Managing cash flow is crucial for every business, and understanding your collections process is key to maintaining a healthy financial profile. One of the most important metrics to monitor is the accounts receivable turnover. This guide will help you grasp what accounts receivable turnover means, explain the accounts receivable turnover ratio, and show you how to calculate accounts receivable turnover using the proper formulas and techniques.

We’ll also explore the average account receivable formula, discuss the significance of the accounts receivable ratio, and provide practical examples of the receivable turnover formula. Additionally, we’ll look at how accounts receivable relate to accounts payable and how professional support from outsourced bookkeeping services, bookkeeping services, tax services, and CFO services can enhance your financial management.

Table of Contents

What Is Accounts Receivable Turnover?

Accounts receivable turnover is a financial ratio that measures how effectively a company collects its receivables from customers. In simple terms, it indicates how many times your business can convert its accounts receivable into cash during a given period. This ratio provides insight into the efficiency of your credit policies and your ability to manage customer payments.

Key Concepts

- Definition:

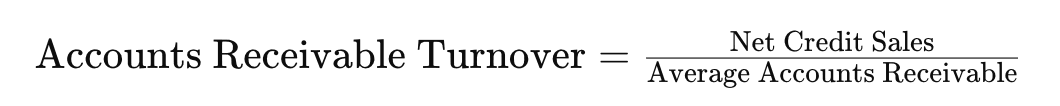

Accounts receivable turnover is calculated by dividing net credit sales by the average accounts receivable. This gives you an idea of how quickly you are collecting payments from customers.

- Purpose:

The main goal of this ratio is to evaluate the efficiency of your credit and collection processes. A higher turnover ratio suggests that your business is collecting receivables more frequently, which typically indicates strong cash flow management.

- Practical Implications:

Understanding your accounts receivable turnover can help you identify potential issues in your collections process, such as slow-paying customers or inefficiencies in invoicing. It also serves as a critical indicator when assessing your overall liquidity.

For example, if your business’s accounts receivable turnover is low, it might indicate that you’re extending too much credit or that your collection efforts need improvement. In such cases, enhancing your credit policies or offering incentives for early payment can boost the ratio, thereby improving cash flow.

Understanding the Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio is an essential metric for measuring the efficiency of your credit policies. It tells you how many times you convert your receivables into cash during a particular period. A high ratio implies that customers pay their bills quickly, while a low ratio may signal issues with credit management.

Breaking Down the Ratio

The ratio is calculated using the following formula:

- Net Credit Sales:

This refers to the sales made on credit, minus any returns or allowances. It represents the revenue that is expected to be collected from customers on credit.

- Average Accounts Receivable:

This is calculated by adding the accounts receivable at the beginning and end of the period, then dividing by two. It provides an average figure that smooths out fluctuations over the period.

Why This Ratio Matters

The accounts receivable ratio is a critical measure because it:

- Reflects Collection Efficiency:

A high turnover ratio indicates that a company is efficient in collecting its receivables, which enhances cash flow and liquidity.

- Impacts Cash Flow:

Faster collections mean that you have more cash available to reinvest in your business or pay down liabilities.

- Helps Manage Credit Risk:

Monitoring this ratio allows you to assess whether your credit policies are working effectively. If the ratio is too low, it might be time to tighten credit terms or improve your collection processes.

For instance, if your accounts receivable turnover ratio is 8, this means that on average, your receivables are collected eight times during the period. Comparing this to industry benchmarks can help you understand if your business is performing well or if there’s room for improvement.

Enhancing the Ratio

Improving your accounts receivable turnover involves:

- Tightening Credit Policies:

Ensure that you only extend credit to customers who have a strong credit history

- Efficient Invoicing:

Send out invoices promptly and follow up on overdue payments.

- Incentivizing Early Payments:

Offer discounts or other incentives for customers who pay before the due date.

Focusing on these strategies can increase your turnover ratio, which in turn boosts your overall financial health.

How to Calculate Accounts Receivable Turnover

Calculating your accounts receivable turnover is straightforward if you have the correct data. Follow these steps:

Step 1: Determine Net Credit Sales

Gather your sales data for the period and subtract any returns or allowances to obtain your net credit sales. This figure represents the revenue generated from credit sales only.

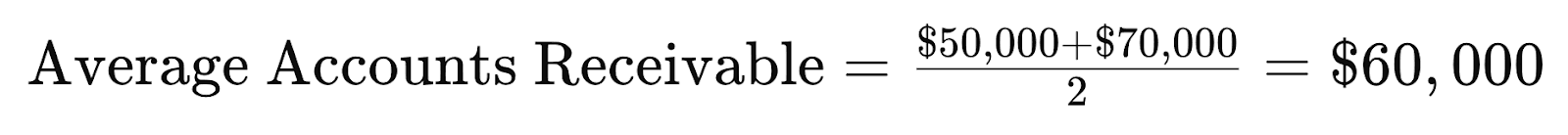

Step 2: Calculate Average Accounts Receivable

Add the accounts receivable at the beginning of the period to the accounts receivable at the end of the period, and then divide by two. This provides an average value that accounts for fluctuations in receivables.

Step 3: Apply the Formula

Divide your net credit sales by your average accounts receivable:

Practical Example

Suppose your business recorded $500,000 in net credit sales during the year. If your accounts receivable at the beginning of the year was $50,000 and at the end of the year was $70,000, then your average accounts receivable would be:

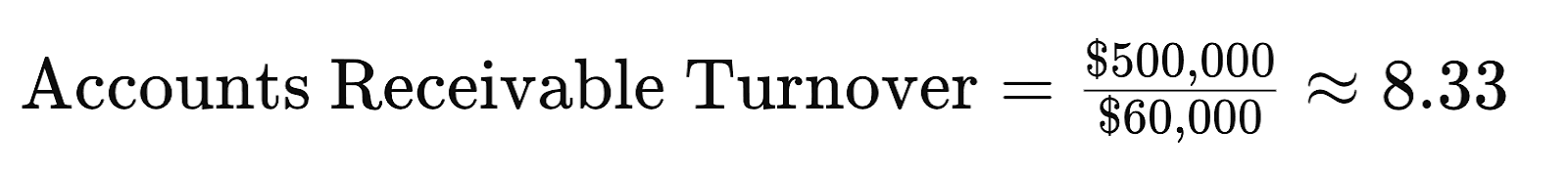

Now, using the formula:

This means that, on average, you collected your receivables approximately 8.33 times during the year.

Why Accurate Calculation Matters

The accurate calculation of your accounts receivable turnover is essential because it provides insight into your cash flow and the efficiency of your credit management. It also impacts your overall financial analysis and can influence key business decisions. Professional bookkeeping services and CFO services can help ensure that these calculations are performed accurately and that the data used is up-to-date and reliable.

Using a receivable turnover formula consistently allows you to track changes over time and benchmark your performance against industry standards. If you notice a decline in your turnover ratio, it may indicate issues with collections or credit policies, prompting you to take corrective actions.

The Average Accounts Receivable Formula and Its Importance

Another critical metric in financial management is the average accounts receivable formula. This calculation provides a more balanced view of receivables by averaging out fluctuations over a period.

Formula for Average Accounts Receivable

The formula is simple:

This metric is important because it gives you a more accurate basis for calculating your accounts receivable turnover. Using the average helps smooth out any anomalies that might occur at the beginning or end of the period.

Significance in Financial Analysis

The average accounts receivable figure is used to:

- Calculate the Receivables Turnover Ratio:

This ratio is crucial for assessing how quickly your business converts credit sales into cash.

- Assess Credit Management:

It provides insight into how effectively you are managing your credit policies and collections processes.

- Forecast Future Cash Flow:

Understanding your average receivables can help you better predict your future cash flow, which is essential for operational planning and budgeting.

Practical Applications

For example, if your average accounts receivable is rising over time, it may indicate that customers are taking longer to pay their invoices. This can lead to cash flow issues, making it essential to review your credit policies and consider measures to improve collections. Conversely, a declining average may indicate efficient collections and improved cash flow.

Regular monitoring of your average accounts receivable, along with the receivable turnover formula, can provide you with early warnings about potential issues in your credit management process. This is where professional bookkeeping services come into play—they help ensure that your records are accurate and up-to-date, allowing for more precise financial analysis.

The Relationship Between Accounts Receivable and Accounts Payable

While our primary focus is on accounts receivable turnover, it’s essential to understand how it relates to other components of your balance sheet, particularly accounts payable. Both metrics play crucial roles in managing cash flow.

Accounts Receivable vs. Accounts Payable

- Accounts Receivable:

These are funds that your business owes to its customers. Efficient management of receivables is critical for maintaining liquidity and ensuring that you have the cash flow necessary to cover expenses.

- Accounts Payable:

These represent what your business owes to suppliers and vendors. Properly managing payables ensures that you maintain good relationships with suppliers and avoid late fees or penalties.

The balance between accounts receivable and accounts payable is vital for effective cash flow management. A high receivables turnover combined with well-managed payables ensures that your business has sufficient liquidity to cover its obligations and invest in growth opportunities.

Strategies for Balancing Receivables and Payables

- Optimize Collections:

Implemented effective credit policies and follow-up procedures to ensure timely payments from customers.

- Negotiate Payment Terms:

Work with suppliers to negotiate favorable payment terms, aligning your cash inflows and outflows.

- Monitor Financial Ratios:

Regularly review ratios such as the accounts receivable turnover and days payable outstanding to assess your financial health.

By monitoring receivables and payables closely, you can improve your overall cash flow and financial stability. Professional bookkeeping services and CFO services can help monitor these metrics and provide strategic insights for better financial management.

The Role of Professional Services in Managing Financial Metrics

Efficiently managing financial metrics such as the accounts receivable turnover ratio and average accounts receivable is essential for making informed business decisions. Professional services play a pivotal role in this process.

Outsourced Bookkeeping Services

Outsourcing your bookkeeping tasks can save time, reduce errors, and ensure that all financial transactions are recorded accurately. Professional bookkeeping services leverage the latest accounting software to provide real-time insights into your financial data. This ensures that you have accurate figures to calculate ratios like the accounts receivable turnover and the average accounts receivable.

Tax Services

Accurate financial records are crucial for tax planning and compliance. Professional tax services help ensure that your financial data is reliable, minimizing the risk of audits and penalties. They also assist in optimizing your tax strategy by identifying potential deductions and credits that can lower your tax burden.

CFO Services

A CFO brings strategic oversight to your financial management, helping you interpret key metrics and make informed decisions. With CFO services, you can better understand the implications of your accounts receivable turnover ratio and take proactive steps to improve cash flow, negotiate better credit terms, and plan for future growth.

By leveraging professional services, you can streamline your financial processes, improve accuracy, and focus on strategic decision-making. This integrated approach to financial management is especially critical for small businesses looking to achieve long-term success.

What is the accounts receivable turnover ratio?

The accounts receivable turnover ratio measures how effectively a company collects revenue from its customers. It is calculated by dividing net credit sales by the average accounts receivable. This ratio provides insight into how quickly receivables are converted into cash. A high ratio indicates efficient collections, while a low ratio may suggest issues with credit policies or collection processes. Understanding this metric is essential for managing cash flow and ensuring that your business maintains liquidity.

How do you calculate accounts receivable turnover?

To calculate accounts receivable turnover, use the following formula:

Net credit sales refer to sales made on credit minus returns and allowances, while average accounts receivable is the average of receivables at the beginning and end of the period. This calculation helps you determine how many times your business collects its receivables during a specific period.

Why is the accounts receivable turnover ratio important?

This ratio is crucial because it indicates how quickly a business can convert credit sales into cash, which is essential for maintaining healthy cash flow. Efficient collection processes reduce the risk of bad debts and ensure that funds are available to cover operational expenses. By regularly monitoring this ratio, businesses can identify potential inefficiencies in their credit policies and make adjustments to improve cash management.

How do accounts payable and accounts receivable interact?

While accounts receivable represents money owed to your business, accounts payable represents what your company owes to suppliers. Balancing these two components is key to effective cash flow management. A high accounts receivable turnover, combined with well-managed accounts payable, ensures that your business maintains liquidity and can meet its financial obligations promptly.

How Profitjets Can Help with Your Financial Management

At Profitjets, we understand the complexities of financial management and the importance of accurate data in driving business success. Our comprehensive suite of services is designed to help small businesses manage their financial metrics efficiently.

Our Key Offerings:

- Bookkeeping Services:

Our expert team ensures that every transaction is recorded accurately and promptly, providing you with reliable data for calculating critical metrics like the accounts receivable turnover ratio.

- Tax Services:

We help you navigate the intricacies of tax compliance, ensuring that your financial records are complete and up-to-date. Our professionals work to optimize your tax strategy, reducing liabilities and maximizing deductions.

- CFO Services:

Our experienced CFOs offer strategic guidance that goes beyond day-to-day bookkeeping. We help you interpret financial metrics, manage cash flow, and make informed decisions that support long-term growth.

By partnering with Profitjets, you can leverage our expertise and state-of-the-art tools to streamline your financial operations and improve overall efficiency. Let us handle your financial management so you can focus on growing your business.

Conclusion

Understanding and effectively managing your accounts receivable turnover is critical for ensuring healthy cash flow and sustainable business growth. By leveraging the receivable turnover formula and tracking key financial metrics, you gain valuable insights into your company’s efficiency in collecting revenue. With accurate calculations and strategic financial management, you can make informed decisions that drive profitability and support your long-term goals.

Professional support through outsourced bookkeeping services, tax services, and CFO services can further enhance your financial management strategy. These experts ensure that your financial records are precise, your tax filings are compliant, and your business is positioned for future success. Embrace a proactive approach to financial management, and let Profitjets be your trusted partner in optimizing your business performance.