“How do I handle filing taxes and tax refunds when a loved one is deceased? This is an emotional time.” If the deceased never filed taxes jointly or didn’t appoint an executor, you’d have to use IRS Form 1310. The form is used when you’re claiming a refund for a deceased person, but you aren’t the surviving spouse filing jointly, and you aren’t a court-appointed executor.

Fill out the form and keep the required documentation in your records to mail tax returns to the appropriate IRS office. Losing a loved one is hard. Dealing with taxes during that time can feel overwhelming. Use this article as a guide to go about tax-related documents after the passing of a loved one.

Table of Contents

What is Form 1310, and How to File Form 1310?

‘The Statement of Person Claiming Refund Due a Deceased Taxpayer’ is more commonly called IRS Form 1310. It becomes necessary when someone dies and isn’t survived by a spouse who was jointly filing tax returns, or there isn’t a court-appointed representative for the deceased, and an individual needs to claim a tax refund due to be received by the deceased taxpayer.

When is IRS Form 1310 required?

When a tax-paying individual has departed, the surviving relatives may have to use the IRS Form 1310 under the following circumstances: The specific scenarios when Form 1310 is required are explained below.

- If you are a relative but not the surviving spouse filing jointly, and

- There is no court-appointed executor representative who is filing the return, or

- You are a relative who might be filing an amended return (Form 1040‑X) or Form 843 for the decedent and are not the executor

These are the specific scenarios when you must file IRS Form 1310 along with the final IRS Form 1040 (or its amendment) to secure the refund.

Where and how to file IRS Form 1310?

An important detail to remember about Form 1310 is that it’s mandatory to mail it physically by paper. Form 1310 cannot be e-filed.

Here are the detailed Form 1310 instructions:

If you are only filing Form 1310, you could mail it to the same IRS Service Center that handled the original return.

If you are filing Form 1310, attached to the final return, follow the instructions for Form 1040 or Form 1040-X

Here’s a complete step-by-step guide on how to obtain, prepare, and file IRS Form 1310 if you’re claiming a tax refund for a deceased taxpayer in 2025:

How to Obtain IRS Form 1310?

- You could download it in PDF format online from the IRS website.

https://www.irs.gov/forms-pubs/about-form-1310 - You can request it by mail.

Call the IRS at 800-829-3676 and request that Form 1310 be mailed to your address. - Visit a local IRS office.

Find a nearby IRS Taxpayer Assistance Center to collect a physical copy.

What do you need to file Form 1310?

Before filling out and mailing the form, make sure you have the following:

Basic Requirement

- Full legal name and SSN of the deceased taxpayer

- Date of death

- Your full legal name, SSN, and current mailing address

- If you’re amending, a copy of the decedent’s IRS Form 1040, or IRS Form 1040-X

Supporting Documents (not required to file)

- Death certificate

- Proof of your relationship to the deceased (e.g., birth certificate, marriage certificate)

- If applicable, documentation proving that no court-appointed representative exists.

- A copy of any will or evidence that you’re legally entitled to the refund under state law

Determine your role

You’ll have to provide information about yourself and how you are related to the deceased individual.

- Disclose if you are a surviving spouse or an unmarried partner

- A court-appointed personal representative

- Other claimants, such as an adult child, sibling, etc.

How to Fill Out IRS Form 1310?

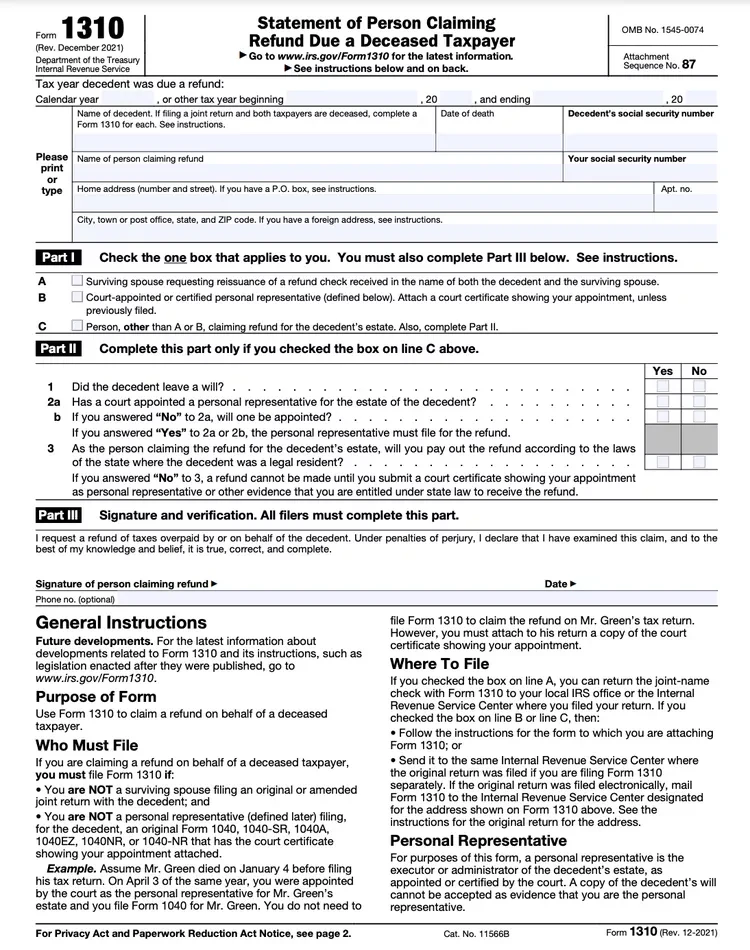

Here’s what’s on the IRS Form 1310:

Part I: Select your relationship to the deceased—surviving spouse, court-appointed rep, or “other claimant” (if neither of the above).

Part II Only for “other claimants” (not spouse or court rep). You’ll answer questions about wills, court-appointed representatives, and whether there’s a will. And whether you’ll distribute according to state laws.

If no personal representative has been appointed, and you’re not the surviving spouse, Part II must be completed thoroughly.

Part III: Signature and declaration under penalty of perjury

Depending on your selection, you must keep certain documents (like the death certificate or court certificate of appointment). However, these records are not mailed unless called upon by the IRS

But generally, do not mail them with the form—just keep them in your records, unless the IRS requests them

How to File Form 1310 with the IRS?

- If filing with the final tax return (Form 1040 or 1040-X):

- Attach Form 1310 behind the deceased’s tax return.

- Mail to the address shown in the IRS Form 1040 instructions for the deceased’s state.

- If filing Form 1310 by itself. This could happen when a refund was already processed, or no return is needed:

- Mail it to the IRS Service Center that processes returns for your state. Use the IRS Form 1040 mailing addresses here.

How long does it take the IRS to process Form 1310?

The IRS usually takes 6 to 12 weeks to process IRS Form 1310 and issue the refund as well. However, these are some factors due to which this timeline could vary.

The standard processing time is 6–8 weeks if the filing is complete with an accurate Form 1040 and if no additional documentation is requested.

However, it takes 10–12 weeks or longer if:

- The form is incomplete or has errors

- The IRS requests additional documentation, e.g., proof of relationship or court appointment.

- You’re filing Form 1310 by itself without attaching a return

- The return is picked for review or audit

You should contact the IRS if more than 12 weeks have passed since you mailed the return with Form 1310 and have not received the refund or an IRS notice.

IRS Refund Hotline: 800-829-1954

Or check the refund status at ‘Where’s My Refund?’ On the IRS website

Fill out the forms completely, make all the required attachments as required, and send further documentation when called upon; this could avoid delays

Can Form 1310 be E-Filed?

IRS Form 1310 cannot be e-filed. It can only be filed physically in paper form. It has to be printed, signed, and mailed to the IRS. Analyzing Form 1310 involves a deceased taxpayer and requires legal verification and a thorough paper check, which calls for manual review.

What are the essential documents needed to file a tax return for a deceased person?

1. Death Certificate

2. IRS Form 1310 (if applicable)

3. Final Form 1040 (U.S. Individual Income Tax Return)

4. Previous Tax Returns (1040 or 1040-X)

5. Court Appointment Papers (if applicable)

6. IRS Form 1099s, W-2s or Form K-1s

7. Form 56 – Notice Concerning Fiduciary Relationship

8. IRS Form 1041 – U.S. Income Tax Return for Estates and Trusts

9. IRS Form 5498 (IRA Contributions)

10. Will or Trust Documents (if available)

Optional documents that could be of use: medical expense records (for final year deductions), charitable donation receipts, mortgage interest statements (Form 1098), and bank statements, if income (interest) needs to be reported.

Who Gets the Deceased Person’s Tax Refund?

The refund goes to the person or legal entity entitled under IRS rules, which depend on the circumstances:

1. Surviving Spouse, if a joint tax return was filed: the refund is issued to both names.

2. Court-Appointed Personal Representative: The refund is issued to the estate and typically handled by the executor.

3. Other Claimant (This scenario required using Form 1310): If no one has been designated as a representative, and the return is due a refund, someone such as a child or a family member can file Form 1310. The individual has to agree to distribute the refund according to state laws. The IRS then issues the refund to the claimant listed on Form 1310, assuming requirements are met.

Even if the IRS issues the refund to the Form 1310 filer, that person must distribute the money based on state inheritance laws if there’s no will or estate instructions.

How can hiring a tax professional make filing Form 1310 easier?

A tax professional turns a potentially confusing and frustrating process into a smooth, accurate, and compliant refund claim, while helping you avoid delays or disputes with the IRS. You are filing for Form 1310 during an emotional time, and hiring a professional at this time helps ease some of the burden off your shoulders. A tax professional identifies your requirements and ensures accuracy in documentation. This could save you months, as errors could leave you waiting and frustrated. Hiring a tax professional helps avoid rejection due to missing supporting evidence. You also benefit from advice on understanding and acting on tax implications, as well as meeting IRS deadlines.

Conclusion:

Form 1310’s purpose is to manage a tax refund of a deceased person whose legal executor has not been named and is not survived by a spouse who typically filed taxes jointly. This IRS form and process help claim a refund by other surviving members of the family by providing the required information and evidence when called upon. Profitjets is a tax professional that can handle your tax filing, planning, and tax advisory needs with proficiency and accuracy. We will ensure there are no errors or delays in your IRS Form 1310 processing. We also provide outsourced accounting and bookkeeping services and CFO services. We are your one-stop solution for all accounting, bookkeeping, and tax needs. Get in touch with us for a custom quote.

FAQs on IRS Form 1310

1. What is Form 1310?

IRS Form 1310, titled “Statement of Person Claiming Refund Due a Deceased Taxpayer”, is used when someone other than the surviving spouse or a court-appointed representative is requesting a federal tax refund on behalf of a deceased person. This form ensures the IRS releases the refund to the correct party in accordance with tax and estate laws.

2. Can Form 1310 be E-Filed?

No, Form 1310 cannot be e-filed. The IRS requires this form to be physically signed and mailed, either attached to the deceased taxpayer’s final tax return or submitted separately, depending on the situation. Be sure to send it to the correct IRS Service Center and retain proof of delivery.

3. When is Form 1310 Required?

Form 1310 is required when:

– You’re not the surviving spouse filing a joint return, and

– You’re not a court-appointed personal representative, and

– You’re claiming a refund on behalf of a deceased taxpayer.

This applies in cases where a refund is due as a court has legally appointed no executor or administrator.

4. Who is not required to file Form 1310?

You do not need to file IRS Form 1310 if:

– You are the surviving spouse and are filing a joint tax return with the deceased.

– You are a court-appointed executor or administrator, and you attach proof of your court appointment to the tax return.

In these situations, the IRS accepts the return and issues the refund without requiring Form 1310.