Effective restaurant bookkeeping and accounting practices are crucial for a business’s financial success and sustainability. These practices provide the framework for managing financial resources, tracking expenses, and maximizing profitability. This article will dive into restaurant bookkeeping and accounting principles and strategies.

Additionally, we will provide practical tips to implement these practices effectively, ensuring that restaurant owners and managers can make informed financial decisions to support their business growth. It’s essential to understand that accurate bookkeeping and accounting not only facilitate compliance with regulatory requirements but also offer valuable insights into the financial health of a restaurant.

Table of Contents

What is Restaurant Bookkeeping and Accounting?

Restaurant bookkeeping involves the systematic recording of daily financial transactions tailored to the unique needs of a restaurant establishment. This process encompasses tracking sales, expenses, and other financial activities to maintain accurate and organized records.

On the other hand, restaurant accounting extends beyond bookkeeping by delving into the interpretation and analysis of financial data. It supports decision-making by providing insights into cost structures, revenue trends, and overall financial performance.

Additionally, restaurant accounting includes preparing essential financial statements such as income statements, balance sheets, and cash flow statements for reporting purposes. In essence, while bookkeeping focuses on the diligent recording of financial activities, accounting takes a more comprehensive approach by analyzing and interpreting the recorded data to facilitate informed decision-making and financial reporting.

How is Restaurant Accounting different from other Businesses?

Restaurant accounting involves unique challenges that set it apart from accounting practices in other types of businesses.

These challenges include:

Managing Inventory Costs: Restaurants have complex inventory needs due to the perishable nature of food items. It’s crucial to track inventory levels accurately to prevent overstocking or running out of essential ingredients, which can impact profitability.

Tracking Food Waste Expenses: Restaurants must account for food waste, which can arise from over-portioning, spoilage, or kitchen errors. Monitoring and minimizing food waste are essential for cost control and sustainability.

Handling Tip Reporting for Employees: Handling tips adds another layer of complexity to restaurant accounting. Employers must accurately report and allocate tips while complying with tax regulations and labor laws.

The need for efficient inventory management, waste tracking, and tip reporting sets restaurant accounting apart as a highly specialized field within the broader spectrum of accounting services.

How to do bookkeeping for a restaurant

Setting up an accounting system in a Restaurant may seem like a tedious task, but here you will find an in-detail guide as to how to achieve it:

1. Setting Up an Effective Restaurant Chart of Accounts

A restaurant chart of accounts is crucial for organizing financial transactions within specific categories. It is the backbone of your restaurant’s bookkeeping and accounting system, providing a structured framework for accurate reporting and analysis.

- Understanding the Concept

A chart of accounts lists all the different types of financial transactions within your restaurant. Each account represents a specific category: sales, expenses, assets, or liabilities. By categorizing transactions this way, you can easily track and analyze your restaurant’s financial performance.

- Tailoring to Your Restaurant

While standard account categories apply to most businesses, it’s essential to customize your chart of accounts to suit the unique needs of your restaurant. This involves considering your menu offerings, service style, and revenue streams. For example, you should include separate accounts for food sales, beverage sales, and other revenue sources like catering or merchandise.

- Aligning with the POS System

To ensure seamless integration between your Point-of-Sale (POS) system and accounting software, it’s beneficial to align the structure of your chart of accounts with that used in your POS system. This enables easy reconciliation between sales data recorded at the front end and financial data captured in your accounting system. It also streamlines the process of generating accurate reports.

- Key Account Categories

Here are some essential account categories to consider for a restaurant chart of accounts:

Food Sales: This category includes all revenue from food sales, including dine-in, takeout, delivery, or online orders.

Beverage Sales: Similar to food sales, this category encompasses all revenue from beverage sales, such as alcoholic and non-alcoholic drinks.

Inventory Assets: These accounts track the value of your restaurant’s inventory, including food, beverages, and supplies.

Labor Expenses: This category includes wages, salaries, and payroll taxes for your restaurant staff.

Other Operating Expenses: Accounts in this category capture various expenses such as rent, utilities, marketing, and maintenance costs.

Owner’s Equity: This account represents the owner’s investment in the business and any retained earnings.

Organizing your financial transactions into these categories allows you to generate specific reports that provide insights into your restaurant’s financial performance. For example, you can track the profitability of different menu items by analyzing the food sales category or monitor labor costs by reviewing the labor expenses category.

A well-designed chart of accounts is essential for effective restaurant bookkeeping and accounting. It provides a structured framework for organizing financial transactions and generating accurate reports for analysis. By tailoring your chart of accounts to suit your restaurant’s unique needs and aligning it with your POS system, you can streamline your bookkeeping processes and gain valuable insights into your restaurant’s financial performance.

2. Implementing Robust Inventory Management Systems for Cost Control

Effective inventory management is crucial for controlling costs and ensuring the profitability of a restaurant business. By implementing robust inventory management systems, restaurants can track ingredient usage, monitor for theft or spoilage, and accurately calculate the Cost of Goods Sold (COGS).

- Tracking Ingredient Usage

An efficient inventory management system allows restaurants to track the usage of ingredients in real time. This helps maintain optimal stock levels and prevents over-ordering or shortages, which can impact food costs.

- Monitoring Theft or Spoilage

Restaurants often need help with theft and spoilage of perishable items. An effective inventory management system enables the monitoring of inventory levels and alerts management to any discrepancies that may indicate theft or excessive wastage.

- Calculating Cost of Goods Sold (COGS)

Accurate calculation of COGS is essential for assessing the profitability of menu items and overall operational efficiency. An advanced inventory management system provides insights into each menu item’s cost by tracking ingredient usage and valuation.

Different techniques, such as First-In-First-Out (FIFO) and Last-In-First-Out (LIFO), can be utilized for inventory valuation purposes in a restaurant context.

- FIFO (First-In-First-Out): This method assumes that the oldest inventory items are used or sold first. In a restaurant setting, this approach ensures that perishable goods are utilized before they expire, minimizing waste and potential losses.

- LIFO (Last-In-First-Out): Conversely, LIFO assumes that the most recently acquired inventory items are used or sold first. While less commonly used in restaurant inventory management due to its impact on tax implications, it may still be applicable in specific scenarios.

By incorporating these techniques into inventory management practices, restaurants can optimize their cost-control efforts and maintain accurate financial records to support informed decision-making.

3. Streamlining Payroll Processes through Technology Solutions

In the restaurant industry, managing payroll is multifaceted, involving complexities such as tip credits, minimum wage laws, and staff scheduling considerations. With numerous employees working varying shifts and earning different types of income, traditional manual payroll processes can become overwhelming and prone to errors.

This is where modern payroll processing software tailored for restaurants comes into play.

- Modern Payroll Processing Software for Restaurants

Restaurant-specific payroll processing software offers a range of features designed to streamline payroll operations and ensure compliance with industry-specific regulations. These platforms are equipped to handle the unique aspects of restaurant payroll, including tip reporting and distribution, overtime calculations for non-exempt employees, and adherence to labor laws.

By leveraging these advanced solutions, restaurant owners and managers can:

- Automate tax withholdings: The software can calculate and withhold taxes accurately based on employee earnings, reducing the risk of errors in tax calculations and ensuring compliance with tax regulations.

- Accurately allocate tips among employees: With built-in tip tracking functionality, the system can allocate tips somewhat based on predetermined rules or percentages.

- Generate comprehensive reports for regulatory compliance: The software can generate detailed reports summarizing payroll data, making it easier for businesses to comply with labor regulations and provide necessary documentation during audits.

- Integrate with time and attendance tracking tools: By connecting with time and attendance systems, the software can automatically import employee hours worked, streamlining the process of calculating wages and overtime pay.

Implementing robust payroll processing software reduces the administrative burden on restaurant staff and minimizes the risk of errors associated with manual payroll calculations.

Additionally, these systems offer transparency, allowing employees to access their pay stubs and tax information electronically, fostering a more efficient and secure payroll management process.

As technology continues to transform the operational landscape of restaurants, investing in specialized payroll processing software is becoming increasingly essential for ensuring accuracy, efficiency, and compliance in managing employee compensation within the industry.

Common Mistakes in Restaurant Bookkeeping and Accounting

In restaurant bookkeeping and accounting, several common pitfalls can significantly impact the financial health of a business. Restaurant owners and bookkeepers must be aware of these challenges and take proactive measures to mitigate their effects.

Two key points are:

1. Failure to Reconcile Bank Statements Regularly.

One common mistake is neglecting to reconcile bank statements regularly. This oversight can lead to discrepancies in financial records, making it difficult to track expenses accurately and identify potential errors or fraudulent activities. To avoid this, it’s essential to establish a routine for reconciling bank statements every month. Utilizing accounting software can streamline this process and provide real-time insights into cash flow.

2. Misclassification of Expenses as Capital Assets

Misclassifying expenses as capital assets can distort the financial picture of a restaurant business. It’s important to differentiate between day-to-day operational costs and capital expenditures, as they have distinct implications for tax reporting and financial analysis. Implementing clear guidelines for expense classification and providing training for staff involved in recording transactions can help prevent this issue.

Proactive measures such as implementing internal controls and conducting periodic financial audits are essential to overcome these challenges. Internal controls, including segregation of duties and authorization protocols, can help prevent errors and detect irregularities in financial transactions.

Additionally, regular financial audits conducted by internal or external professionals can offer valuable insights into the accuracy and integrity of financial records, providing opportunities for corrective actions if discrepancies are identified.

By addressing these common pitfalls through diligent oversight and strategic measures, restaurant businesses can uphold the integrity of their financial data and make informed decisions to support long-term success.

Key Financial Statements for Assessing Restaurant Performance

Financial statements are crucial for assessing a business’s financial health and performance. They provide valuable insights into the establishment’s revenue trends, cost structures, and cash flow dynamics. Here are the fundamental financial statements that every restaurant owner should be familiar with:

1. Income Statement (Profit and Loss Statement)

The income statement summarizes a restaurant’s revenues, expenses, and net income or loss over a specific period. It provides a snapshot of the business’s profitability by comparing total sales and costs.

Critical components of an income statement include:

- Revenue: This includes all sources of income, such as food sales, beverage sales, catering services, and other revenue streams.

- Cost of Goods Sold (COGS): COGS represents the direct costs incurred in producing the restaurant’s goods or services, including food and beverage costs.

- Operating Expenses: These are the day-to-day expenses required to run the restaurant, such as rent, utilities, salaries, marketing expenses, and insurance.

- Net Income/Loss: This is calculated by subtracting total expenses from total revenue and indicates whether the restaurant has made a profit or incurred a loss.

2. Balance Sheet:

The balance sheet provides a snapshot of a restaurant’s financial position at a specific point in time. It presents an overview of its assets, liabilities, and owner’s equity.

Critical balance sheet components include:

- Assets: These represent what the restaurant owns or controls and can include items like cash, inventory, equipment, furniture, and accounts receivable.

- Liabilities: Liabilities are what the restaurant owes to creditors and can include accounts payable, loans payable, accrued expenses, and taxes payable.

- Owner’s Equity: Also known as shareholders’ equity or net worth, this represents the residual interest in the restaurant’s assets after deducting liabilities.

3. Cash Flow Statement

The cash flow statement tracks the inflow and outflow of cash within a restaurant business over a specific period. It provides insights into how money is generated and used by the business.

Critical components of a cash flow statement include:

- Operating Activities: Cash flows from day-to-day operations, such as cash received from customers and money paid to suppliers and employees.

- Investing Activities: Cash flows related to purchasing or selling long-term assets like equipment or property.

- Financing Activities: Cash flows related to external financing, such as loans or equity investments and dividends or distributions to owners.

By analyzing these financial statements, restaurant owners can identify areas of strength and weakness and make informed decisions about pricing strategies, cost control measures, and investment opportunities.

Additionally, they can use these statements to demonstrate their financial performance to potential investors, lenders, or partners.

Remember that accurate and timely financial reporting is essential for effective decision-making. Utilizing accounting software or working with professional bookkeepers can help streamline the process and ensure your financial statements are accurate and up-to-date.

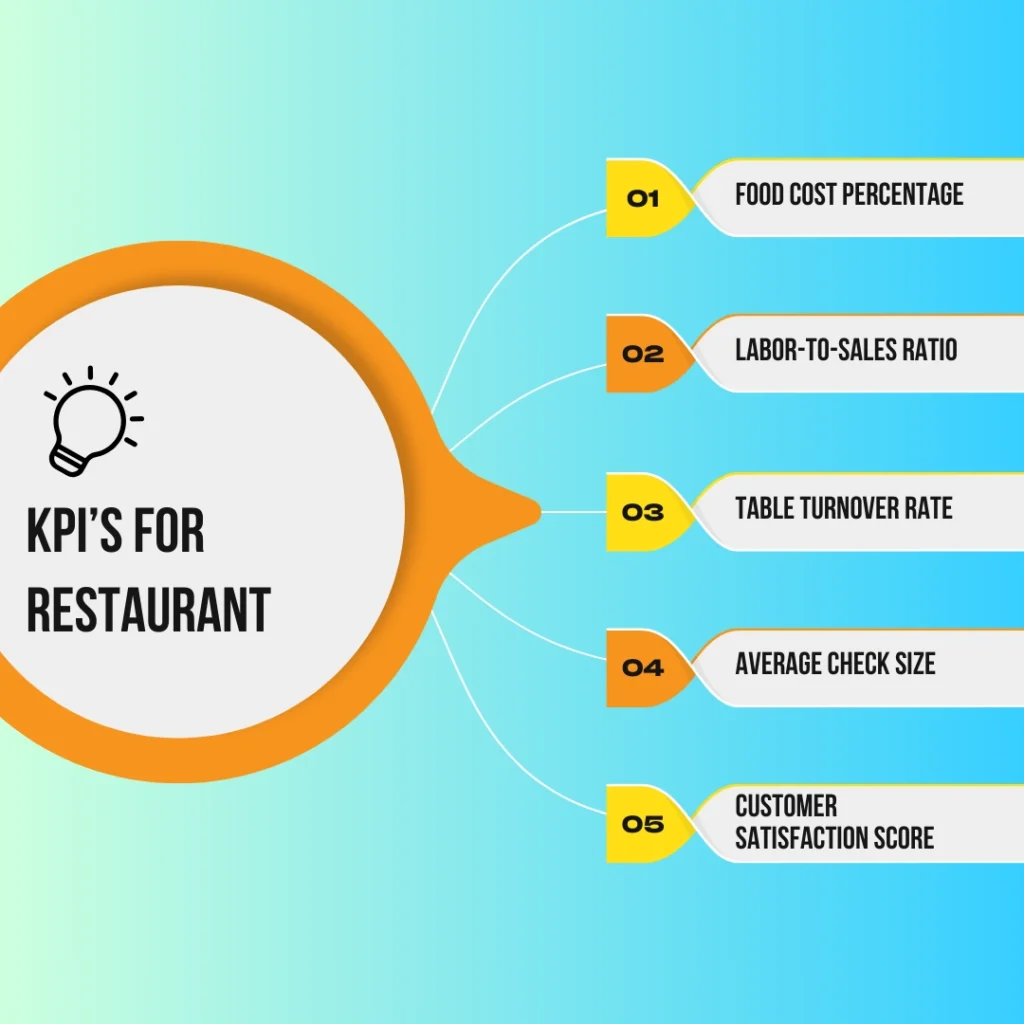

KPI’s in Restuarant Bookkeeping and Accounting

Key Performance Indicators (KPIs) are crucial in measuring progress toward business goals in the restaurant industry. By tracking and analyzing these metrics, restaurant owners and managers can gain valuable insights into the performance of their establishment and make informed decisions to improve efficiency and profitability.

KPIs are quantifiable measurements that reflect the success or effectiveness of an organization in achieving its objectives. In the context of the restaurant industry, KPIs help monitor various aspects of operations, such as financial performance, customer satisfaction, and operational efficiency.

By identifying and monitoring the right KPIs, restaurant owners can:

- Identify areas for improvement and set realistic goals

- Measure progress towards those goals

- Make data-driven decisions to optimize operations

- Compare performance against industry benchmarks

1. Food Cost Percentage:

This KPI measures the cost of food as a percentage of total food sales. It helps assess the efficiency of food purchasing, inventory management, portion control, and pricing strategies. By tracking food cost percentages regularly, restaurants can identify potential wastage or overpricing issues affecting profitability.

2. Labor-to-Sales Ratio:

This ratio compares labor costs to total sales revenue. It helps determine whether labor expenses are within an acceptable range and if staffing levels align with demand. A high labor-to-sales ratio may indicate overstaffing, while a low ratio may suggest understaffing that could impact service quality.

3. Table Turnover Rate:

This metric measures how quickly tables are cleared and reoccupied within a specific time frame. A higher table turnover rate indicates efficient use of resources and increased revenue potential. Monitoring this KPI can help identify bottlenecks in service, such as slow table turnover due to long wait times or slow kitchen operations.

4. Average Check Size

This KPI calculates the average amount each customer spends during a visit. It provides insights into customer spending patterns and helps identify up-selling opportunities. By analyzing average check size, restaurants can develop strategies to increase customer spending and maximize revenue per guest.

5. Customer Satisfaction Score

This KPI measures customer satisfaction levels through surveys or feedback platforms. It helps assess the overall dining experience and identify areas for improvement. By tracking customer satisfaction scores, restaurants can address specific issues and enhance customer loyalty.

Remember that KPIs may vary depending on the restaurant’s unique goals and priorities. It is essential to select indicators that align with your business objectives and regularly review and update them as needed.

By implementing a robust system to track these KPIs, restaurant owners can gain valuable insights into their operations, identify areas for improvement, and make informed decisions to drive growth and profitability.

Role of Technology in Restaurant Bookkeeping and Accounting

The advancement of technology has brought about specialized accounting software tailored to meet the unique demands of the restaurant industry. These solutions are equipped with features that cater to the specific requirements of restaurants, such as seamless integration with Point of Sale (POS) systems, robust inventory tracking capabilities, and comprehensive financial reporting tools.

Best Restaurant Bookkeeping Software [Latest List]

Managing a restaurant’s finances can be a complex task. Thankfully, several robust bookkeeping software solutions cater specifically to the needs of the restaurant industry. Here’s a breakdown of some of the most popular options in 2024, highlighting their key features:

1. Restaurant365:

- Description: A comprehensive restaurant management platform offering a powerful accounting system. Features include inventory management, recipe costing, payroll processing, and point-of-sale (POS) integration. Restaurant365 caters to businesses of all sizes, from independent restaurants to multi-location chains.

- Strengths: User-friendly interface, robust features, scalability for growing businesses.

2. QuickBooks Online:

- Description: A widely recognized accounting software solution offering a user-friendly interface and strong reporting capabilities. QuickBooks Online integrates seamlessly with popular restaurant POS systems, simplifying data entry and streamlining bookkeeping tasks.

- Strengths: Familiarity, ease of use, extensive reporting features.

3. Xero:

- Description: A cloud-based accounting software known for its clean interface and automation capabilities. Xero automates tasks like bill payments and tax calculations, saving restaurant owners valuable time. It also offers strong inventory management features.

- Strengths: Cloud-based accessibility, automation capabilities, inventory management tools.

4. FreshBooks:

- Description: A user-friendly and affordable cloud-based accounting software suitable for smaller restaurants or those on a budget. FreshBooks offers basic bookkeeping tools, expense tracking, and simple invoicing functionalities.

- Strengths: Affordability, user-friendliness, ideal for startups or smaller restaurants.

5. POS bytz:

- Description: A comprehensive restaurant management software with a built-in accounting system. POSbytz offers features like inventory control, recipe costing, staff scheduling, and customer relationship management (CRM) tools in addition to core bookkeeping functionalities.

- Strengths: All-in-one solution, extensive functionalities beyond just accounting.

By leveraging these advanced technological tools, restaurant owners and managers can streamline their bookkeeping and accounting practices, ensuring accuracy, efficiency, and timely access to crucial financial data.

How Profitjets helps Restaurants with our Bookkeeping Services

Running a successful restaurant requires juggling a multitude of tasks, with finances often taking a backseat in the daily hustle. Here’s where Profitjets soars in, offering comprehensive bookkeeping services specifically tailored to meet the unique needs of the restaurant industry. We go beyond basic data entry, providing a holistic approach to financial management that empowers you to focus on what matters most – delivering an exceptional dining experience.

Our team of experienced bookkeepers are well-versed in restaurant accounting intricacies. We handle all your bookkeeping tasks, including:

- Transaction Categorization: We meticulously categorize all your income and expenses related to food costs, labor, beverages, rent, utilities, and other restaurant-specific categories. This meticulous categorization provides valuable insights into your operations and spending patterns.

- Bank Reconciliation: We ensure your financial records are accurate by regularly reconciling your bank statements with your accounting software. This process identifies and rectifies any discrepancies, guaranteeing the integrity of your financial data.

- Accounts Payable & Receivable Management: We handle the timely processing of vendor invoices and manage outstanding customer receivables, ensuring smooth cash flow and avoiding late payment penalties.

- Payroll Processing: We can handle payroll processing for your restaurant staff, including calculating taxes and deductions, generating paychecks, and ensuring compliance with labor laws.

Leveraging Technology for Efficiency:

Profitjets utilizes cutting-edge cloud-based accounting software specifically designed for the restaurant industry. These tools automate many tasks, such as data entry and bank feeds, minimizing errors and saving you valuable time. Additionally, the cloud-based nature of these systems allows for real-time access to your financial data from anywhere, anytime.

Gaining Valuable Financial Insights:

Beyond basic bookkeeping, Profitjets empowers you with insightful reporting and analysis. We generate comprehensive financial reports tailored to the restaurant industry, including:

- Profit & Loss Statements: Understand your overall profitability by analyzing revenue streams and cost breakdowns and identifying areas for potential optimization.

- Inventory Reports: Gain insights into your inventory levels, track food costs, and minimize waste through informed purchasing decisions.

- Labor Cost Reports: Analyze labor expenses, identify areas for improvement in staffing schedules, and optimize employee productivity.

These reports clearly show your restaurant’s financial health, allowing you to make data-driven decisions that improve profitability, optimize operations, and ensure long-term success.

Dedicated Support and Partnership:

At Profitjets, we understand that every restaurant is unique. Our dedicated bookkeeping specialists work closely with you to understand your specific needs and goals. We provide ongoing support, answer your questions promptly, and offer guidance on interpreting financial reports for actionable insights.

By outsourcing your restaurant’s bookkeeping to Profitjets, you gain a reliable partner who goes beyond data entry. We free you from the burden of tedious financial tasks, allowing you to focus on your passion—creating exceptional culinary experiences and growing your business.

Conclusion

Establishing sound restaurant bookkeeping and accounting practices is crucial for long-term success and sustainability. By diligently recording financial transactions and analyzing data, restaurant owners can make informed decisions to maximize profitability and minimize risks.