ensure you maximize your tax savings.

Table of Contents

What Is Form 8995?

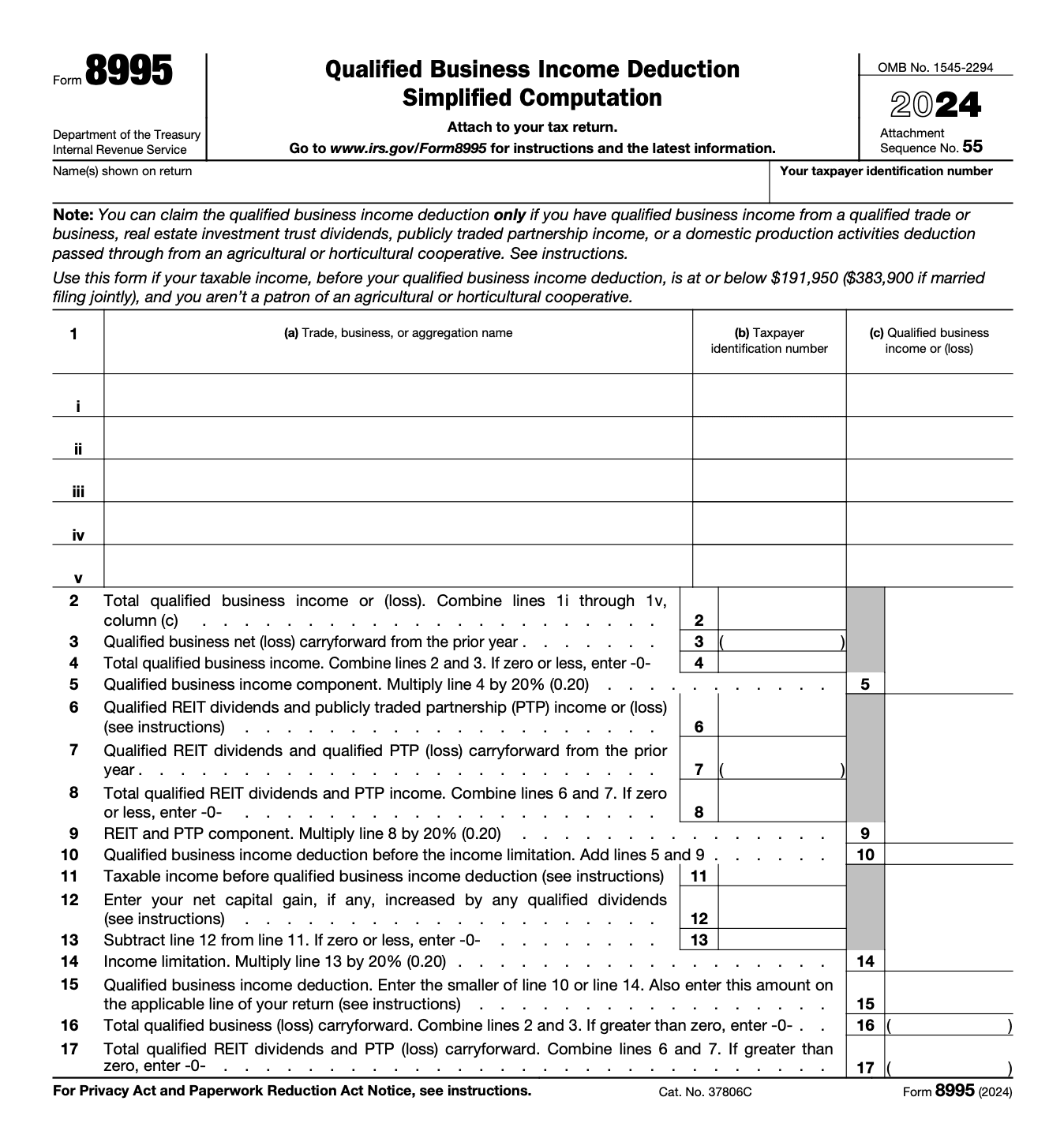

Form 8995, also known as the Qualified Business Income Deduction Simplified Computation form, is used to calculate and claim the 20% QBI deduction. The deduction applies to pass-through entities, including:

- Sole proprietors

- Partnerships

- S corporations

- LLCs taxed as pass-through entities

If your taxable income is below a certain threshold, you can use Form 8995 to claim the deduction without complex calculations. For 2024, the income threshold was:

| Filing Status | Income Threshold |

| Single | $191,950 |

| Married Filing Jointly | $383,900 |

The IRS may adjust these thresholds for inflation in 2025. Always check the latest IRS updates before filing.

Who Needs to File Form 8995?

You must file Form 8995 if:

- You own a pass-through business and have QBI

- Your total taxable income is below the IRS income threshold

- You’re not subject to QBI limitations on specified service trades or businesses (SSTBs)

If your income exceeds the limit, you may need to use Form 8995-A, which has a more detailed calculation process.

Step-by-Step Guide to Filing Form 8995 in 2025

Step 1: Gather Required Information

Before you start filling out Form 8995, collect the following:

- Your business’s net income

- W-2 wages paid by the business

- Unadjusted basis of qualified property (UBIA)

- 1099 forms (if applicable)

These details will help you complete the form accurately.

Step 2: Complete Part I – Determine Your QBI Deduction

The first section of Form 8995 enables you to calculate your Qualified Business Income (QBI) deduction. Here’s how:

- List all qualified businesses you own (sole proprietorships, partnerships, S corporations).

- Report net QBI for each business (use your bookkeeping records or financial statements).

- Multiply QBI by 20% (0.20) to determine your tentative deduction.

Example:

If your business had $100,000 in QBI, you calculate:

$100,000 × 20% = $20,000 deduction

If you own multiple businesses, repeat this process for each one.

Step 3: Apply Any Carryforward Losses (If Applicable)

If you had QBI losses from prior years, you must subtract them from your current year’s deduction.

- Enter any QBI loss carryforwards on Line 3

- Deduct this amount from your total QBI before applying the 20% deduction

Example:

If you had a QBI loss of $5,000 last year, and your current QBI is $100,000, your new deduction is:

($100,000 – $5,000) × 20% = $19,000

Step 4: Calculate the Overall Income Limit

Your QBI deduction cannot exceed 20% of your taxable income (excluding capital gains).

- Take your total taxable income.

- Multiply it by 20%

- If this number is lower than your QBI deduction, you must use the lower amount.

Example:

- Your taxable income (before QBI deduction): $80,000

- 80,000 × 20% = $16,000

- If your QBI deduction was initially $19,000, you must reduce it to $16,000

Step 5: Report the Deduction on Your Tax Return

Once you’ve calculated your final QBI deduction, enter it on Line 10.

Make sure your deduction is accurate, as IRS audits often focus on QBI claims.

Expected Changes to Form 8995 in 2025

While the basic structure of Form 8995 will likely remain the same, here are some potential updates for 2025:

- Inflation-adjusted income thresholds

- Possible updates to SSTB rules

- Changes in depreciation rules affecting QBI calculations

Stay updated by checking the IRS website or consulting a tax professional.

How Profitjets Can Help with Form 8995 Filing

Correctly filing Form 8995 is essential to maximizing your QBI deduction while staying compliant with IRS regulations. At Profitjets, we provide:

- Bookkeeping Services: Ensuring your QBI numbers are accurate

- Tax Services: Helping you claim the maximum deduction

- CFO Services: Offering financial strategy to optimize your tax position

Let our experts handle the complexities of tax filing while you focus on growing your business!

Final Thoughts

Filing Form 8995 correctly can save your business thousands in taxes. By following the step-by-step guide above, you can ensure accuracy while maximizing your QBI deduction.

However, tax laws change frequently, and the IRS closely monitors deductions like QBI. To avoid mistakes and ensure compliance, consider working with a trusted tax professional like Profitjets.

FAQs About Form 8995

What Is the Purpose of Form 8995?

Form 8995 calculates your Qualified Business Income Deduction (QBID), allowing eligible businesses to deduct up to 20% of their QBI.

Who Qualifies for the QBI Deduction?

If you own a pass-through entity (sole proprietorship, partnership, S-corp, or LLC) and your taxable income is below the IRS threshold, you qualify.

How Is the QBI Deduction Calculated?

Multiply your net QBI by 20%, ensuring it doesn’t exceed 20% of your taxable income.

Can I File Form 8995 Without an Accountant?

Yes, but errors can lead to IRS audits or missed deductions. Using professional tax services ensures accuracy.

What Happens If My Business Has a Loss?

If your QBI is negative, you must carry it forward to offset future QBI deductions.